2020 presented many challenges, but also opportunities and lessons learned. As we turn the page and look to 2021, we’ll look at four questions:

- What did we learn from 2020?

- Why did the market perform while the economy struggled?

- What’s in the Biden tax plan?

- What can we expect in 2021?

What did we learn from 2020?

The COVID-19 pandemic was the first of many challenges in 2020. Before looking to lessons learned, here’s a timeline in brief of COVID-related events.

- January – First COVID-19 death in China, first case reported in the US (WA State)

- February – First COVID-19 death in US, major sports seasons suspended & events cancelled, 50 year low in unemployment at 3.5%, S&P 500 hits all time high

- March – National state of emergency declared, S&P declines 34% from high, CARES Act passed, stay at home orders issued in many states

- April – Highest unemployment since Great Depression at 15%

- June – S&P 500 flat for the year

- August – S&P 500 recovers Feb high

- December – first COVID-19 vaccine received

CARES Act – We’ve learned from the past

As we discussed in Why This Isn’t the Next Great Depression, the CARES Act was a major success. In hindsight, improvements can always be made, but congress put money in the hands of businesses and consumers to dampen the blow delivered by the economic shutdown. This type of congressional easing action, though not without its own consequences, has repeatedly prevented prolonged shocks like those seen in the Great Depression.

The Growth vs. Value divide – There is no single “market”

In 2020, Morningstar reported the widest gap on record between US Growth and US Value stocks. The S&P 500 Pure Growth pulled in 29.7% while the S&P 500 Pure Value lost 8.7% – a 38.4% gap. Technology and consumer discretionary companies performed well while energy, real estate, financials, hospitality struggled.

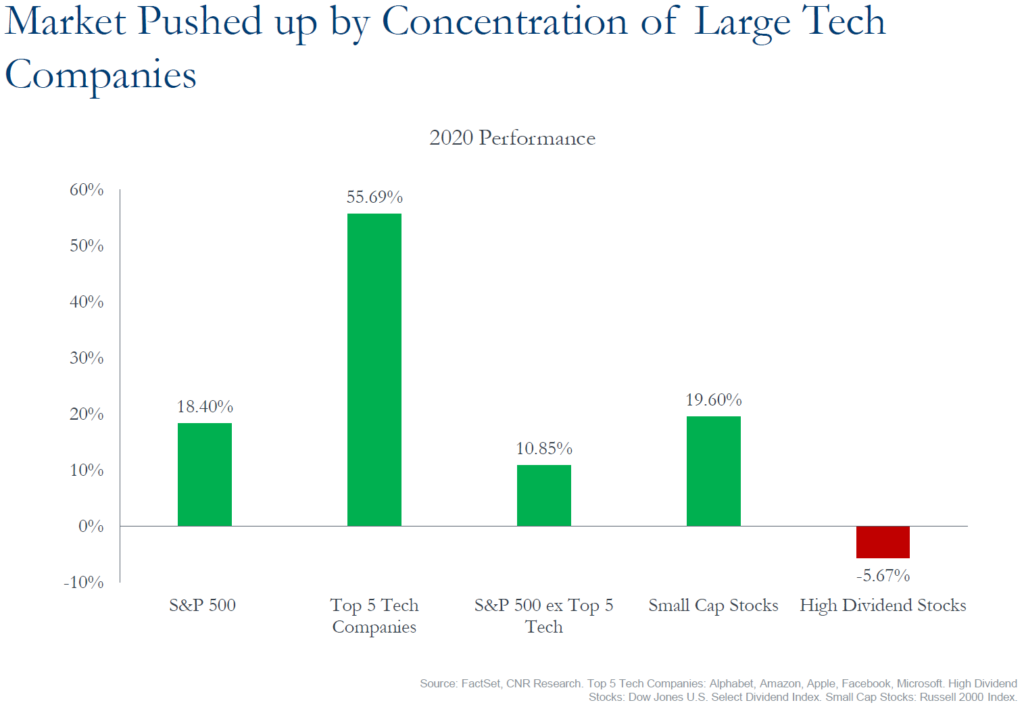

Our big 5 tech companies – Apple, Alphabet, Amazon, Microsoft, Facebook – drove most of 2020’s market gain – see My Portfolio & the S&P 500 for more. They comprise about a quarter of the S&P 500’s weight and, without them, the picture looks a lot different, as CNR shows here.

The COVID-related restrictions hit value companies much harder than growth companies in 2020. But these gaps don’t last forever. In fact, Q4 in 2020 started reversing the growth over value trend as the vaccine started distribution and hope of relaxed restrictions grew. Maintaining diversification can be hard in these times, but history shows it’s the best way to balance risk and reward.

Staying the course wins again

March’s 34% decline in the S&P 500, unsettling headlines and day to day market swings brought anxiety to everyone in some way. But, as discussed in Time In the Market is Better than Timing the Market, the market’s biggest gains tend to follow shortly after its biggest losses. This proved true yet again. The S&P 500 hit its low on March 23, but by March 26, it had rebounded 18%. If you stayed the course, you may not have escaped the stress, but you did recover. If you moved to cash, you were stuck with the stress and the loss. A well-funded cash reserve and a risk/time-based approach allowed space for mid and long term funds to recover.

Why did the market perform while the economy struggled?

In such a challenging year like 2020, why did the market grow while the economy struggled – and shutdown? There are couple reasons for this:

- The market prices forward 6 months or more, meaning prices reflect where companies are going, not just where they are today.

- The market is not reflective of the whole economy, just the ones with publicly traded stocks. Restaurants, gyms, and other struggling businesses don’t have ticker symbols.

- The market indexes – particularly S&P 500 and Nasdaq – are heavily weighted to tech companies, who thrived during the pandemic. Tech companies represent 39% of the S&P 500 but only 6.9% of the US GDP while Service companies – restaurant, retail, travel, entertainment – represent only 7% of the S&P 500 index yet contribute 19% to US GDP.

What’s in the Biden tax plan?

The big change on everyone’s mind is the change in the Presidential administration. Tax, regulatory, and social policy are all taking shape, but will require more clarity to see how they will impact the markets and economy. Historically, we typically do not see a large impact tied to the presidential administration – see Elections & Markets for more. Many eyes will be focused on the Biden tax plan. Though nothing is set in stone yet, here are a few key proposals:

- Top income tax rate increases to 39.6%

- Corporate tax rate increases from 21% to 28%

- Capital gains taxed as ordinary income for high earners

- Additional social security and Medicare tax for high earners

- Federal estate tax exemption cut in half from current $11.58 million

- Step up in cost basis at death eliminated

- First time homebuyer tax credit reinstated

- Expansion of Child Tax Credit and Earned Income Tax Credit

Many analysts expect the tax credit expansions in the first 100 days of the Biden administration, but major tax increases are likely to wait until economy recovery gains traction. If passed into law, these changes will affect many tax and estate strategies – all part of the constantly changing financial planning landscape.

What’s coming in 2021?

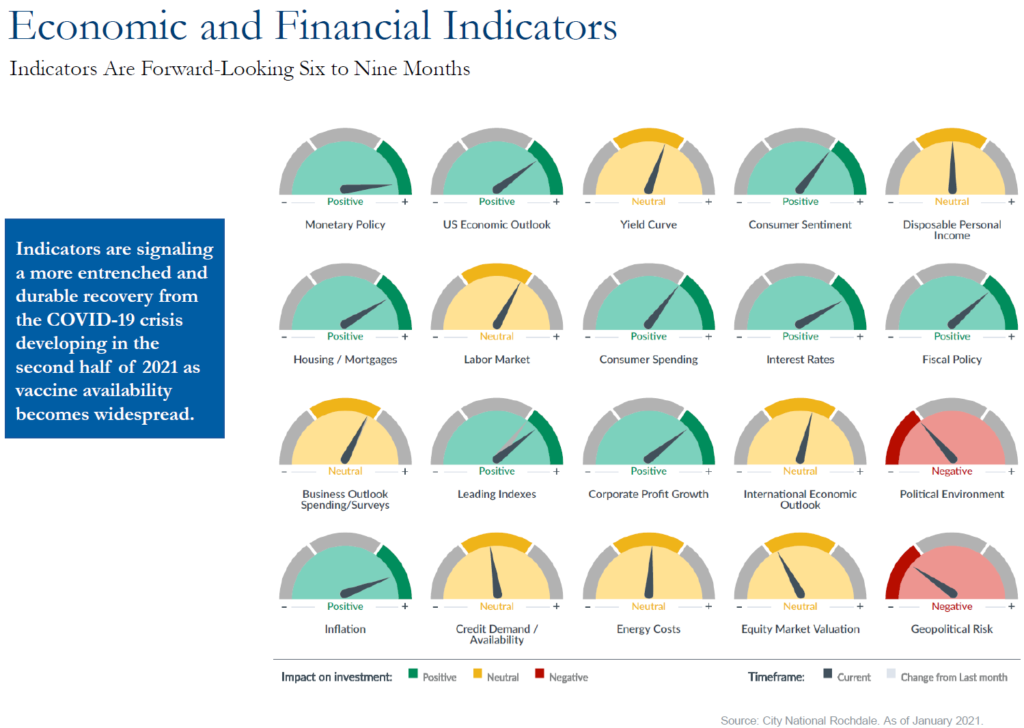

Overall, the stage is set for a strong and welcomed economic recovery and there are a few distinct themes on the horizon.

COVID-19 vaccine key to full reopening

In the short term, the COVID-19 vaccine distribution and efficacy are the most important factors for economic recovery. Struggling small businesses need to be allowed to reopen and the vaccine appears to the biggest hope. The good news is that distribution is already underway, with widespread access expected by late April or May. Even after the vaccine is widely available, it will take time to fully recover and more “normal” economic function isn’t expected until the latter half of 2021.

Economic outlook

Economists and the Federal Reserve have released improved projections for the 2021 economy in 2021 – a welcomed outlook after 2020’s challenges:

- Low interest rates are expected to continue throughout the year.

- Inflation is expected to be a low 1.8%.

- Unemployment is expected to decline to 5% though post-recession improvement and slower in service-based economies like the US than in manufacturing-based economies.

- Gross Domestic Product (GDP) is expected to be between 3.5% – 5.5%.

CNR’s economic and financial “speedometers” are a helpful visual guide.

Market Outlook

Themes in the market are already shaping up, anticipating the economic outlook above.

- Growth company valuations are high, but increased profits in 2021-2022 would help prevent excessive overvaluation.

- The growth/value gap is expected to close as dividend paying and cyclical companies catch up in the recovery and benefit from bond investors substituting dividend stocks to produce more yield.

- US recovery is expected more quickly than many international markets, but overseas valuations are very attractive, creating opportunity to benefit from the recovery there when it comes.

- Bond-heavy portfolios will struggle with low rates, though opportunities exist in high yield and emerging market debt.

Above all, keep in touch with your advising team! We have come a long way in the recovery and still have a long way to go. Remember that we’re here to talk through changes, questions, concerns, and discuss how these issues affect your plan.

Sources – CNR Outlook, CNR On the Radar, CNR FAQs, JP Morgan, Morningstar

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.