Bad news is easy to find. And it’s especially easy to find when reading about the economy during the COVID-19 pandemic. How bad will this be? How long will it last? And the big question – Is this the next Great Depression? With so much uncertainty, you’re not alone in asking these questions. There are still many unknowns about the impact of this global health crisis, but there’s reason to be hopeful.

We don’t see this as the next Great Depression. Why? Well, consumers and businesses give life to our economy. In a major economic downturn, the government and central bank play a role in stabilizing the economy so businesses and consumers can get back to work, primarily by putting money into the economy, like jump-starting a car battery. We saw this in the Financial Crisis of 2008. But during the Great Depression, we learned painful but valuable lessons about the right way to respond to a crisis – by making many of the wrong moves.

For a deep dive on definitions and how to tell when we’re in a recession, check out Correction, Bear Market, Recession…What Do They All Mean?

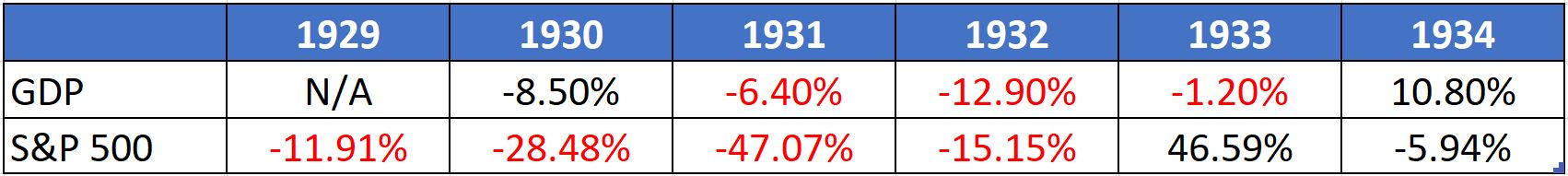

Let’s compare the causes, government and Federal Reserve responses, and impacts on GDP (economic productivity) and S&P 500 (stock market) in the Great Depression of 1929 and the Great Recession or Financial Crisis of 2008, then look at how we’re responding to the COVID-19 pandemic.

The Great Depression – 1929-1938

A few factors started the Great Depression, universally considered America’s worst financial crisis.

- The 1929 stock market crash started things off, largely considered a result of poor regulation and excessive borrowing to invest, or buying “on margin”, which had just recently been introduced.

- Consumers ran to the banks to get their cash in a panic, causing widespread bank failures.

- The Dust Bowl, a prolonged draught, caused many farmers to lose their farms, a major economic driver.

Policy responses from the government and Federal Reserve made things much worse.

- Congress passed the Smoot-Hawley tariff to protect US industries, devastating worldwide trade.

- The Federal Reserve tightened the belt, increasing interest rates to protect the dollar and did not increase the money supply, commonly used to fight deflation.

- Bank failures were almost entirely ignored by the government and Federal Reserve, which devastated confidence in the financial system and led people to keep dollars under their mattresses, further reducing the money supply.

- President Hoover increased the top marginal tax rate to 63% – reaching 94% by 1944 – to raise revenues.

The impact was a decade of suffering in the US economy and around the world. Unemployment reached 25% and the production of the economy cut in half due to inflation. The combination of consumers filling their mattress with cash and these government policy responses reduced the money supply by over a third, leaving consumers with little to spend and businesses with little to produce. It was the worst economic event in U.S. history.

The Great Recession – 2008-2009

The Great Recession is largely considered America’s second worst financial crisis behind the Great Depression. It had a few key contributors.

- Excessive subprime, interest-only, and short-term adjustable rate mortgages led to a wave of defaults when housing demand fell.

- Financial institutions packaged these risky mortgages into mortgage-backed securities and other derivative investments with high quality mortgages, which plummeted in value.

- Banks thought of as “too big to fail” were found holding these worthless investments, leading to the Lehman Brothers bankruptcy and massive stress on the banking system at large.

- The 2008 stock market crash cemented the impact on everyday investors.

This time, policy responses from the government and Federal Reserve buoyed the economy.

- The Federal Reserve injected $24 billion into the banking system and lowered interest rates throughout the recession.

- Congress passed the Troubled Asset Relief Program, also known as the “bank bailout”, to stabilized banks.

- Congress passed the American Recovery and Reinvestment Act to provide financial relief directly to consumers and small businesses through government spending, tax cuts and guaranteed small business loans.

No one can argue that the Great Recession of 2008 was a difficult time. Global stock markets declined, unemployment reached 10% and many lost their homes. So, why didn’t this turn into another Great Depression? The policy response made a world of difference, bringing relief to a struggling economy, improving consumer confidence and spending, and turning GDP positive by the third quarter of 2009.

COVID-19 Pandemic – 2020

The COVID-19 Pandemic has been contrasted with the Great Depression in many headlines lately. We’ve seen a stark drop in economic activity combined with a spike in unemployment.

So, where are we now? There are many unknowns. We don’t yet know the full impact on the economy and how long the recovery will take. We don’t know if there will be subsequent waves of the virus. And, we don’t know exactly what the “new normal” will look like.

However, we do know one thing – the policy response to the COVID-19 Pandemic looks much more like the 2008 than 1929.

- The Federal Reserve cut interest rates.

- Congress passed the CARES Act to put cash in the hands of consumers and businesses.

- Steps are being taken to evaluate the need for further stimulus.

We’re already seeing indications of impact from this crisis. Unemployment reached just shy of 15% in April and is likely to go higher. The CARES Act stimulus measures are likely to slow and prolong economic recovery. On the positive side, we have an otherwise healthy economy that, due to COVID-19, has been put on pause. As things restart, we have good prospects of seeing steady recovery.

Lessons from the past

We’ve faced many other recessions throughout history, so why has none reached the level of the Great Depression? History shows us the common key for recovery – getting cash to consumers and businesses to keep the economy moving. Of course, the scope, speed and size of government actions are never perfect and will always be debated. But the fact remains – when consumers and businesses have an environment to keep going, we are all better off.

Sources – CNN, Macrotrends, The Balance

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.