Headlines, social media, internet ads, 24-hour news – everything seems determined to remind us that there’s a presidential election coming. And most news media aren’t content to state facts and call it a day, but instead spin stories that certain outcomes might lead to the next recession or spell disaster.

So, if you’re anxious about how the upcoming presidential election will affect your portfolio, you’re not alone. But what should you do? Should you be taking drastic action now? We find that the best start is usually a look at what history has to say.

How does the market react to election years?

We have more access than ever to data about what happens in the stock market following a presidential election. What do we find? The market doesn’t seem very bothered by presidential elections.

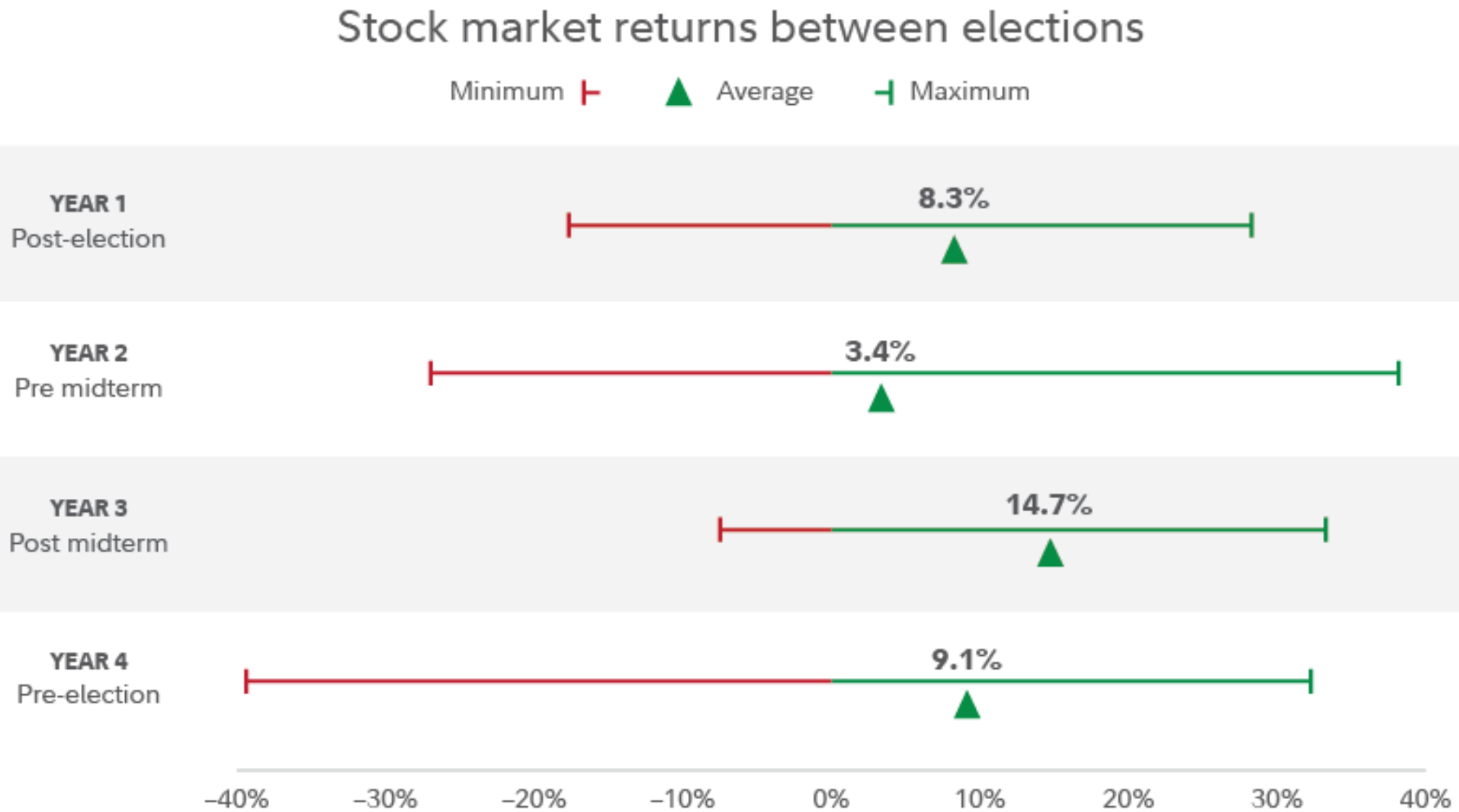

Fidelity’s analysis below shows average and range of returns for the S&P 500 between elections. We see the average return in the year before and after the election is relatively similar, but the widest range of return is actually the year before the election, which makes sense because the markets don’t like uncertainty.

Source: Fidelity

JP Morgan and Barrons have conducted similar research with similar conclusions. So, while constant headlines and political anxiety can be unsettling, there’s no indication that you should change your investment strategy because of an upcoming election.

Do elections actually react to markets?

While the market doesn’t clearly react to elections, it could be interpreted that elections do react to markets, specifically the stock market performance in the three months before a presidential election. Between 1932 and 2020, we’ve had 23 presidential elections. In the three months leading to the election, the S&P 500 was positive 13 times and negative 10 times, which had surprising correlation to the outcomes.

- In 11 of 13 instances of a positive market, the incumbent party won, an 85% success rate.

- In 9 of 10 instances of a negative market, the incumbent party lost, a 90% failure rate.

So, while the election doesn’t have strong predictive power for the market, the market may tell us what to expect in an election!

Put what You CAN’T control in terms of what you CAN

Of course, politics might play a role in some decisions, but it can be dangerous to let emotion drive financial planning and investment choices. Today, investors can impulsively sell everything with the push of a button after reading a polarizing headline or social media post. It’s easy to get stuck focusing on things beyond your control, such as inflation rates, the tax code, the ups and downs of the stock market…or stressful political headlines! But a comprehensive financial plan can help you put these impacts back in terms of what you can control. Your financial plan should answer big questions like how much you need to retire and if you should change your investment strategy. As your financial partners, we’re also here to talk through concerns and help plan accordingly. This allows you to put the effects of things out of your control back in terms of what you do control. And, of course, a break from the headlines never hurts.

Looking for an approach like this in your situation? Reach out to schedule a conversation with us!

Past performance is no guarantee of future results. Fidelity’s data spans from November 30, 1950, to November 14, 2023, representing the 12-month period from November 30 to November 30 following a US presidential or midterm election. Indexes are unmanaged. It is not possible to invest in an index.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.