Why is my portfolio underperforming the S&P 500? Do I need to make a change? These questions are on the minds of many investors, especially when a primary index like the S&P 500 rallies ahead of many others. As one of the most widely recognized benchmarks, it’s common to compare your strategy against it – but should you? First, let’s take a closer look at the S&P 500 as a benchmark. Then, we’ll look at three principles to follow so you can confidently build and evaluate your strategies.

A look at the hidden risk of the S&P 500

According to Marketwatch, about a quarter of your investment in the S&P 500 rests on the fate of Apple, Facebook, Microsoft, Google, Amazon and Netflix. Why? These six companies make up about 25% of the S&P 500’s value. As a “capitalization-weighted” index, the S&P 500 tracks 500 US stocks, but the biggest companies carry the most weight.

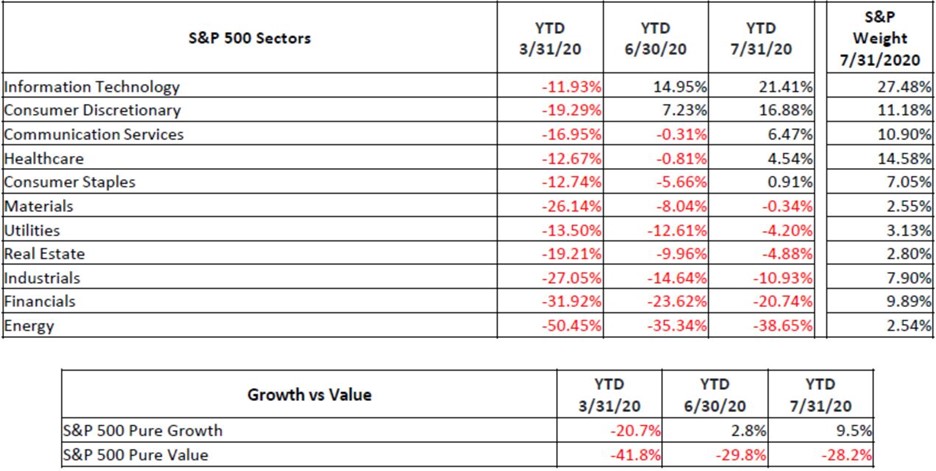

In 2020, those companies are also responsible for most of the S&P 500’s gain. Tech has rallied 21.41% through 7/31 – which has continued through the end of Q3 – while most other sectors have remained relatively flat to significantly down. We also see how lopsided 2020 has been between growth stocks (think Amazon) and value or dividend stocks (think Johnson & Johnson) – a whopping 37.7% gap in performance.

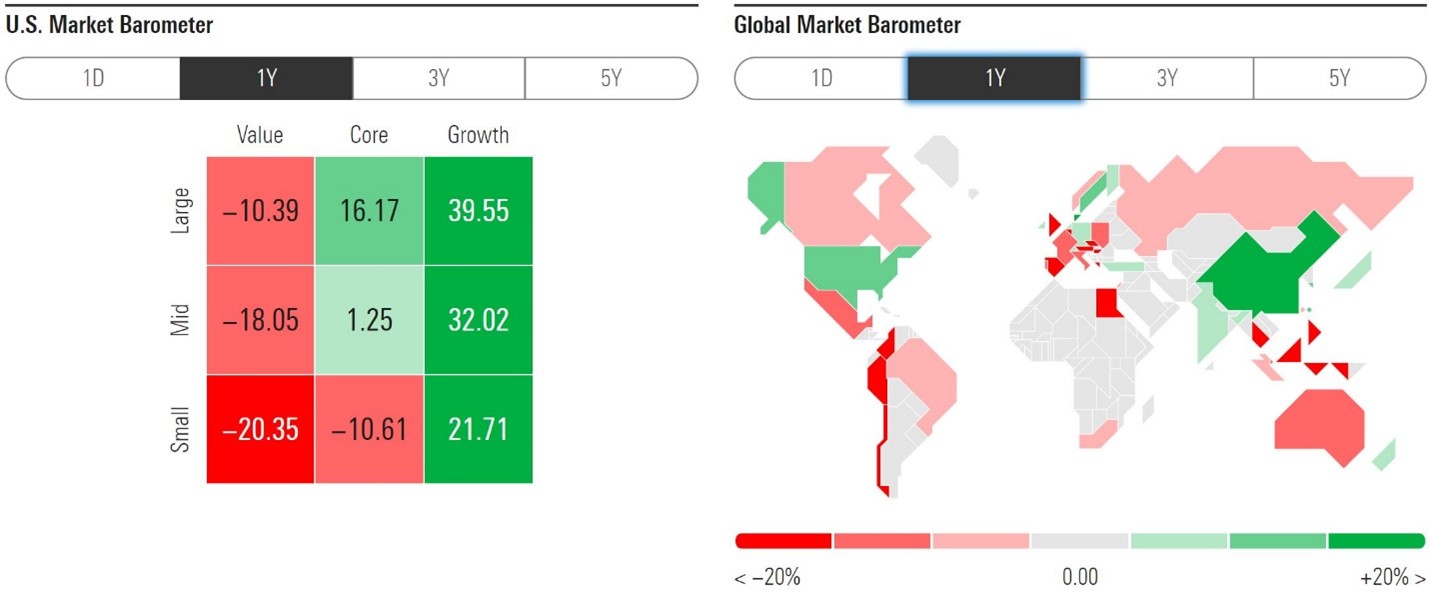

Over the last year, Morningstar shows a similar story, with growth far outpacing value and the US gaining ground while stocks around the globe largely declining.

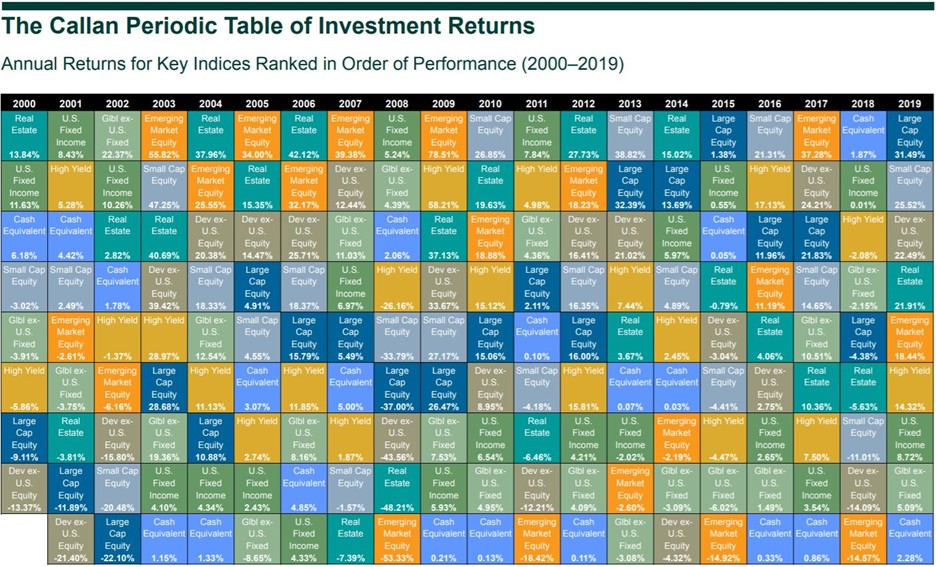

The Callan Periodic Table of Investment Returns – also called the “Investment Quilt chart” – shows us that these gaps don’t last forever. Compiled annually, the analysts at Callan Institute track returns of different categories of investments, often called asset classes. This chart assigns a color to each type of investment and ranks them top to bottom each year from highest to lowest return.

Build the right strategy…for you

So, if the idea of having 25% of your investment portfolio rest on the fate of five or six companies makes you uncomfortable, what should you do? Above all, start with your needs and build a diversified strategy accordingly. No one can consistently predict which stock or sector will win out next year, but we can focus on three key principles.

- Let your needs guide your strategy. Are you an aggressive investor focused on growth for 10 or more years? Your strategy might be invested entirely in stock, spread across US and international, growth and value, large and small companies. Or are you retired and need steady income today? Your strategy might be evenly split between stocks and bonds with a focus on dividend paying companies.

- Evaluate your portfolio against the right benchmarks. Your portfolio invested 40% in international stocks will look very different than an index invested 100% in US companies. A dividend focused strategy will not always track closely with a growth focused index. Look at your mix and use an appropriate blend of benchmarks.

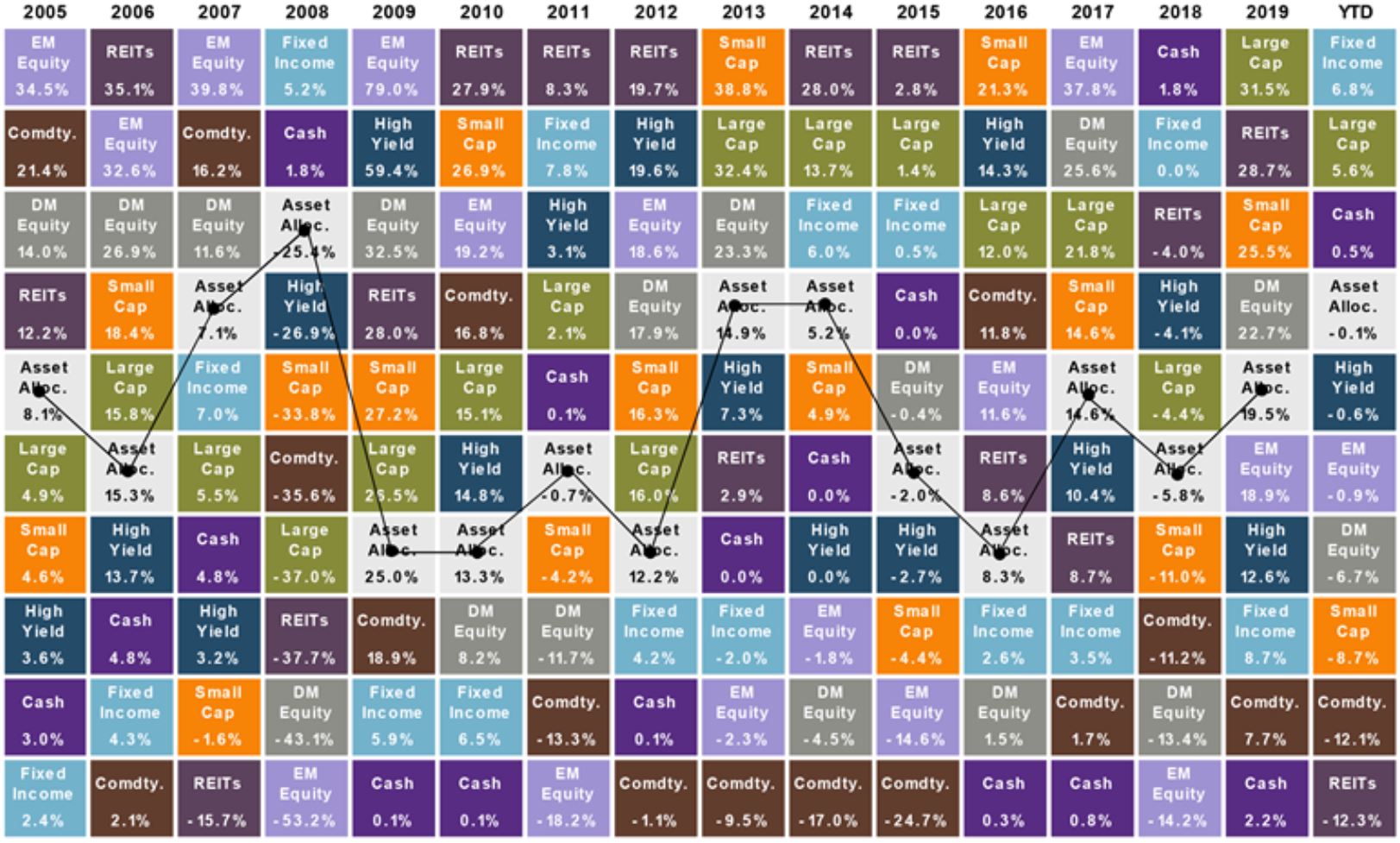

- Eliminate the guesswork. As the folks at the Callan Institute show, no asset class wins forever. Rather than shifting dramatically between assets each year, maintain a mix of asset classes throughout your investment life and make adjustments as your needs change. JP Morgan’s revised Investment Quilt chart below adds a diversified portfolio to make this point.

Benchmarks like the S&P 500 can be helpful guideposts, but don’t focus too much on any single index, as you’re likely to find yourself chasing past returns. Your portfolio strategy should be built around your needs. While no one has the crystal ball to tell exactly what the future holds, we do have a wealth of historical evidence of what works. These time tested habits put you in great position to reach financial independence and have peace of mind.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.