Before making drastic changes to your financial plans, this five-point checklist can help you understand what a recession really means to your plan.

Prefer video over an article? Check out Recession-Proof Your Retirement – A Video Walkthrough where Grant Monson and I discuss how to apply these principles!

1. Know your recession history

Start with an understanding of recessions. Our article titled Recessions – How Bad Are They & How Long Do They Last? is a good place to start. On average, a recession will happen once every three to four years. And while these recessions often come with a steep market decline, they are also historically followed by sharp recoveries.

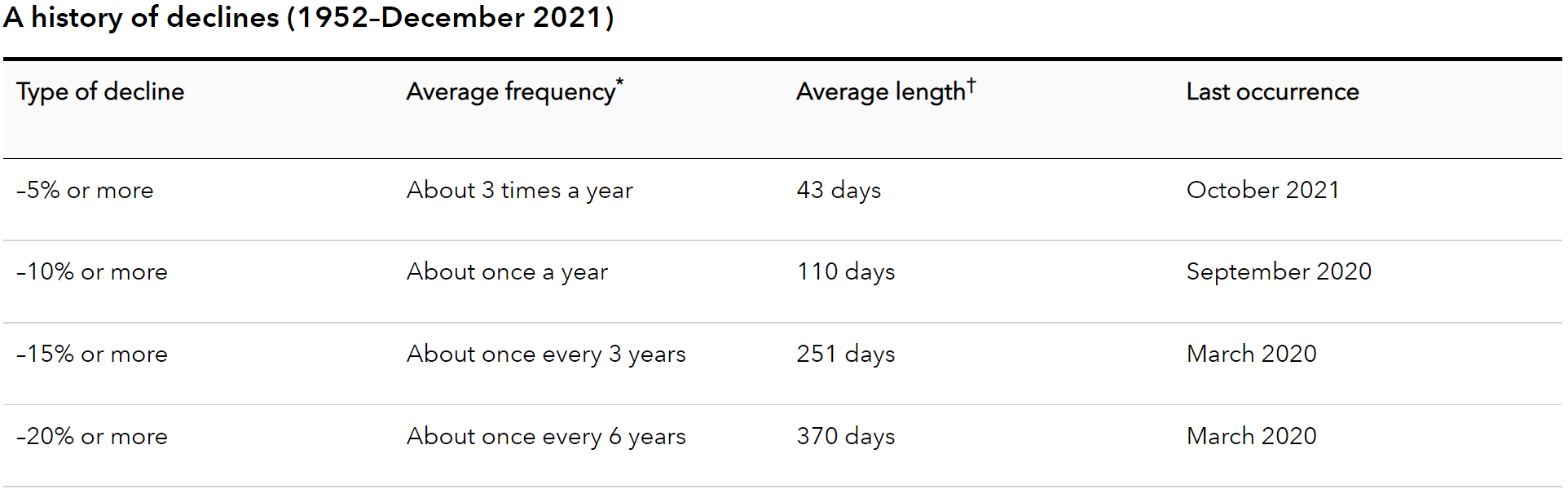

Though recessions are common, you likely fear the market decline more than the recession itself. In Market Declines: What We Can Learn from History, we see how often these kinds of corrections occur and how long they last. A 5% drop may disappear in a month, while a 20% downturn could mean a year or more of recovery. In either case, this gives us valuable information to plan with.

Source Capital Group. Historical data does not imply future results.

2. Simulate a portfolio decline

If you’re worried about the impact a drop in the market could have on your portfolio, your advising team can walk this through with you. In How Much Should I Save for Retirement, we walk the Millers through retirement spending scenarios, showing the projected impact of more spending on their nest egg. Looking at the impact of a market decline can work in the same way, though a drop in the market doesn’t mean you have to spend more from your portfolio. And as we discuss in step four, a reserve of funds outside the stock market may mean you can ride out a recession with less loss.

3. Build stable income into your investment strategy

In retirement, your plan should expect that recessions will happen and build in stable income strategies to help you in up and down markets. We generally discuss two strategies: the Golden Goose or Buckets. We show you how to build both in Where Does My Retirement Paycheck Come From?.

Golden Goose

An ideal retirement nest egg allows you to live on interest and dividend income from your portfolio without having to sell shares, similar to owning a rental property where you only want to spend the rental income, not sell the house. As a hypothetical example, if you find you need $6,000 per month and can generate a steady 3.5% income, you’d need just over $2 million in your portfolio. Don’t forget to account for future inflation, which can drive this number up.

Buckets

If portfolio income alone won’t meet your needs, a bucket approach can help you divide your nest egg into safety, income, and growth strategies.

- Safety. This bucket is a six-to-twelve-month reserve kept in a high-interest savings account. This is generally only used if you have an unexpected expense but can also be tapped during a major market decline to let your invested portfolio recover.

- Income. This bucket sends you your monthly paycheck, designed to hold enough to provide your next five to seven years of income. Focus on dividend and interest-generating investments that can deliver steady income limit the ups and downs of the market.

- Growth. This bucket grows the funds you won’t need for seven or more years. Because this is intended for use more than seven years from now, you can let it ride out the ups and downs of the market, even during tough economic downturns.

Personal Pensions

When the market is in decline, Social Security or a pension feels like a lifesaver because the income keeps showing up regardless of what stocks are doing. If you don’t have a pension, some use annuities to create this same security. Annuities can be very complicated and should be carefully considered with your planning team, but simply put, it can be like paying to guarantee lifetime income from a portion of your investment portfolio.

4. Diversify outside of the stock market

When the market is down, reserves that aren’t affected by market volatility can play a vital role. In How Your Portfolio is Like Your House, we show how shares in your portfolio are like square feet in your house. When the housing market is down, your home declines in value, but if you don’t sell your home, you haven’t lost any square footage and you may recover your lost value as the market bounces back.

In a market decline, you still own all your shares, but you’d get less for them if you sold today. However, if you have funds outside the stock market to draw on when the market is down, you can spend from these reserves and let your portfolio bounce back.

5. Make (and follow) a “freak out” plan

So, you know your recession history, how a market decline could impact you, where your income will come from, and where to draw funds if the market is down. You’re immune to retirement fear, right?

If you’re like most people, you’ll still feel anxiety and fear when the market drops or a recession hits. You might feel like this one is different and you should throw the plan out and head to the bunker. The technical term for this is a “freak out” (though you won’t find it in the CFP® handbook). When panic sets in, decisions become clouded and much more difficult. With this reality in mind, we recommend making a panic plan, and there’s no better time to make this plan than right now when you’re not panicked. Here’s a suggestion to start.

- Acknowledge that the fear is real, normal, and needs to be addressed. You’re not crazy. Fear makes sense in uncertain times because you don’t know exactly what will happen next.

- Reach out to your advisor who helped you build the plans in the first place. We’re here to help you sort through the noise and find the decisions that are best for your long-term future.

- Walk through steps one through four above to see if you’re still on track despite the current market circumstances. A well-designed plan should have a strategy to help you through future recessions.

- Make necessary changes to keep your plan on track, avoiding those that may soothe the short-term anxiety but hurt your plan in the long run. In other words, avoid short-term decisions with long-term money.

In short, your panic plan means knowing who to talk and strategize with when the future feels bleak. For more on this, see 5 Mistakes People Make in a Recession and How to Avoid Them.

We find that with the right game plan, your retirement can survive recessions and market declines when these five steps are followed. There are circumstances where your plan may require a change and building open and honest communication with your advising team is a great place to start. Though you may not be able to avoid the anxiety that can come with a recession, you’ll know how to handle it!

Strategies discussed may not be suitable for all investors depending on specific investment objectives and financial position. Annuities are backed solely by the financial strength and claims-paying ability of the issuing insurance company. Diversification does not guarantee a profit or protect against a loss. Historical performance does not guarantee future results.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.