Turn on the TV or scroll through a news feed in uncertain times and you’re sure to see that nasty “R” word – Recession. You see it and concern, fear, and anxiety set in. “How bad will this be?” “How long will this last?” It’s not uncommon to hear, “This one is different!” or “We’ve never seen this problem before!” This is almost always true and, in many ways, it’s encouraging. It shows we tend to learn from our mistakes.

Like inhaling and exhaling, expansion and recession are a natural part of the market cycle. Technically speaking, a recession occurs when GDP, or our economy’s total production, falls for two straight quarters. Most recover quickly. That said, recessions always feel long and stock market drops always feel shocking. We shouldn’t expect this to change regardless of where the actual breadth and depth falls historically. However, we can look at history to guide our response.

How long and how bad is the average recession?

A recent Forbes analysis showed the average period of economic growth lasted 3.2 years while the average recession lasted 1.5 years – an average of 4.7 years for the full cycle.

What about the stock market? When does it bounce back? The stock market prices in expectations. Investors look forward, about 6 months on average, to anticipate what’s coming and decide what prices they’re willing to pay. So, the stock market tends to bounce back based on positive expectations and does not wait for the economy to recover first.

Of course, baked into that average are both major events like the 2008 Great Recession and minor blips on the radar that no one remembers. Recessions are a bit like earthquakes in that way. Minor earthquakes happen all the time – we just don’t feel them. But we certainly remember the major ones. So, let’s look at a few of those major events to see how bad and how long they tend to be and what we can learn.

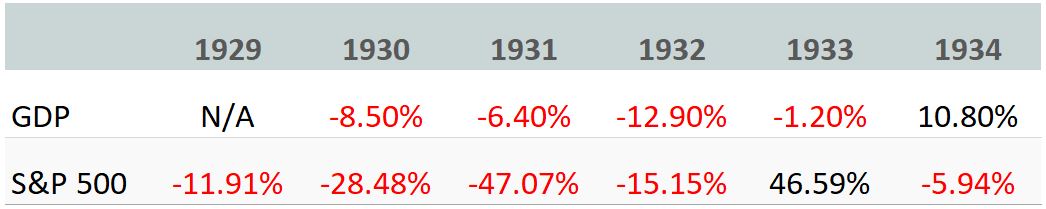

The Great Depression (1929-1938) – A decade-long event

This is America’s worst financial and economic crisis by quite a margin – a decade long event. The Great Depression started with a stock market crash caused by poor securities regulation and excessive borrowing to invest. Investors ran to pull cash from banks in masses, stressing the system further. But many place the length and severity on the shoulders of the Federal Reserve and Congress’s response. Increases in taxes, trade tariffs and interest rates, as well as neglecting to address the bank crisis, dramatically reduced the money supply and sucked much of the remaining oxygen out of the economy.

As a result of the Great Depression, there were many painful but valuable lessons learned. From investment regulation to government policy response, many changes were implemented that have prevented this kind of devastation in any event since.

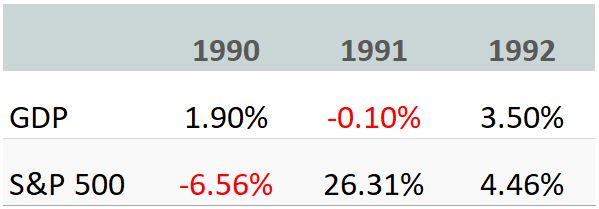

The Savings and Loan Crisis (1990-1991) – A 9-month recession

Savings and Loan (S&L) banks were largely created to provide affordable mortgages to Americans, providing lower rates than other banks, yet were prohibited from providing any other loans. S&L legislation imposed interest caps both on what they could pay on deposits and what they could charge on loans. When double digit inflation hit in the 80s, depositors went elsewhere to get higher rates, and home purchases slowed, leading to the Savings and Loan collapse.

Soon after, the Financial Institutions Reform, Recovery, and Enforcement Act was passed, which provided $50 billion to help close out the failed banks, stopped further losses, and revised regulations.

The Tech Bubble (2001) – An 8-month recession

The internet age ramped up in the late 90s and a new crop of tech companies emerged. Investors found these hard to value and prices skyrocketed beyond what was justified by earnings. The surge was magnified by billions in software purchases to prepare for Y2K, stemming from fear that systems built in the 90s would not work in the 2000s. The recession was then further fueled by the 9/11 terrorist attacks.

The response came in 2001 with a reduction in income tax rates and expansion of tax credits to consumers. The Federal Reserve responded with a reduction in interest rates to provide liquidity to the economy.

The Great Recession (2008-2009) – An 18-month recession

This is widely considered America’s second worst financial crisis, after the Great Depression. It started with a rise in excessive, risky mortgage lending. These loans, otherwise thought to be safe, spread throughout mortgage backed securities and into the portfolios of many investors. As the risk became apparent, investors sought safety, which led to a sharp economic slowdown and stock market decline.

In contrast with the Great Depression, however, Congress passed the Troubled Asset Relief Program in 2008 and the American Recovery and Reinvestment Act in 2009 to provide relief to stressed banks and consumers. The Federal Reserve also lowered interest rates and purchased government bonds to inject liquidity into the economy. These measures helped improve consumer confidence and spending, bringing forward the recovery and resulting in a positive GDP by the 3rd quarter of 2009.

The COVID-19 Pandemic (2020)

We’re now dealing with another crisis. We are seeing record job losses and businesses in trouble. However, in this case, we’re not facing internal financial or regulatory issues, but an external health crisis. In many ways, it has been like pushing the pause button on an otherwise healthy economy. So, though there is still a lot of uncertainty, we have good prospects of seeing a recovery, even if it is slow to arrive.

The good news today is we have seen an extremely fast response in policy actions, with the Federal Reserve cutting interest rates and Congress passing the CARES Act. Both are actions designed to create liquidity in markets and keep cash flowing to consumers and businesses.

This too shall pass.

In the words of Edward FitzGerald, “This too shall pass.” It is important for us to remember that recessions are short lived, while expansions are much longer. If history has anything to teach us, it’s that we pull together, innovate, and find solutions in times of distress. Those with a long run view are the ones who come out on top. Though they may feel long, the dark days do not last.

Sources: Macrotrends, The Balance, The Balance

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.