How much do I need in my nest egg to retire? Do I have to worry about running out of money? Am I on track?

These are some of the most common questions we hear in discussions about retirement. Building financial independence can be a daunting task because it’s not clear how much you’ll actually need and if you’ll make it simply by continuing on your current path. Fortunately, there is a road to clarity!

Find out if you’re on track by answering these 4 questions.

To begin clearing the confusion, you’ll need to find out what nest egg you need and what you’re on track to accumulate. Consider the following questions:

- How much longer do I want to work? If you own a business, when do you want to sell? Or if you’re putting the finishing touches on a long career, when will you step away? This sets your time horizon – how much longer you’re able to save.

- How much do I need for expenses? In today’s dollars, how much do you need to keep the lights on? How much more do you need to create your dream retirement life? If you need $100,000 per year for day-to-day expenses and an extra $50,000 per year for those bucket list trips, your target would be $150,000 per year. This needs to be adjusted for inflation going forward, but this is your starting point.

- What income will I have? Consider pensions, social security, and rental income. If you plan to work part time at something you enjoy, you’ll want to factor this in as well. These will establish the baseline income you can rely on each month.

- What have I saved? Take stock of your cash, 401(k)s, IRAs, brokerage portfolios, and any other funds you can draw on to fill the gap between your monthly income and your monthly spending goal. Make sure to factor in what you plan to invest along the way.

What’s your number?

Your answers to the four questions above focus on variables within your control: what you spend, how long you work, what income sources you’ve built, and what you save. With these established, you’ll be able to come up with your number, the nest egg you need to build to make your retirement dreams a reality.

So, what does this look like? Here’s a case study we can use as an example.

Sandy & James Miller – a case study

The Millers were worried they were behind. They feared they hadn’t saved enough and might not be able to enjoy the retirement life they dreamed of. To start our work together, we learned about them by walking through the four planning questions:

- How much longer do we want to work? Sandy & James run Miller Consulting and, though they love their work, they were ready to sell the business and spend more time with family. At age 60, they would love to sell today, if possible. They could extend to 62 if necessary but they’d prefer to sell now.

- How much do we need for expenses? They carefully considered their regular living expenses and what they would need to travel and enjoy life. They set a $150,000 per year target to spend. They could pull this back to $125,000 if needed and would rather spend a little less if it meant hitting their goal of retiring at 60.

- What sources of income will we have? As lifelong business owners and entrepreneurs, they wouldn’t have a pension to count on, but they would have $3,000 per month in social security benefits and $2,000 per month in rental income.

- How much have we saved? The early startup years of their company took most of their cash flow, a common situation for small business owners. However, they took advantage of their later years and had accumulated just over $3 million in their investment portfolio and expected to receive $1 million in cash from the sale of Miller Consulting.

With their goals and current landscape set, we looked at what they were on track for using our financial planning tools.

What’s the Millers’ number?

To find out if the Millers were on the path to a happy, healthy retirement, we looked at their current position, identified gaps, and looked at options to fill these gaps. In our projections, we assumed investments would earn 5% per year while living expenses and income would rise 3% per year.

Ultimately, we arrived at a $4 million target for the Millers, which would allow them to meet their spending goals living primarily on the income of their portfolio.

So, are the Millers on track?

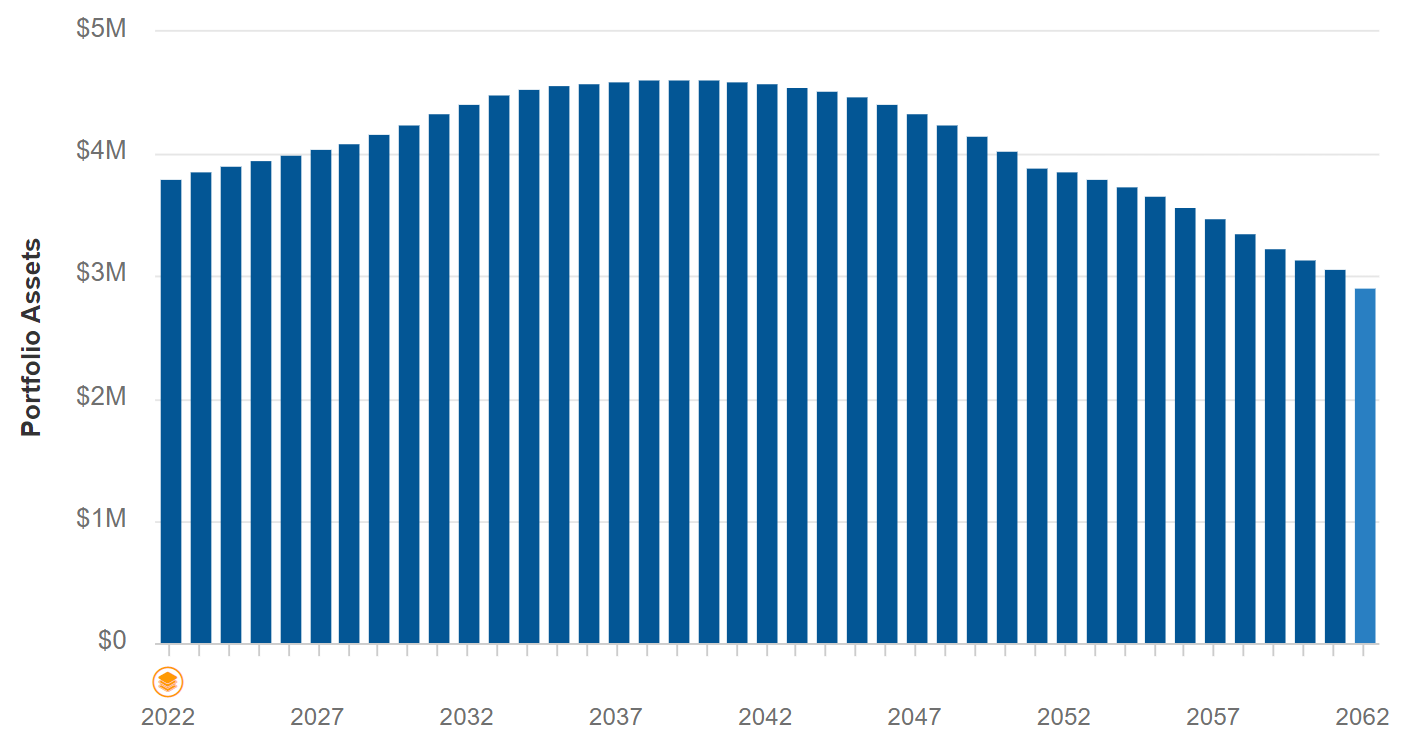

Current position

The Millers were surprised to learn that they could actually sell today and make ends meet! After selling their business and paying taxes, they would have $3.75 million in their nest egg. Our concern when looking at this scenario was that they would likely spend their portfolio down to under $3 million over the course of their lifetime rather than living on their portfolio income alone. This puts them at some risk of outspending their nest egg if unexpected expenses arise. This gives the Millers options: work longer, spend less, or accept the risk of outspending their nest egg.

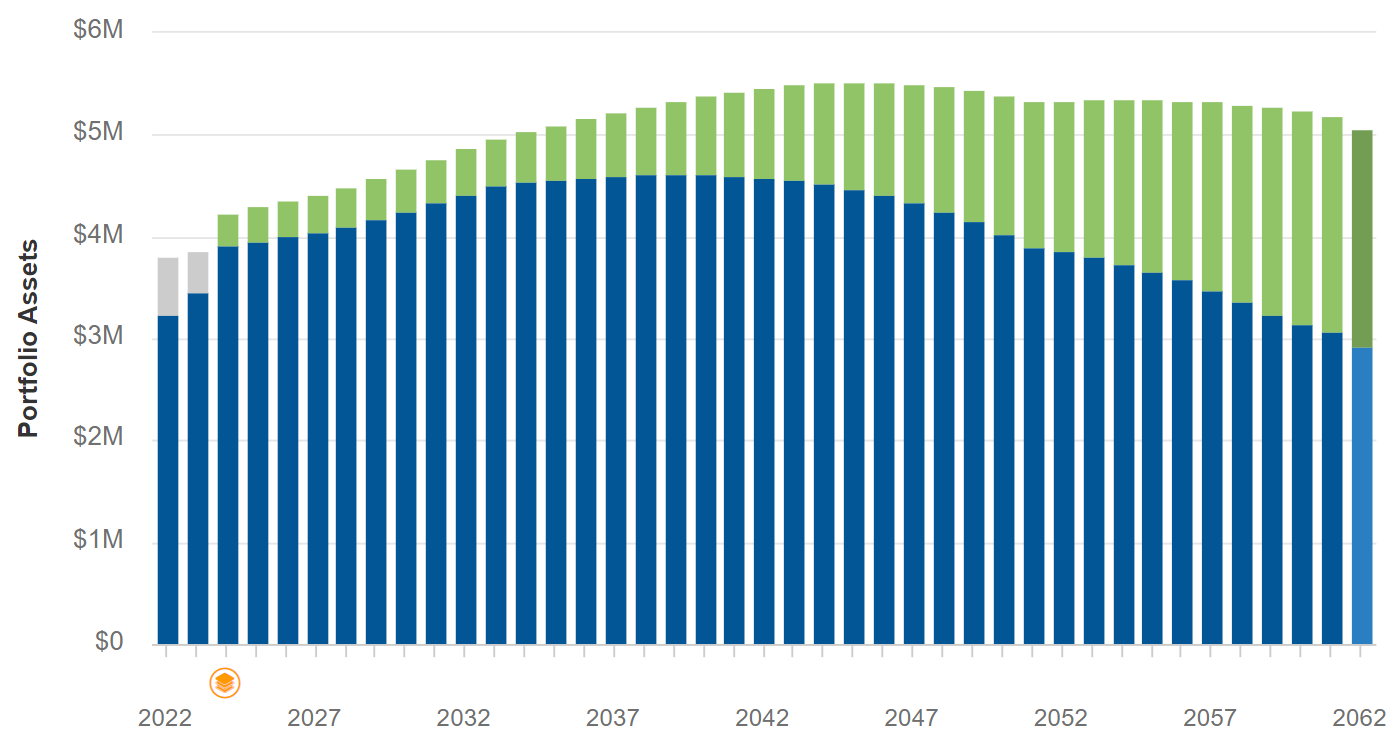

Working to 62

If the Millers worked until 62, we see that their portfolio was projected to grow to more than $5 million, so a few extra years of work would buffer the risk of spending down their assets. However, Sandy and James would prefer to sell today, so we looked at a slight reduction in spending.

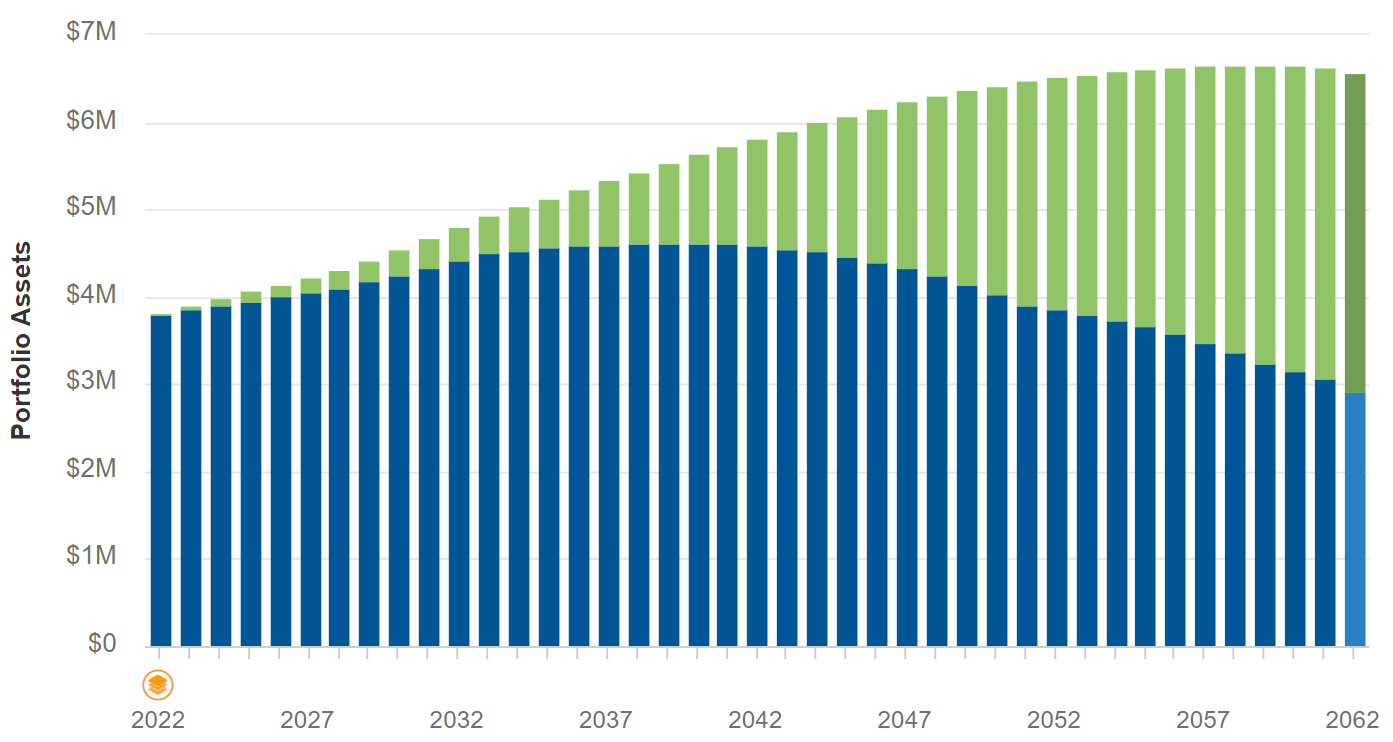

Reducing spending to $125,000 per year

If the Millers pulled spending back to $125,000 per year, a target they could manage but would restrict them a bit, their portfolio was projected to grow even more, topping $6 million by their age 100. This gives them a far better chance to maintain or grow their nest egg over time, but wouldn’t offer the flexibility they were looking for, especially in the early years. They had places to go!

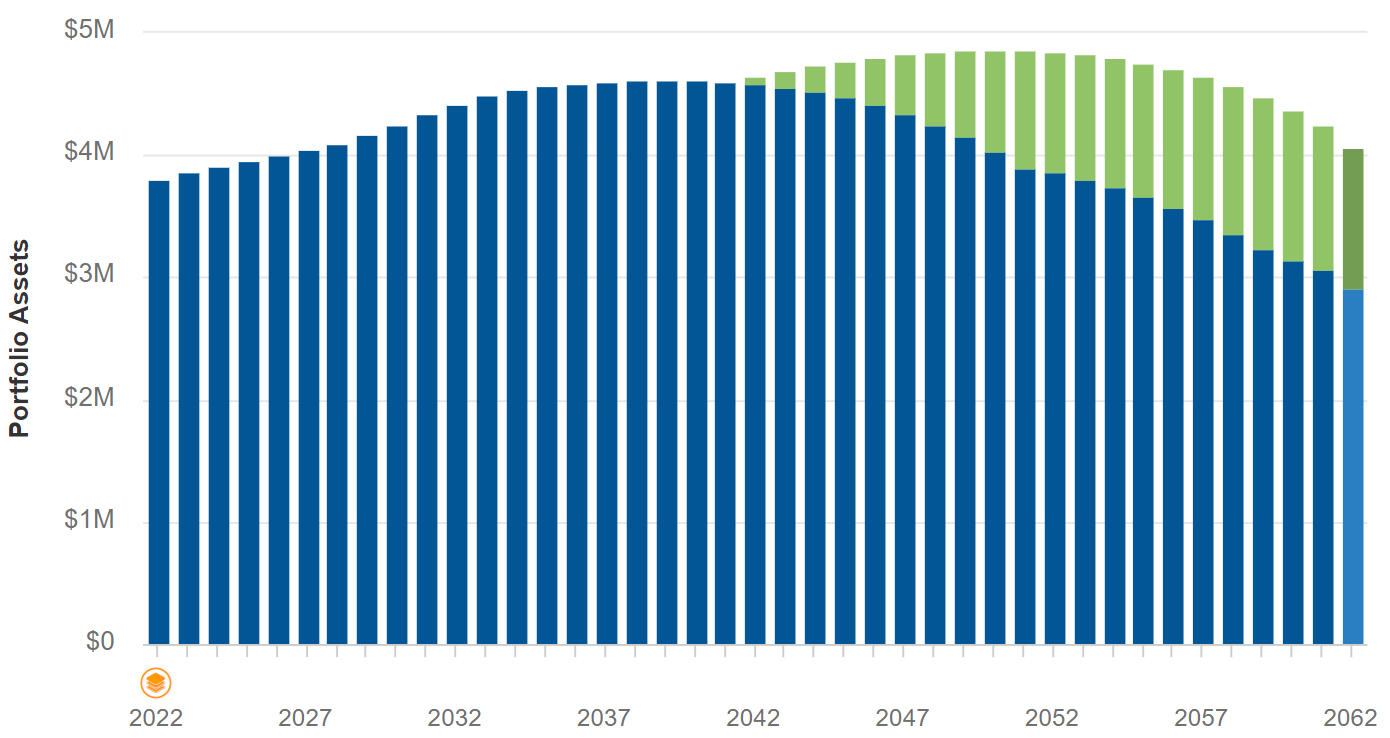

Middle ground for the Millers

They ultimately decided on a blend of these options. They would sell today, spend their $150,000 per year target for 20 years to complete their travel bucket list, then reduce spending down to $125,000 at age 80 when they are less likely to want to travel as much. In this case, we see they are able to reach their goals, see the world, and maintain the health of their nest egg – a win, win, win! While there’s still work to do to craft their income and investment strategy, they are well on the way to success.

The Millers started confused and worried. They dreamed of a life spent traveling with family but weren’t sure it could happen. However, with some careful planning, they discovered that they could sell the business and turn their focus to travel planning, replacing their anxiety with excitement and anticipation.

If you can relate to the Millers, with big dreams but no roadmap to reach them, building a financial plan can be a great first step. Use these four planning questions to start setting your own goals. Then find a planning team you can trust to help build your roadmap to reach your own financial independence goals! If you’re looking for a team like this, you’re welcome to reach out to schedule a Fit Interview with our team.

Projections above were run using eMoney assuming 5% return on investments and 3% inflation. Past performance is no guarantee of future results. This case study does not suggest future stock market performance and does not reflect an actual client experience. It is used only to illustrate services available through Alterra.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.