Do you panic when the stock market drops 10%? How about 20%? How did you react during the Great Recession of 2008 when the S&P 500 lost 50% of its value? Market declines are never fun, no matter how long they last, and it’s common to feel concerned, anxious, and even panicked. Each one feels different, too: the tech boom and bust in 2001, the housing bubble in 2008, and the global Covid-19 pandemic in 2020.

But despite the gloom brought by each downturn, we know that declines are part of the market cycle and they have always bounced back. So how often do market corrections occur? History can help understand how frequently these events happen and what to do when the next market decline strikes.

A history of past market declines

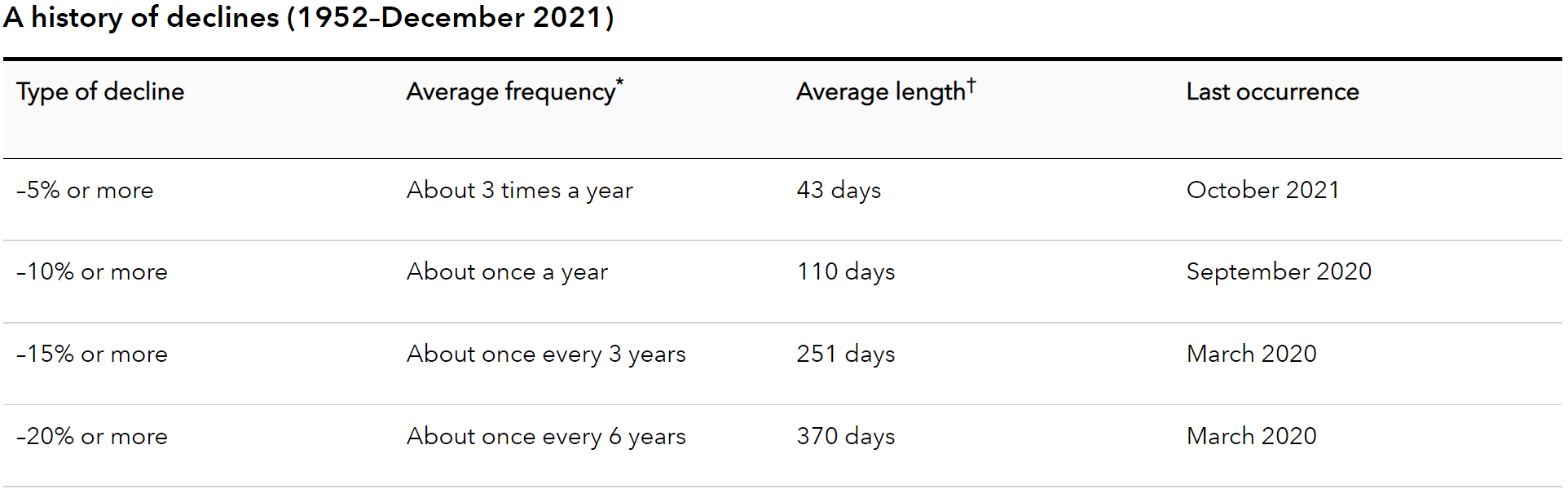

Using the table below from a recent Capital Group analysis, we can better understand how frequently market declines happen, how bad they are, and how long they last.

Though we can see how frequently declines happen on average, no one can predict when the next one will happen or how long it will last. As we discuss in Time In the Market Is Better Than Timing the Market, market recoveries tend to be just as fast (or faster) than the declines that precede them and missing just a few of the best days can be devastating to your results.

Does this mean you’re stuck just riding it out without a plan? You certainly don’t have to be! Here are three ways to plan for market declines.

3 market decline survival tips

1. Expect declines.

If you’re up to date on your market history, you know that dealing with declines is part of the life of an investor. This means you don’t have to be surprised by the next one. Selling while the market is down and “waiting for things to recover” is one of the few mistakes that can wreck a retirement plan. Why? While the situation may feel better after the market has recovered, but by then you’ve missed out on the gains you would have earned by staying in it.

2. Understand how to evaluate your results.

Are you an aggressive investor looking for high growth? If so, you’re likely to be invested primarily in stocks and can expect that your portfolio will be more volatile, and your decline could be just as much or more than a benchmark like the S&P 500.

On the other hand, if you’re retired and looking for stable income, your portfolio may be focused on dividend-paying stocks and invest in more bonds to reduce volatility. This usually leads to smaller declines when the market turns down, though this is not always the case, as we discuss here.

Talk with your advising team about what to expect in different market environments based on your specific investment strategies, as well as a game plan for what to do if results aren’t what you thought they would be.

3. Plan your buckets based on your goals.

We know that staying invested during market declines is a key to the success of your retirement income plan. But what if you’re taking monthly income from your investments or a big expense comes up? As we discuss in Understanding Retirement Income, planning your short, mid, and long-term buckets can help.

- Safety. This bucket is for 6-to-12-months of emergency reserve expenses to provide more security in bad times, usually kept in a high-interest savings account. In major market downturns, you can draw on this if needed.

- Income. This bucket is for 5-to-7 years of income, focused on providing you with steady income and limiting the ups and downs of the market.

- Growth. This bucket grows the funds you won’t need for 7+ years and, because this is intended for use more than 7 years from now, you can let it ride through even the worst of the market ups and downs.

Talk with your team!

In addition to these planning tips, remember that your advising team should serve as a partner with you to help navigate tough times and decide if changes are needed. Your needs are unique, which means the right approach to the next market decline might be different for you than others like you. But with the right plan, you’ll be equipped to confidently persevere through future downturns and keep your retirement income plan on track!

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. Clients cannot invest directly in an index. Past performance does not guarantee future results.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.