The good news is, through the strategies we’ll discuss here, many have found just that: a clear, simple path to creating order, reducing estate taxes, and preparing the family legacy they want.

In Simplifying Your Estate Planning, we introduced a 4-step blueprint to create your estate and legacy plan:

- Start with how much income you need to enjoy life.

- Look for opportunities to discount your assets.

- Freeze the value of your estate.

- Create liquidity for taxes.

Here we look at the simple but powerful combination of steps 3 and 4: “freeze” assets by moving them outside of your estate and leverage irrevocable life insurance trusts to create optimal liquidity for taxes. This dynamic duo of strategies not only minimizes tax liabilities but also safeguards your wealth and ensures a smooth transfer to future generations.

What do you mean by “freeze”?

As discussed in How to Avoid $2.6 Million in Estate Taxes, anything over $13.61 million (the amount you can pass estate tax-free, also called your “estate tax exemption”) is subject to up to 40% estate taxes, a threshold set to cut in half at the end of 2025. By default, those assets are valued and subject to tax when you die. So, if you have an investment portfolio worth $5 million today that grows to $10 million by the end of your life, that full $10 million could be subject to estate tax.

Instead, you can “freeze” today’s valuation by moving that portfolio out of your estate into certain kinds of trusts now. This means any future growth on these assets takes place outside your estate and would not be subject to estate tax rather than passing the asset later at a higher value. You get the added benefit of locking in the current $13.61 million tax-free exemption by using it before it’s too late.

This idea alone has the potential to save millions on estate tax. But what if you’ve used your full exemption and are still facing an estate tax bill? Or perhaps “freezing” assets by moving them into certain kinds of trusts isn’t right for you? Let’s look at how to simply create liquidity to pay those taxes with less of your own money.

Create tax-free liquidity with the Irrevocable Life Insurance Trust (ILIT).

Now that you have created a strategy to minimize the amount of estate tax you’ll have to pay, here’s how an Irrevocable Life Insurance Trust can create a simple way to pay any remaining taxes. It combines two tools:

- An irrevocable trust. This trust sits outside your estate, so assets you move into the trust pass estate tax free at your death. In this case, the trust will own a life insurance policy.

- A life insurance policy. Life insurance death benefits pass income tax free at your death, which helps your beneficiaries because this is when your estate will owe tax.

By addressing both income and estate tax, how big an impact can a well-designed ILIT have?

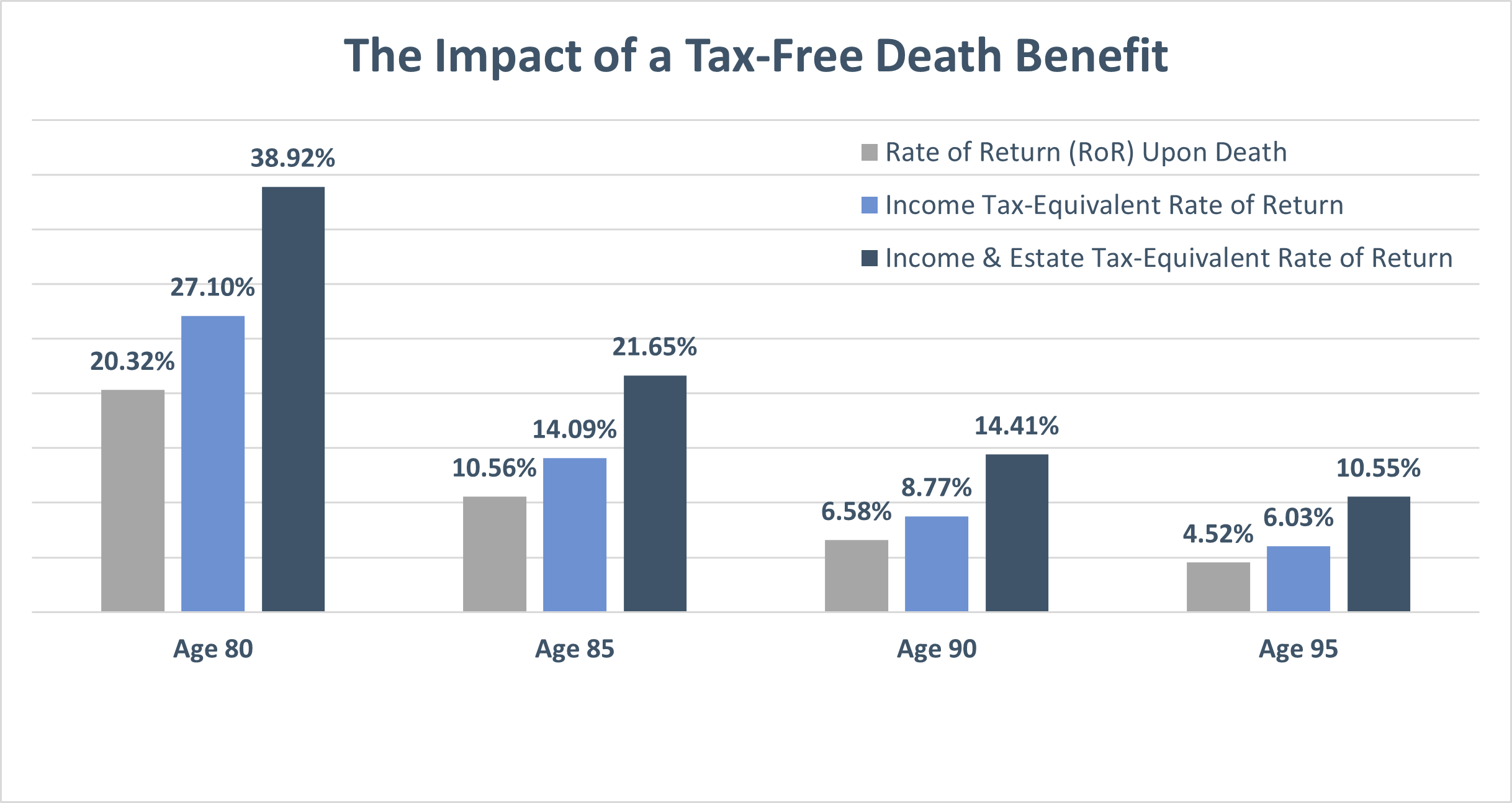

Let’s compare a sample Irrevocable Life Insurance Trust strategy, which avoids income and estate tax, with the equivalent rate of return you’d have to earn in a taxable investment to overcome income and estate tax that would otherwise be due. To explain the case study below, let’s look at the client’s age 90 the example below:

- The rate of return from a hypothetical life insurance death benefit is 6.58%.

- If a hypothetical investment account was created using the same outlay, but subject to 25% in income tax, it would have to earn 8.77% to achieve the same after-tax benefit.

- If that account was subject to both income and estate tax, it would have to earn 14.41% to achieve the same after-tax benefit as the ILIT.

The returns vary by year because, for example, if the client passes away before age 90, she receives the same death benefit but pays for if for fewer years.

How does this work?

- Identify the amount of tax you’re projected to owe. A team like ours can help you do this as part of a comprehensive financial plan.

- Set up an Irrevocable Life Insurance Trust. A qualified estate attorney can consult with you on the best structure and set up the trust. It’s important to have your attorney and financial advisor work together in efforts like this.

- Obtain life insurance in the amount of your projected tax. This requires application, medical and financial evaluation, and then ensuring it’s properly set up to be funded and owned by the trust. Again, our team can help with these steps.

- Make gifts to the trust to pay the annual life insurance premium. Some do this all at once, others make annual gifts, but this is another aspect that requires careful coordination with your advising and attorney teams.

In the end, when properly structured, you’ve created income and estate tax-free cash at your death – right when your beneficiaries need it. With money available to pay any taxes, they won’t be forced to sell illiquid assets like your business or real estate. And, even when there’s no major estate tax problem, this strategy of using trust-owned life insurance in your estate plan is often used to increase the wealth passed to your family or charity.

Ready to take the next step? Let’s talk! Together, let’s embark on a journey to help you create the life and legacy you love.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.