Have you ever wondered, “Should we have a trust?”, then quickly realized you don’t even know how to start to answer that question? Well, you’re in good company. Confusing terms and acronyms like “irrevocable”, “ILIT”, “SLAT”, “CRUT”, and others only compound the confusion. Many people who want to protect their assets from a lawsuit or an estate tax bill hear that a trust might help and reach out to ask.

So, is a trust right for you? And, if so, what kind? While there are many uses for different kinds of trusts, we’ll focus on Revocable vs. Irrevocable trusts, and which is better for reducing estate taxes.

What is a Trust?

Let’s start with a simple definition. A trust is a legal tool that allows one party (“Grantor”) to give a second party (“Trustee”) the right to hold assets on behalf of a third party (“Beneficiary”). For example, a parent might be concerned about providing for her minor child in case she dies. So, the parent (Grantor) might give an aunt (Trustee) the right to manage certain assets for her child (Beneficiary). Once the legal agreement is set up, ownership of these assets is transferred to the trust.

Common uses for trusts include eliminating estate tax, caring for a child with special needs, and avoiding probate court, with a different kind of trust used in each case. These are complicated decisions, so we suggest enlisting a qualified team to help select and set up the right trust for you.

Revocable vs. Irrevocable trusts & the estate tax

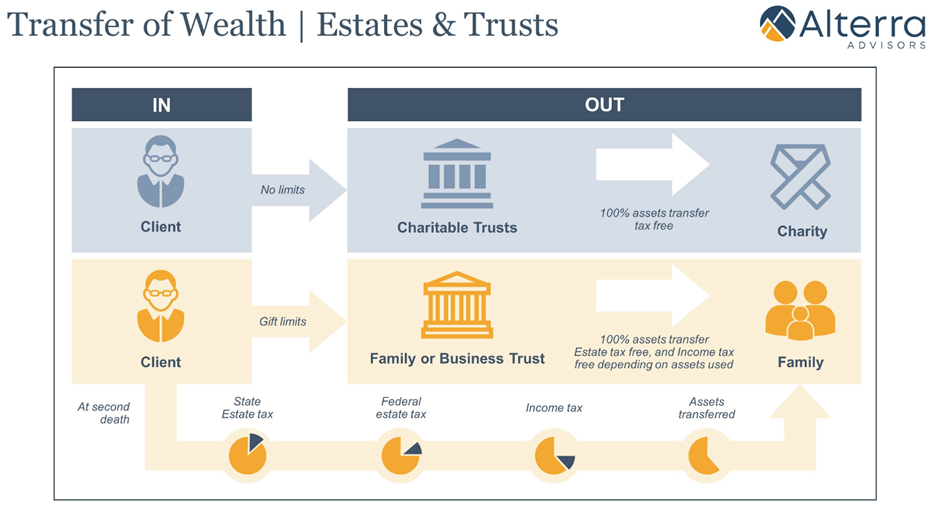

As we discuss in How to Reduce Estate Taxes, the illustration below shows that some assets are considered “IN” your estate, while others are considered “OUT” of your estate:

- Assets IN your estate include anything you personally own – the left column – and are generally subject to estate taxes.

- Assets OUT of your estate include assets that started in your estate but were moved to certain kinds of trusts – the right column – and are generally protected from estate tax.

Protection from estate taxes largely comes down to one factor: control. To be protected from estate taxes, you must give up some level of control over your assets. If you choose not to, you’re not likely to be protected. We’ll break this down a little more here:

Revocable Trusts help pass assets outside the probate process but allow you to keep control of the assets during your lifetime. You can be the trustee of the trust, move assets in and out, and dissolve the trust – the decision is “revocable”.

Because you keep full control of the assets, revocable trusts remain IN your estate, so you’ll still be subject to estate tax. If protecting your assets from the estate tax is your goal, you may need an Irrevocable Trust.

Irrevocable Trusts offer protection from estate taxes because they require you to give up some form of control over assets. Once you set up and move assets into the trust, you typically cannot change the trust in any meaningful way – the decision is “irrevocable”.

Because you give up legal control of assets in an Irrevocable Trust, these assets are considered OUT of your estate and are no longer subject to estate taxes, saving millions in tax for many. Some strategies allow you to keep some access, as we discuss in Out of Your Estate, Not Out of Reach, but you should expect limitations.

Why is this important for estate taxes?

Why consider an irrevocable trust for estate taxes? There are two key reasons: reducing estate taxes and paying estate taxes. Let’s look at each case.

1. Reduce estate tax

Kathy and Kyle live in Washington State and have a $20 million estate between their personal home and a variety of investment accounts. They aren’t currently subject to federal estate tax but would owe about $3 million in estate tax to Washington State, which kicks in above $4.386 million, if they died today.

We helped them discover that they can live happily on $5 million. If they were comfortable giving up access to the remaining $15 million and moved it into an Irrevocable Trust, they would nearly eliminate their potential estate tax bill.

2. Pay estate tax

Sharon lives in Washington State and has a net worth of $25 million, mostly consisting of a large commercial property that she’d like to pass to her kids. She used our estate tax calculator and learned that she would have an $8 million estate tax bill if she passed away tomorrow. But with most of her net worth tied up in the property, her kids wouldn’t have the funds to pay the tax and would likely need to sell.

Sharon needs to keep control over her assets, so moving them out of her estate and giving up control won’t work for her. Still, she needs a plan to pay the tax.

If she saves enough and sets money aside (not using an Irrevocable Trust) to pay $8 million tax bill, she’s covered, right? Nope. Now the estate is worth $33 million with a $12 million tax bill.

Alternatively, she could use an Irrevocable Trust to hold her new tax reserve fund, moving these assets out of her estate today, and passing them to her kids at death to pay the tax bill. Commonly, an Irrevocable Life Insurance Trust (ILIT) is used in this situation. Sharon makes annual payments to the trust, which are used to purchase enough life insurance to pay the expected bill. She lowers her taxable estate, creates tax-free funds to pay the tax bill, and keeps control of her assets for longer.

Should you use an Irrevocable Trust? Ask these 3 questions.

- Do I have a taxable estate or am I likely to have one in the future? You can use our estate tax calculator to find out! Make sure to account for state estate taxes if you live in a state with additional estate taxes like Washington or Oregon. Also note that we expect estate taxes to start at much lower estate levels in 2026.

- Do I have assets that I would be comfortable giving up access to today? As we’ve discussed, moving assets to an Irrevocable Trust is a permanent decision that should not be taken lightly. Work with your advising team to make sure you’ll have access to the funds you need to enjoy life!

- Do I want to pass more to loved ones or causes I care about? Reducing taxes means passing more to others. It’s important to consider the long-term impact you want to make.

If you answered “Yes” to at least two of the questions above, an Irrevocable Trust could make a big difference and is worth considering. Your financial and legal planning team can walk you through different types of Irrevocable Trusts and what might the best fit for your situation.

Zach Hamilton

CFP®

Partner, Financial Advisor

About the Author

Zach graduated from Gonzaga University with degrees in Marketing and Finance. While growing up, Zach heard stories from his grandfather about his work as an insurance agent, and other stories from his dad who was an investment manager. They both spoke financial “languages” but had completely different dialects. Recognizing the breadth of the financial vocabulary ultimately led to Zach’s passion for financial planning. He credits his family for this enthusiasm. Zach sees his time with clients as an opportunity to translate all of the different – and often confusing – information they’ve heard and provide clear guidance for each unique situation.

Zach enjoys working with people – his clients – who also appreciate that their financial decisions have an impact not just on themselves, but also on their families, charities and their own life legacy. Many of Zach’s clients have a strong desire to “make a difference”, and they rely on his financial expertise to magnify their philanthropic goals.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.