Did you know that a soon-to-be-expired law could help your family avoid paying $2.6 million in estate taxes? If not, you’re not alone.

Estate taxes are complex and ever changing, making it difficult to keep up. They not only take a substantial bite out of your wealth, but they can also create confusion and tension for your family during an already difficult time. No one wants to pay more in taxes than necessary and, perhaps more importantly, no one wants to leave a legal mess to their family after they’re gone.

Though estate taxes can be high, the federal estate tax exemption – the amount you can pass tax free – is also at an all-time high…for now. But that window is closing. So, what can you do to take advantage of the all-time high exemption and reduce your estate tax bill?

Let’s look at an overview of estate taxes, the exemption, and what you can do now.

What is the federal estate tax and the estate tax exemption?

The estate tax is a tax on your accumulated wealth assessed by the federal government when you die. Let’s start with how the federal estate tax works.

- Your first $12.92 million passes tax-free – called an “exemption” (adjusted annually for inflation).

- Each spouse gets an exemption, so married couples can pass $25.84 million tax-free in 2023.

- The exemption is “portable” which means your unused exemption transfers to your spouse if you are married.

- After exemptions are applied, the tax rate starts at 18% on your first taxable $10,000 and climbs to 40% on taxable assets over $1 million.

Many states add an additional estate tax. In our home state of Washington, your first $2.193 million passes tax free and remaining assets are taxed at up to 20%. This article focuses on the federal estate tax only, but a complete plan should account for state estate taxes, too. If you live in Washington, use our estate calculator to find out if you’re at risk of owing federal or state estate taxes.

The current exemption is the largest in history, but it won’t last.

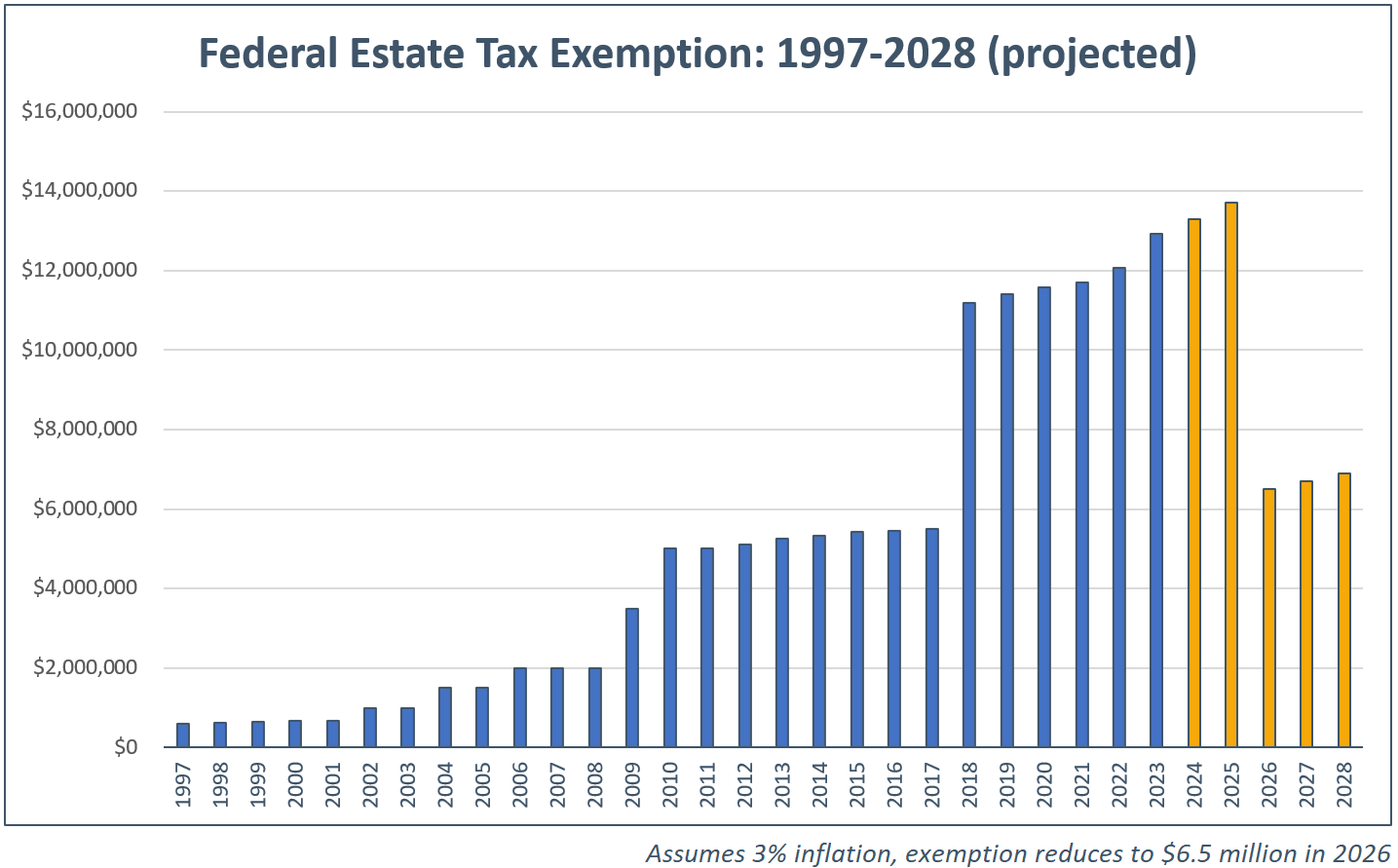

The current federal estate exemption is at an all-time high, increasing from $600,000 in 1997 to $12.92 million today. Here’s a look at how this exemption has changed over the years.

This all-time high exemption limit is expiring effectively reducing the exemption by half to approximately $6.5 million at the end of 2025.

Much of today’s exemption is a ‘use it or lose it’ opportunity.

As we discuss in Plan by Default vs. Plan by Design, everyone has an estate plan by default…the government’s plan. Doing nothing means accepting their plan for your assets, which is fine for many. But is it fine for you? What’s the potential cost to your loved ones if you wait? Let’s look at two examples:

$10 million estate

If your estate is $10 million, you’re under the current exemption and you wouldn’t owe any estate tax today. But if the exemption reduces from $12 million to $6.5 million (as it is scheduled to do in 2026), your estate tax bill could jump to more than $1.4 million.

$35 million estate

If your estate is $35 million, you’re already facing nearly $8.8 million in federal estate tax. If, however, the exemption went from $12.92 million to $6.5 million before you used it, you’re looking at a total federal estate tax bill of $11.4 million – a $2.6 million increase in taxes.

What can I do now?

You don’t have to wait to use your $12.92 million exemption, you can use it during your life through gifts, which can be far more effective in many cases. This is in addition to the $17,000 gift limit you can give to each person each year.

So why would you give during your life instead of at your death? Two reasons:

- You lock in today’s all-time high estate tax exemption. We’ve already looked at the potential cost of waiting. If you give $12 million today and the exemption reduces to $6.5 million in future years, your full gift is already out of your estate and exempt from estate tax. But if you wait and the exemption is reduced, you’re now limited to that lower exemption and will pay more in tax.

- Save tax on future growth. If you give away $12 million today, live for another 20 years, and your gift earned 5% per year, the initial $12 million would grow to nearly $32 million. The $20 million in growth would be outside your estate and not subject to tax when you die, saving $8 million in taxes.

If I give it away, don’t I lose it? What if I need those funds?

There are a wide variety of ways you can make gifts for estate tax purposes and maintain some level of income or access to these assets during your life. Your estate and financial planning team can help you weigh these options when considering substantial gifts.

For more, read Out of Your Estate, Not Out of Reach.

Want to learn more about how to use your exemption and reduce estate taxes?

In How Do I Reduce Estate Taxes?, we detail a 5-step process to reduce your potential estate tax bill.

To start, you’ll want to be prepared to answer three questions:

- How much do I need in my retirement nest egg? These are the funds you need to enjoy life without worry. Once your nest egg is secure, attention can shift to reducing estate taxes.

- Do I want to make gifts to charity when I pass? Nothing passes to charity unless you make special provisions, so you’ll want to consider specific causes you care about and make sure funds are set aside in your estate plan.

- What impact do I want to make on my family? Some want to leave unrestricted funds to future generations, while others want to direct funds toward specific uses like education. Consider including the kids and grandkids in the discussion. These future generations will ultimately be the stewards of your wealth and it can help to invite them into your long-term legacy vision.

I’m ready to get started…but where do I start?

You’ve made up your mind that it’s time to be remembered as the one who thought of everything – the one who prepared your family for a peaceful transition of assets and enhanced the harmony within the family.

Your plan to reduce taxes and pass more to loved ones will require a team of financial, legal, and tax professionals, but a conversation with a comprehensive financial planning team, like ours at Alterra, is a great place to start. Before you have wills and trusts drafted, you’ll want a clear, coordinated action plan for the big picture.

Whatever your goals, the time to act is now. This is not something to rush through at the end of 2025, it takes time. But the all-time high estate exemption is a costly opportunity to miss. With a clear plan and a coordinated team, you’ll be setting the stage to minimize the impact of estate taxes and to establish the legacy you genuinely envision for your family.

Alterra Advisors does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.