Open any financial article and you’re likely to find terms that are familiar but confusing for a lot of investors. When the market is up, terms like bull market and economic expansion pass by without concern. But when the market turns down, terms like correction, bear market and recession can add confusion, uncertainty and anxiety, especially without understanding their meaning. So, let’s clear some of the confusion – what do these terms mean? And how do they affect you?

Some measure the economy and some measure the market

As a start, it’s important to know the difference between terms that measure the economy versus terms that measure the market. Recession and expansion measure economic growth, while correction, bear market, and bull market measure what’s happening in the market.

Correction & bear market – measures of the market

Corrections and bear markets track specific levels of decline in major stock market indexes like the S&P 500 or Dow Jones.

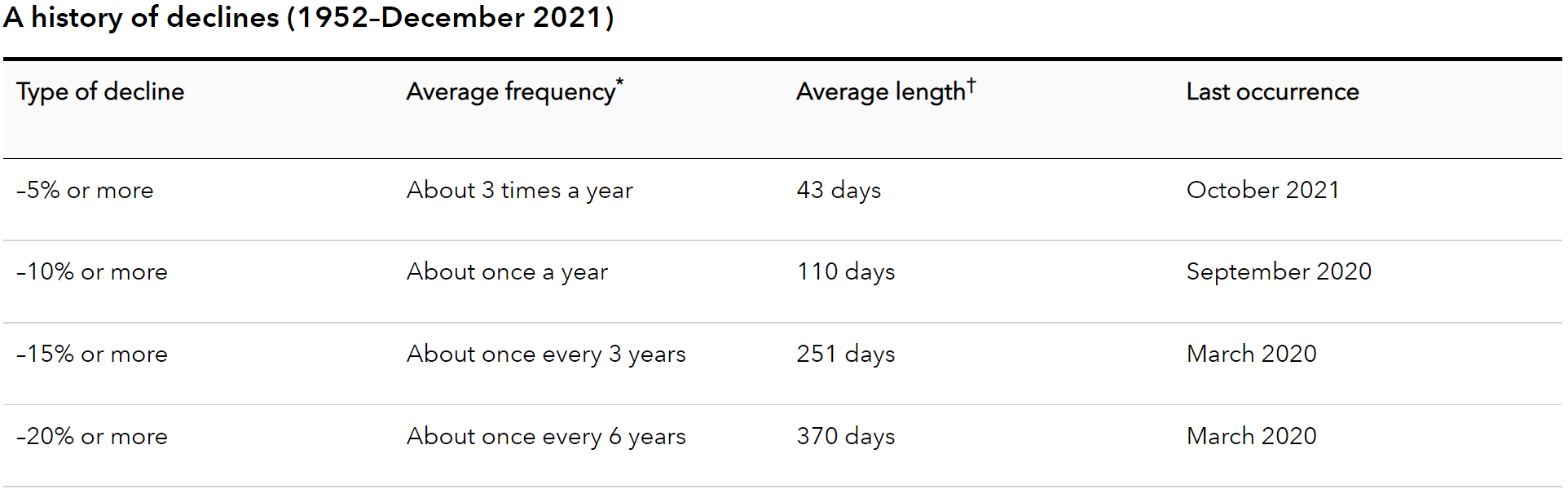

- A bear market is a decline of 20% or more, tends to last more than a few months and occurs once every 5-6 years or so.

- A correction is a decline of 10% or more, typically recovers within a few months and occurs almost every year – sometimes more than once.

In good times, it’s easy to forget that market declines are part of the cycle. In the down times, it’s hard to remember that every downturn has been followed by recovery.

Recession & GDP – measures of the economy

Businesses are constantly making things based on the rate they expect people will buy them. When businesses make more than consumers buy, inventory builds up and new productivity slows down. If a grocery store restocks the shelves weekly, but customers start buying less for a period, the store might move to restocking every other week until customer activity picks back up. This ripples up the entire chain, slowing down every company with a product on those shelves.

A recession occurs when GDP, or gross domestic product – a measure of our economy’s total production – falls for two straight quarters. Economists disagree on what specifically causes a recession, but like the ebb and flow of the tides, it’s a normal part of the cycle. According to Forbes, the average period of economic growth lasted 3.2 years while the average recession lasted 1.5 years – an average of 4.7 years for the full business cycle.

How can I stay in control during the next bear market or recession?

- Accept that both are part of the cycle and very difficult to predict. While we don’t know when, history shows us that we will see another correction, bear market and recession at some point. It doesn’t mean the system is broken – it’s a natural part of the cycle and is usually followed by expansion and recovery soon after.

- Check your allocation and risk tolerance. Real loss occurs when you sell in a down market, usually because of fear of further loss. Review what your portfolios would have done in prior downturns. Would you have been able to stick it out? If so, you’re more likely to make it during the next one. And, if you’re widely diversified, you reduce your risk of loss due to one poorly performing area of the investment world.

- Confirm your time horizons. Regardless of your ability to handle risk, your emergency reserves shouldn’t be in the stock market. Will you need any of your long-term funds on a short-term basis? This is a great reason to consider making changes to your investment mix.

- Try not to panic and stay the course. As we’ve previously discussed, if you’ve made it through steps 1-3 above, you have good reason to stay the course. The ups and downs of the market and economy have always been – and almost surely always will be – part of the investing process. But, if your financial plan, risk tolerance and time horizons line up, you don’t need to let the next correction, bear market or recession throw off your long-term plans.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.