In 2022, inflation peaked at 9.1%. In response, the Federal Reserve increased interest rates a total of 5.25% between March 2022 and July 2023, their primary way to combat inflation. The US stock market declined nearly 20% and the US bond market was down 13%. The stock market tends not to like surprises and, historically, short-term volatility spikes when interest rates jump.

But how does the market respond when interest rates fall? If inflation continues to fall, many expect the Federal Reserve to start cutting interest rates later this year. What should we expect in the stock market?

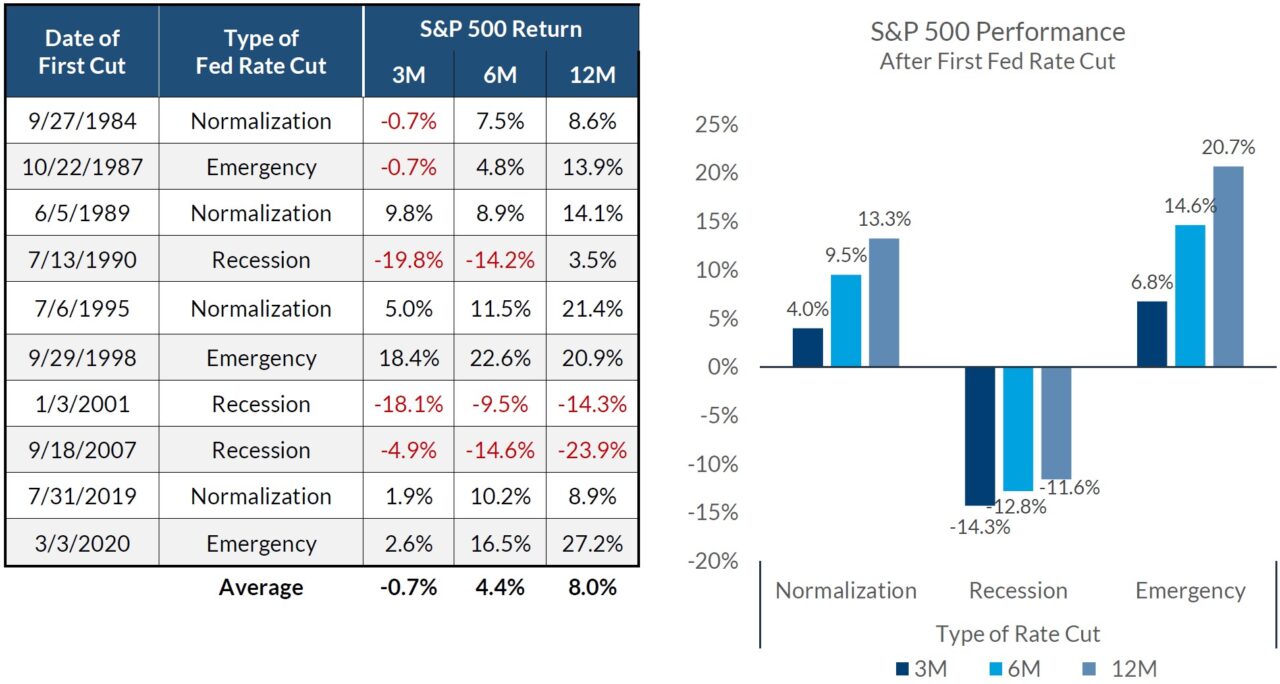

The analysts at City National Rochdale say…it depends. Their analysis below shows three historical situations where the Federal Reserve cuts interest rates:

- Normalization, bringing interest rates down to a normal range after prior increases.

- Recession, spurring economic activity by making money cheaper to borrow.

- Emergency, stabilizing the economy during times of crisis.

According to CNR, the S&P 500 increased 13.3% on average in the 12 months following the first “normalization” rate cut. After the historic rate increases in 2022-2023, the anticipated Federal Reserve cuts would be an effort to normalize rates. So, while the past is no guarantee of the future, it could be a promising sign for what’s to come.

And, of course, though it can be helpful to understand what’s happening in the market and economy, we want to focus on the controllables in your life and your plan and strategies that help you reach your goals regardless of what the market does in any given year. For more, see our articles on Time In the Market vs. Timing the Market and The Best Day of the Year to Invest!

The Standard & Poor’s 500 (S&P 500) is an unmanaged, value weighted group of securities considered to be representative of the stock market. Clients cannot invest directly in an index. Bond prices are inversely correlated with interest rates, have maturity dates when principal must be paid back or risk default, and have some advantages over stocks, including relatively low volatility, high liquidity, legal protection, and various term structures, however bonds are subject to interest rate risk, prepayment risk, credit risk, reinvestment risk, and liquidity risk.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.