If you have a lump sum of money sitting in the bank, you might find yourself caught between two fears:

- What if I invest now and the market goes down?

- What if I wait too long and I miss out on all that growth I could have had?

This is a common situation to find yourself in. You don’t want to lose your hard-earned dollars, but you probably also know someone who sat on cash for too long and suffered because of it. Wouldn’t it be great to know the best day of the year to invest?

Russell Investments has some interesting insight for us in a recent analysis they put together.

A tale of 5 investors

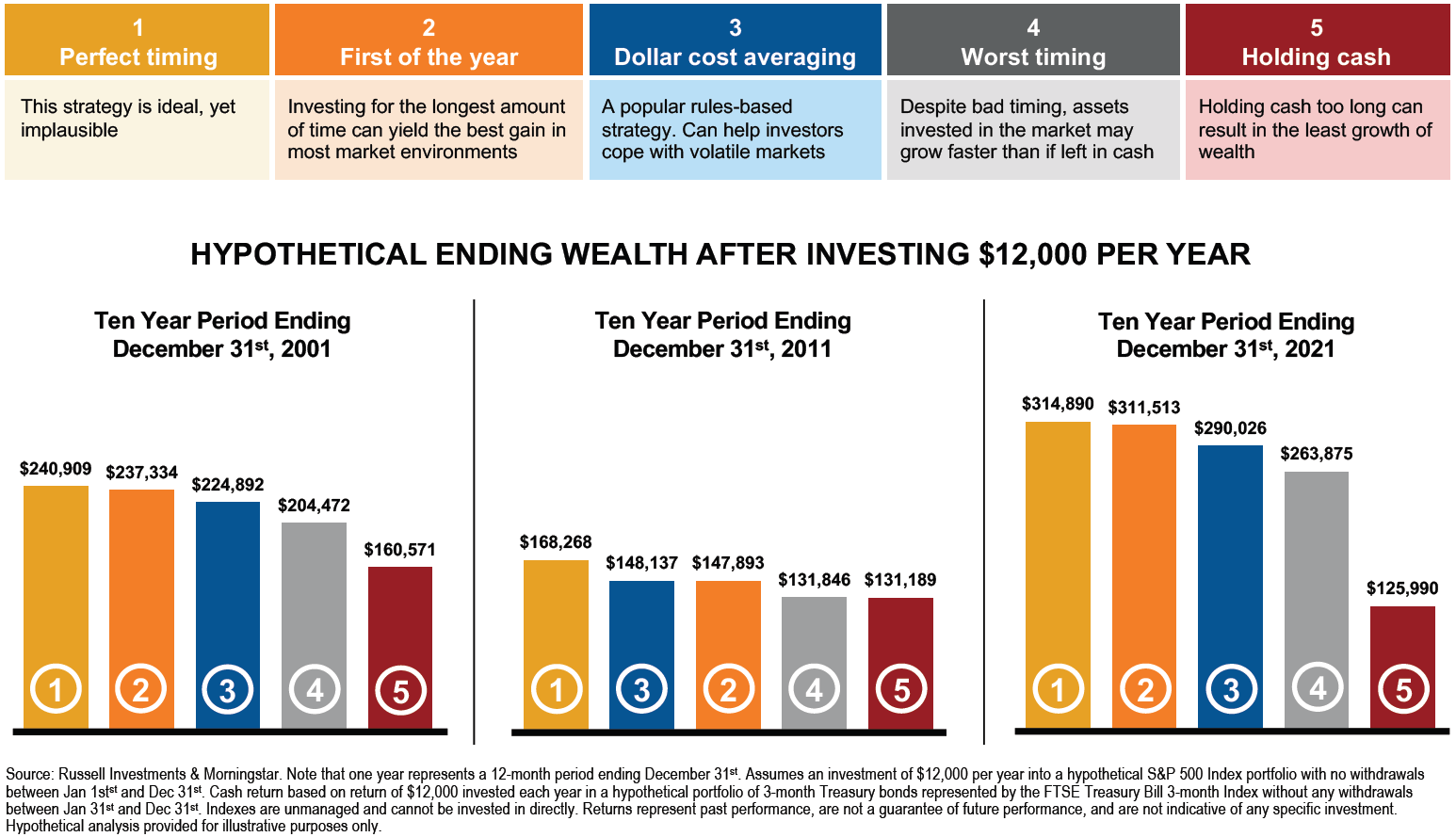

The Russell Investments team projected the results of 5 long-term investors who each have $12,000 per year to invest for 10 years.

- Investor 1 has perfect timing and invests on the lowest day of the market each year.

- Investor 2 invests everything all at once on the first day of the year.

- Investor 3 invests $1,000 per month to spread the risk out, a strategy called Dollar Cost Averaging.

- Investor 4 has the worst timing and invests on the market’s highest day each year.

- Investor 5 never invests, holding cash in a bank account.

They looked at this over three 10-year periods:

- Ending December 31, 2001

- Ending December 31, 2011

- Ending December 31, 2021

How did each investor do?

- Investor 1 with perfect timing won in each scenario. However, we know this is an implausible strategy because no one can successfully predict the lowest day of the market each year, though it would be nice!

- Investor 2 who invested on the first day of each year came in close second most of the time, showing because her funds had more time to grow.

- Investor 3 who made monthly contributions came in third, a solid strategy to spread out risk while remaining committed to a disciplined investment strategy.

- Investor 4 who had the worst timing and invested at the high point of each year, came in fourth. However, despite his impossibly poor timing each year, he still came out ahead of the last investor who kept everything in cash.

- Investor 5 who kept everything in the bank earning minimal interest but avoiding investment risk came in last in every 10-year period.

What can we learn from this?

There are a few important lessons we can learn here:

1. Perfect timing is impossible. So, if you find yourself waiting for “the right time”, we encourage you to ask yourself how you’ll spot that perfect time. For many, this means waiting until things feel better, usually after the market increases and those gains are already in the rearview mirror.

2. Time in the market is better than timing the market, as we’ve previously discussed. Investor 2 who invested everything on the first day of each year gave her money more time to grow and beat investors 3, 4 and 5 most of the time.

3. Dollar cost averaging is a solid way to reduce risk. As investor 3 shows, if the prospect of investing all your cash at once feels too risky, spreading your contributions out monthly is a good next strategy. If this sounds like you, set up an automatic monthly investment to avoid having to remake this decision each month.

4. Investing on the worst day is still better than not investing. Investor 4, that poor guy who picked the worst day of every year to invest still came out ahead of investor 5, who kept all his cash in the bank.

Investing can be a nerve-racking experience, especially in volatile times. History shows us time and again that sticking to a diversified investment strategy for the long-term is the way to go, but we’ve also learned here that there is more than one approach that can work…each one better than leaving funds on the sidelines in cash. Integrating your investment strategy into a comprehensive financial plan that carefully assigns time horizons to each investment can help bring confidence, knowing what you should spend now and what you should leave to grow for the future.

A note on dollar cost averaging. Dollar cost averaging may help reduce per share cost through continuous investment in securities regardless of fluctuating prices and does not guarantee profitability nor can it protect from loss in a declining market. You should consider your ability to continue investing through periods of low price levels.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.