The headlines have recently been full of news about inflation, high interest rates, the risk of inflation…all causing big swings in the market. If you’re retired, volatility is concerning, but chances are you’re a moderate investor generally shielded from the full swings of the market.

Then you opened your first or second quarter statements and saw that, in some cases, your moderate portfolio was down just as much – or more – than an aggressive benchmark like the S&P 500. Why? Is there a flaw in your strategy? Do you need to make a change?

Though the first two quarters of the year were uniquely challenging for investments across the board, you may be wondering why your bonds didn’t protect you against the stock market volatility this time around. It’s a great question and one we’ll look at together.

Bonds declined more than stocks in the first quarter.

The first six months of this year marked the worst start for the market since 1970, due in large part to high inflation lasting longer than expected and the prolonged war in Ukraine. This uncertainty brought big swings to stocks. It usually makes sense to assume that bonds would be a safe haven, but that wasn’t the case this year. Here’s why.

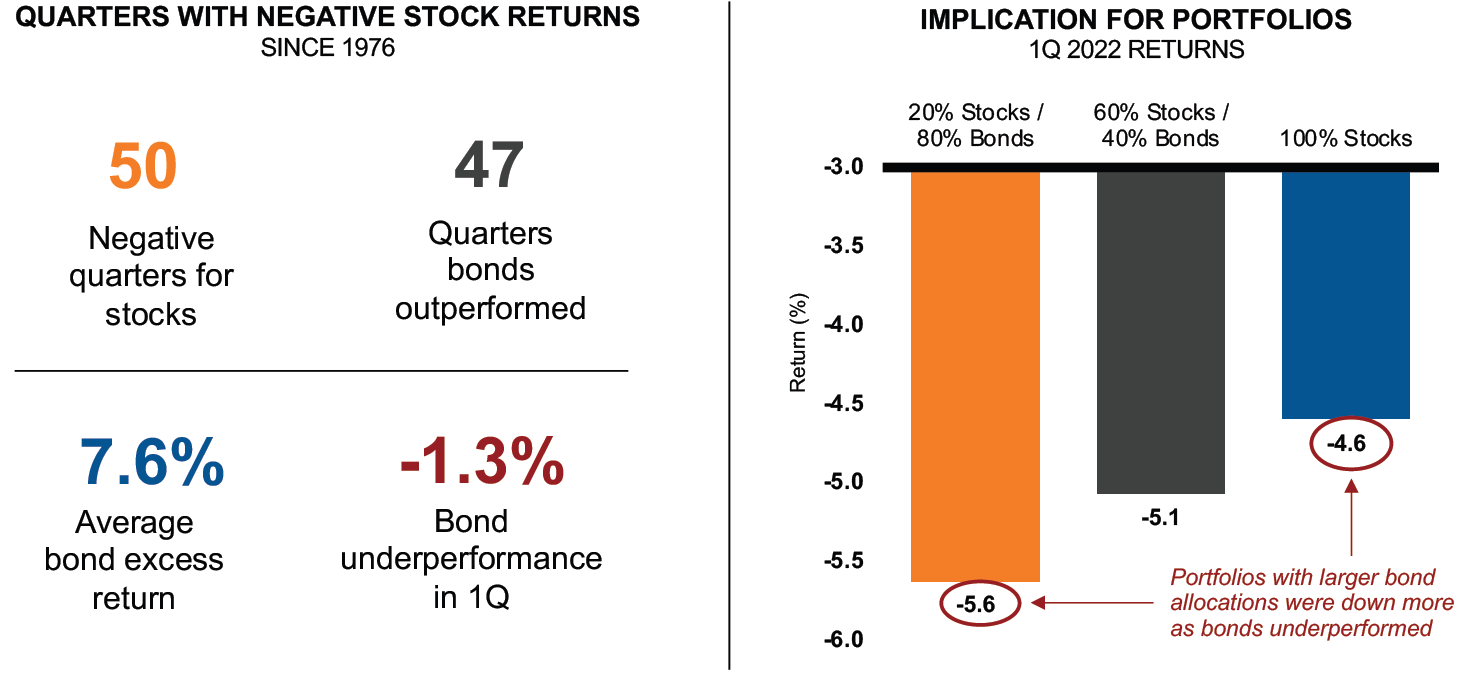

The Federal Reserve made big increases in interest rates to combat inflation. While the rate hikes appear to be helping to curb inflation, they were very tough on bonds. In the first quarter, US Bonds declined nearly 6% while the S&P 500 declined just 5%. This is very rare and surprised many moderate investors. Russell Investments showed that in 50 negative quarters for stocks since 1976, bonds lost more than stocks just three times. As shown below, this meant that a portfolio invested 80% in bonds with just 20% in stocks lost more than a portfolio invested entirely in stocks.

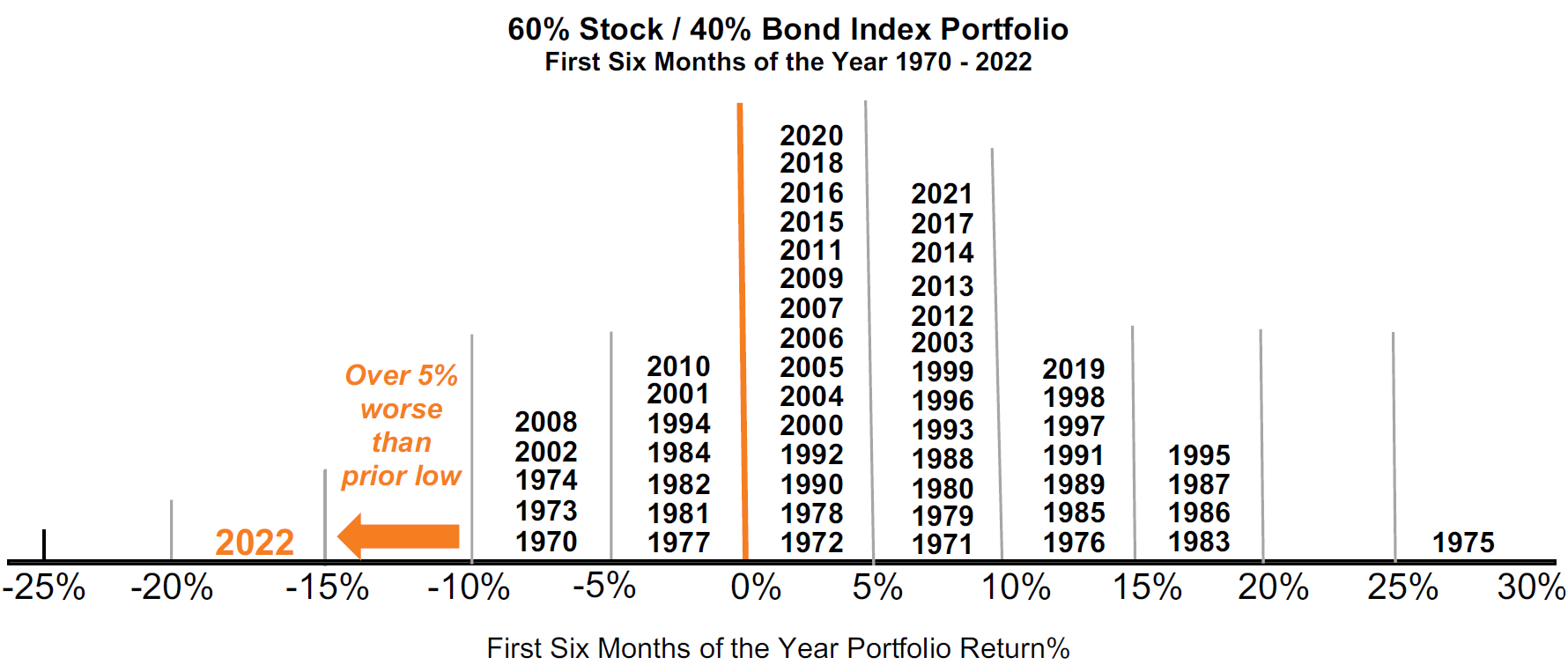

By the end of June, a portfolio invested 60% in stocks and 40% in bonds, a fairly common blend for retirees, had lost more than 15% on average in the first six months, over 5% worse than the next lowest result since 1970.

Is it time for a change?

When a portfolio that usually shields you from market volatility suddenly loses more than expected, it’s common to wonder if it’s time to make a change. However, in this case, we don’t think so, for a few reasons.

- A portfolio’s short-term behavior won’t always match its long-term average. A portfolio invested 60% in stocks, 40% in bonds will usually lose less in downturns and gain less in upswings, but when it doesn’t happen, we shouldn’t confuse an outlier with what happens most often. Zoom out and look at how your strategy has served you over a 3 to 5-year period to help gain some helpful perspective. In most cases, we find the kind of protection from volatility that we hope for when we look over a three-to-five year period.

- Your retirement portfolio should generate the income you need even in volatile times. Preparing a portfolio to send you a regular paycheck involves more than simply getting more conservative, decreasing stocks and increasing bonds. As we discuss in Understanding Retirement Income, there are a variety of ways to increase income and reduce the risk of market volatility.

- Big downturns tend to be followed by big rebounds. According to CNR, the stock market returned nearly 15% on average 12 months after entering a bear market, defined as a stock market downturn of more than 20%.

Worried you’re falling short of your retirement goal? Review your plan!

In volatile times, it’s very common to worry about running out of money. You had enough when you retired, but is it still enough after the market declines? This is a perfect time to check you plan and projections. A group of trusted advisors can help you see if a market downturn puts your retirement livelihood at risk or not. In many cases, your plan could still be right on track even with short-term swings. Reach out to our team at Alterra and we’d be more than happy to review this with you!

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.