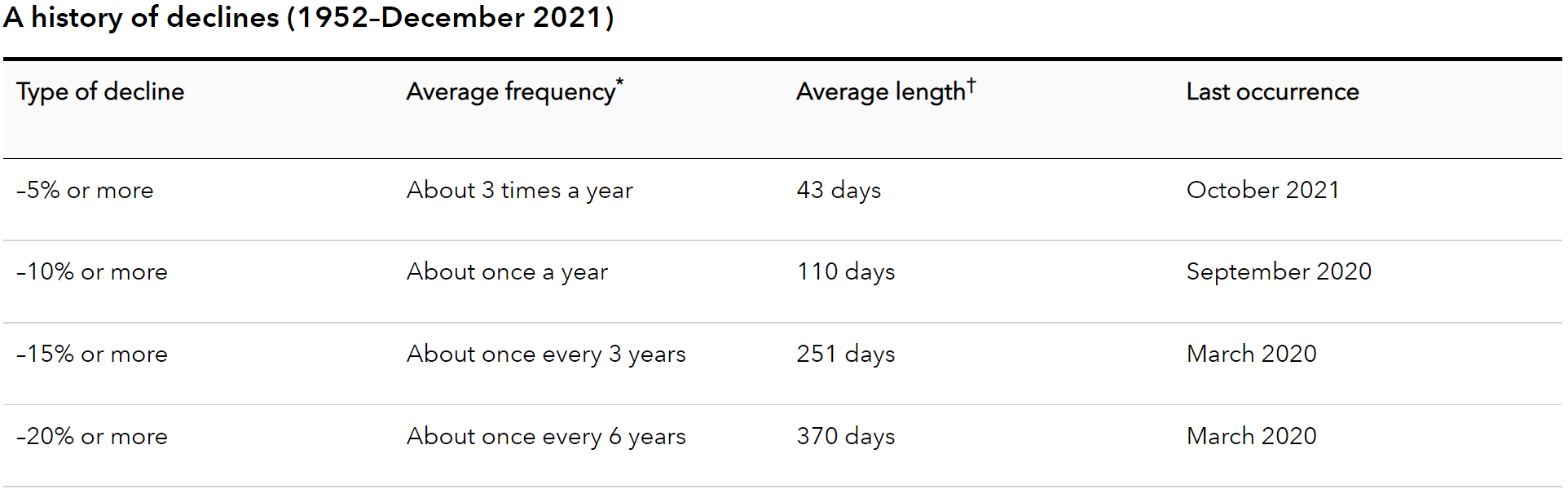

After more than 22 months of steady market recovery from the 2020 COVID pandemic, volatility is back for stocks. Since January, the S&P 500, which tracks US stocks, has declined nearly 17% with even greater losses in international stocks. We’ve also seen two drops of 10% or more – a level of decline only seen once per year on average, according to Capital Group.

If you’re feeling unsettled, it makes sense…uncertainty seems to be everywhere. Inflation is at levels not seen in decades, interest rates are on the rise, and the war in Ukraine is not showing a clear path to resolution. So how should we expect these ongoing challenges to affect your investment strategy? Are we heading for recession? And, most importantly, should you make a change?

A tug of war between competing forces.

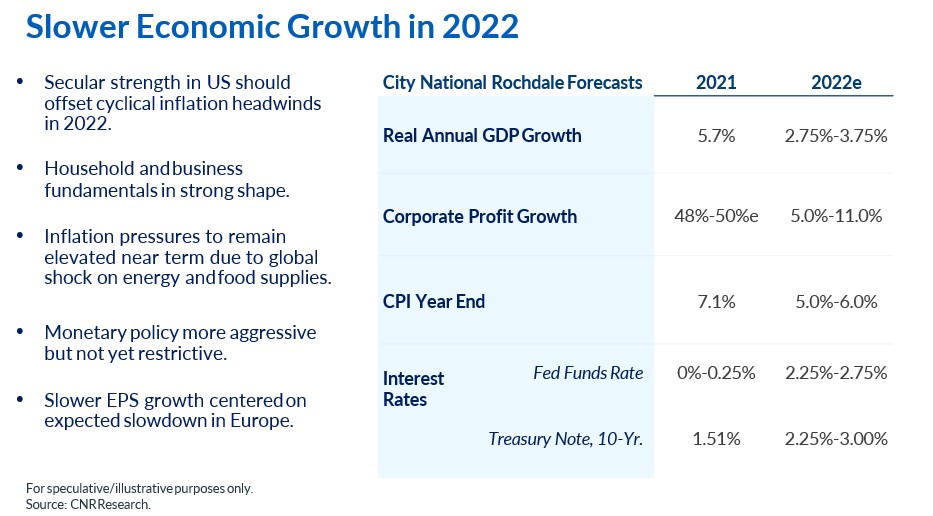

As we referenced in our first quarter recap, the US economy is showing strong signs in key areas. US consumers are spending, unemployment is down, US companies are growing profits, and GDP is projected to be positive for the year. With data like this, why isn’t the market rising?

Markets hate uncertainty, and we have quite a bit of uncertainty right now. Inflation exceeded 7% in 2021, peaked at 8.5% in March 2022, and is projected to be 5-6% by the end of 2022. In response, the Federal Reserve has dramatically increased the pace of interest rate change. While most economists expected interest rates to increase, the sustained high inflation levels have accelerated those rates. Rates that increase quickly can slow economic growth which, in severe instances, can lead to recession.

Globally, the situation in Ukraine has not improved, which injects the fear that a larger scale war could break out. This uncertainty poses the greatest risk to Europe’s economy and China’s current COVID response pressures growth in Asia. These crises are prolonging inflation.

But with all these headwinds, economists like those at CNR give us reason to be hopeful going forward.

Are we heading for recession?

Economists think it’s unlikely now, but if inflation remains high and interest rates continue to rise in response, we could see some level of recession in 2023. However, strong corporate profit growth and solid balance sheets for nearly 80% of U.S. households are expected to dampen the effects of rising interest rates and risk of recession. This is important because consumers drive the U.S. economy, so if spending continues, a significant economic slowdown is less likely.

Though a major recession looks unlikely, we know that recessions are part of the economic cycle, though each one brings economic and market challenges. See Recessions–How Bad Are They & How Long Do They Last for a look at recessions throughout history and how they impact the market. And, again from Capital Group, we see that market volatility is also more common than we tend to recall.

These questions of recession and volatility lead to perhaps the most important question – should I change my investment strategy?

Do I need to make a change?

Concern and anxiety around these issues makes sense, especially in times of war and other headwinds. It’s as important as ever to make sure your investments strategies fit your goals. To check, here are a few questions to ask:

- Do I have enough safe cash reserves on hand in case of unexpected expense or downturn in the market? This is an important key to weathering short-term storms.

- If I’m retired, are my investments positioned to deliver the stable income I need? If so, you might need to make small tweaks, but you’re not likely to need a major overhaul.

- If I’m still building my nest egg, do I have the risk tolerance to stay the course? Abandoning a well-crafted investment strategy in a downturn can harm your plan.

If you have no need for change based on the answers to these questions, we see good reasons to stay the course with your investment strategy.

Want to take a deeper dive with our team? We invite you to watch our recent webinar, Inflation, Interest Rates, the Ukraine War & Your Portfolio, for a more in-depth discussion.

Source – CNR, Capital Group

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.