Inflation has continued to increase…how concerned should we be?

How will interest rate increases affect our economy?

What could a prolonged war in Ukraine mean for financial markets?

How does all this impact my portfolio…do we need to make any changes?

These are among the most common questions we discussed with many of you last quarter and for good reason. Each of these themes has implications for the economy and your investments strategies. Here’s a look at last quarter and our thoughts on each of these questions.

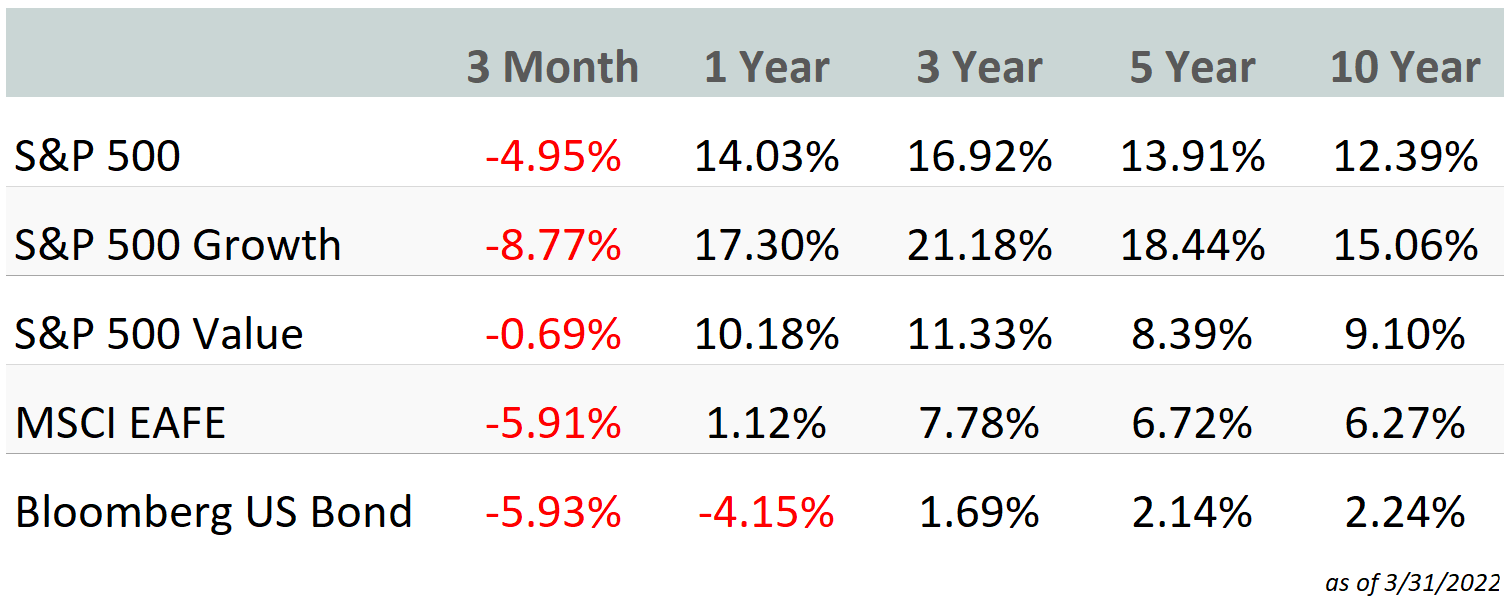

What happened in the markets last quarter?

Most asset classes lost ground in the first quarter, with only a few exceptions. There are a few things we notice when looking at the last three months.

- Stocks were down broadly, but we saw growth stocks take a much bigger hit than value stocks.

- Energy stocks increased due to price spikes from the war in Ukraine. These companies generally fall into the value category, partially explaining why value held more ground than growth.

- Bonds also suffered losses this quarter as interest rates increased.

- Though we see positive long-term results, the short-term volatility is always unsettling.

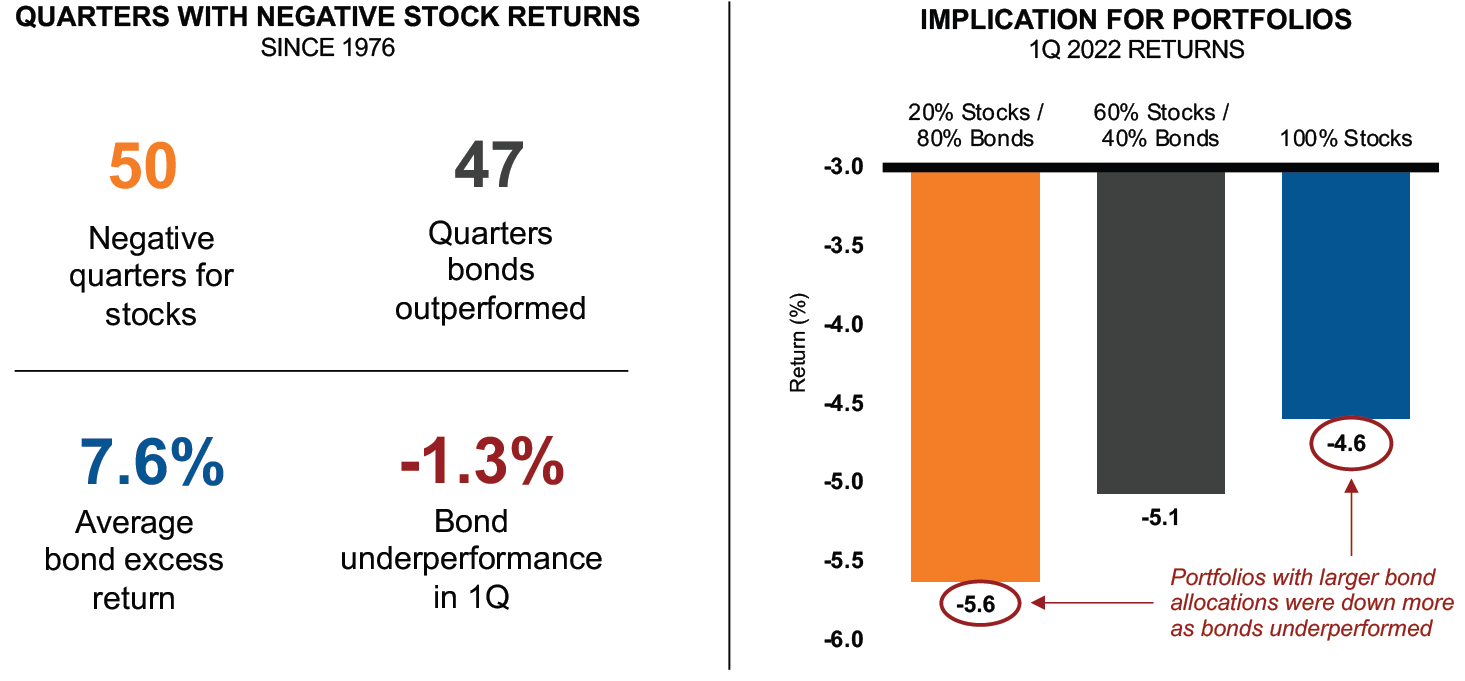

Why did bonds underperform stocks?

Bonds are commonly thought of as less risky than stocks. Over the long run, this is true, but this quarter we saw a rare occurrence where bonds were down more than stocks. This meant greater losses for a portfolio with stocks and bonds than for stocks alone. How rare is this? In 50 negative quarters for stocks since 1976, bonds outperformed in 47 of them.

In many cases, we’ve seen reason to reduce bonds even for those of you in or near retirement, as interest rate risk increases. Bonds still have their place, but we should be considering stocks for income, not just growth.

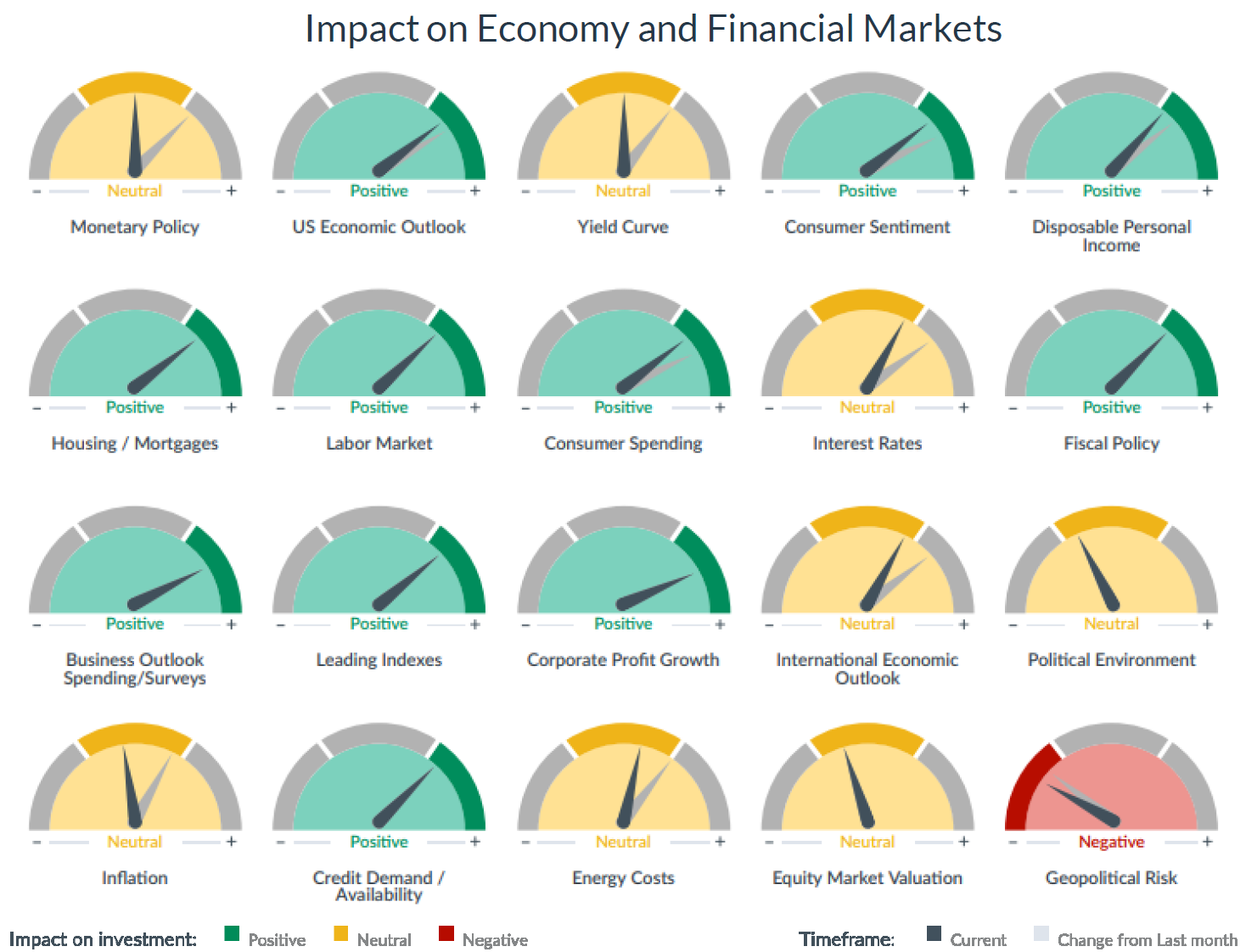

Where is the economy headed?

We see some shifts in outlook in CNR’s economic and financial speedometers. Their team makes a few specific observations.

- The US economy continues to show generally solid fundamentals.

- Most measures of financial and economic activity have reached or surpassed pre-pandemic levels.

- Some of the moderation in outlook is driven by higher inflation and commodity prices, and interest rate increases expected from the Federal Reserve.

- Strength in the US has the potential to offset many of the inflation-related headwinds.

- The prolonged war in Ukraine brings heightened concern, as well, and is being watched closely.

- With all the challenges, there are still many positive indicators of health.

How concerned should we be about inflation?

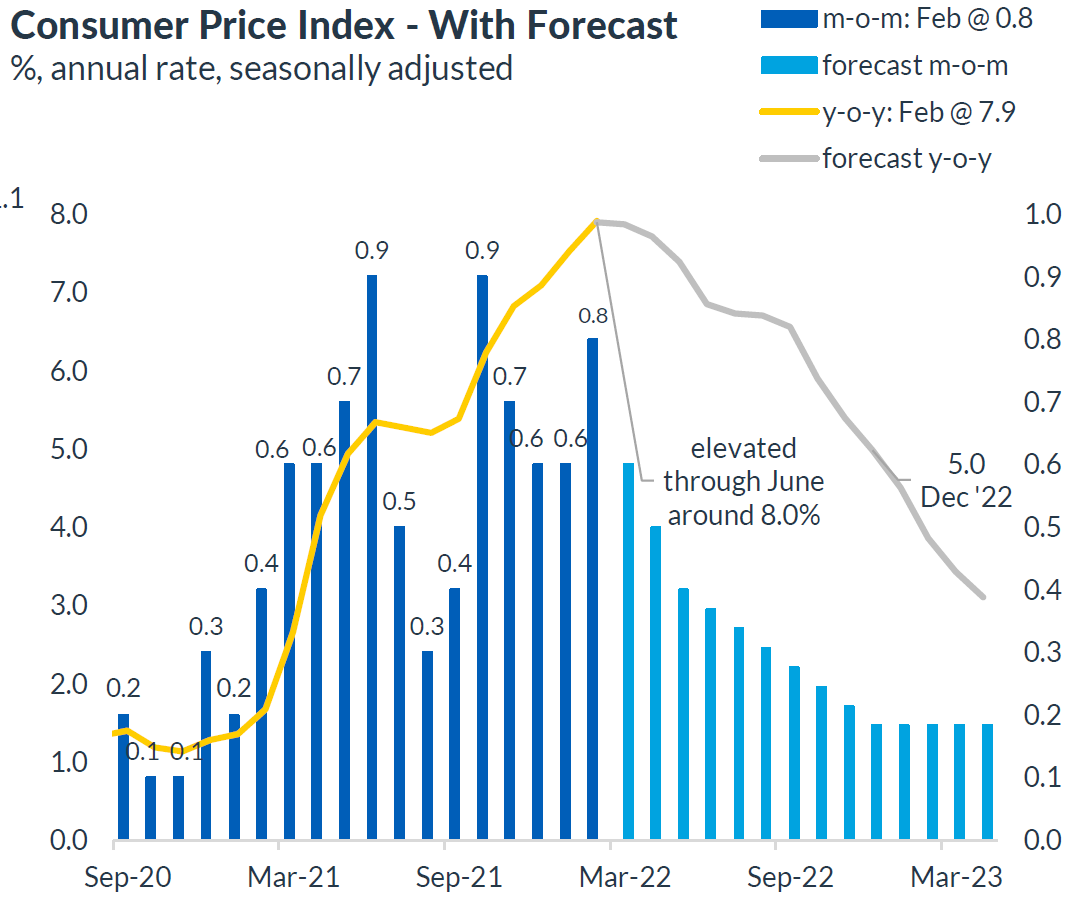

Inflation has continued to rise. For the last few quarters, this has been explained by economic recovery after the pandemic as restrictions lifted and we were all able to get back out and spend. However, we’re now seeing more widespread price increases and supply shortages due to the war in Ukraine. It makes sense to be concerned, especially if you’re noticing an impact in your monthly budget.

These supply imbalances are still expected to subside in the second half of the year which will help moderate inflation, though not as quickly as expected prior to the war in Ukraine. The economists at CNR see the current elevation lasting through June or so, then beginning to fall.

How much are interest rates increasing and what impacts should I expect?

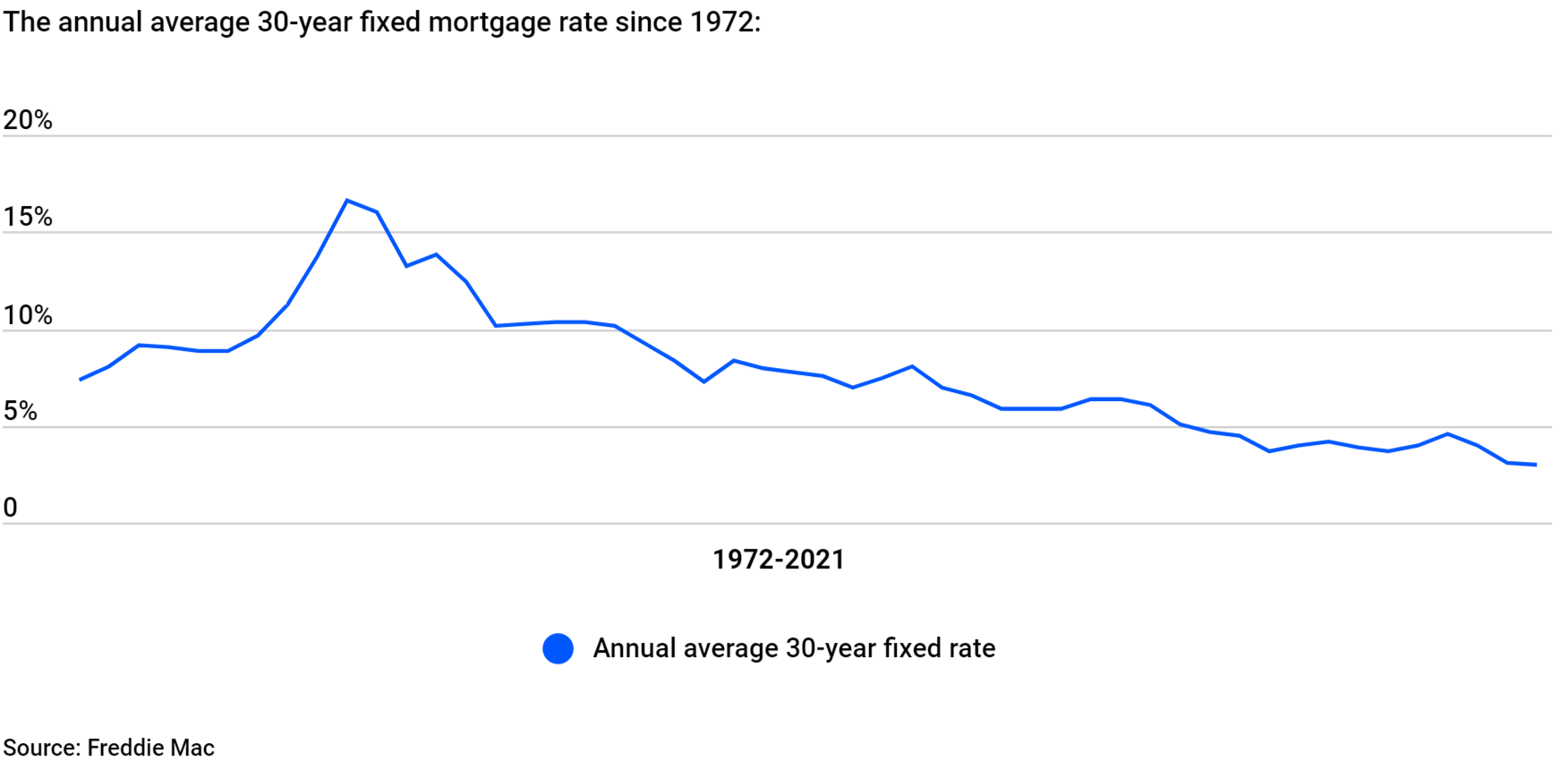

Interest rates are one of the primary levers the Federal Reserve pulls when concerned about inflation, so it’s not surprising to see rates increasing faster than anticipated a year ago. Depending on how the inflation picture develops, we could see rates increased by as much as 2% this year.

This would be a significant increase and has already started to push mortgage and other borrowing rates higher. However, we’re still in an historically low rate environment. We are coming out of a 40 year period of declining rates and some level of interest rate increase indicates a healthy economy – the Fed would be far less likely to raise rates if the economy were on rocky ground.

What could a prolonged war in Ukraine mean for markets?

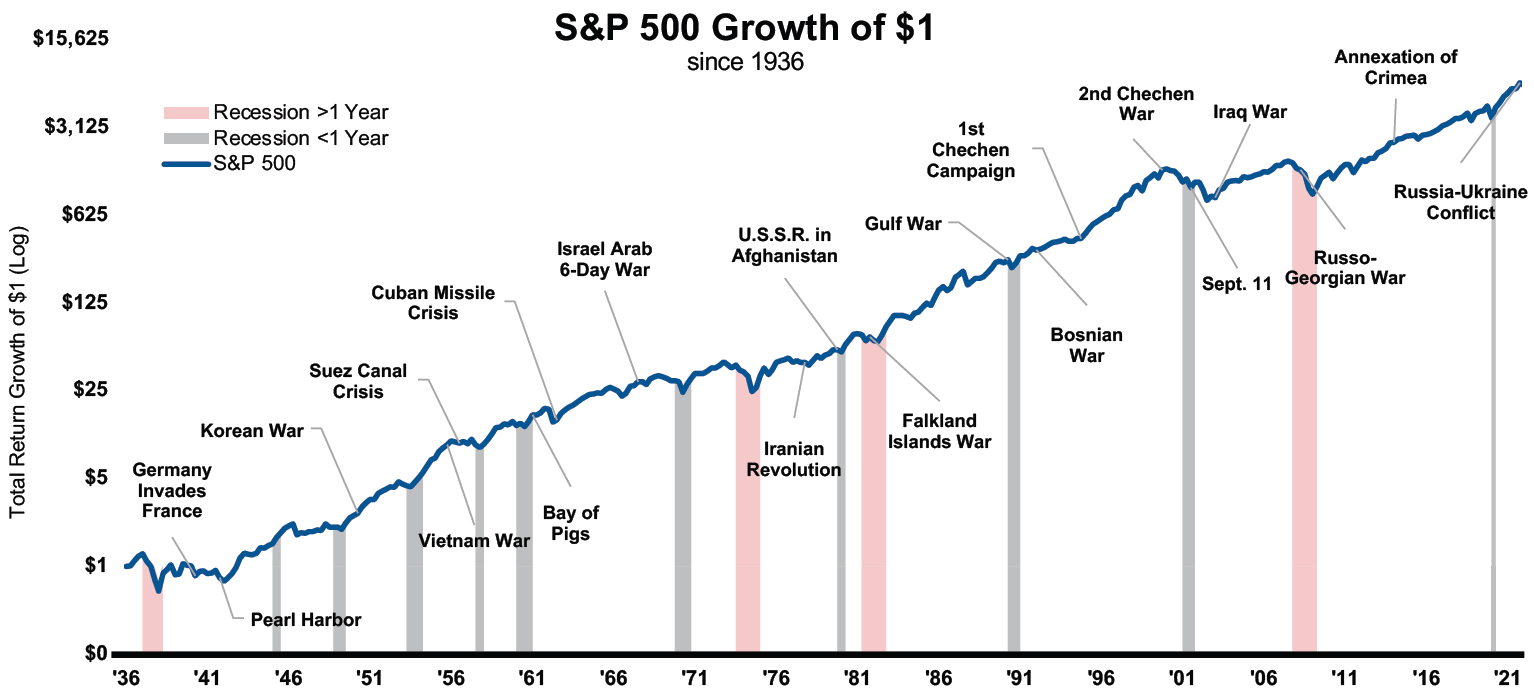

The risk of war almost always brings volatility. It’s an uncertain time. However, we’ve seen the short-term impacts to supply chains and energy prices already. If the war persists, we’d expect to see continued pressure in these areas, which could keep inflation higher for longer.

These risks should never be taken lightly, and this is a serious conflict in Ukraine. However, we’ve been here before and the US market has proven resilient time and again. As the Russell Investments team shows us, we’ve seen more than 20 notable wars or military conflicts since 1936 and the market has persevered through each of them.

What does all this mean for my investment strategies?

Concern and anxiety around these issues makes sense, especially in times of war and other headwinds. It’s as important as ever to make sure your investments strategies fit your goals. To check, here are a few questions to ask:

- Do I have enough safe cash reserves on hand in case of unexpected expense or downturn in the market? This is an important key to weathering short-term storms.

- If I’m retired, are my investments positioned to deliver the stable income I need? If so, you might need to make small tweaks, but you’re not likely to need a major overhaul.

- If I’m still building my nest egg, do I have the risk tolerance to stay the course? Abandoning a well-crafted investment strategy in a downturn can harm your plan.

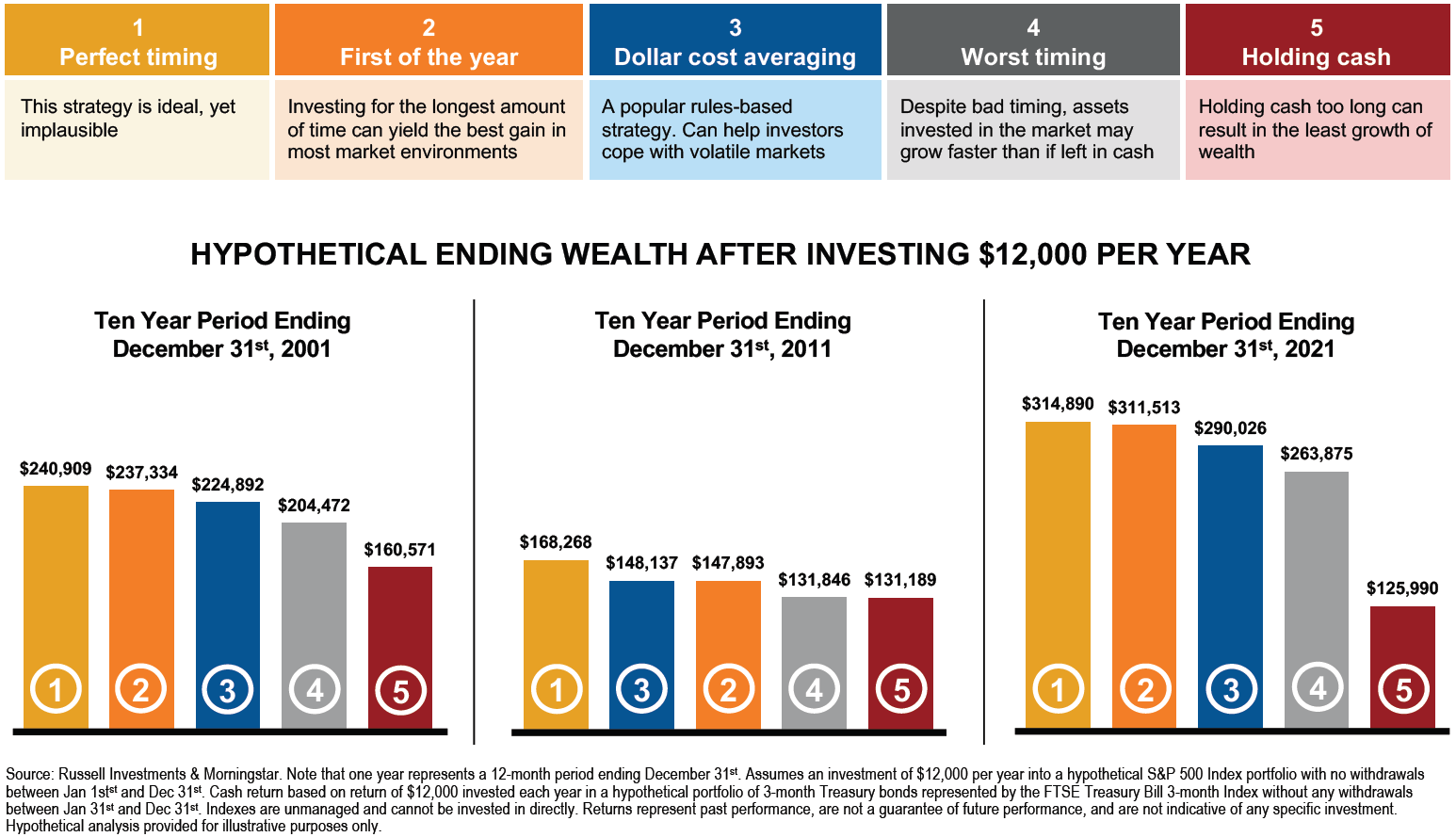

Time in the market, not timing the market, is what’s important in the long-run. We’ve covered this many times before, so we’ll let the Russell Investments team make the point this time. There’s a lot to digest here, but the main point is that investors should be more concerned with getting cash appropriately invested and staying invested, rather than holding cash and waiting for exactly the right moment.

We’ve beat this drum many times before but staying invested is about the most helpful investment advice you can adhere to. It must also be integrated into good planning advice. With enough time, this strategy has worked, but you must be invested according to your timeframe.

Resources – CNR The Bottom Line, CNR Speedometers, CNR Lite Economic Outlook, Russell Investments, S&P 500, SSGA, MSCI

Investing involves risk and possible loss. Past performance is no guarantee of future results. It is not possible to invest directly in an index, which is unmanaged.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.