Retirement is an exciting time of life but can also be quite daunting when you aren’t sure that you’ve adequately prepared. It’s also common to be struck with fears that the next recession could ruin your retirement or that you’ll outlive your money and end up working again when you’re 80.

Retirement planning work does three things:

- Calculates the amount you need in your retirement nest egg to provide day-to-day expenses, travel, and to enjoy life.

- Designs an income plan to turn your hard-earned retirement savings into a steady paycheck.

- Anticipates the impact of bumps in the road, like unexpected expenses or market declines.

So, what ruins a retirement plan? Is it big market declines, taxes, or tough economic times? While these can prove challenging, a well-designed retirement plan can help you weather these storms. But even a well laid retirement plan can be derailed if the three big goals of retirement planning, as well as their opposing challenges, are not addressed.

Mistake 1: Overspending

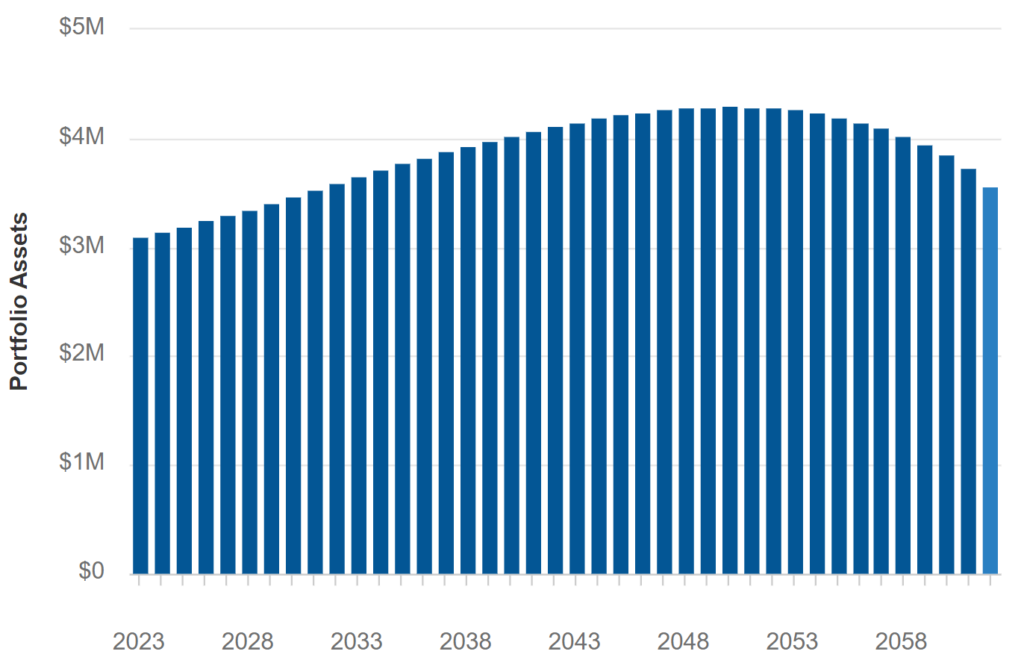

If you’ve built your plan around spending $120,000 per year, but end up spending closer to $150,000 per year, you could be looking at the difference between a healthy nest egg and an empty nest egg. In this example, we have a couple retiring at age 60 with a $3 million portfolio spending $120,000 per year. Their portfolio grows over time to just over $3.5 million, meaning they’ve lived on their portfolio income without spending the principal, like rent from a home.

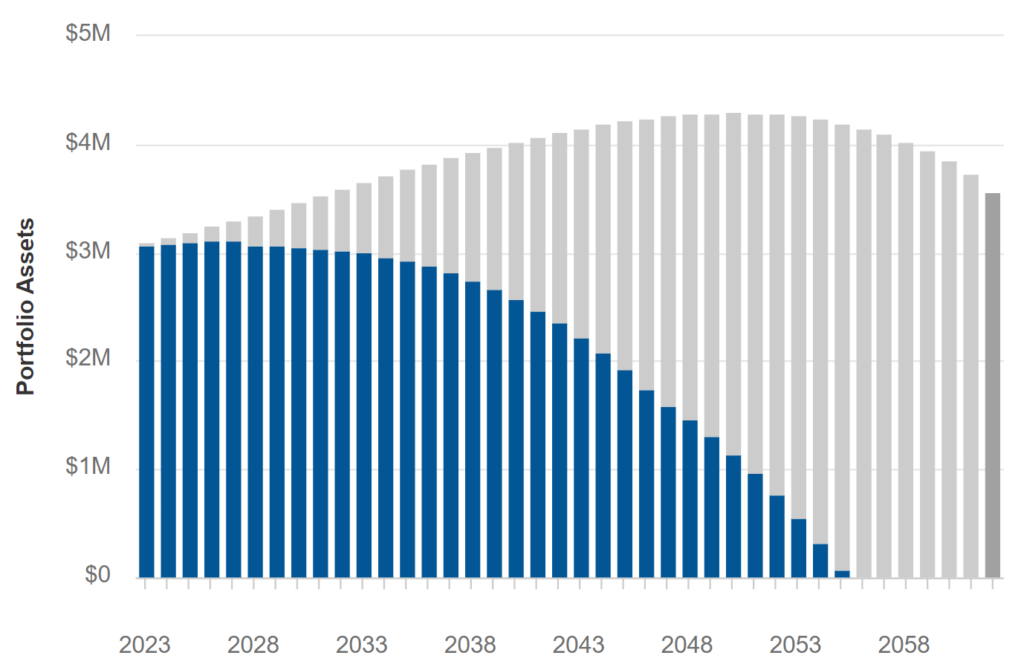

But if they aren’t careful in estimating what they needed or just stopped paying attention and spent $150,000 per year, their nest egg will run out at age 93 – a major shock for what seems to be a small spending increase.

Hypothetical examples are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment.

How can you avoid this? Carefully consider what you’ll need in your retirement nest egg, including the fun you hope to have! We lay this out step-by-step in How Much You Need to Retire.

Mistake 2: Failing to make an income plan

It’s common to think that you’re all set once you’ve hit the target number for your retirement nest egg. But without a plan to turn your portfolio into a steady paycheck, you could end up drawing from the wrong account at the wrong time.

For example, taking regular withdrawals from your long-term account. In retirement, most should still have safety, income, and growth buckets. Your safety bucket is a reserve for unexpected expenses. Your income bucket invests for higher interest and dividends to send you your paycheck. Your growth bucket refills the other two buckets as needed. Without an income plan, however, you could be spending from the wrong bucket, selling valuable future investments at inopportune times.

How can you avoid this? Make sure each part of your retirement nest egg has a specific job. We lay this out step-by-step in Understanding Where Your Retirement Paycheck Comes From.

Mistake 3: Panicking during market declines

Even with a fully stocked nest egg and a carefully crafted income plan, it’s common to panic when the market turns south. During the Covid-19 market decline, many feared their retirement plans were damaged beyond repair and thought the best action was to move their investments to cash and wait out the storm. But what would this mean practically? It would usually mean selling investments while they’re down, waiting for the market to rebound, then reinvesting. While this can feel more comfortable, it unfortunately means taking losses without receiving the gains that follow this kind of market decline.

How can you avoid this? Think through this kind of situation in advance, while you’re building your income plan. History shows time and time again that it pays to stick to your diversified investment strategy through market downturns. Our resources like Should You Really Stay the Course and Time in the Market Is Better Than Timing the Market provide a historical look at market declines, and share insight on what to do about them. And, in particular, making a “freak out plan” as outlined in step 5 of Recession-proof Your Retirement in 5 Steps is crucial and can help you plan out how you’ll address the fear of market declines before they occur.

Mistake 4: Thinking retirement is all about money

Much of retirement planning says that when you’ve saved enough to be financially independent, you’ve crossed the finish line! But while finances are an important piece of the retirement puzzle, it leaves an important question unanswered: where will your fulfillment come from next?

As we discuss in 4 Parts of a Joy-Filled Retirement Life Portfolio, it helps to think of retirement not as a finish line, but a starting line for your next great adventure. Fulfilling retired life may operate at a different pace, but it can still leave you satisfied at the end of each day knowing that you continue to make a difference in your life and in the lives of those you care about. Think of four categories:

- Career continuation – use the skills you built during your working years to mentor, counsel, and teach those who will follow you to keep your expertise gears turning.

- Volunteering – find a cause you care about that would benefit from time and talent. Few things provide life-giving energy like serving those in need with your time.

- Family – invest in your kids and grandkids, not just with your time, but with the lessons and values most important to you.

- Hobbies – golf and travel are serve you better as a break rather than your entire purpose. And, after all this time investment, you’ll need a break!

Don’t forget that you’re retired, so rather than implementing a rigid schedule, find a comfortable, unforced rhythm across the four areas.

Communicate openly!

If you have a financial advising team, practice open communication with them. We encourage everyone to reach out with concerns as soon as they arise…there’s no reason to wait! You’re never alone in your fears and the sooner you express your concerns, the sooner you can craft a game plan to address them and get back to enjoying your retirement life!

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.