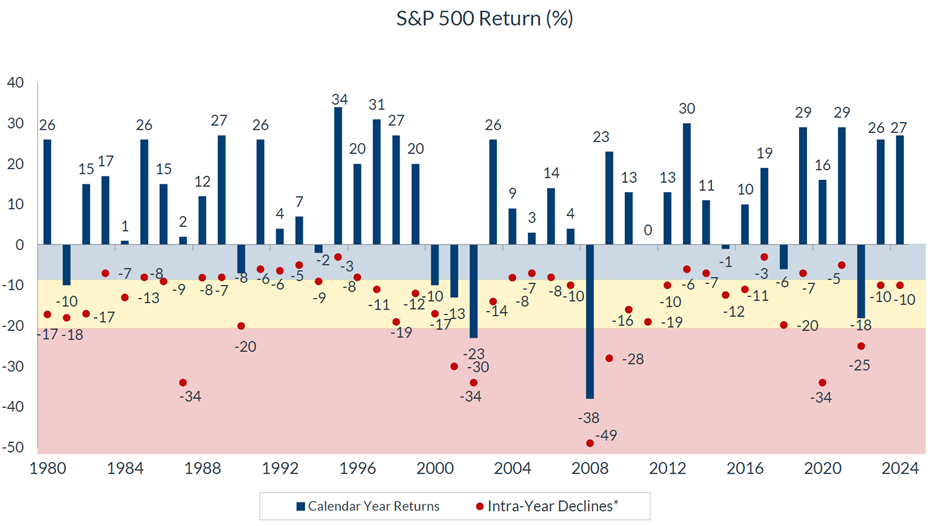

Stock Market Volatility Is Normal

Fluctuations in the stock market might seem alarming, but they are a regular part of its natural rhythm. Historically, markets experience corrections, recoveries, and growth cycles. These dips often reflect short-term reactions to news or economic shifts, but the long-term trend for the market remains upward.

Intra-year declines in the S&P 500 average about 14%, yet the index typically ends the year with positive returns. The chart below shows year end returns in blue along the top and the largest decline within that calendar year.

What does this mean for you? Staying invested during these moments often leads to long-term gains. Temporary market dips are part of the investment journey, not a cause for alarm.

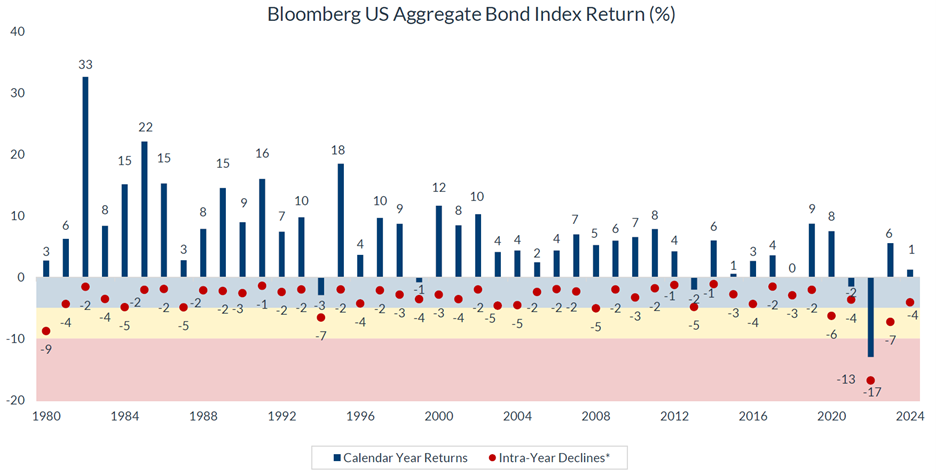

Bond Market Volatility Is Unusual

Unlike stocks, bonds are generally considered a stable asset. That’s why the recent three years of heightened bond market volatility are noteworthy. As we discuss here, rapid interest rate changes and inflationary pressures have shaken this traditionally steady segment. The chart below illustrates year-end bond returns in blue and the largest intra-year declines, providing a clear look at this unusual volatility.

What Does This Mean for You? Bonds are a cornerstone of a well-diversified portfolio, particularly in retirement. However, even traditionally stable assets can experience periods of heightened volatility, as we’ve seen in recent years. That’s why reviewing your strategy with your financial planning team during uncertain times is more important than ever. Additionally, taxes play a crucial role in bond investing—if you’re in a high tax bracket, tax-free bonds or alternative fixed-income options may provide better after-tax returns.

What Can You Do to Help Protect Your Portfolio?

While you may not be able to avoid market risk, the a

- Make a Comprehensive Wealth Management Plan: A team like ours at Alterra can help make sure your risk fits you and your goals.

- Stay Diversified: A mix of stocks, bonds, and alternative investments helps manage risk.

- Focus on the Long Term: Market cycles smooth out over time.

Volatility, whether in stocks or bonds, can feel unsettling, but knowledge is power. By understanding what’s normal and seeking guidance during unusual trends, you can stay on track toward your financial goals.

Curious if your portfolio is positioned for a successful retirement? Schedule a discussion with Alterra to see if our team to create the clarity, simplicity, and certainty you need to ensure you’re prepared for whatever comes next.

Source: CNR

Bond prices move opposite to interest rates. Bonds offer stability but carry risks like interest rate, credit, and liquidity risks. Stocks involve risk, and no strategy guarantees returns. Investment values fluctuate. Investing in alternative assets involves risk of loss and may not be tax-efficient. Consult a tax advisor prior to investing. All investments carry risk. Past performance doesn’t guarantee future results. Diversification doesn’t ensure profits or prevent losses. The S&P 500 index is considered to represent the stock market in general, but isn’t directly investable.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.