We’ve had no shortage of volatility in the stock market in the last few years, so you’re not alone if you feel like the ups and downs have been intense. With Covid, inflation, interest rates, and global conflicts all providing headwinds, it’s no surprise that a day, a week, or a quarter, can be high and the next low. But when we zoom out to look at the bigger picture, we often learn valuable lessons. 2022-2023 was one such time.

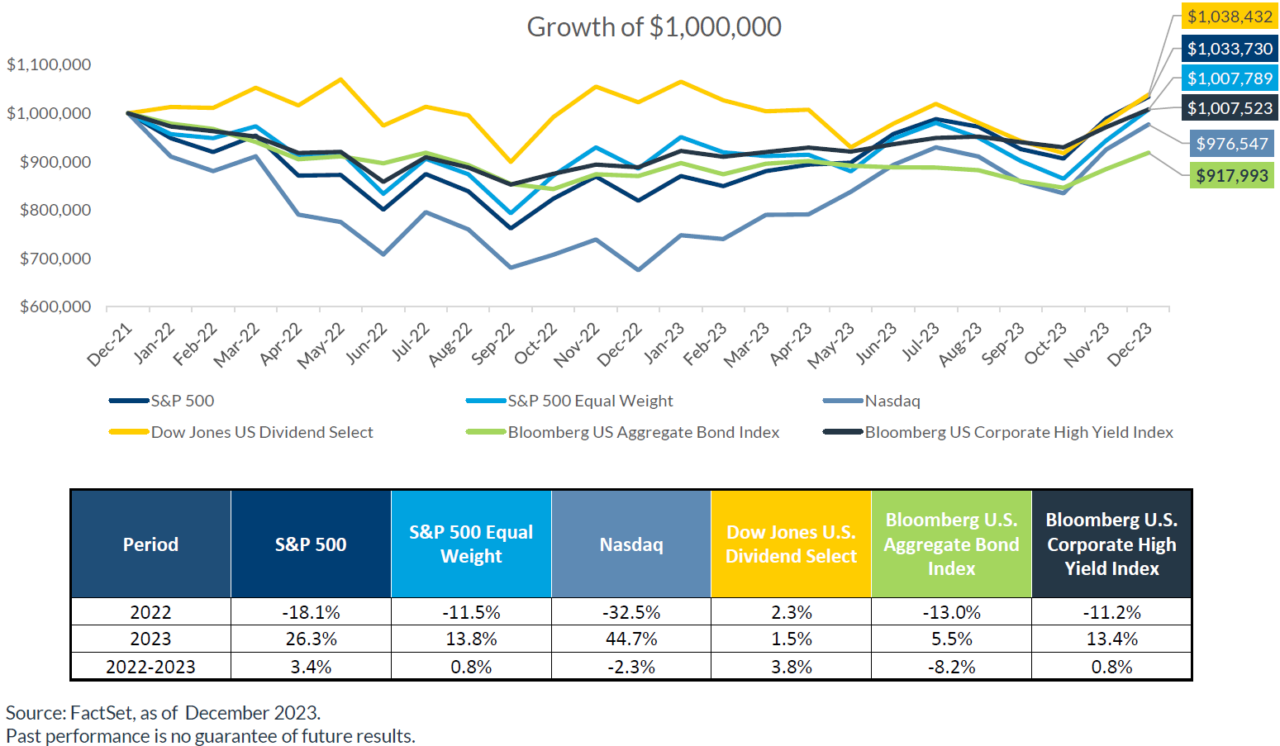

In 2022, we saw the start of persistently high inflation that exceeded 9% at its peak. In response, the Federal Reserve increased interest rates by an historic 5.25% between March 2022 and July 2023 (see Inflation and the Federal Reserve for more on why). Stocks and bonds indexes dropped across the board. Then, in the latter half of 2023, inflation started showing signs of retreat and the market rebounded, though we aren’t out of the woods yet. When taken together, 2022-2023 was a rocky road to small gains or losses in most indexes, with bonds being the exception, although they may see more rebound as interest rates are cut.

The interesting part of the story, however, is that though the net result doesn’t seem too different, the ride to get there was quite different depending on what kind of portfolio you had. The analysis at City National Rochdale show what would have happened to $1 million invested in a range of indexes in 2022, 2023, and 2022-2023 together.

Let’s start with a brief description of the indexes above:

- S&P 500 tracks the performance of 500 large U.S. companies and is often considered a benchmark for the overall U.S. stock market.

- S&P 500 Equal Weight is similar to the S&P 500 but each company is given equal weight, regardless of its size. It provides a different perspective by giving smaller companies the same influence as larger ones.

- NASDAQ tracks the performance of more than 3,000 stocks, primarily those of technology and growth-oriented companies.

- Dow Jones U.S. Dividend Select aims to represent the performance of high-quality dividend-paying stocks, U.S. companies with high dividend yields and a strong track record of paying dividends.

- Bloomberg U.S. Aggregate Bond measures the performance of the U.S. investment-grade bond market and includes a wide range of bonds such as government, corporate, and mortgage-backed securities.

- Bloomberg U.S. Corporate High Yield tracks the performance of below-investment-grade (high-yield) corporate bonds and represents bonds with higher risk but potentially higher returns.

Over this period different kinds of investors had quite different experiences. The experience of an aggressive investor focused on growth and tech companies was a rollercoaster, with big declines in 2022 and big gains in 2023. An income investor focused dividend stocks, on the other hand saw their portfolio dodge much of the ups and downs across those two years. And as a result of the drop in bonds due to interest rate spikes, many retired investors wondered why their more conservative portfolios were so volatile, a question we discuss in depth here.

Here are a few key takeaways to better understand your results during volatile times:

- Know what kind of investor you are. If you’re an aggressive investor still building your portfolio, your strategy might be invested entirely in stock, focused on high growth. But if you’re retired and need steady income, your strategy might be evenly split between stocks and bonds with a focus on dividend paying companies.

- Know your “portfolio story”. Learn how your portfolio should behave relative to headline benchmarks. If you’re retired, your income-focused portfolio will look very different than an index like the S&P 500, heavily weighted to growth companies. Look at your mix and use an appropriate blend of benchmarks.

- Take a methodical approach to evaluating your strategies. When you have a concern, a series of questions can help. Is my plan still on track? Based on my goals, should we change my strategy? Does my performance track with what my “portfolio story”, or what should be happening in a portfolio like the one I have? With answers to these questions, it becomes much clearer whether staying the course or making a change is your best bet.

As advisors, one of our core values is to help our clients create clear, confident action plans in what can otherwise feel like a chaotic mess of confusing conflicting information. And while we don’t know exactly what the future holds, history can teach us what has worked over time, and help us choose strategies together to put you in a great position to reach your financial goals.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.