After decades of hard work, Sharon recently sold a Seattle-based business for $40 million and was ready to enjoy life and spend more time with her family. But she was also thinking about her legacy and how her would wealth be used after she passed. She hoped to help grandkids, great grandkids (and more, if possible!) pay for college and start small businesses. She also wanted to support local charities focused on ending hunger and homelessness.

Like many in this situation, however, she learned that her estate tax bill could be nearly $21 million today and could more than triple in the next 20 years.

She engaged us to help answer some big questions: Am I stuck with this tax bill? Do I have to choose which goal is more important? Or is there something I can do?

How to avoid estate taxes in 5 steps

Does this sound familiar? Are you worried about estate taxes eating into your wealth, leaving less for your family or charities you care about?

If you’re like Sharon, feeling frustrated by high taxes but confused about where to start, you’re not alone. Fortunately, we’ve found this doesn’t have to be as hard as it first seems. Here’s a simple 5 step process to make and maintain a plan to avoid estate taxes and keep more wealth focused on family and causes you care about.

- Identify the size of the problem. How big is your potential estate tax bill?

- Define your desired impact. What impact do you envision with the wealth you don’t spend during your life? Would you like to give to charity? To family? Or both?

- Evaluate and choose strategies that match your goals. Work with a team of experts to look at options that match the impact you want to make.

- Put your plan into motion. Many stop short of putting their plans in motion. Don’t let this be you.

- Set a regular review schedule. Laws and strategies change frequently. Make sure your plans stay up to date.

But first…what is the estate tax and how does it work?

Before discussing these steps in more detail, let’s look at what it is and how it works.

- The federal “estate tax” is a tax on your accumulated wealth assessed by the federal government when you die.

- The tax starts at 18% on your first taxable $10,000 and climbs to 40% on taxable assets over $1 million.

- Your first $13.61 million passes tax-free – called an “exemption”. Each spouse gets an exemption, so married couples can pass $27.22 million before owing any federal estate tax. This is the highest exemption in history and an opportunity to pass more wealth tax-free. For more, read Federal Estate Tax Exemption 2022: Making the Most of History’s Largest Cap.

- Many states, including Washington, add an additional estate tax. In WA State, your first $2.193 million passes tax free. Then, the tax rate starts at 10% for the first taxable $1 million and climbs to 20% for taxable assets above $9 million.

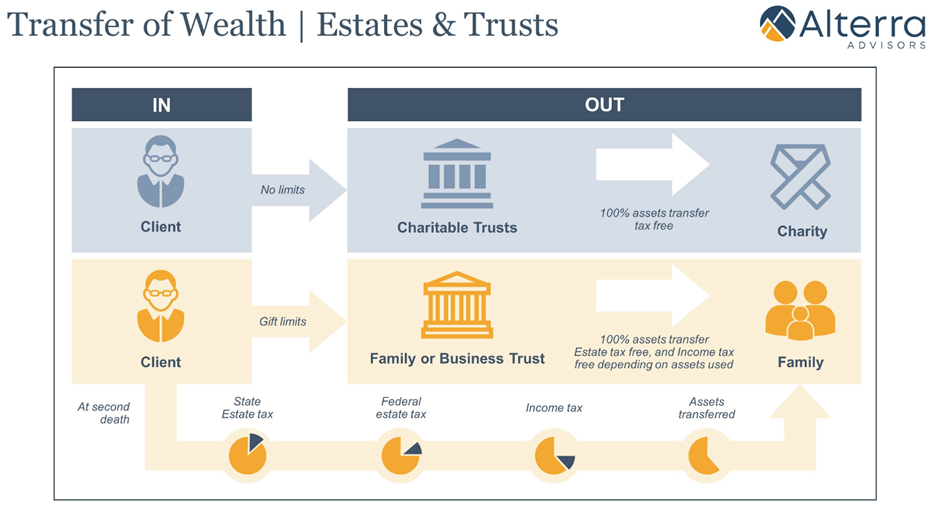

To better understand what gets taxed, let’s cover some basic concepts using the diagram below.

- Assets IN your estate. Your estate is the total of everything you personally own – the left column. These assets “in your estate” are subject to taxes as described above.

- Assets OUT of your estate. While your assets start “in your estate”, you can move many assets out of your estate – the right column – and prevent them from being subject to estate tax by giving them to certain kinds of trusts. While there are dozens of trust iterations, they generally fall into two categories: trusts that pass wealth to family and trusts that pass wealth to charity.

A few important points from the diagram above:

- The government takes their cut first. In orange, we see that state estate tax, federal estate tax, and income taxes all take a bite out of your estate before passing on the remainder to your family. A wide range of trusts and transfer strategies can reduce taxes and pass more to loved ones.

- Nothing passes to charity unless you say so. In blue, we see that there are no limits to what you can pass tax-free to charity, but this doesn’t happen automatically. Strategies like Charitable Remainder Trusts can even pay you income today, reduce estate taxes, and leave a gift to charity.

- Moving assets out of your estate doesn’t always mean giving up full access. As we discuss in Out of Your Estate, Not Out of Reach, you can take measures to reduce taxes without losing your assets entirely.

With a basic understanding of how the tax works, let’s walk with Sharon through this 5-step process.

Step 1 – Identify the size of the problem

How big is your potential estate tax bill? You can use our calculator to find out!

Sharon’s combined assets totaled $50 million. If she passed away today, she would lose nearly $22 million to state and federal estate taxes – a whopping 44% of her nest egg. This was indeed a big problem, but she was motivated to solve it.

Step 2 – Define your desired impact

Begin with the end in mind. Visualize the impact you want to make with your wealth. Do you want to leave gifts to charity? Provide for future generations of family? Both?

Your wealth can only pass to one of three places: the government, your family, and charities you care about. By default, the government will take their cut and your family will inherit the rest. But is this the plan you would choose?

This framework helped Sharon define three distinct goals:

- I want to leave 25% of my remaining assets to charities providing local food and housing solutions for those in need.

- I want my remaining funds to enable future generations of my family to fund education and start small businesses.

- I want to reduce taxes as much as possible, preserving wealth for my family and charity goals since they are so ambitious!

Having clearly defined goals is a crucial part of determining which tools are best suited for your plan.

Step 3 – Evaluate and choose strategies that match your goals

With goals set, you can start evaluating possible solutions. Many strategies can help reduce taxes, but some focus on passing wealth to charity, while others preserve assets for your family. Work with a team of experts to look at options that match the impact you want to make.

In Sharon’s case, her goal of leaving 25% to charity and the rest to family guided her selection process. Her final plan included three components:

- Retirement nest egg. Sharon wanted to comfortably spend $150,000 per year. She also had a few vacations on the bucket list and wanted to be able to take the kids and grandkids. She would need a $7 million portfolio to meet this goal.*

- Charitable gifts. Sharon chose three strategies to make her charitable impact:

- She would give $1 million to a Donor Advised Fund, providing a potential $370,000 tax deduction today and the flexibility to make periodic gifts at any point in the future.

- She would give $2 million in highly appreciated stock to a Charitable Remainder Trust. She could sell the stock tax-free, receive a potential $900,000 tax deduction, $100,000 in annual income, and leave nearly $2.5 million to charity.**

- She would leave her pre-tax IRA to a local food bank. As a non-profit organization, they would avoid the income taxes Sharon would pay on this account, leaving more to serve those in need.

- Family legacy. Sharon would move $12 million to a new Family Trust. With careful tax and strategy selection, she could reduce her estate tax by nearly $14 million and leave more than $30 million to future generations.***

Sharon’s specific goals of passing wealth to family and charity helped narrow down the tools and select the right mix to reduce taxes, maintain the income she needed for her life, and make the legacy impact she wanted.

Step 4 – Put your plan into motion

At this point, you’ve done an impressive amount of planning and crafted a blueprint. Now it’s time to put the plan in motion! You can spend thousands on estate and financial planning, but until documents are signed and assets are repositioned, you haven’t changed the outcome.

You’ll need a team of professionals, usually comprised of a comprehensive financial planner like our team at Alterra, an estate attorney, and a CPA. Others might be needed, but this is a common professional core. It’s important that they work as a team, as well. You’ll save yourself a big headache (and cost, too!) if you can assemble a team that works well together on your behalf.

Sharon was thrilled with her CPA, and we were able to introduce her to a qualified attorney to create the trusts and legal documents needed. She granted our team permission to discuss options with her CPA and attorney to help her make clear, simple, educated decisions…much easier to do as a team. A short time later, her plan was fully implemented, and she could breathe easier knowing the impact she hoped to make would become reality.

Step 5 – Set a regular review schedule

This is not a one and done process. Laws and strategies change frequently, and your plans must stay up to date. Annual reviews are most common, but the important thing is to put a regular meeting on the calendar to make sure your plan stays current.

In Sharon’s case, we schedule an annual review of her legacy plan, in addition to her retirement income and other financial planning, to see if the changing landscape requires an update to any of her strategies. When needed, we can then coordinate with her CPA and attorney. As with the initial planning, the teamwork must continue to keep her plans current with new laws and her own needs.

In summary…

Sharon started this journey feeling frustrated at her looming estate tax bill but unsure what to do about it or where to start. Now, with clear goals and a plan in place, she has a sense of clarity and comfort, knowing that estate taxes will prevent her from providing for future generations of her family and the causes she cares about.

You can do the same! This 5 step process can take you from frustration, confusion, and uncertainty to confidence, clarify, and comfort. And, more importantly, ensure the impact you intend is the impact you make.

* Assumes 3% inflation, 5% annual return on investments

** Assumes 6% annual return on investments, 5% lifetime payments from CRUT

***Assumes 5% annual return on investments

Alterra Advisors does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.