Are you frustrated by high taxes on investments owned by your trust?

Trusts are one of the most common estate planning tools for a range of goals and can be an effective way to reduce estate taxes. But income taxes can be a challenge. Like you, trusts pay taxes on earnings from assets like stocks and bonds. Some trusts pass these taxes along to you, which can be beneficial because trust tax rates reach high rates much faster than your personal tax rates.

But if you have investments in a trust that pays its own taxes, you have options to reduce the tax burden. Let’s look at the difference between trust tax rates and your personal tax rates, then how a strategy called Direct Indexing can help reduce these taxes.

Trust tax rates vs. your tax rates

Income from trusts that pass taxes to you, often called “grantor trusts”, are taxed at your personal tax rates. If you’re married, you reach the highest tax rate of 37% at $731,200 of income. But trusts required to pay their own taxes, called “non-grantor trusts”, reach the highest 37% rate at just $15,520 of income.

What does this mean in real dollars?

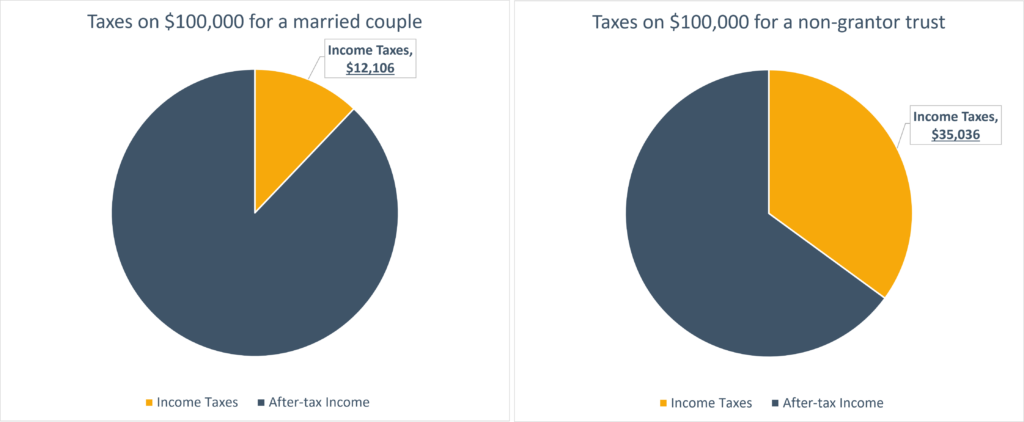

As the chart above shows, if you’re married, you’ll pay just over $12,100 on $100,000 of taxable income, but if you have a trust that pays its own taxes, you’re looking at more than $35,000 in taxes.

If you’re thinking “Wait…I thought trusts were supposed to REDUCE taxes, not increase them?”, you wouldn’t be alone. But when it comes to trusts and income taxes, what you own in the trust can be just as important as setting up the trust itself.

With that in mind, here’s how a unique investment strategy called Direct Indexing can help.

Using Direct Indexing to help reduce trust investment taxes

As we detail in this article, Direct Indexing seeks to replicate an index like the S&P 500 but with more opportunity to reduce taxes. Here are a few of the key concepts to understand this unique portfolio strategy:

- Direct indexing invests directly in stocks, rather than a fund.

- If you own an S&P 500 fund, you own a piece of all 500 companies in the S&P 500 without the ability to sell some and keep others.

- With Direct Indexing, you own the individual stocks, giving more control over when these positions are bought and sold, opening more opportunities for tax-loss harvesting.

- Direct indexing will systematically identify stocks that have fallen, replace them with similar companies, and use that “tax loss” to help reduce taxes your trust would otherwise owe.

When it comes to trust strategy, managing taxes is critical to your long-term success. When combined with other tax-efficient assets like municipal bonds and certain types of life insurance, you don’t have to be a victim of high trust investment taxes.

Here are a few other resources to check out if you’re interested in learning more:

- How Direct Indexing Seeks to Reduce Portfolio Taxes

- Do I Need a Trust?

- Should I Use an Irrevocable Trust to Save on Estate Taxes?

If you’re curious about how these strategies could fit your financial and wealth management plan, reach out to schedule a conversation with us!

Indices are unmanaged and investors cannot invest directly in an index. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. Municipal bonds generally pay tax-free income at lower interest rates than taxable bonds and may not be suitable for all investors. Active portfolio management does not guarantee a profit or protect against a loss in a declining market and can include potentially higher fees and transaction costs. There may be potential tax consequences from these strategies. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Alterra Advisors, Lion Street Financial, LLC. and Lion Street Advisors, LLC. do not provide tax or legal services.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.