Are you considering the future of your wealth and how to pass it on to the next generation—without the need to sell essential assets just to cover estate taxes? Many business owners, real estate investors, and successful families face a similar dilemma. They want to pass their hard-earned wealth to loved ones but are confronted with a large tax bill. What options do you have?

Life insurance can provide a solution, as it can match the timing of the tax bill with available funds when structured properly. For those seeking to stretch their dollars further, premium financing offers an additional advantage. By using a loan to cover life insurance premiums, you can keep your assets liquid, reduce immediate out-of-pocket costs, and ensure your family has the resources they need at critical times. However, this strategy involves risk and should be approached thoughtfully.

Our team partnered with Schechter Wealth, experts in advanced estate and insurance planning, to explore how premium financing can help protect your estate, meet future tax obligations, and transfer wealth or business assets seamlessly to your heirs.

What is Premium Financing?

Premium financing is a strategy where borrowed funds are used to pay life insurance premiums, allowing you to secure a life insurance policy without using personal assets.

Who Should Consider Premium Financing?

While premium financing isn’t for everyone, it can be a powerful option in specific scenarios, including:

- High-Net-Worth Individuals or Families: If you’re securing life insurance as part of an estate plan, premium financing can:

- Provide liquidity to pay estate taxes upon death.

- Restore family wealth diminished by estate taxes.

- Protect income or assets.

- Ensure equitable distribution of assets among heirs.

- Businesses: Companies may use premium financing to fund life insurance for key employees or as part of a deferred compensation plan, creating a future source of tax-free income.

Most lenders and insurance providers have financial qualifications, typically requiring a net worth of $10 million and borrowing needs over $1 million to access competitive rates and terms. A long-term commitment of 10 or more years is usually necessary, similar to traditional life insurance policies.

Opportunities and Risks of Premium Financing

Premium financing offers several benefits and risks to weigh carefully:

- Funding with Borrowed Money: Instead of using personal assets or paying out-of-pocket, you can finance the policy premiums.

- Collateral Requirements: Lenders will typically require collateral, often up to 95% of the policy’s cash value, because life insurance policies are backed by highly rated insurance companies.

- Leverage: Loans add both potential gains and risks. If your policy’s value appreciates faster than the borrowing rate, it creates a financial advantage. Conversely, if it underperforms, there may be losses.

- Interest Servicing: You’ll need to pay the loan interest, typically on a quarterly or annual basis. If rates rise, your out of pocket costs could rise.

Adam’s Case Study

Meet Adam, a single father of three, whose business grew from a modest startup to a thriving company and “family of employees”, including his kids, who help run operations. His estate comprises 65% in the business, 15% in real estate, and 20% in liquid investments. His net worth growth has introduced a new concern: estate taxes. Why is this a concern? If he were to pass away prematurely, his kids would face a substantial estate tax bill and likely be forced to sell the business. And with the potential reduction in estate tax exemptions approaching in 2026, Adam is eager to lock in his planning opportunities under the current tax landscape.

Adam is in good health at 55 and expects his family to need $20 million to pay estate taxes if he passes in his late 80s. Adam thinks life insurance addresses these financial risks and, as a business owner, he’s comfortable with using leverage to enhance returns. Should Adam consider financing this purchase? Let’s examine both options.

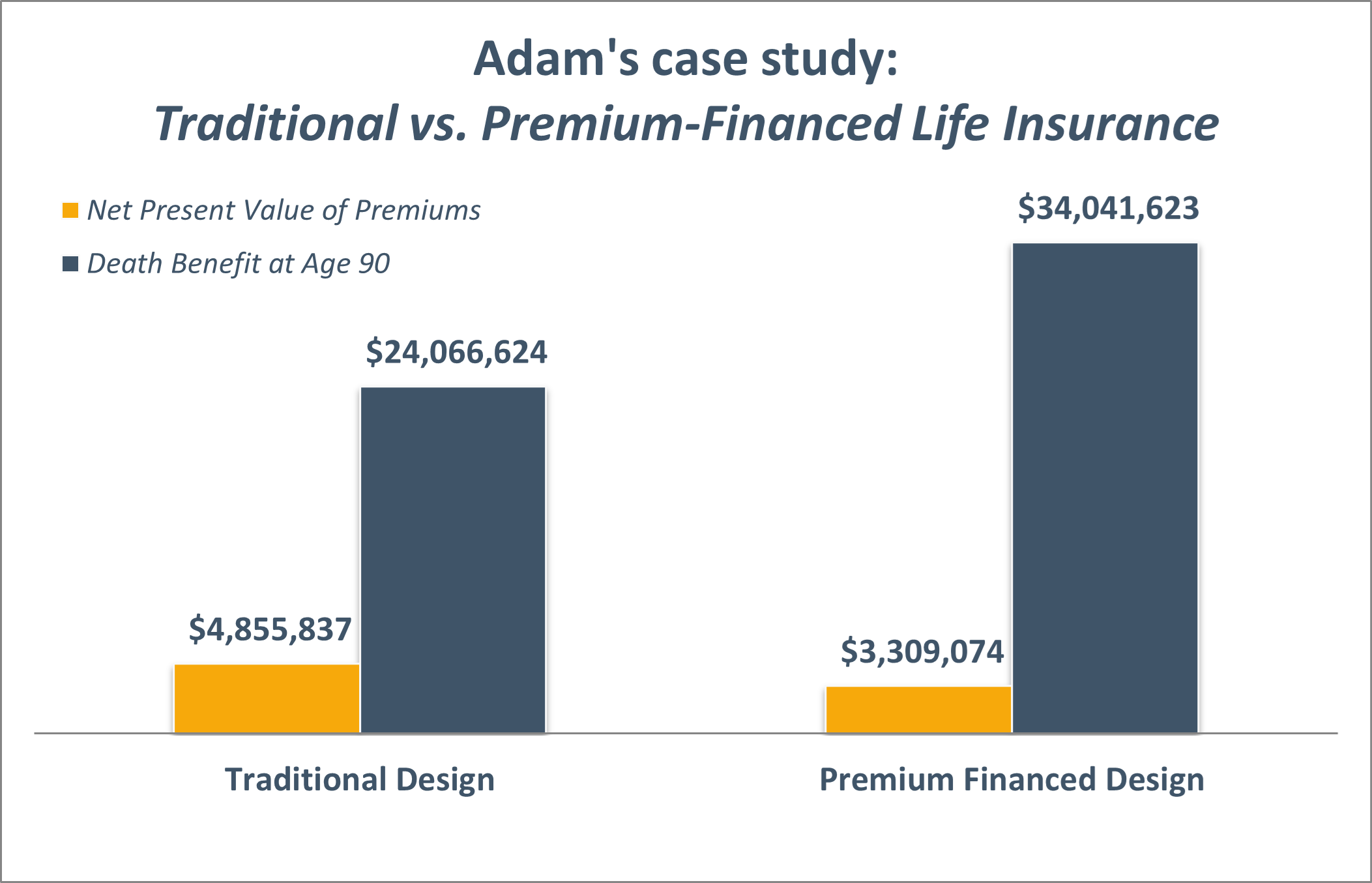

Option 1 – Traditional Design, $20 Million Initial Death Benefit

- Annual Premium: $389,645 for 20 years

- Present Value (5%) of Premiums: $4,855,837

- Death Benefit at Age 85: $20,419,095 (4.64% tax-free return)

- Death Benefit at Age 90: $24,066,624 (4.40% tax-free return)

Option 2 – Premium Financed Design, $20 Million Targeted Death Benefit

- Bank-funded Premiums: $2 million annually for 7 years

- Cumulative Interest (Years 1–10): $4,496,000

- Collateralized Investments: ~$2 million

- Present Value (5%) of Interest Costs: $3,309,074

- Death Benefit at Age 85: $25,488,618 (7.25% tax-free return)

- Death Benefit at Age 90: $34,041,623 (7.03% tax-free return)

Results

When Adam compared his options, he found that premium financing offers:

- About 30% lower present value of cumulative costs.

- Higher death benefits at life expectancy.

- Approximately 25% higher benefit at age 85 and 40% at age 90.

- Enhanced flexibility, allowing for adjustments as needed with a team of advisors.

Adam, with his entrepreneurial spirit, is excited by the chance to amplify his results.

Is Premium Financing Right for You?

The answer: it depends. This decision should be made with careful consideration of your overall wealth plan, risk tolerance, cash flow, health, and other factors. It’s crucial to consult an expert team to ensure this strategy aligns with your goals and is implemented effectively.

Ultimately, premium financing is one of many tools to help you build a legacy you’ll be proud of, ensuring security for your family for generations.

Does this situation sound familiar? We’d love to have a conversation to see how we can help. Reach out here!

Case studies are intended to illustrate services available through the advisor. Case studies do not imply future performance and do not necessarily represent the experience of any clients. Tax and legal services are not offered by LSF or Alterra Advisors.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.