It’s clear that financial plans and investments should be reviewed regularly. We need to make sure you’re still on track to reach your goals, ensure portfolios are performing as expected, and look for ways to improve on your current strategies. In many plans, however, we find that life insurance policies are often ignored. But they shouldn’t be!

Why? Here’s and example of how Marilyn was able to create an additional $600,000 from a life insurance policy she already had in place.

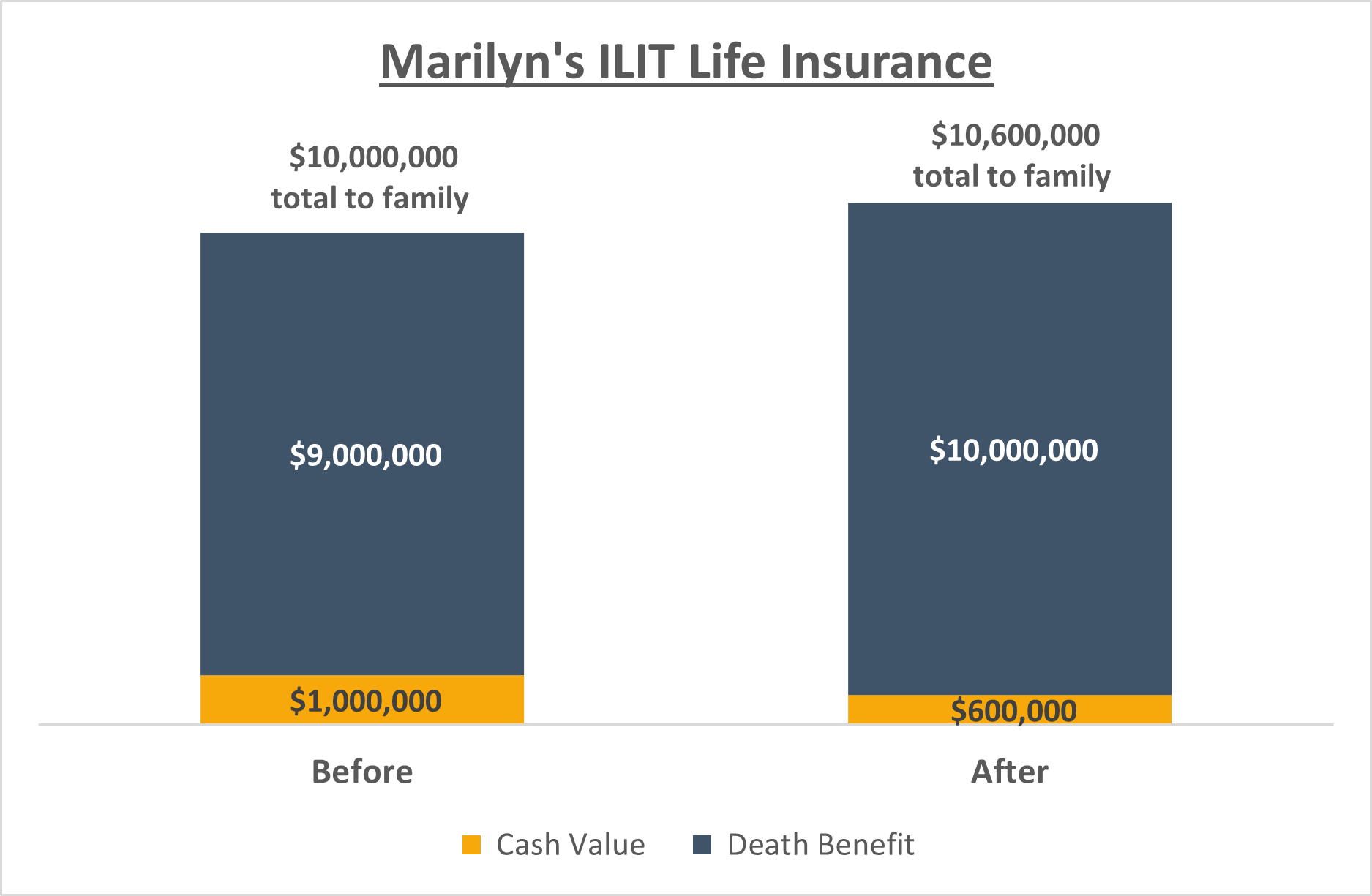

Creating $600,000 from an old life insurance policy.

Marilyn, aged 65, wanted to pass wealth to future generations of her family. 15 years ago, she set up a life insurance policy inside an Irrevocable Life Insurance Trust (ILIT). Life insurance is often thought of as “set it and forget it” because a death benefit is guaranteed as long as you pay the premiums, so she hadn’t reviewed the policy since then.

But when we review these plans, we’re looking to make sure they are finely tuned for their job – in this case, passing the most wealth possible to Marilyn’s family. When we reviewed the current plan, we found that she could increase her overall wealth passed to her family by $600,000. How?

Life insurance policies like these have two components: death benefit which passes to beneficiaries at death and cash value that can be used during life. Marilyn’s existing policy had built up $1,000,000 in cash value. Following our review, she was able to use $400,000 in existing cash value from her current policy to add $1,000,000 in new coverage, a $600,000 net increase to her family.

And, because these funds were already in a trust outside her estate, this $600,000 increase to her family didn’t require her to use any additional gifts or lifetime estate tax exemption. It’s important to note that Marilyn had to qualify for new coverage based on current health. If she was in poor health, sticking with the existing strategy would likely be her best bet.

Give your life insurance a job.

Life insurance is a tool that can serve a range of purposes, or “job descriptions”:

- Protecting your family today in case of your unexpected death.

- Building tax-sheltered cash value, often protected from stock market downturns, to be used later in your life.

- Providing funds to pay estate taxes or pass wealth to family or charity at your eventual death.

When setting up a life insurance strategy, we want to assign a job description. If your goal is to pass the most wealth to your family when you die (goal #3), you might consider a strategy that accumulates less in cash and focuses more on the most future death benefit for each dollar you contribute.

We often find, however, that policies set up years, even decades, ago don’t have a clear job description and can be improved, as in Marilyn’s case.

Your advisors should not set it and forget it.

Working with a comprehensive financial planning and wealth management team should allow you to focus your time and attention on what matters most to you. This requires your team to have a disciplined approach to reviewing each strategy to make sure it’s still the best thing for you, including those life insurance policies! In many cases, we find old strategies are still working quite well and don’t need to be changed. But there are others, like Marilyn, whose family will benefit for generations to come because of a quick review!

Interested in a proactive approach like this? Let’s have a conversation!

Hypothetical examples are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment for actual clients.

Zach Hamilton

CFP®

Partner, Financial Advisor

About the Author

Zach graduated from Gonzaga University with degrees in Marketing and Finance. While growing up, Zach heard stories from his grandfather about his work as an insurance agent, and other stories from his dad who was an investment manager. They both spoke financial “languages” but had completely different dialects. Recognizing the breadth of the financial vocabulary ultimately led to Zach’s passion for financial planning. He credits his family for this enthusiasm. Zach sees his time with clients as an opportunity to translate all of the different – and often confusing – information they’ve heard and provide clear guidance for each unique situation.

Zach enjoys working with people – his clients – who also appreciate that their financial decisions have an impact not just on themselves, but also on their families, charities and their own life legacy. Many of Zach’s clients have a strong desire to “make a difference”, and they rely on his financial expertise to magnify their philanthropic goals.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.