News of the coronavirus is front and center in the headlines. Health organizations around the world are actively assessing the situation, learning about this new virus and attempting to build containment and treatment plans as they observe and respond to the spread and impact on those affected. Uncertainty about how the virus will impact business both in the US and around the world has also catalyzed a decline in financial markets since hitting all time highs in mid-February, which has also been at the top of headlines.

We wanted to provide our perspective on a few questions you might be asking yourselves and what history has to say about these kinds of events.

What’s happening in the market impact and why is it responding this way?

In short, it’s fear. The markets don’t like uncertainty and investors tend to run from anything volatile in response. Of course, history would tell us to keep the big picture in mind and not to make drastic short-term decisions with long-term funds.

The major US market indexes have pulled back sharply from all-time highs reached in mid-February, with similar responses in stocks overseas. It’s not yet clear how the virus will impact businesses throughout 2020, though travel restrictions, temporary shutdowns, and related supply chain disruptions are already in motion and will have a short-term impact on US and global companies.

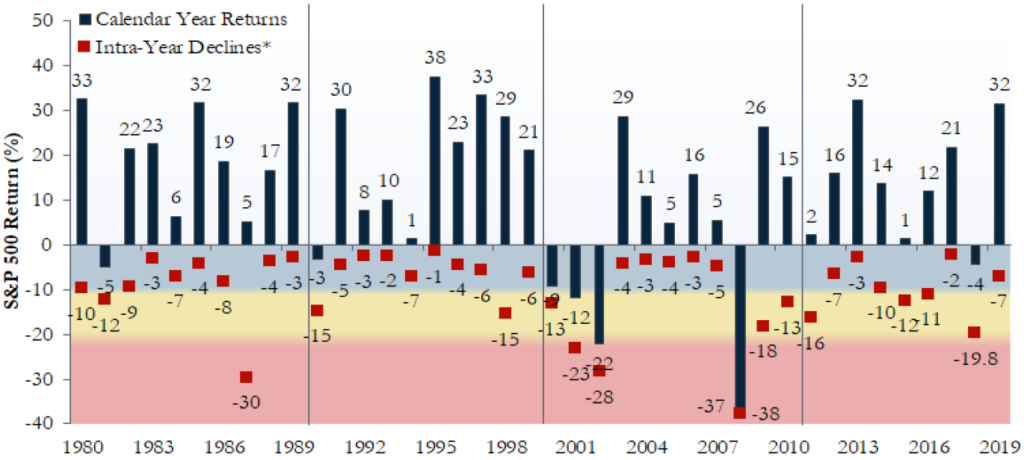

It’s also important to note that market indexes like the S&P 500 were historically high and due for some level of correction. Since the beginning of October, they had been on quite a run, setting new all-time highs in mid-February. Even the best markets take a breather now and then and this one is also being compounded by the coronavirus uncertainty. It’s important to remember that corrections are a normal part of the regular market’s cycle and often serve to resetting stock valuations and investor expectations within the bigger picture. In our planning, we assume these events will happen periodically, as they always have, and why we place so much emphasis on how your investments should be allocated based on your specific goals and time frames.

What could this mean for the US and global economy?

While it’s too early to tell the full impact this coronavirus will have, we’ve seen in past epidemics that the impact, though strongly felt, tends not to be short-lived. Of course, we’ll watch carefully to see how this situation develops.

Could this lead to a recession? We’re likely to see some level of recession, as focus on global containment has led many businesses to close their doors temporarily. While normal business activity is on hold, both spending and production will drop and the longer this persists, the deeper the economic impact will be. Looking forward, we should keep in mind that most of the disruption in global economic activity ahead will not be a permanent loss, but rather postponed until business operations and consumer activity normalize once the outbreak is contained. Like pushing the pause button on an otherwise healthy economy, it will take businesses time to recover and resume normal operations once healthcare and government officials give the green light but we fully expect they will. And historic recessions from external shocks like this one tend to drop and recover more quickly.

Has this happened before?

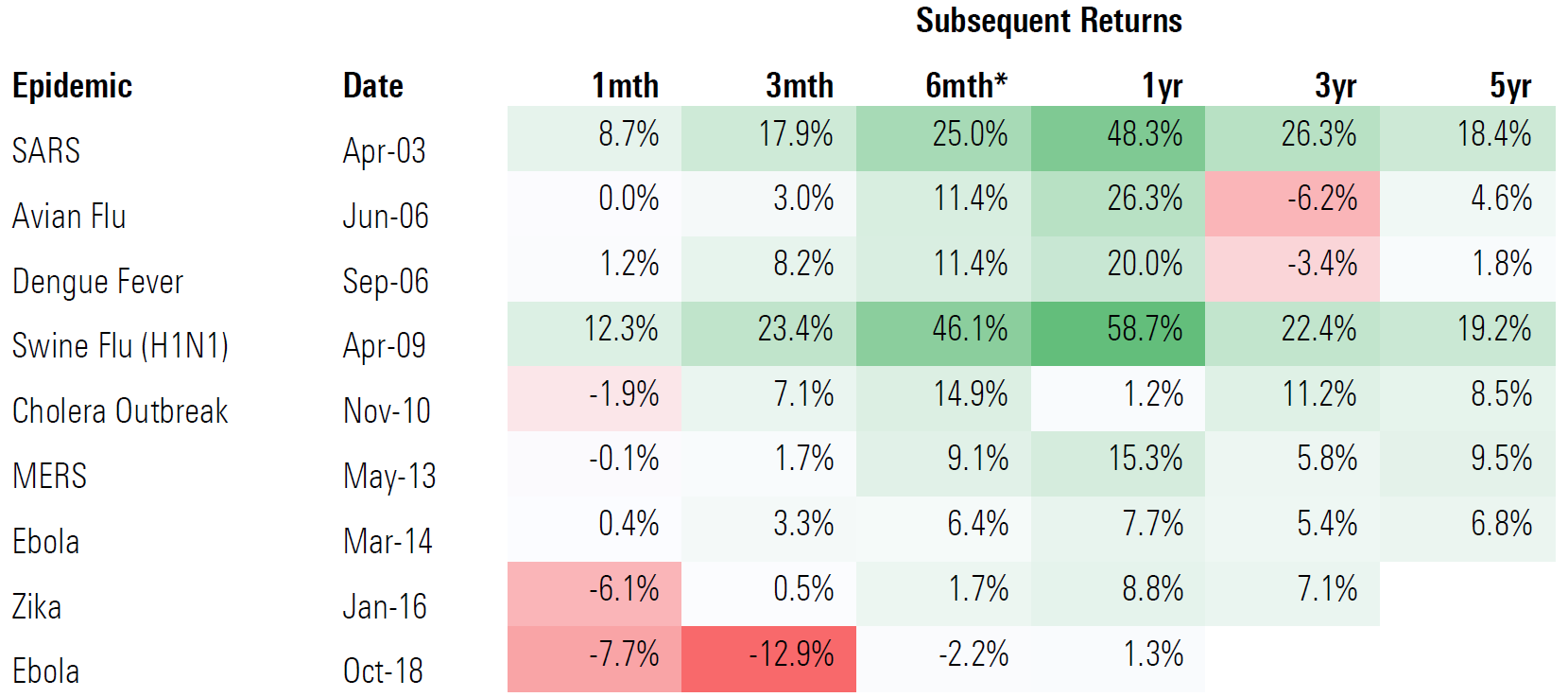

History has a lot to say about this. The specific disease is different, but we’ve seen similar circumstances in the past. As you’ll see below, of nine major outbreaks since 1998, the markets have returned to normal in three months in eight cases, and the outlier recovered in a year.

Mid-year declines are also a regular part of the market’s history. Below, we can see the S&P 500’s year by year calendar returns (black bar) and the biggest mid-year decline (red bar) experienced that same year.

What’s our Game Plan?

Before coronavirus was on the radar, we were already late in the market cycle with over a decade of annual increases in the S&P 500 and portfolios are positioned accordingly – strategic allocation increases to large and mid-sized, value-oriented stock and high quality bond holdings – assets that tend to hold up better in volatile times like this we’re seeing. The goal is to remain positioned for long term growth while reducing the impact of the short term ups and downs.

We want to remember that markets tend to react to emotion in the short run and value in the long run. We’ve seen a significant amount of fear-based trading in recent weeks. Though we expect to see many businesses affected in the short run, nothing we see here changes long run market fundamentals. Again, this appears more like pushing the pause button on an otherwise healthy economy. Once we see widespread containment and the rate of new COVID-19 cases decline, a sharp rebound is likely to follow. Selling long-term investments and moving to cash for “safety” is riskier than it seems. The market tends to turn positive just as sharply as it turned negative and you run a significant risk of missing the recovery. Check out our article “Should You Really Stay the Course?” for a closer look at this topic.

Instead, we should zoom out from the day to day and month to month volatility and revisit a few key points.

- Big changes should be goal-based. If your goals haven’t changed, in times of short-term market panic, history shows us that the best move is to watch carefully but stay invested. If you have a significant change in your goals, we should certainly discuss how to update your strategies accordingly.

- We assume these events will happen periodically and factor this into your plan. History is clear that market volatility, corrections and occasional recessions are part of the cycle and this helps identify strategies that fit your goals and time frames when we work together to build your plan.

- Maintaining proper diversification is key. When markets are going up and up, adding risk doesn’t make sense. For the same reason, when markets are going down, taking out risk doesn’t usually make sense. Why? Because it’s never possible to tell exactly what’s going to happen next in the short run. The most reliable long-term strategy is to let your goals, risk tolerance and time horizon determine your investment mix.

And remember, to us, all questions are good questions! We’re here to discuss any questions or concerns – it’s one of the most important parts of our service to you. Please don’t hesitate to reach out to discuss what’s on your mind.

Sources – City National Rochdale, Morningstar

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.