What’s going on in the market right now…why so much volatility?

Is inflation about to stop the economy in its tracks?

What about interest rate hikes?

What’s next for the economy and my portfolio?

2022 is off a bumpy start. You’re likely seeing headlines about record inflation, January’s market losses, and the change in tone from the Federal Reserve on interest rates and their plan to tamp inflation down. What does all this mean for you? Here’s look at where we are now, the 2022 economic outlook, and our thoughts on how this affects your strategies.

Where we’ve been, where we’re going.

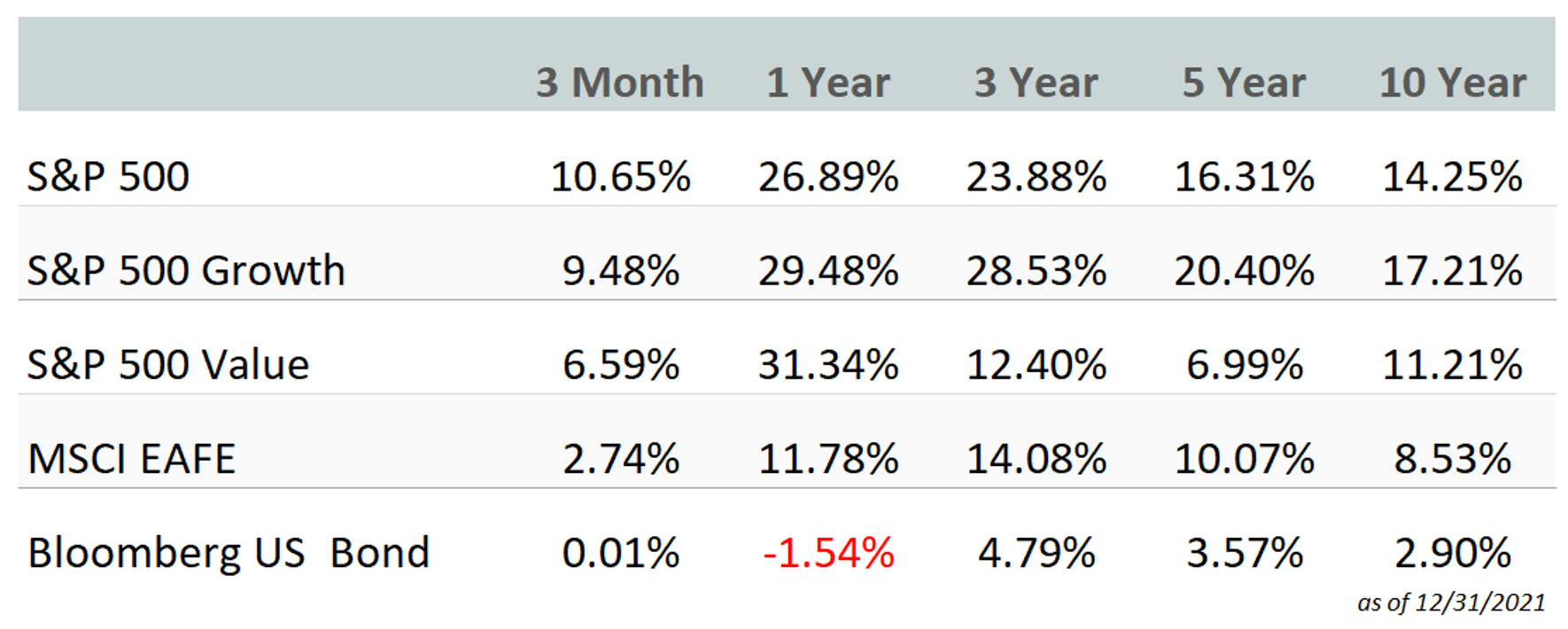

2021 was a positive year in many respects. For the stock market, it was another rallying year, which you’ve likely seen to some degree when opening year end statements, depending on how aggressively you’re allocated.

But as history shows time and time again, rallies don’t last forever. January has given back the fourth quarter gains we saw last year and is on pace to post the biggest losses since February 2020. The S&P 500 is down nearly 10% with the tech-heavy S&P 500 Pure Growth index down almost 19%.

What’s happening? We’re likely seeing a combination of correction and reaction to the Federal Reserve’s recent moves. Prices in many areas, but specifically among the largest tech companies, reached all-time highs, which is commonly followed by a correction. Additionally, the Federal Reserve has signaled intent to tighten its monetary policy in response to rising inflation. We’ll discuss this in more detail.

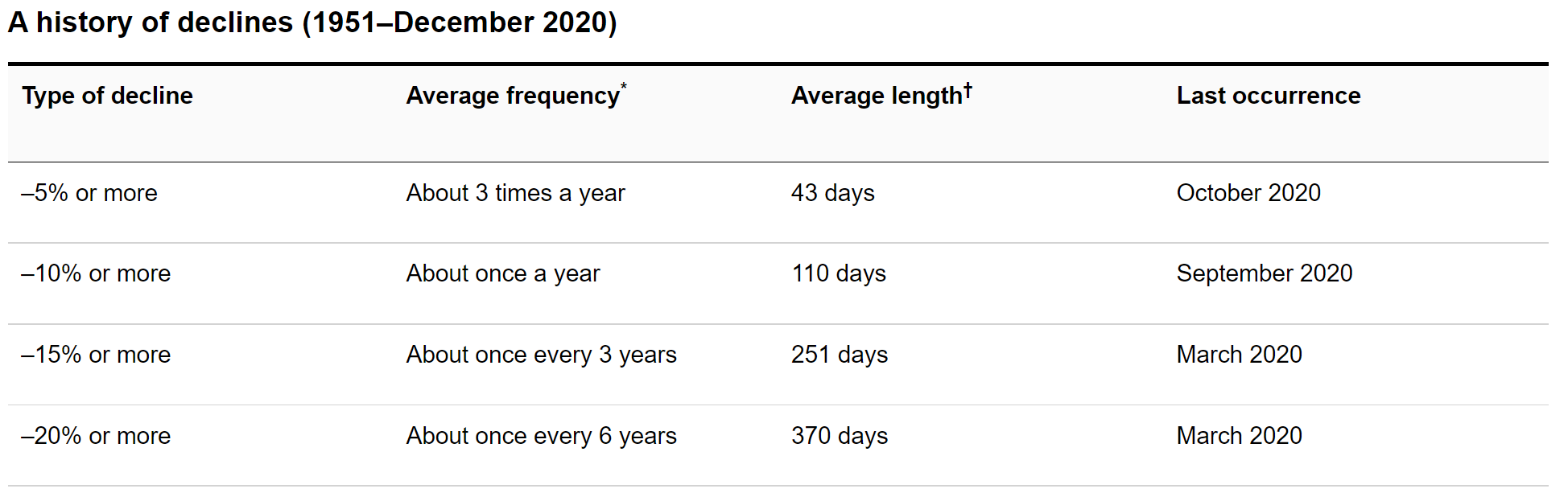

As painful as market corrections can be, it’s always important to remember that they are part of a normal cycle.

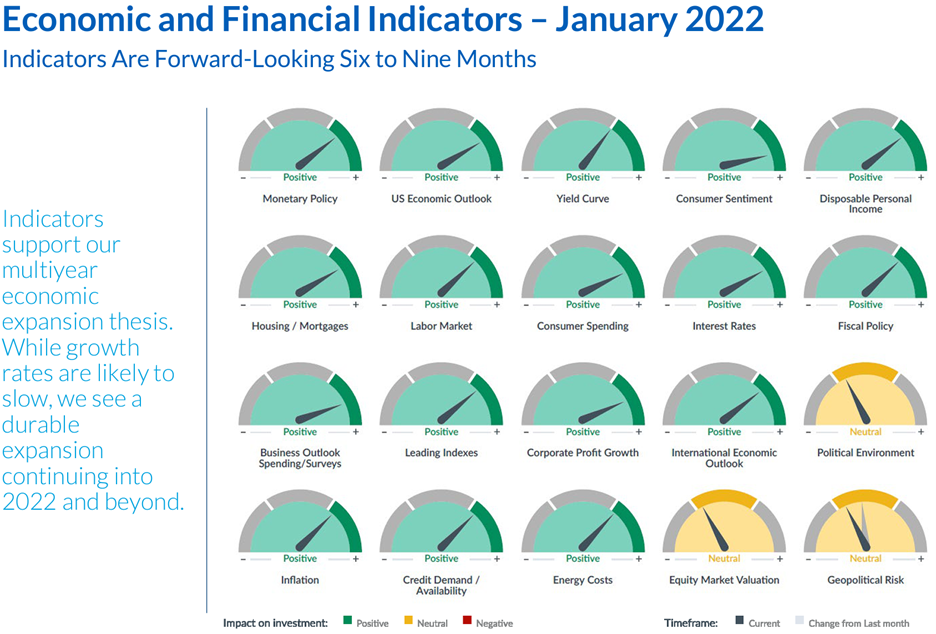

How about the economy? City National Rochdale’s economic speedometers are a clear dashboard of a wide range of market and economic metrics and whether they appear positive, neutral or negative. We’ll dive deeper into a few of these, but it’s clear that we’re still in a largely positive environment.

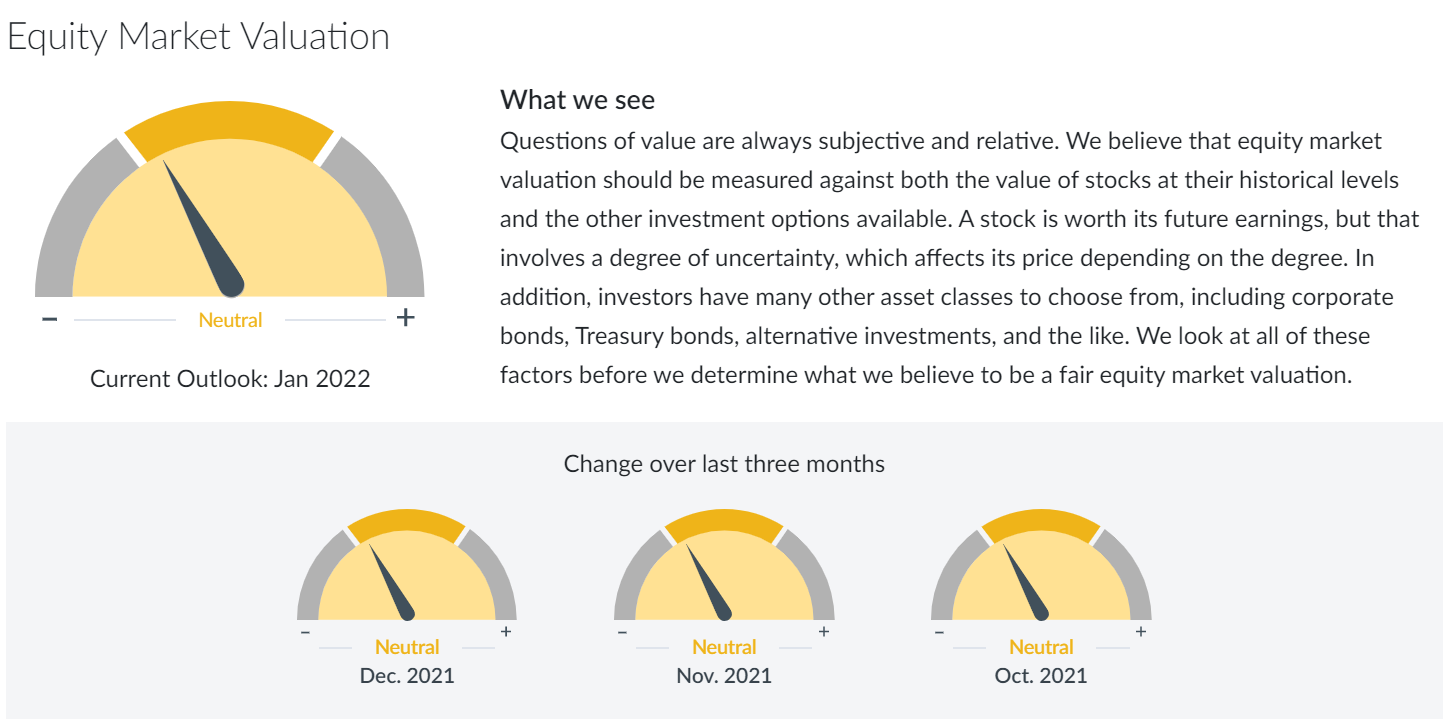

Is the stock market overvalued?

The rally that continued through 2021 led to many stocks reaching all-time highs and left many asking if prices were a little overcooked. It appeared that stock prices were at least fairly valued, if not a bit high in some areas. January’s pullback has seemed to confirm this. The Equity Market Valuation speedometer indicates values to be on the low end of neutral, though we’d expect this to shift back in the positive direction when January is done.

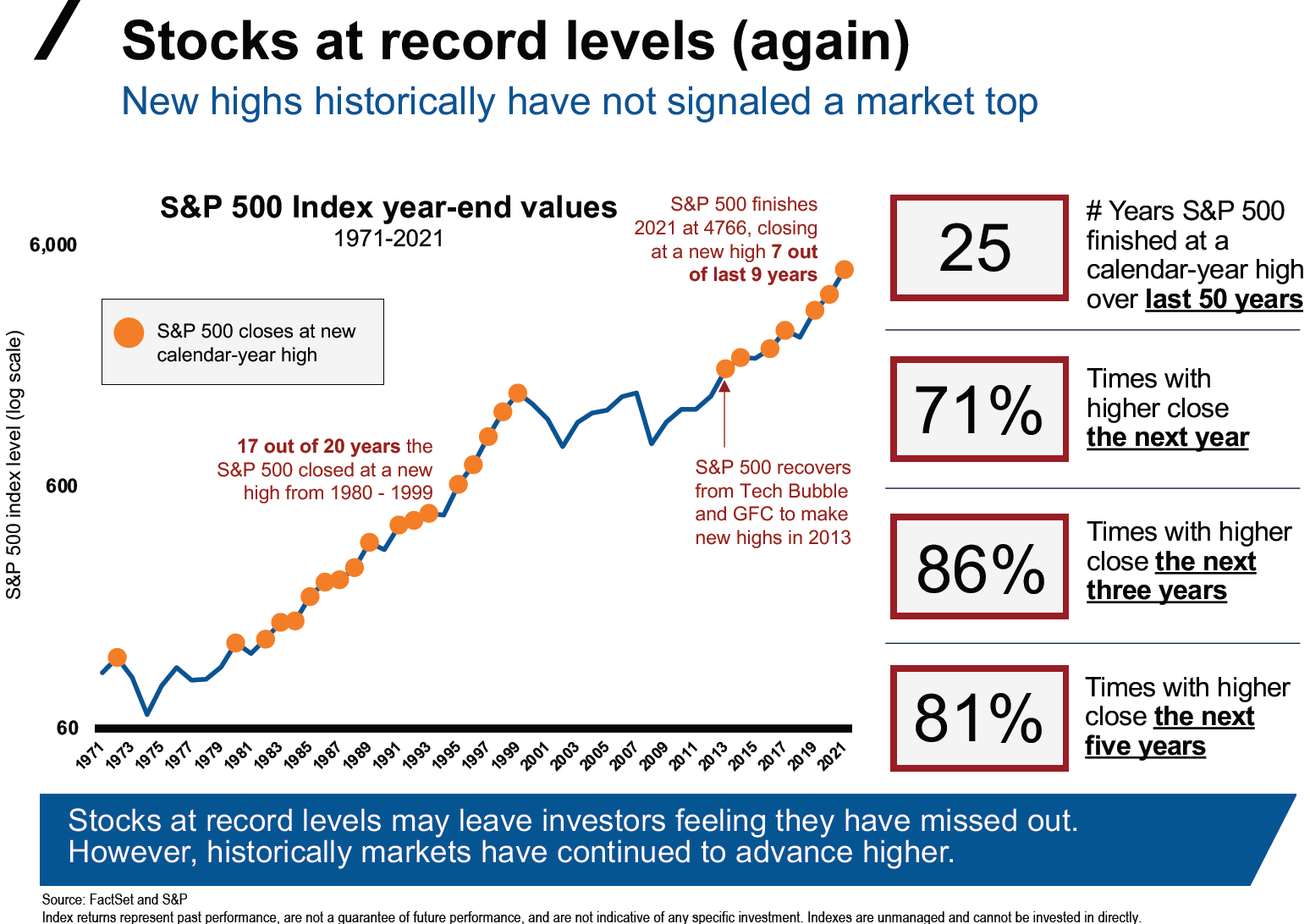

History shows us, however, that stocks aren’t overvalued simply because they reach new high prices. Every new high is the all-time high…until the next one. Statistics from Russell Investments demonstrate this clearly.

What about inflation?

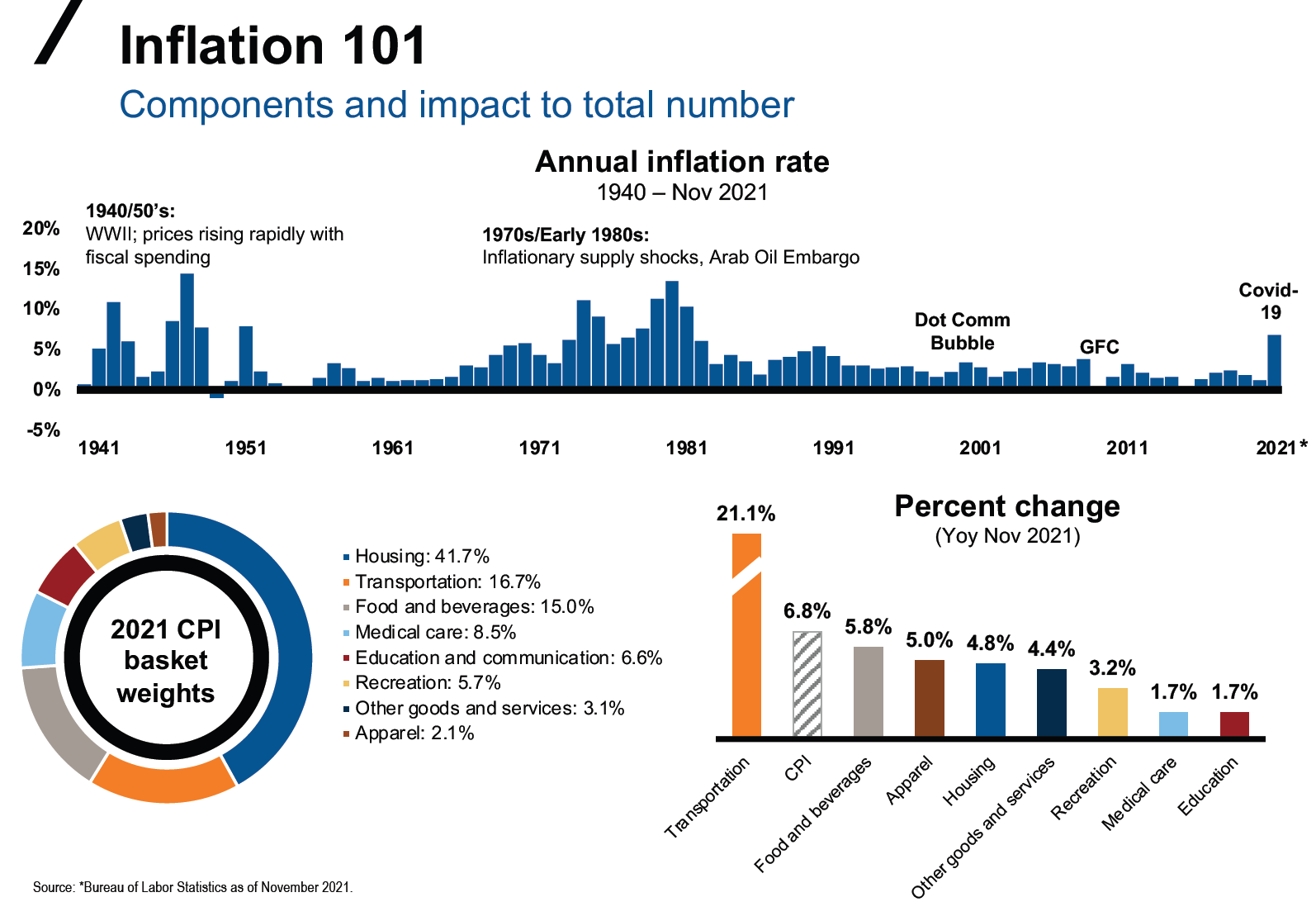

Inflation ended 2021 at 7%, the highest year-over-year rate we’ve seen since 1982. Until the recent market downturn, this topped the financial headlines. What does this mean? Let’s start with a historic look at inflation. The Russell Investments chart below shows us that inflation isn’t a single price increase. It aggregates price changes in a wide range of categories. In this case, transportation costs spiked more than 21%, primarily due to a lack of supply of cars.

What does this mean for us now? The current spike in inflation is historically unique. Much of the economy shut down entirely in 2020. So, for a year, like pinching a garden hose, the pressure built up. Consumers saved rather than spent their money because there was nowhere to go. In 2021, as economies around the world began reopening, we were all able to enjoy meals, visit our favorite stores, and purchase goods…and we purchased at record pace. We’re bouncing off a 2020 floor of 0% inflation and it’s widely expected that the year-over-year rate will drop as the spring 2021 spike starts to fall off.

For our recent deep dive, read Should You Worry About the Spike in Inflation?

We’re still recovering as an economy, so why are we seeing rising interest rates?

Though the inflation rate is expected to moderate later this year, the Federal Reserve is taking steps to make sure this happens in a measured way. Why do we see rate hikes when inflation creeps up? Interest rates are one of the tools the Federal Reserve uses to influence inflation. If inflation creeps up, a bump up in interest rates slows that down.

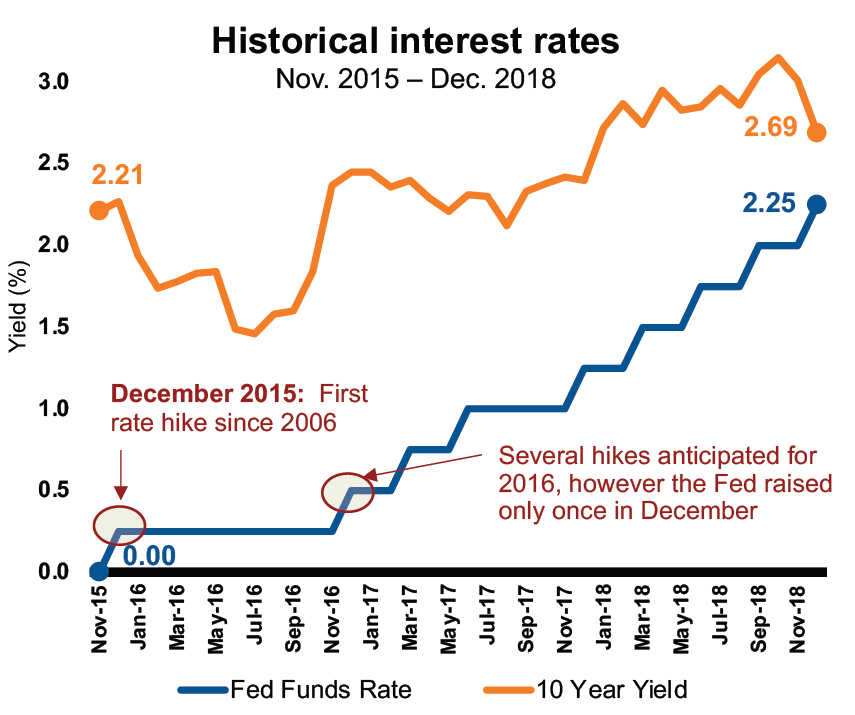

This is not the first rate hike cycle we’ve seen. The last started in 2015 and continued through 2018.

What happened? Our economy’s GDP averaged 2.35%. The S&P 500 grew an average 7.57% per year, positive, though lower than average. More importantly, those with disciplined financial strategies continued to build wealth.

Mortgage refinancing activity may slow down, though rates will still be near historic lows. But while borrowing is likely to get more expensive, the impacts of rising rates shouldn’t change your long-term investment strategy.

What does this mean for the 2022 economic outlook?

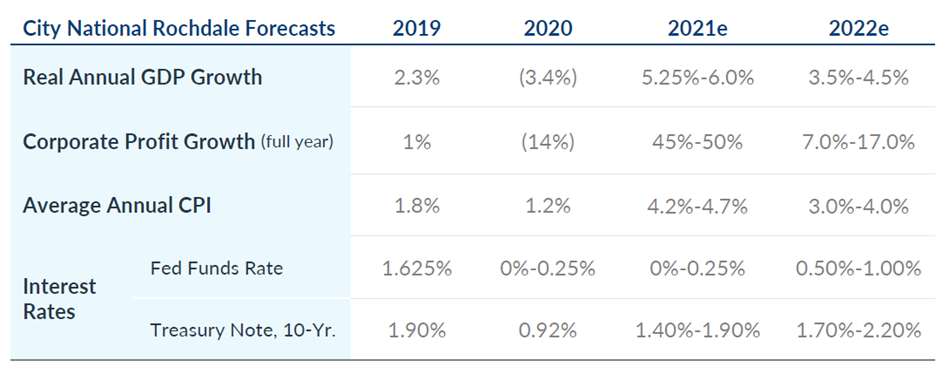

Prospects for the economy and stock markets still look strong in general. We can take a few things from the outlook below.

- GDP, gross domestic product (the primary measure of our economy’s productivity) is still expected to grow 3.5-4.5%, a more moderate pace.

- Corporate profits are also projected to grow 7-17%.

- Stocks are positioned for more moderate growth with higher volatility.

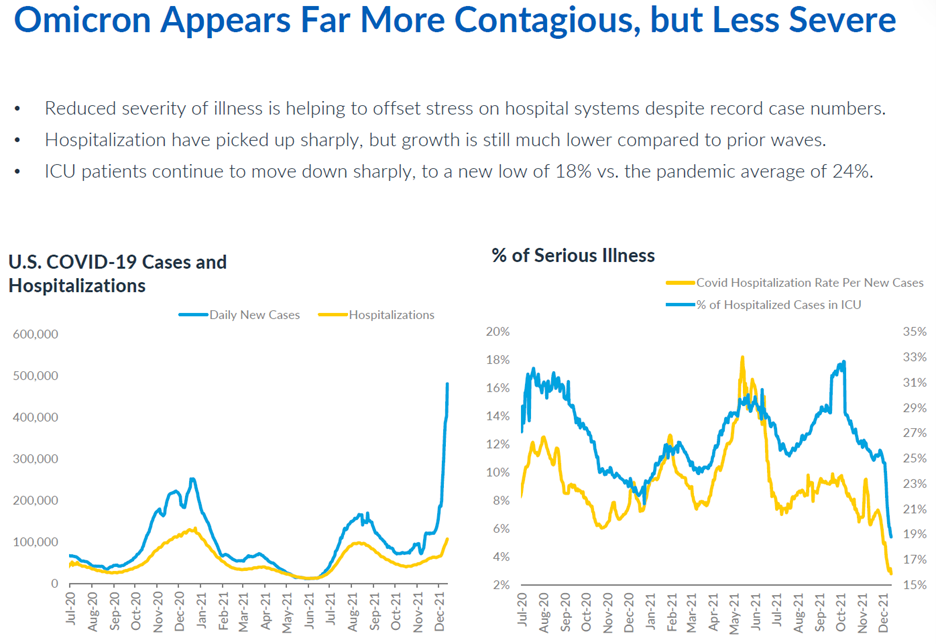

The omicron variant of Covid, while highly contagious, appears to be resulting in fewer serious illnesses, hospitalizations, and ICU admissions on a percentage basis, which is encouraging for us all. If this holds true, it’s far less likely to cause 2020 levels of economic interference.

To sum up, we expect moderate growth with more stock volatility than we’ve seen in past years. As always, this highlights the importance of a portfolio strategy based on your goals and risk tolerance. Time is a blessing, but timing can be a curse. Those taking funds from an aggressive portfolio during a downturn see the timing as a curse. But you can avoid this with a strategy based around when you’ll need your money and how much volatility you can withstand. When you’ve accounted for these two variables, you’re well positioned for success in up and down markets.

Resources – CNR The Bottom Line, CNR Speedometers, CNR Economic Outlook, Russell Investments, Capital Group

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.