Have you been car shopping recently? Noticed a spike at the gas pump? Has the Costco bill reached a new record? It’s not hard to find real world examples of rising prices amid the recent inflation spike. This might leave you wondering if it will ever end, if you’ll have to make lifestyle changes or, even worse, if we’re about to return to the 80’s-era inflation.

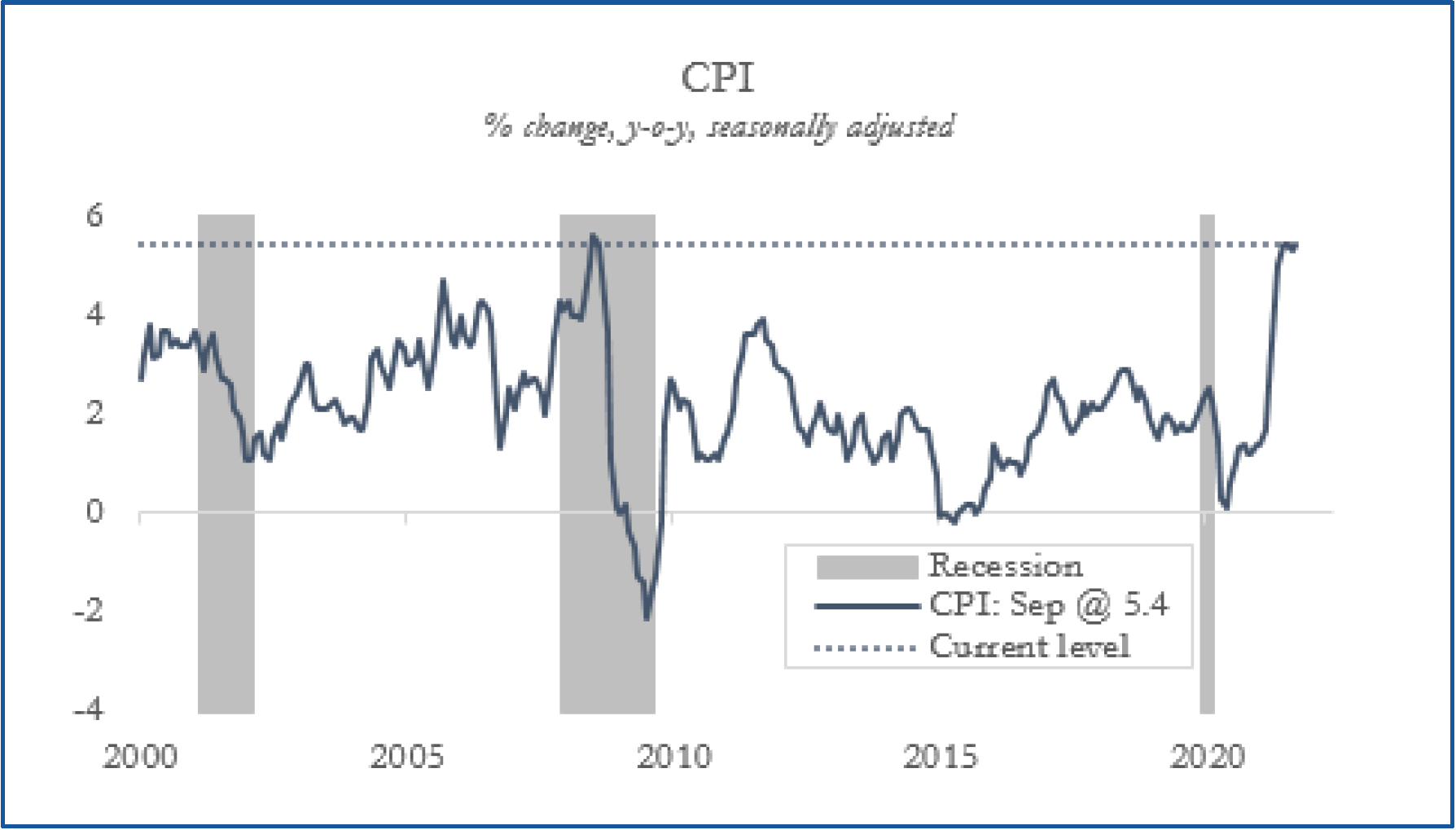

According to the most recent Consumer Price Index report, prices climbed 6.8% in the last 12 months, the biggest jump in almost 40 years. So, what’s happening? And, more importantly, should you be concerned?

What’s happening with inflation?

In recent months, we’ve seen a perfect storm of events to create an inflation spike. What are they?

- Prices on everyday products dropped considerably during the 2020 Covid lockdowns as businesses around the world were forced to shut their doors for an extended time. This meant any year-over-year comparison was bound to be much higher than average.

- Demand is up. Consumers are opening their wallets, eager to usher in more normal times and start buying again.

- Supply is bottlenecked. Companies are having a harder time getting products into consumers’ hands for a variety of reasons. This is the “supply chain” trouble you may have read about. Production of key components like semiconductor chips is backed up. Shipping products across the globe has slowed. And millions of workers involved in making these products who have been laid off or left their jobs voluntarily have been slow to return.

Isn’t this all because of government stimulus?

“Wait, I thought the inflation spike is a result of all those government stimulus dollars.” Stimulus funds and expanded unemployment certainly had an impact but is not the primary driver of what we’re seeing today. For more, read Should You Worry About Inflation?

What about the doom and gloom headlines?

Headlines are scary and, in many ways, they need some shock value to attract your attention.

“Inflation hits 30-year high!”

“Fastest rate of inflation since 1990!”

Take these headlines at first glance and it looks like we’re headed for disaster. But let’s dig a little deeper.

The inflation rates reported in the news usually reflect price increases over the last 12 months. As previously mentioned, we are bouncing off the floor of a 0% inflation rate in 2020. Any increase from 0% is going to appear more significant than average, like the 6%+ rate over this time last year.

We are certainly seeing an inflation spike, higher than we’ve seen in some time and much higher than the Federal Reserve’s 2% target. But inflation in 2021 is expected to be 4-4.5% with 2.8-3.0% forecasted in 2022. Compared to 6.8%, this seems high, but far more reasonable.

Will this derail the economic recovery?

In short, no, we don’t think so. On the economic front, the sources of the inflation spike as discussed above are not expected to sustain long enough to derail the economic recovery. The Federal Reserve is carefully monitoring the situation. In a recent statement, the committee decided to reduce the pace of monthly bond buying, a move expected to slow inflation. Projections following the most recent meeting also indicated that we should expect interest rate hikes in 2022, revising prior plans to keep rates unchanged.

Corporate earnings, a primary driver of economic health, are still near all-time highs, indicating an ability to weather the storm. The everyday consumer also looks financially better than ever with higher savings and lower debts coming out of the pandemic. This means demand for goods is set to remain high.

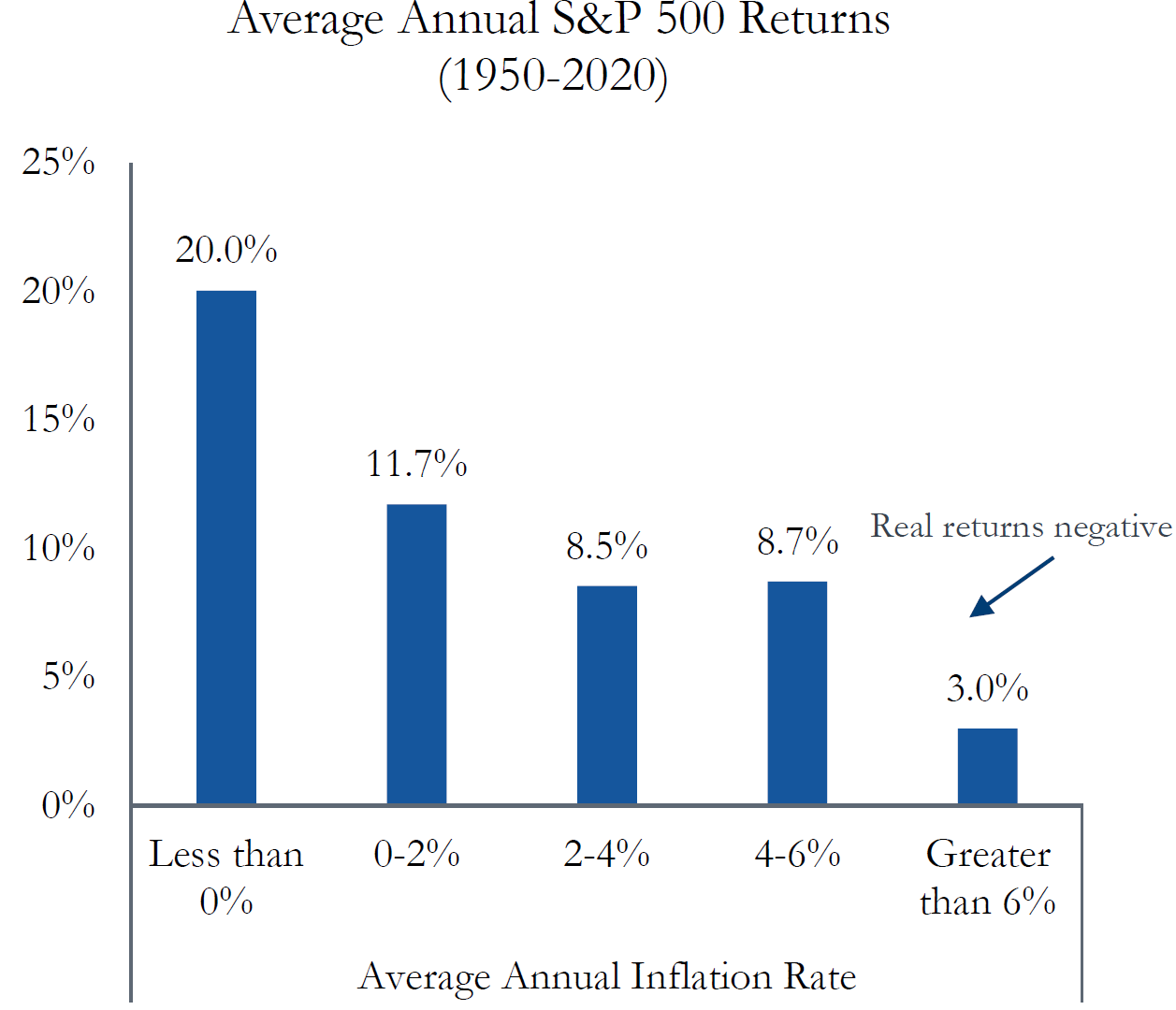

Turning to the market, stocks tend to perform well with higher-than-average inflation and haven’t seen significant setbacks until inflation persists above 6%.

Should I be concerned?

If you’re remodeling a house or running a business, the supply shortages and increased prices are hitting harder than any time in recent memory, which is a relevant concern. We haven’t seen an inflation spike like this in over a decade. However, this imbalance is not expected to last.

Prices are already more than recovering from the 2020 drop. The labor struggles will settle. Manufacturing will catch up with demand. It is taking longer to sort out these imbalances than many hoped but look for them to be largely corrected through next year. It’s important to remember that our global economy operates at a fast pace and it’s in everyone’s best interest to work toward solutions.

In the meantime, estimates show that inflation is likely to stay high through the first half of 2022, balancing out in the second half of the year. The bottom line? We don’t see a need for long-term concern.

What should I do?

Let’s talk action… What should you do in times like these? Here are a few suggestions:

- Defer large purchases where you can, especially in highly affected areas like automobiles, while shortages are causing spiked prices.

- Expand your portfolio income sources. It’s common to think of stocks for growth and bonds for income. But when rates are low and set to increase, consider a slight shift to high dividend stocks for income and consider bonds more of a volatility buffer. This might mean reducing bonds in favor of high-quality dividends.

- Don’t ignore your retirement timeline. The short-term uncertainty could lead to a bumpier ride for the market. If you’re retiring soon, or are already retired, make sure your portfolio is positioned to generate stable income to meet your needs. This doesn’t mean ignoring growth, but, as we’ve previously discussed, you want to make it safely down Wealth Mountain and a steady portfolio paycheck is key.

Last but certainly not least, reach out with questions! We’re here to talk through these concerns with you. Every concern is valid and should be addressed to ensure your plan is protected and you can get back to a good night’s sleep.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.