The first quarter of 2021 brought continued economic recovery, gains in markets, and the COVID-19 vaccine is being rapidly administered, bringing hope that we’re approaching post-pandemic times. Let’s look at common questions we encountered this quarter.

- What happened in Q1?

- How does this affect the 2021 outlook?

- Is the market overvalued?

- Should I worry about inflation?

- Will stimulus continue to carry the economy forward?

- What is the WA State LTC payroll tax and how do I opt out?

What happened in Q1?

- Unemployment improved significantly.

- 1 million people returned to work in March.

- 14 million, or 63% of jobs lost in the pandemic, have been recovered.

- Manufacturing is expanding at pre-pandemic levels, due in part to supply chains moving more freely and pent up demand from the pandemic.

- Cash balances are high with consumers and banks.

- Consumer confidence grew, demand for goods and services was up.

- Supplies are still down causing upward pressure on prices.

- Global recovery is underway as well

- China and Asian emerging markets led the way.

- Europe lagged due to virus containment struggles.

- We saw a spike in year-over-year inflation largely due to pent up demand and recovery from the steep drop this time last year – think “reflation”

- 34% of the US population has received at least one vaccine, which seems to be effective so far.

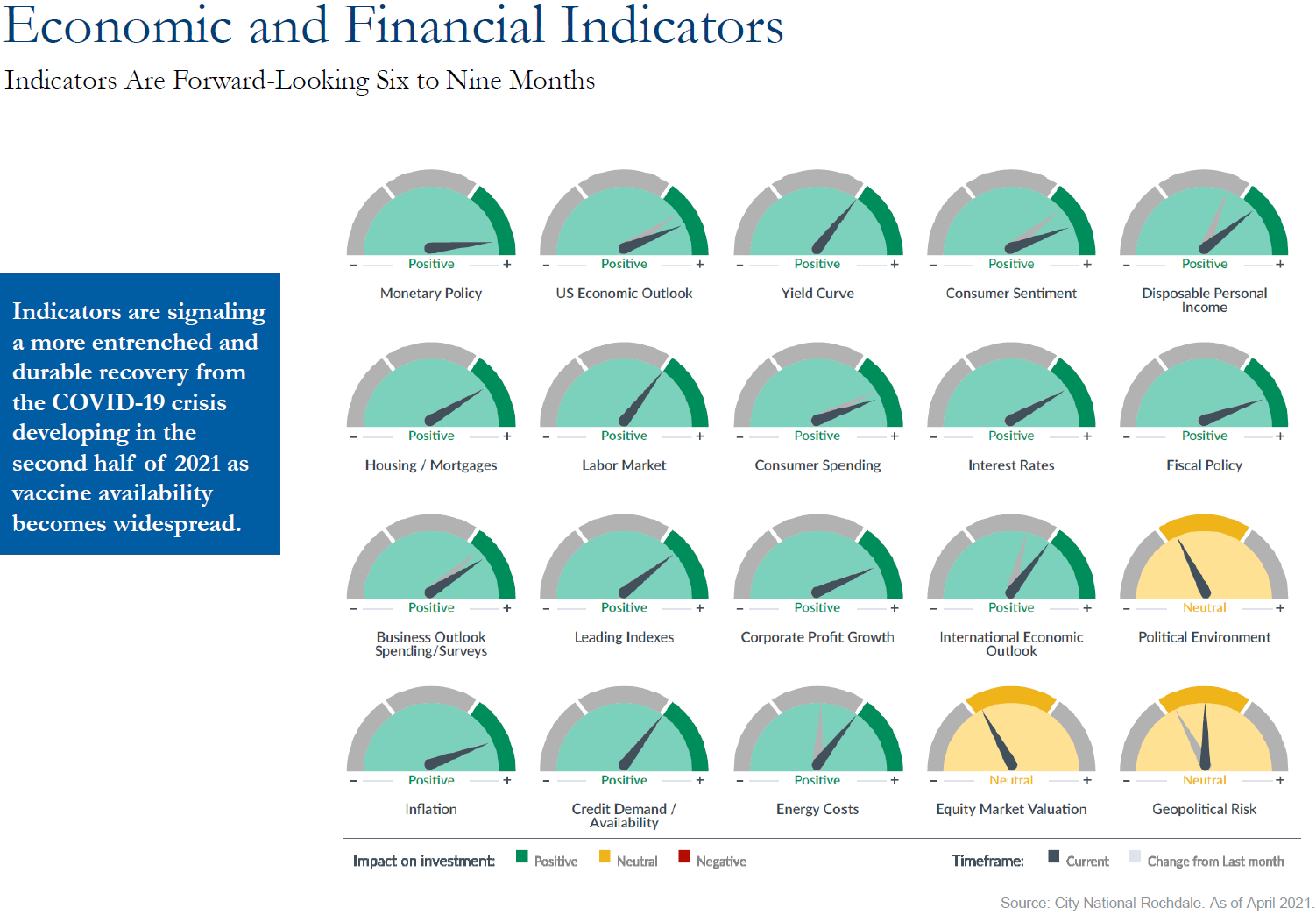

How does this affect the 2021 outlook?

- Vaccine progression gives hope that we will see something closer to more normal life by mid-to-late summer.

- The Federal Reserve appears committed to seeing a much faster recovery than 2008.

- Rates in 2020 dropped from over 1.5% to near zero – this is historically more stair-stepped.

- They are signaling a hold on rate increases until they see sustainable economic growth.

- Estimates show low rates from the Fed through 2024.

- Year-over-year inflation will spike in the short term, but likely subside toward the end of the year.

- US economic recovery will remain a bright spot.

- 2021 GDP is estimated at 6.5%, the strongest in almost 40 years.

- Unemployment rates are expected to be 4.5% by year end, just 18 months after record job losses.

- Corporate profits are expected to be 25% or more, which will help sustain market growth.

CNR’s Speedometers is a helpful visual for economic and financial indicators.

Is the market overvalued?

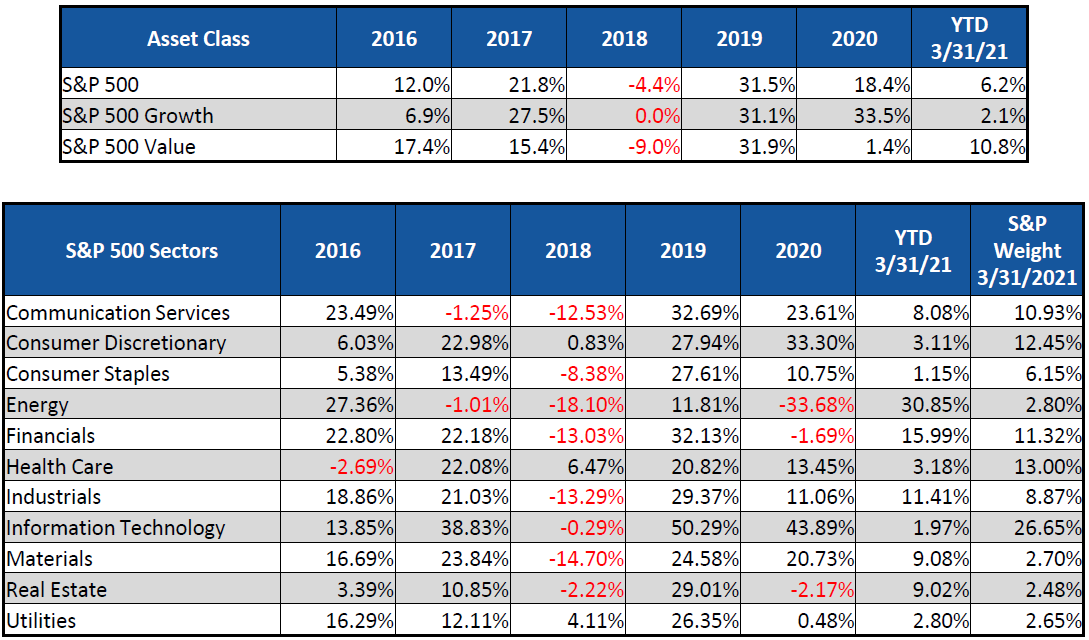

Though bumpy at times, Q1 brought strong market performance, though not in equal measure.

Value narrowed the gap on growth with S&P 500 Value rising 10.8% and S&P 500 Growth up just 2.1%. Value companies suffered the most in the pandemic while many growth companies benefited, which led to historic outperformance of growth over value in 2020. Q1 2021 showed why it is important to stay balanced in allocation and focused on the long term.

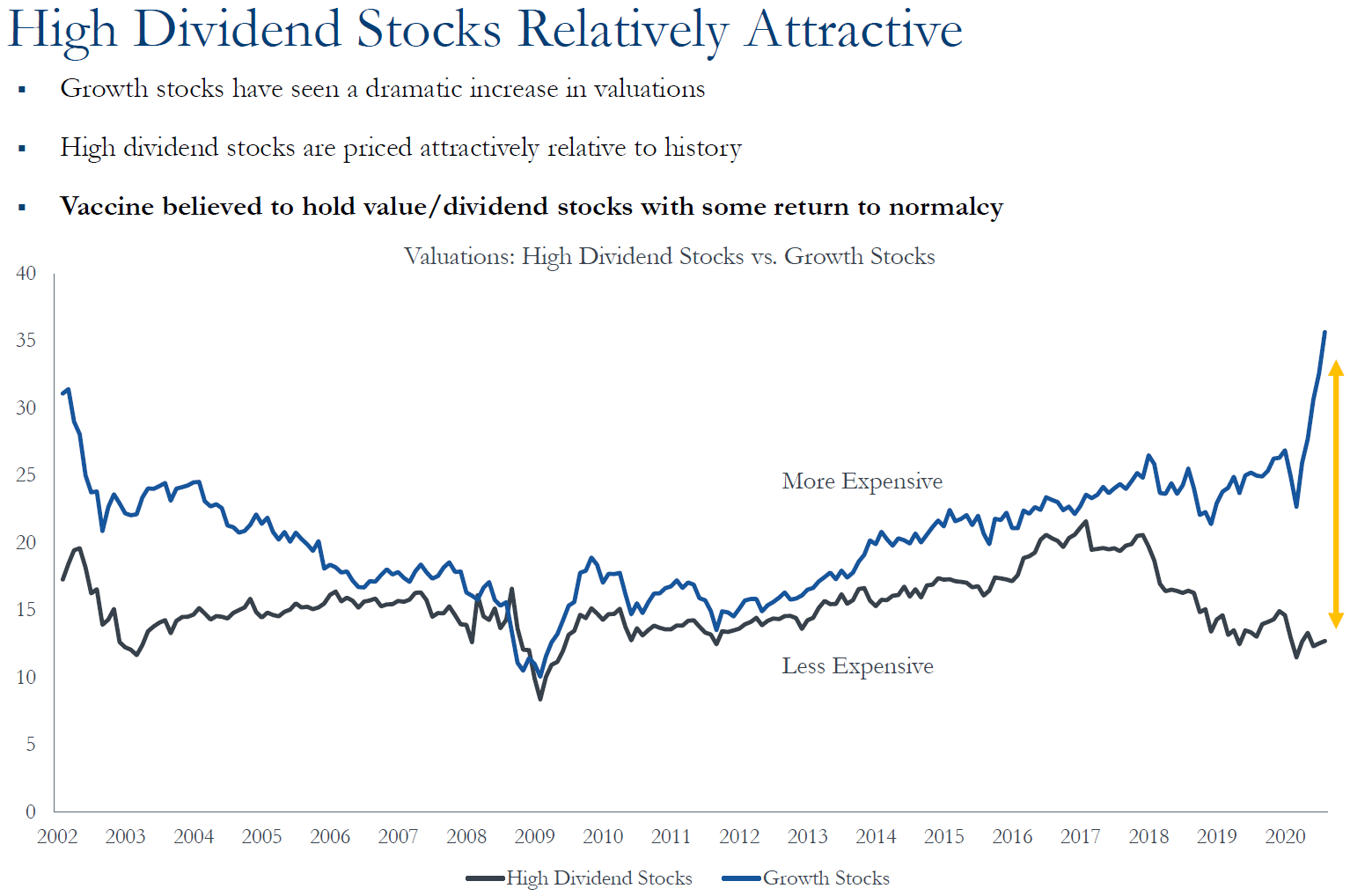

Dividend stocks are still attractive relative to growth stocks. Though the value vs. growth gap narrowed this quarter, valuations are still most attractive in value and dividends payers. These companies also look more attractive in low interest rate environments because they offer income with the potential for growth.

Though growth, specifically tech, companies have shown the fullest valuations, corporate earnings are growing at double digit rates and ‘catching up’ with their prices.

Low and rising rate environments tend to advantage stocks over bonds. In higher rate environments, bonds can be a source of income and volatility buffer. However, when rates are low, investors tend toward dividends for income and bonds solely for volatility protection.

Do I need to worry about inflation?

With all the stimulus money flowing into the economy this past year, concerns about inflation make sense. However, money supply increases are just one part of inflation equation. For inflation to take hold, people have to spend those dollars and demand must consistently outpace supply. In the short term, expect a spike in year-over-year inflation, but think of this more like reflating an economy that was severely deflated a year ago. Significant long-term inflation doesn’t seem likely. Read more on how stimulus and inflation interact in Should You Worry About Inflation?.

Will stimulus carry the economy forward?

Federal stimulus supported the economy in an unusually trying time, as we discuss in Why This Isn’t the Next Great Depression. But stimulus funds are a Band-Aid, not a solution. The key to a sustainable economy is a recovery in consumer spending. Consumer spending leads to increased business profits, which leads to more jobs, which loops back to more consumer spending – economic viability is all interconnected.

What is the WA State LTC payroll tax and how do I opt out?

Starting on January 1, 2022, WA State will impose a payroll tax on all employees to fund a new long-term care benefit for its residents. However, the state is allowing a one-time permanent exclusion for anyone with qualifying coverage in place by November 1, 2021. We cover all the details in Washington’s Long Term Care Payroll Tax and How to Opt Out.

Sources – CNR Speedometers, CNR The Bottom Line, CNR Economic Outlook, JP Morgan

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.