The third quarter saw the most significant market volatility since March 2020. The economy continues its post-Covid recovery, though some of the momentum slowed due to stimulus ending and the rise of Delta variant cases. In addition to the bumpy economic recovery, more changes were made to federal income and estate tax proposals.

What happened in Q3 and what’s next?

- US stocks were virtually unchanged after September’s 5% drop erased the quarter’s gains. This marked a return to volatility and was the biggest monthly decline since March 2020.

- Earnings for S&P 500 companies are on track for strong growth in 2021 and 2022.

- Valuations suggest moderate long-term returns for stocks.

- Delta variant of COVID-19 may have a moderate near-term impact on the economy, but unlikely to derail the long-term recovery. US cases are down 50% since reaching a high in September.

- Inflation stabilized at 5.4%, may increase slightly in the near-term, but is likely to moderate in the long-term.

- Unemployment continued to decline, though the rate of hiring slowed primarily due to a shortage of qualified workers.

- Federal Reserve likely to slow bond-buying but remains committed to keeping interest rates low until employment targets are reached.

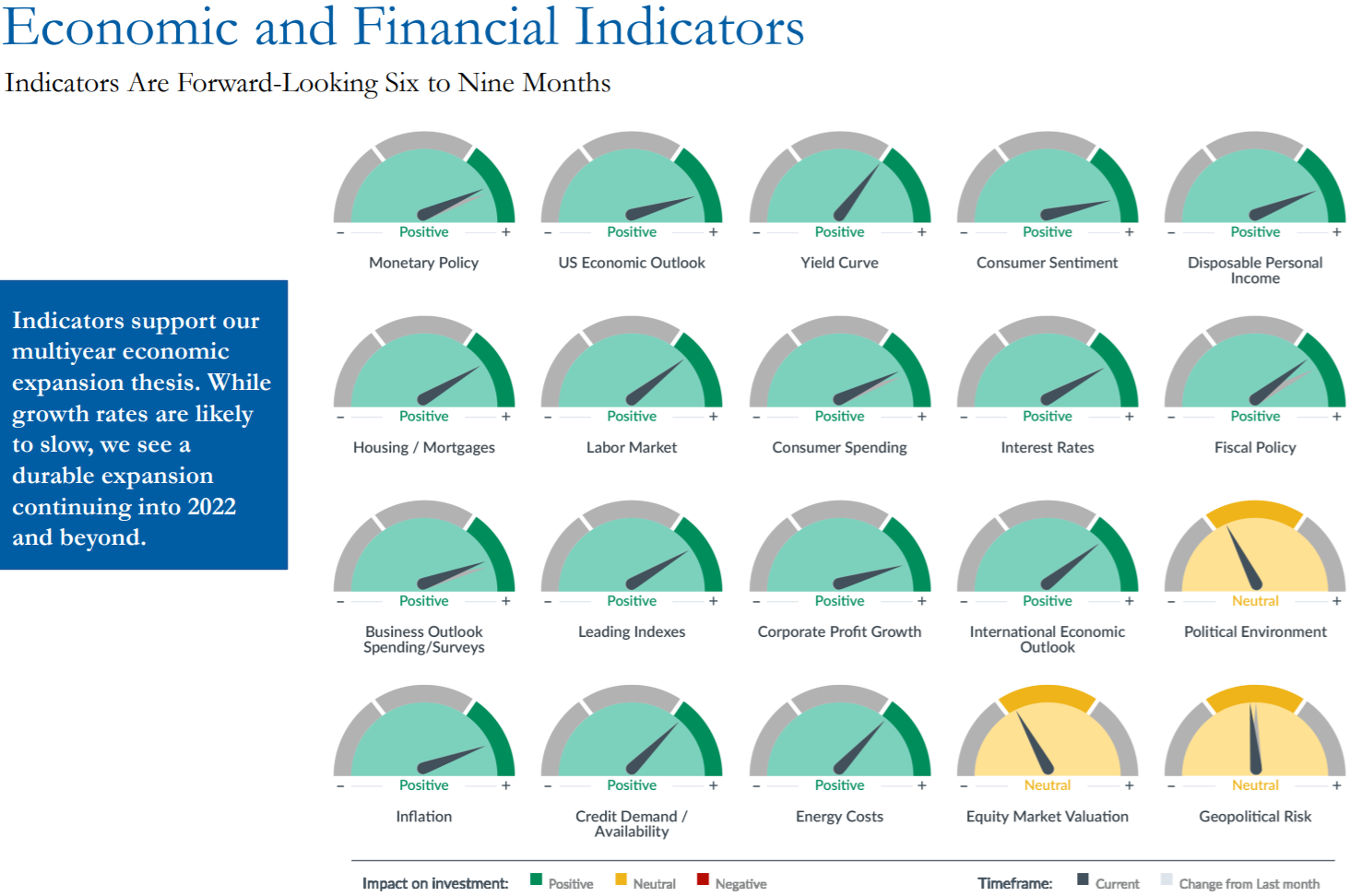

CNR’s Speedometers are a helpful visual for key economic and financial indicators.

Federal income and capital gain tax changes

Here are key provisions reflecting the most recent updates:

- Top income tax rate increases from 37% to 39.6% for incomes over $450,000.

- Corporate tax rate increases from 21% to 26.5% rather than 28%.

- New 3% tax on incomes over $5 million married, $2.5 million individual, $100,000 trusts.

- Capital gains tax rate increases to 25% at $450,000 joint income, $400,000 single income and includes the 3.8% Medicare surtax, resulting in a top combined rate of 31.8% up from 23.8%.

- Medicare surtax of 3.8% applies to all net investment income – passive and active – for taxpayers with adjusted gross income above $400,000.

- Proposed $500,000 gain limit on 1031 real estate exchange is eliminated.

- 20% pass-through income tax deduction for small business owners (199A) is limited to incomes below $500,000 joint, $400,000 individual, rather than being eliminated.

- New excess Required Minimum Distributions required from high balance IRAs for incomes of $450,000 joint, $400,000 individual:

- 50% of balance over $10 million

- 100% of excess over $20 million, starting with Roth assets

- Mega Backdoor Roth 401k contributions would be eliminated in 2022 regardless of income.

- Roth IRA conversions eliminated in 2032.

These updated changes would result in the following total tax rates for the highest earners:

- 6% for earned income (39.6% top rate + 3% surcharge)

- 4% for ordinary investment income (39.6% top rate + 3% surcharge + 3.8% net investment income tax)

- 8% for long-term capital gains (25% top rate + 3% surcharge + 3.8% net investment income tax)

Federal estate tax changes

Here are key provisions reflecting the most recent updates:

- Estate tax exemption reduces from the current $11.7 million to $6.03 million, rather than $5.85 million.

- Estate tax rate of 40% would be unchanged rather than increasing to 45%.

- Proposal to eliminate to step up in cost basis at death is rescinded, current step up would remain.

- Constrain use of valuation discounts commonly used for family owned businesses to “active trade or business.”

- Elimination/limitation of several estate tax strategies, most notably to Irrevocable Grantor Trusts (IGT). Under the new proposal, trust assets would be:

- Included in the grantor’s gross estate.

- A sale between the IGT and owner would be a taxable event.

- Distributions of trust assets other than the grantor are deemed gifts.

- Common trust designs like Grantor Retained Annuity Trusts (GRAT), Spousal Limited Access Trusts (SLAT), Charitable Lead Trusts (CLT) and Irrevocable Life Insurance Trusts (ILIT) would be affected.

- Other previous changes removed in the most recent proposals:

- Treating gifts as a taxable event

- Dynasty trust changes

- Constraints on annual gifts – the free $15,000 you can give per year to each recipient

What you should do before year end

If you’re affected by these changes, doing nothing is the worst option. These changes would have a significant impact on larger estates and high income earners and there are actions to consider before year end.

- Don’t let tax tail wag the planning dog. First and foremost, keep the end in mind. It’s easy to get lost chasing tax minimization and lose sight of what’s most important – your goals. Start with your desired outcomes and work back from there to build a plan that optimizes your strategy and taxes. Tax changes may require new or revised strategies, but don’t make hasty moves to avoid potential taxes if those moves aren’t aligned with your long-term goals.

- Use your lifetime exemption before it gets cut. The current $11.7 million lifetime estate exemption is an historic high. Were you planning on making substantial gifts eventually? Consider making them by year end to lock in today’s exemption and tax savings.

- Pre-fund grantor trusts. If you’re making annual gifts to a grantor trust to move assets out of your estate over time, consider a larger, lump sum contribution before year end instead. The new law includes contributions in your taxable estate starting in 2022, but grandfathers contributions up to the end of 2021.

- Accelerate taxable income to avoid taxation at higher rates. Strategies include Roth conversions, taking larger capital gains, accelerating shareholder dividends, exercising non-qualified or incentive stock options, or accelerating gain under 453(d) for installment sales.

What you should do in 2022 and beyond

In many ways, this is simpler because we’ll know exactly what the new legislation looks like. However, based on the current proposals, you’re more likely to consider the following strategies:

- Use non-grantor trusts. These trusts would still help reduce your taxable estate, but with less flexibility and additional income tax considerations. Gifts would need to be cash only and these trusts carefully drafted to ensure no triggers exist that would convert them to grantor status.

- Use partnerships instead of trusts. A family LLC can be created where you gift 99% of the ownership to your beneficiaries. At your passing, 99% of the assets in the LLC would kept out of your taxable estate.

- Consider tax deferred plans with higher contribution limits. Business owners can reduce income taxes by using tax deferred plans designed for high contribution limits such as cash balance plans and non-qualified deferred compensation plans.

- Loans for executive compensation. With historically low federal interest rates, you can reduce taxes for your business and key executives through compensation plans designed as low interest loans to the employee, effectively deferring income taxation.

- Spread out or defer taxable income to remain under proposed new thresholds for higher tax rates. Examples can include doing Roth conversions over multiple years, using 453(d) installment sales, charitable remainder trusts, 1031 like-kind exchanges, or investing in Opportunity Zones.

It is important to understand that these tax law changes are just proposals. Congress continues to debate the legislation and the situation is likely to change in the coming weeks. We do expect some form of tax reform to be passed this fall and considering possible actions ahead of time helps prepare for the road ahead. Any actions should be carefully considered with your tax and financial planning team.

Sources – CNR, CNR, Lion Street, Tax Policy Updates from Jeff Ricchetti

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.