You own and manage a portfolio of rentals or perhaps a few office buildings. You like the income but you’re tired of dealing with tenants and toilets and would love to retire. The problem? You rely on the income and would face a massive tax bill if you cashed out.

Or perhaps you’re worried the local market for your commercial real estate has peaked and you’d like to stay in real estate but managing a property in another state sounds like a major headache.

Maybe you’ve been the real estate manager for the family, but you’re worried your family doesn’t have the skill or interest in managing the portfolio after you’ve passed.

If any of these sounds familiar, you’re not alone! As we discussed in Taxes & Highly Appreciated Real Estate, many real estate investors find themselves stuck between a landlord headache and a big tax bill, but you’re not stuck. There are a variety of strategies depending on your goals, including Qualified Opportunity Zones, Charitable Remainder Trusts, and simply selling and paying the tax. However, we’re focusing on one specific strategy here: a 1031 exchange into a Delaware Statutory Trust (DST). We’ve collaborated with NexPoint, a DST sponsor company, to walk through the basics of 1031 exchanges, DSTs, and who might benefit from this solution.

Before diving in, it’s important to talk with your advising team thoroughly before investing in DSTs or other illiquid assets to understand costs, restrictions, and risks. 1031 exchanges also come with strict guidelines that require expert facilitators. With that in mind, let’s walk through a few basics, from NexPoint’s Guide to 1031 Exchanges & DSTs.

What is a 1031 exchange?

A 1031 exchange is an IRS-recognized tax deferral strategy that allows an investor to sell an investment property and acquire a similar property with the intent to defer capital gains and depreciation recapture taxes.

The transaction is named for Internal Revenue Code §1031, which states:

No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment, if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment.

Qualifying properties include, but are not limited to:

- Multifamily apartment buildings

- Single-family rental homes

- Condominiums and duplexes

- Office buildings

- Retail centers

- Warehouses and storage units

- Tenancy-in-Common (TIC) interests

- Delaware Statutory Trust (DST) interests

1031 exchanges usually takes place in 4-steps with a maximum of a 180-day time limit, which starts with the close of sale of the existing property.

- Day 0: Close of property. The investor sells the relinquished property to a third-party buyer.

- Day 45: Identification period. Sale proceeds are transferred to a qualified intermediary (QI).

- Maximum of Day 180: Complete exchange. The QI uses the proceeds to purchase the replacement property on behalf of the investor within the 180-day IRS time limit.

According to Forbes, properties must meet a number of rules and requirements to qualify for a 1031 exchange:

- Like-kind property. The properties exchanged must be “like-kind”, which doesn’t always mean they must be the same type but must be held for use in a trade, business or investment. Personal residences don’t qualify.

- Greater or equal value. The net market value and equity of your new property must be greater than or equal to the property you’re selling.

- Same taxpayer. The tax return and name on the title of the property being sold must be the same as the tax return and title holder that buys the new property.

- Must not receive “boot”. Boot refers to cash, debt relief, or any other additional value that isn’t like-kind property.

- Reinvest all equity. You must reinvest all of the equity received from the sale into the replacement property or you may be owe taxes on the portion that isn’t reinvested.

- Arm’s length transactions only. Purchases and sales involved in a 1031 exchange must be “arm’s length” transactions, meaning transactions with family and friends would be excluded.

1031 exchanges are complex transactions with strict requirements, but when followed, can allow you to defer that big tax bill you’d otherwise pay if you sold your property. But what if you want to diversify into multiple properties or just don’t want to be a landlord anymore? A Delaware Statutory Trust might be able to help.

What is a Delaware Statutory Trust (DST)?

A Delaware Statutory Trust (DST) is a legal entity created under Delaware law as a trust that holds title to 100% of the interest in real property. It allows an investor to acquire a fractional interest in the trust’s properties, with limited personal liability.

Each owner receives their share of the cash flow income, tax benefits (deferral when entering on a 1031, reset depreciation, and mortgage write offs if it’s a leveraged investment), and potential asset appreciation.

With a DST, investors must keep the following things in mind regarding control and liability on the assets in the exchange:

- IRS Governance: Investors need to assure that the sponsor will be compliant with IRS guidelines.

- Voting Rights: Investors will forfeit all voting rights for decision making to Trust manager.

- Expenses: Investors will incur no additional LLC costs.

- Liability: Investors will be limited on liability to invested equity.

- Debt: Investors will not personally assume liability for property-level debt.

- Ownership: Investors will own a beneficial interest in the trust.

How can you tell if a DST is for you? Start by evaluating a few key potential benefits and risks.

Key potential benefits and risks of a Delaware Statutory Trust (DST)

The big draw of a 1031 exchange into a DST for many is the ability to stay invested in real estate, defer taxes, diversify beyond what they may be able to purchase on their own, and become a passive investor rather than an active manager. Here are a few other potential benefits and risks to be aware of:

Potential benefits

- Ability to own high-quality real estate with lower investment minimums.

- Ability to diversify a portfolio with various locations and property types.

- Professional asset and property management creates passive ownership, which eliminates property management responsibilities for the investor, but retains monthly income in most cases.

- Quick closing process helps meet timing requirements.

Potential risks

- The trustee may be unable to close a deal within the required time frame.

- There may be limited transferability, lack of liquidity and less control over operating decisions for individual investors.

- There is a potential of loss of principal value invested.

- If the trustee violates one of the mandatory tax restrictions, the investment could become immediately taxable.

- The tax code could change and negatively impact the investor.

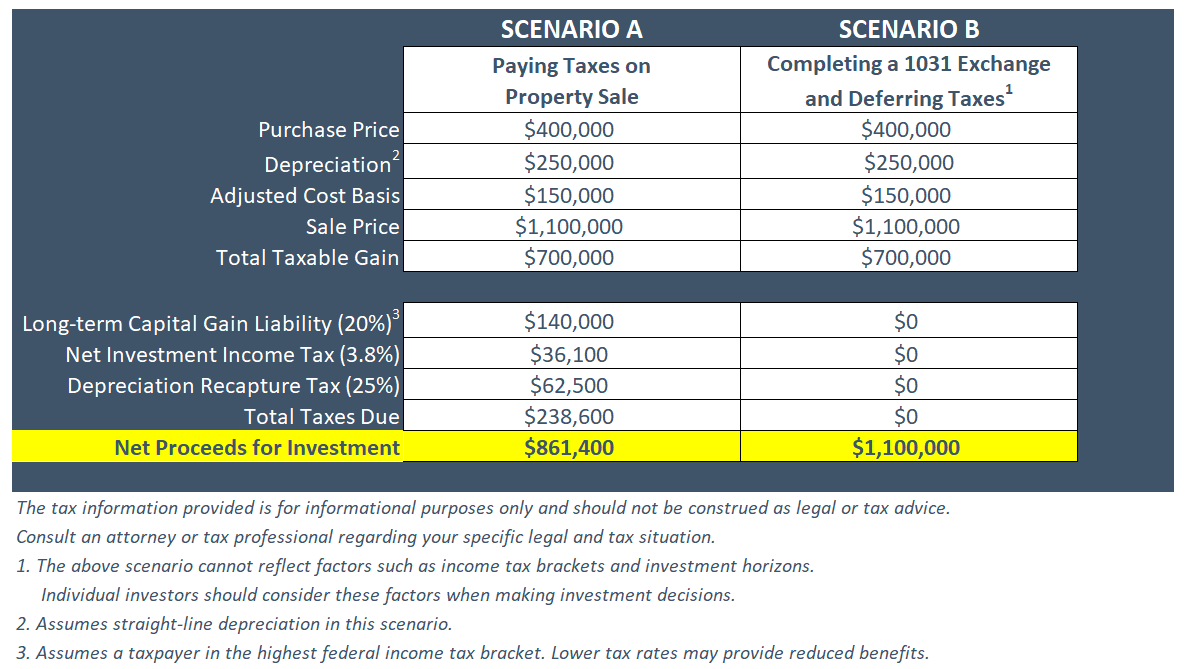

A NexPoint comparison scenario

If you’re a real estate investor feeling stuck between being a landlord and paying a big tax bill hopefully you have a few key takeaways from this discussion:

- You have ways to stay invested in real estate without keeping the managed responsibilities or paying the tax bill.

- 1031 exchanges are complex transactions with strict timelines that require expert guidance but provide the opportunity to defer taxes.

- Delaware Statutory Trusts are one way to escape the burden of being a landlord but should be very carefully considered before investing.

As comprehensive financial planners and wealth managers, we know that real estate plays a vital role in wealth building for many clients. We also know that it’s not the only asset in a comprehensive plan and can help you see how real estate, combined with other assets, can help you on the path to reach your financial goals!

There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, returns and appreciation are not guaranteed. IRC Section 1031 is a complex tax concept; consult your legal or tax professional regarding the specifics of your situation. This is not a solicitation or an offer to sell any securities. DST 1031 properties are only available to accredited investors (typically have a $1 million net worth excluding primary residence or $200,000 income individually/$300,000 jointly in each of the last three years) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity, please verify with your CPA and Attorney.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.