Approximately 70% of Americans will need long-term care treatment at some point in their lives. If this is you or your parent, you may be dealing with a range of emotions, but you’ve almost certainly noticed the high cost, which can exceed $10,000 per month.

While no one looks forward to this exorbitant expense, it can create an opportunity to save thousands in taxes – a strategy that most walk right past.

Long-term care costs are a “qualified medical expense”, which means the IRS allows you to deduct expenses that exceed 7.5% of your Adjusted Gross Income. If you earn $60,000 and pay $120,000 in annual long-term care costs, you now have $115,500 in tax deductions this year (the amount that your expenses exceed $4,500 or 7.5% of your income).

While this seems great – you’ll pay zero in tax! – more than half of that deduction goes to waste because you don’t make enough income to use the full amount. But what if you or your parent could use that extra deduction and create tax-free income for the future?

Use Roth conversions to make the most of your tax deduction!

If you have dollars in a pre-tax IRA or 401(k), you pay taxes when you withdraw those funds. But if you have other sources of income and don’t need your retirement funds to pay long-term care expenses, you may be able to harness that unused tax deduction with Roth conversions, creating tax-free income for you or your loved ones down the road. How?

Roth IRAs grow tax-free and all qualified withdrawals are also tax-free. If you have funds in a pre-tax retirement account, you can “convert” those dollars to a Roth account, pay taxes on the converted amount today, and let those funds grow tax-free going forward.

Help reduce taxes by leaving an Inherited Roth IRA

Funds in a Roth IRA grow tax-free, and qualified withdrawals are tax-free for you AND any beneficiaries you leave them to after you pass away. You’ll still have tax-free access to these funds if you’re over age 59.5, but if you don’t use them, they pass as a tax-free inheritance to your loved ones!

Let’s look at how you pass an IRA to the next generation. When you pass away:

- An IRA you owned is transferred to an Inherited IRA owned by your beneficiary.

- Your beneficiary must fully distribute this account over 10 years.

- If your IRA was a pre-tax IRA, they will pay tax at their highest rate on every dollar distributed.

- However, if you left a Roth IRA instead, they wouldn’t owe any income taxes on these distributions.

In most cases, the beneficiary of an inherited IRA is still working, often in their highest earning years, and could lose 40% or more to tax. In real dollars, they could pay more than $400,000 in tax on a $1 million IRA.

So, how does this work?

Two simple steps to turn long-term care expenses into tax-free income

Once you understand the strategy, it does take some effort each year if you manage this on your own. But if you work with an advising team, they can take care of this for you! Here’s how the strategy works:

1. Calculate your unused tax deduction.

This requires collaboration between your advisor and accountant. Here’s an example using the numbers above, assuming you’re single.

- $60,000 is your total adjusted gross income.

- $115,500 is your total tax-deductible medical expenses (the amount of your $120,000 expenses that exceeds 7.5% of your adjusted gross income).

- $60,000 of the $115,000 total deduction reduces your taxable income to $0 for the year

- $55,000 deduction is unused

2. Convert an amount of your pre-tax IRA equal to the unused deduction to a Roth IRA.

In this example, if the goal is to pay no income tax, you could still convert $55,000 from your pre-tax IRA to a Roth IRA, use your full tax deduction, reduce your taxes, and have income tax-free access to your Roth funds going forward.

Many in this situation choose to convert more IRA dollars to their Roth IRA, which is an income taxable event, but they pay those taxes out of cash or other investments, while still staying in their current tax bracket. This has the potential to enhance their tax-free inheritance because many retirees pay taxes at a lower rate than their beneficiary would.

What’s the impact? Steve’s case study.

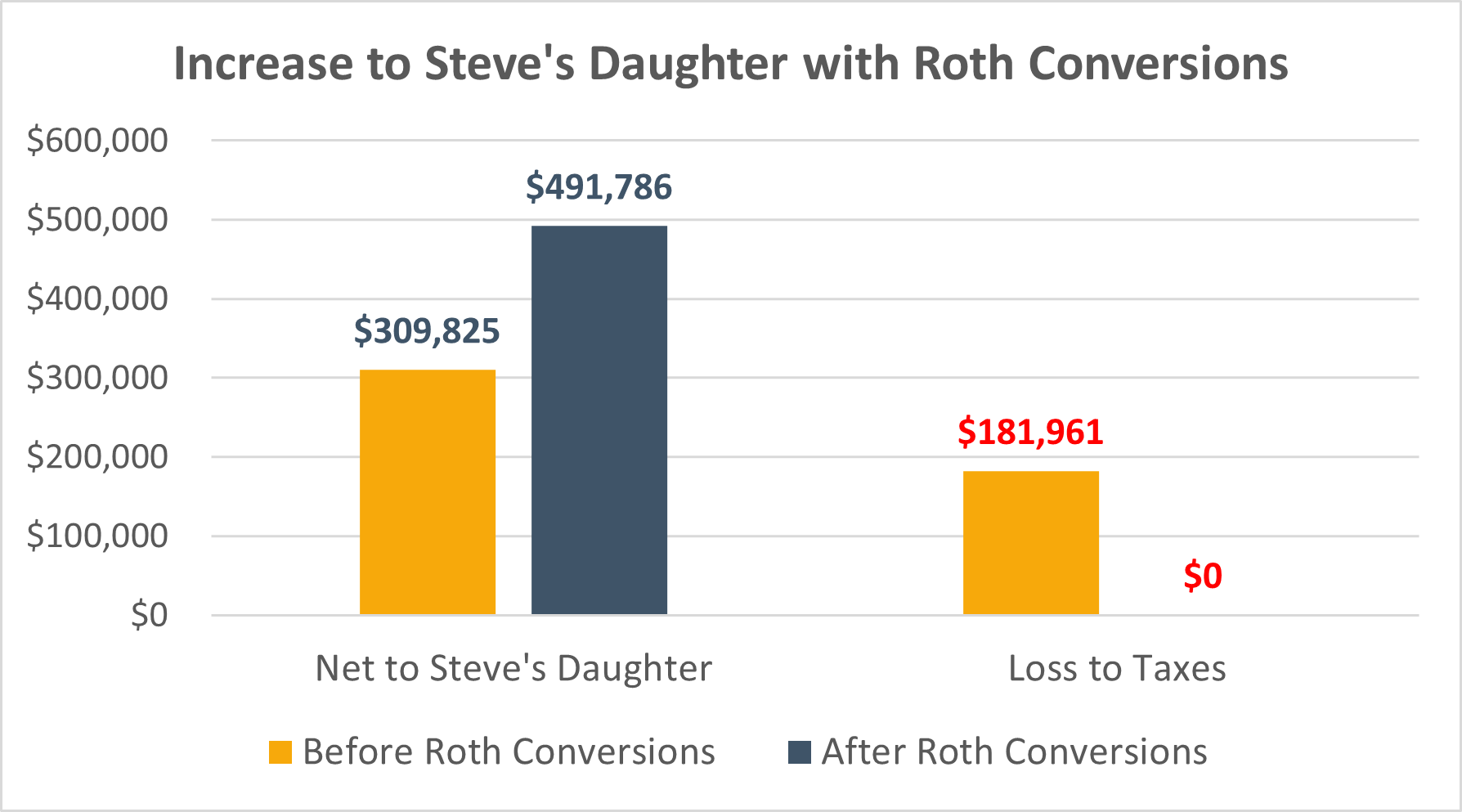

In real dollars, let’s look at how big of a difference this could make for your loved ones, using the case study below:

- Steve earns $60,000 income and has $120,000 in long-term care expenses each year. Though he pays zero in taxes, he wastes $55,000 per year in tax deductions as described above.

- He has $250,000 in a pre-tax IRA and $2.5 million in a brokerage account, enough to cover expenses for the rest of his life from brokerage funds alone.

- He receives long-term care for 5 years before passing away.

- His daughter is his IRA beneficiary, is in the highest tax bracket of 37% and will be for 10+ years.

- When Steve’s daughter inherits the IRA, she expects an estimated 7% annual investment return and will withdraw all funds at the end of 10 years.

If Steve makes no Roth conversions:

- His daughter inherits the $250,000 pre-tax IRA and must distribute it over the next 10 years.

- If the IRA doesn’t grow, she’ll pay $92,500 in federal income tax alone.

- If the IRA earns 7% per year, she’ll pay more than $181,000 in income tax…ouch!

- After taxes, Steve’s daughter has less than $310,000 left over after paying that painful tax bill.

If Steve converts the full $250,000 IRA to Roth:

- Steve uses his $55,000 extra tax deduction each year to convert his entire $250,000 IRA balance to Roth over 5 years.

- He pays no taxes on these Roth conversions because they are fully offset by the tax deduction from long-term care expenses.

- He now leaves a tax-free Roth IRA to his daughter, who invests it and earns 7% per year.

- After 10 years, she withdraws more than $490,000 tax-free, reducing the prior $181,000 tax bill to $0.

Is this right for you or your parent?

This is a great tax saving strategy for many. But before proceeding with this strategy, it is very important to consult with your CPA to confirm your (or your parent’s) long-term care expenses meet the definition of qualified medical expenses. Then, get your financial and tax team on the same page, ideally communicating directly with one another to optimize your strategy each year.

If you are considering this strategy for a parent, a conversation between you, your parent, and your advising team can explain how this concept works and make sure everyone is on the same page and ready to move forward.

Once set up, this can be a simple way to add thousands of dollars of inheritance for the next generations, funding college educations, paying for weddings, helping with business startups, and increasing the impact your hard-earned dollars make for the future!

Alterra Advisors and LSA/LSF do not provide tax advice.

Increased taxable income from the Roth IRA conversion may have several consequences including but not limited to, a need for additional tax withholding or estimated tax payments, the loss of certain tax deductions and credits, and higher taxes on Social Security benefits and higher Medicare premiums. Consult your tax professional.

A Roth IRA distribution is qualified if you’ve had the account for at least five years and/or the distribution is made after you’ve reached age 59½, because of total and permanent disability, in the event of death, or for first-time homebuyer expenses. Distributions made prior to age 59 1/2 may be subject to a federal income tax penalty. Hypothetical examples are for illustrative purposes only, not intended to represent the past or future performance of any specific investment, and do not necessarily represent the experience of any clients. Actual results will fluctuate with market conditions and will vary over time.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.