We’ve all heard it before – time in the market is better than timing the market, stay the course, ride it out. Why? Because, over the long run, it’s clear that stocks have trended up. But zoom in on select shorter periods – the tech bubble in 2000, the financial crisis in 2008 to name a few – and it’s clear to see why it doesn’t always feel that way.

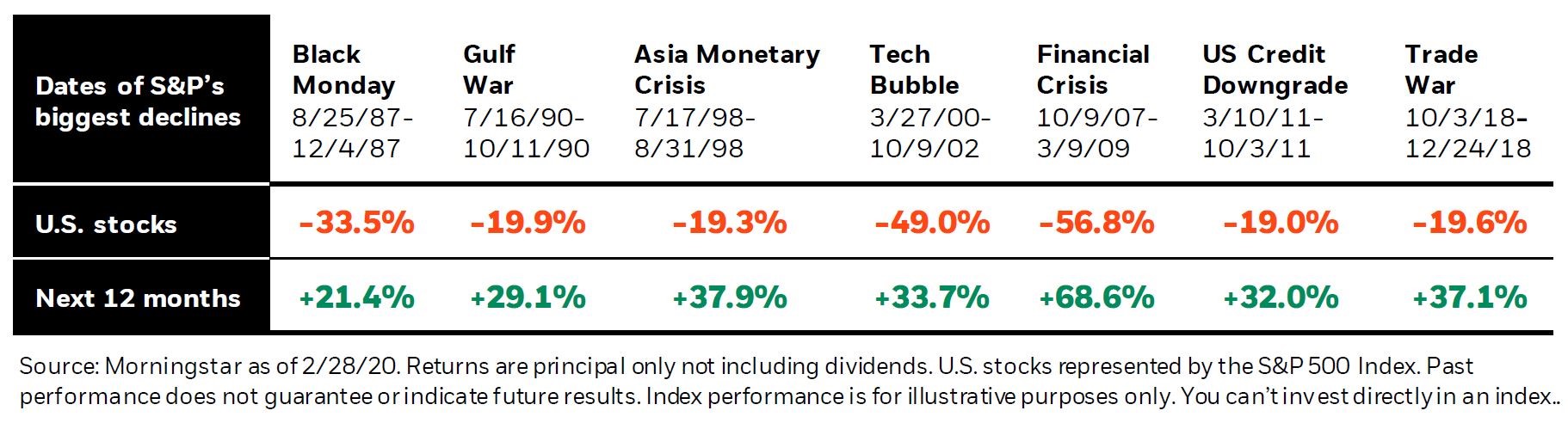

In days, weeks and months of sharp declines, the first thought is often to sell stocks and “wait for things to stabilize”. Unfortunately, this usually means watching the market rebound and missing the upswing. Why do many advisors say you should ride it out? Because sharp market declines are usually followed by equally sharp recoveries. Here are seven of the S&P 500’s biggest declines and the 12 months that followed each of them.

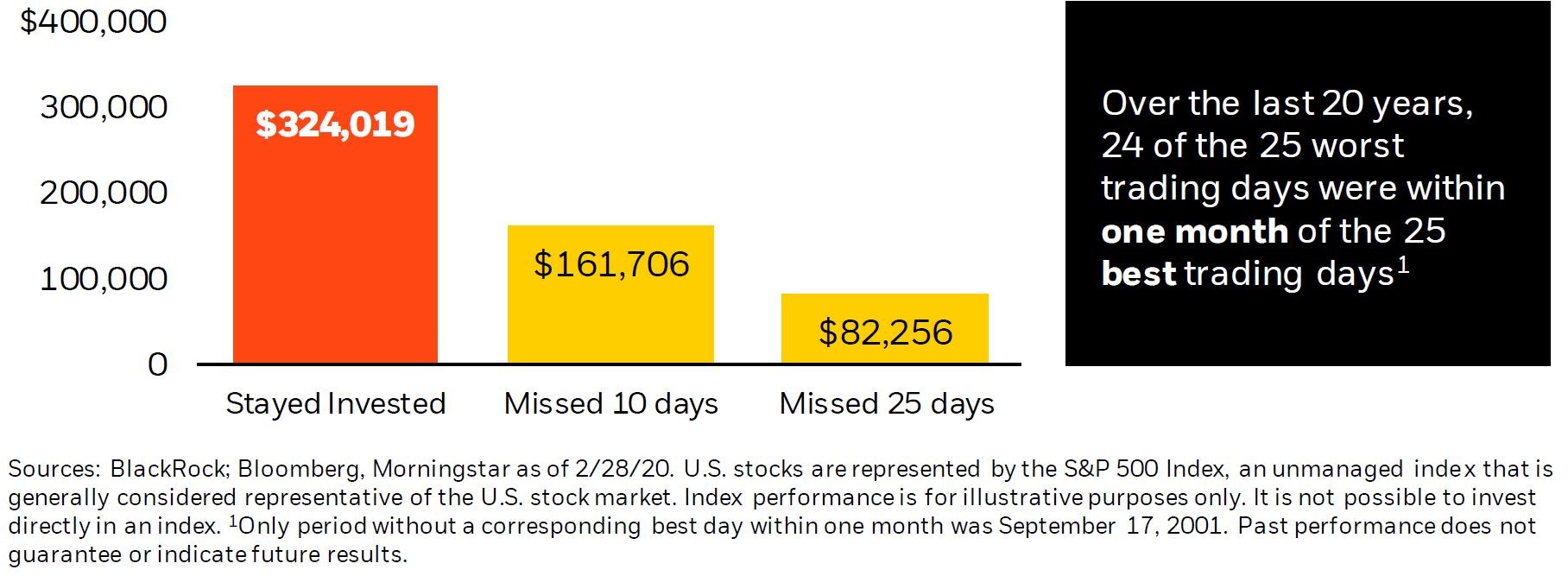

Consider the following example, as well. From 2000 to 2019, $100,000 invested in the S&P 500 would have grown to $324,019 (see the chart below). But if you missed the best 10 days while waiting for things to stabilize, you missed over half of that growth. Historically, the best and worst days aren’t far apart – 24 of the 25 worst days were within one month of the 25 best days.

So, in volatile times, how do you know if you should make a change? We usually ask two questions.

- Have your goals or needs changed? This is always a good reason to revisit your strategies regardless of what’s happening in the market.

- Is your portfolio behaving like it should in the current market? Short and long-term buckets should be set for different levels of growth and risk – a portfolio with 50% in stocks should be less volatile than a portfolio with 95% in stocks, so you’re looking for this to hold up.

If your goals are generally unchanged and your portfolio’s behavior makes sense in the current market, you have good reason to stay the course.

Sources – Blackrock, Morningstar

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.