When an index like the S&P 500 rallies, as it did in 2023, a few common questions arise.

If my portfolio underperformed the S&P 500 last year, do I need to make a change? Should this matter to me?

These questions make sense because it’s common to compare your strategy against the most popular benchmarks – but should you? The answer is…it depends. What kind of investor are you? Are you an aggressive investor with 10 years until retirement? Or are you retired and relying on your nest egg for stable income?

Let’s start with a closer look at the S&P 500 as a benchmark. Then, we’ll look at three principles to follow to decide if this is the right measuring stick for your portfolio.

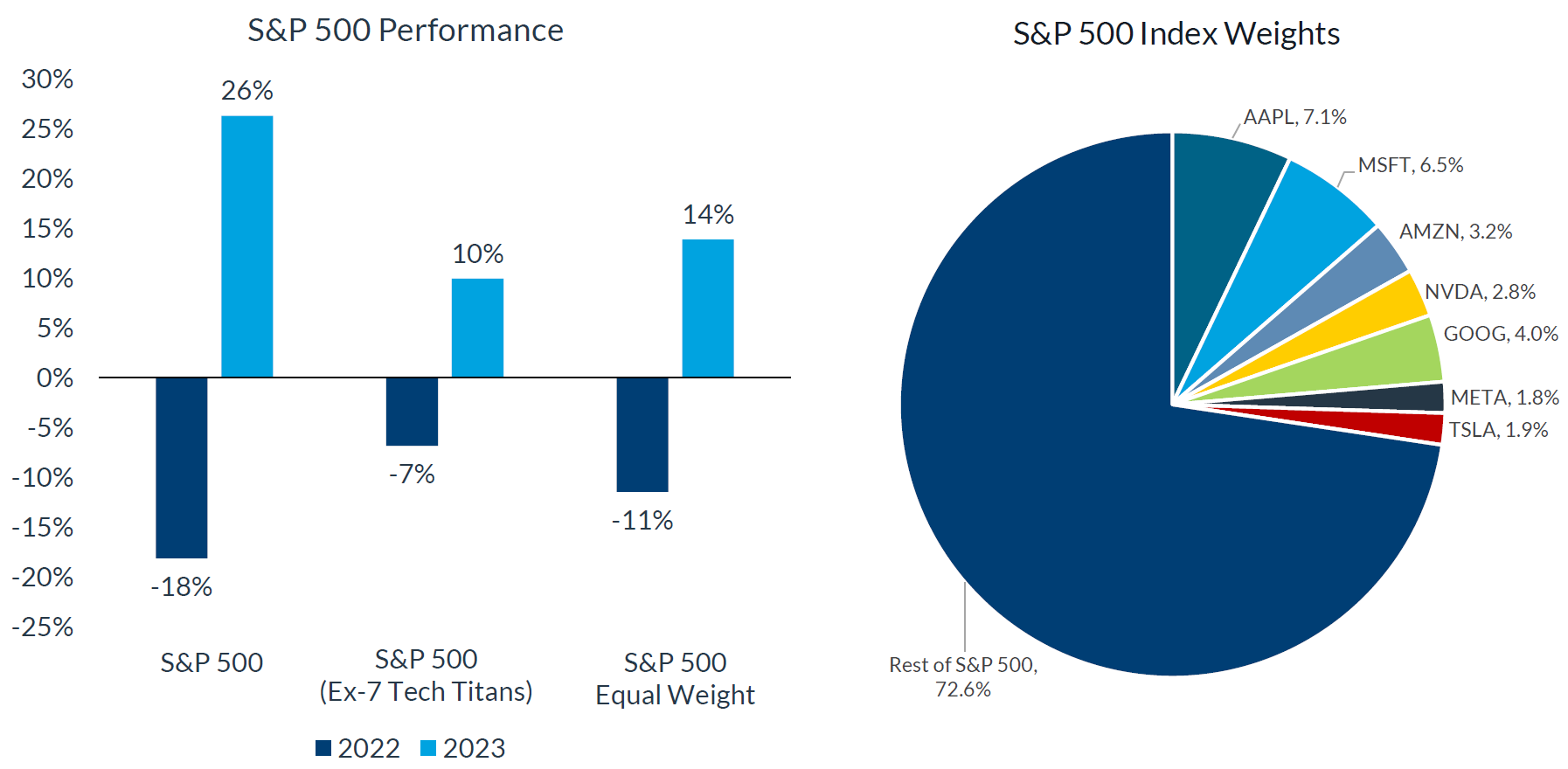

The S&P 500 is dominated by 7 “Tech Titans”.

The S&P 500 is a “capitalization weighted” index, meaning the biggest companies impact the benchmark the most. Think of rocks being thrown into a pool where the biggest companies are giant boulders, and the smallest companies are tiny pebbles. At the end of 2023, Apple was the biggest company in the S&P 500, at just over 7% of the total weight, so if Apple doubled in price, the S&P 500 would increase over 7% – a big splash from a big company. On the other end, fashion company Ralph Lauren is less than 0.01% of the weight of the S&P 500. If it doubled in price, you’d barely notice a splash at all in the S&P 500’s performance.

The top seven companies in the S&P 500 – Apple, Microsoft, Amazon, Nvidia, Google, Meta, and Tesla – make up nearly 28% of the index’s weigh and all large technology companies (many include Tesla in “tech stocks” because it’s highly technology-driven, though this is debatable).

If the S&P 500 were “equally weighted”, each of the 500 companies would make an equal impact on performance regardless of company size. The analysts at City National Rochdale provide a helpful visual in the chart below comparing the 2022 and 2023 performance of the S&P 500 in three ways:

- S&P 500

- S&P 500 without these 7 “Tech Titans”

- S&P 500 equally weighted

Source: City National Rochdale

The difference is dramatic, with the seven biggest companies driving more than 40% of the loss in 2022 and 40% of the gain in 2023. With this understanding of the S&P 500 as a benchmark, it can help to ask the following question: if you were designing your portfolio from scratch, would you choose to put 28% of your total funds into seven companies all in the same category? Let’s look at three portfolio building principles.

Let your plan, not a benchmark, guide your strategy.

Is the S&P 500 the right benchmark for your portfolio? Or does the idea of having 28% of your nest egg rest on the fate of seven companies make you uncomfortable? When it comes to your investment strategy, these three principles can help you start with your needs and build your portfolio accordingly.

- Let your needs guide your strategy. If you’re an aggressive investor with 10 or more years until retirement, your strategy might be invested entirely in stock, focused on high growth. But if you’re retired and need steady income today, your strategy might be evenly split between stocks and bonds with a focus on dividend paying companies.

- Evaluate your portfolio against the right benchmarks. Your portfolio invested 40% in international stocks will look very different than an index invested 100% in US companies. A dividend focused strategy will not always track closely with a growth focused index. Look at your mix and use an appropriate blend of benchmarks.

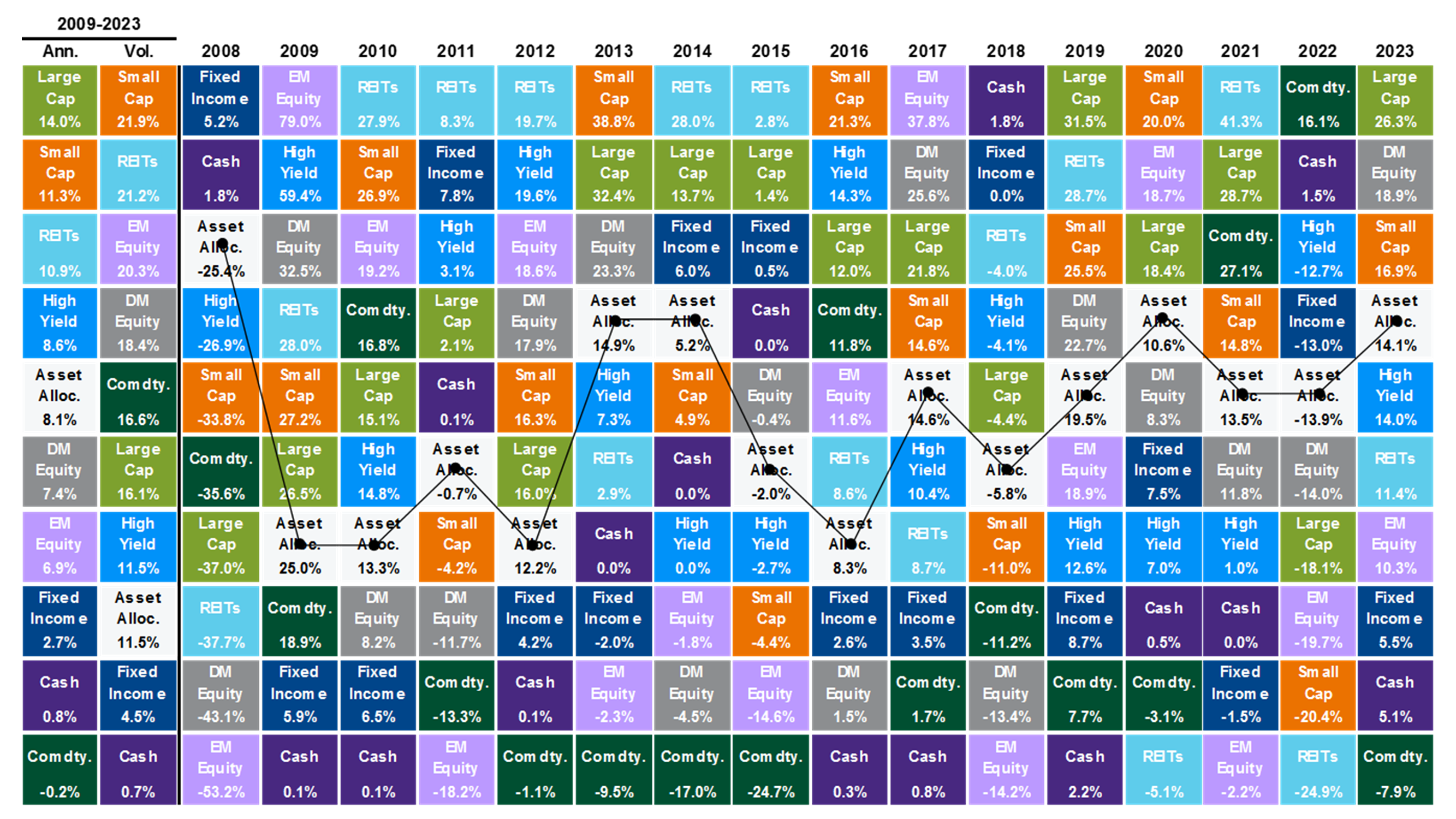

- Eliminate the guesswork. No single company or asset class wins forever. History shows that, rather than shifting dramatically between assets each year, maintaining a mix of asset classes that fits your risk tolerance and time horizon, is a time-tested approach that doesn’t require you to guess and be right. JP Morgan’s Investment Quilt Chart makes this point, showing the performance of a variety of investments and a diversified “asset allocation” through the middle.

Source: JP Morgan

Benchmarks like the S&P 500 can be helpful guideposts for some portfolios, but too much focus on a single index could find you chasing past returns. Your portfolio strategy should be built around your needs and the benchmarks you use to evaluate success should match your strategy, metrics we review closely here at Alterra.

While no one has the crystal ball to tell exactly what the future holds, we do have a wealth of historical evidence of what has worked over time, strategies to put you in a great position to reach financial independence and have peace of mind. Need an approach like this in your plan? We invite you to reach out to schedule a conversation with us!

Clients cannot invest directly in an index. Past performance does not guarantee future results. Diversification and asset allocation do not guarantee a profit or protect against loss.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.