The second quarter built on much of the encouraging economic progress we saw in the first quarter. Many states, including Washington, moved to being nearly fully open after more than a year of pandemic-related restrictions. In addition to economic recovery, significant federal income and estate tax legislation progressed. Let’s look at the following questions:

- What happened in Q2?

- How does this affect the 2021 outlook?

- Are the markets overvalued?

- Inflation is on the rise, should we be concerned?

- How can we prepare for coming income and estate tax changes?

What happened in Q2?

Here are a few market and economic highlights from last quarter:

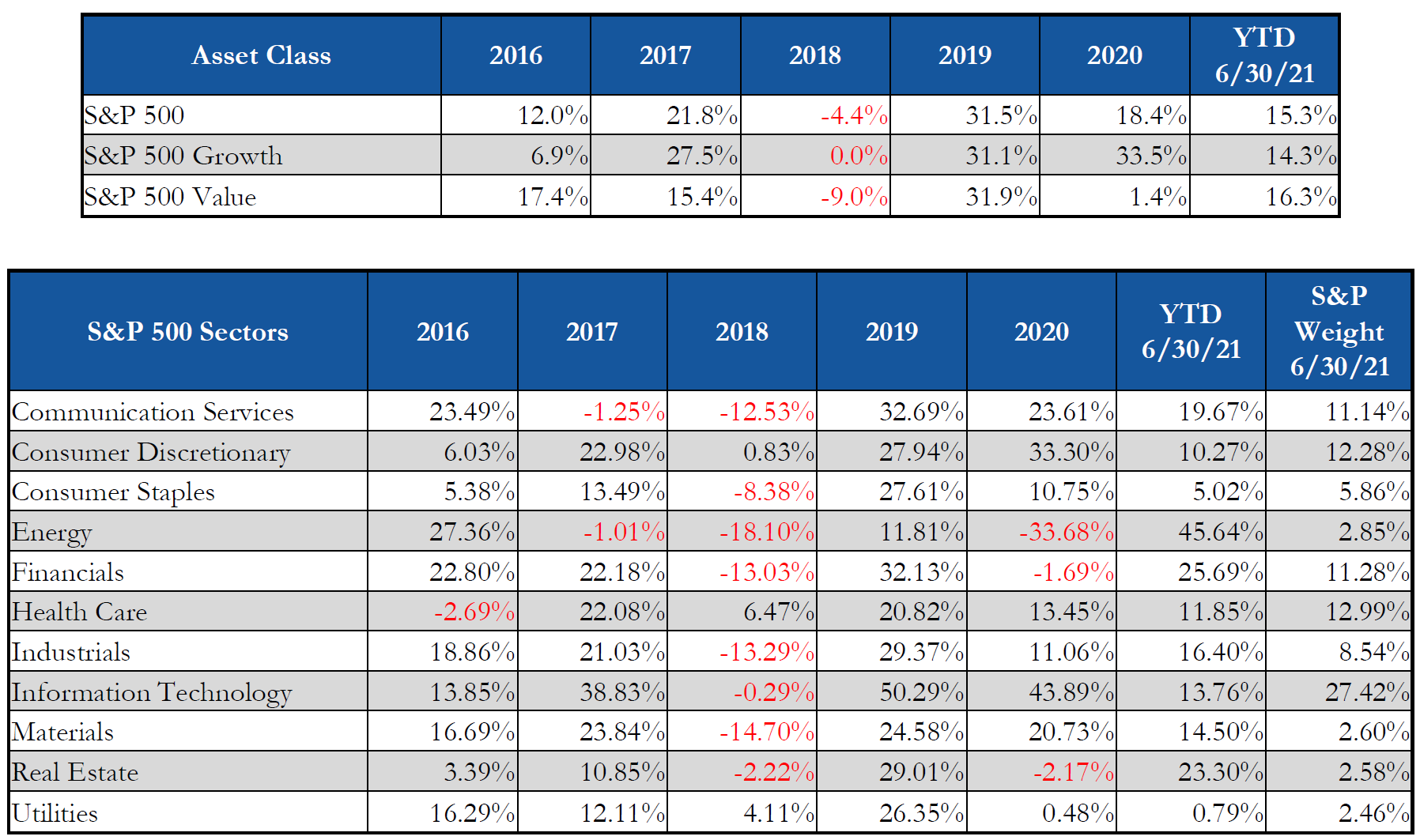

- U.S. growth stocks rallied in Q2 bringing them about even with value stocks for the year after value led the way in Q1.

- Economic indicators have continued to signal a more resilient recovery as the economy continues to return to more normal activity.

- Globally, the U.S led the way in economic recovery. Our consumer and business activity picked up faster in response to a successful vaccine rollout and progress toward more normal life.

- Consumer confidence continued to increase. Household net worth levels exceeded pre-pandemic levels leading to new heights in retail sales, home prices, and auto sales. Consumer spending is now driving the economy forward, with less reliance on stimulus.

- States reopening led to temporary supply shortages, which may limit output for a short time, and is a primary driver in the uptick in inflation. Inflation is expected to subside as supply increases.

- U.S. corporate earnings surpassed pre-pandemic levels, driving stock prices higher.

- Unemployment declined, though the rate of decline slowed due to factors like childcare needs in the new hybrid remote/in-person work schedule, health fears, and higher unemployment benefits. These are expected to be temporary setbacks as people adjust to new normal and unemployment benefits are reduced in the fall.

- The Federal Reserve has reiterated it will not increase rates soon, still planning to hold steady until 2024.

How does this affect the 2021 outlook?

With last quarter’s progress, how is the 2021 outlook shaping up?

- GDP (gross domestic product) targets are now a record 5.5–7% with the progress we’ve seen so far this year.

- The inflation uptick looks to be a temporary result of pent up demand. As states reopen, consumers are finding more opportunity to get out and spend money they’ve been saving.

- Government spending will continue, likely funded by tax increases. Markets have not been historically derailed by tax increases when accompanied by a strong economy and federal infrastructure spending.

- Stocks look to be approaching fair value, which could indicate a bumpier ride up in the short run.

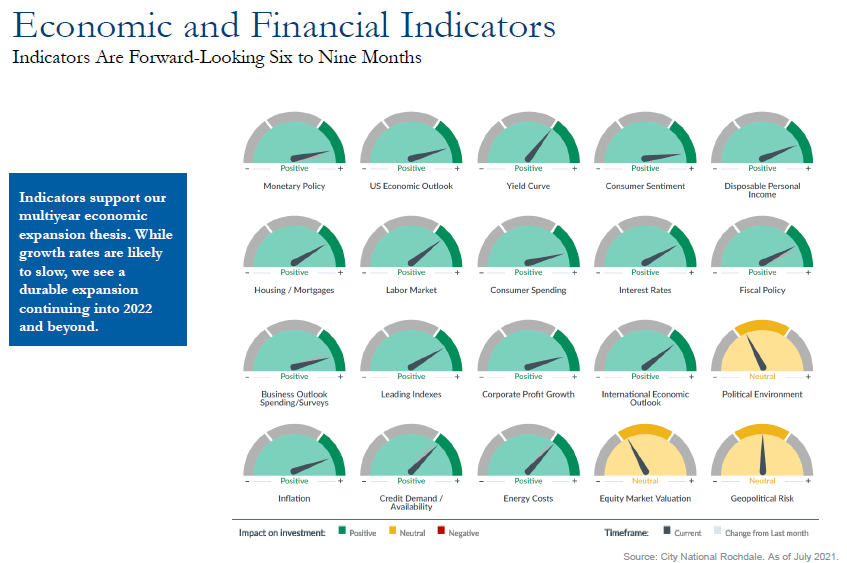

CNR’s Speedometers are a helpful visual for key economic and financial indicators.

Are the markets overvalued?

Though growth and tech stocks rallied last quarter, value stocks like financials, real estate, industrial, energy, continued closing the overall gap from 2020. Here’s this quarter’s growth vs. value and sector breakdown:

Are markets overvalued? Though many stock prices are higher today, valuations on average were actually higher in 2020 when the pandemic started. This year, corporate earnings are catching up, which supports a higher stock price. So, though prices have exceeded pre-pandemic levels, they seem better supported now. As previously mentioned, stocks do appear to be approaching fair or full valuations.

Inflation is on the rise, should we be concerned?

Last quarter, we discussed inflation expectations for 2021 and the impact of government stimulus. Not much has changed. We’ve seen inflation tick up, with pent up consumer demand and a lack of supply, which drives prices up in the short run – people are willing to pay more for things they have been waiting for but haven’t had access to during the pandemic. However, economists expect this to moderate as the economy normalizes.

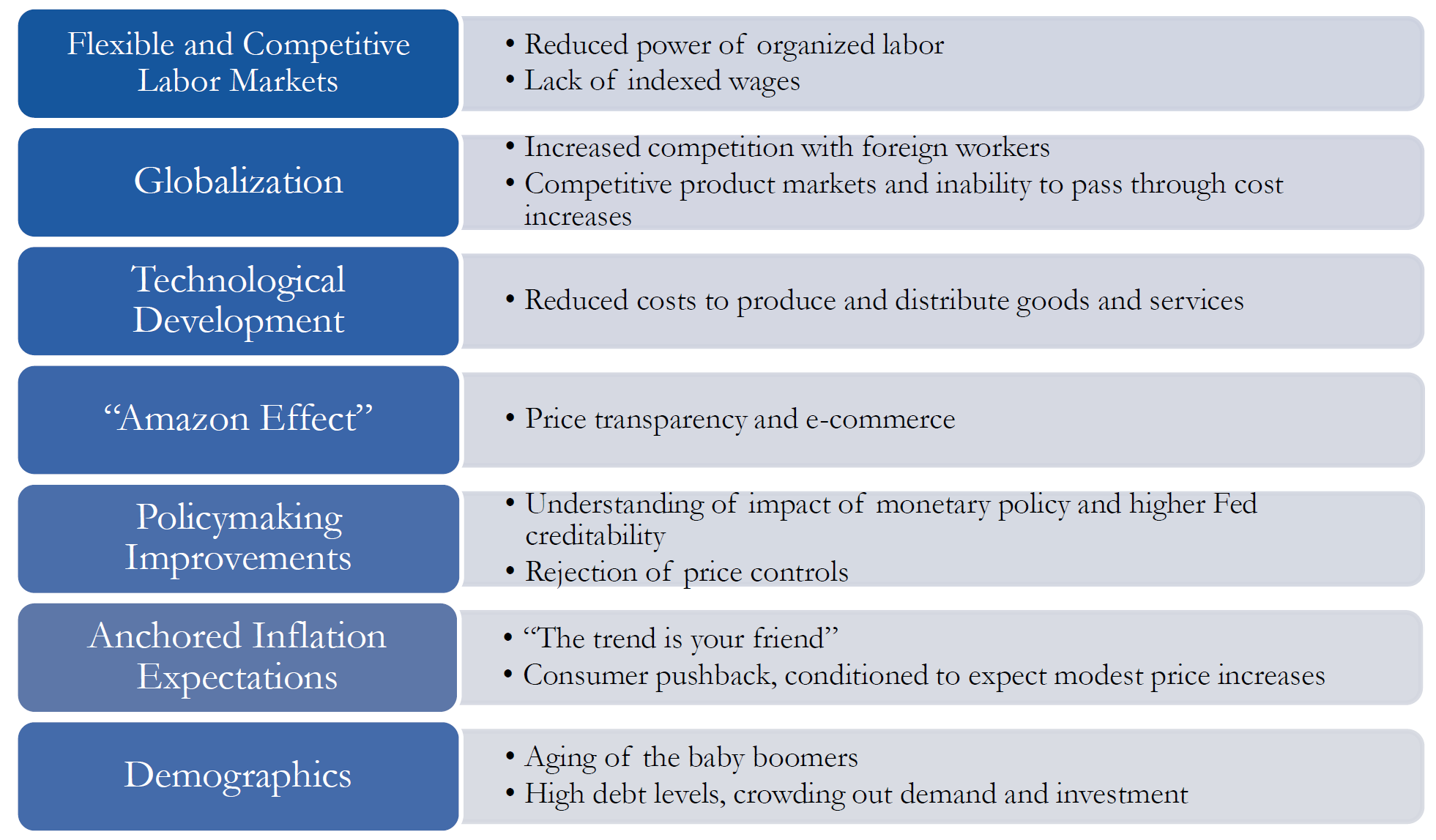

In the last 50 years, we’ve moved from a manufacturing economy to an information economy, shifting the factors that drive inflation. These factors have also served to keep inflation low for decades, a trend that doesn’t appear to be changing soon. Here are some of these factors:

Historically, equity markets hedge against inflation and do not face significant headwinds until inflation exceeds 6%. Though we’re seeing a spike now, the past decade has averaged around 1.7% to 2.0%.

Taxes, taxes, taxes

Taxes are among the most significant changes on the planning horizon. The Biden administration’s American Families Plan has reforms in income, capital gain, and estate taxes. These tax increases would help fund new social programs like tuition-free community college, childcare, universal preschool, and expanded tax credits. Here’s a look at key components of each and strategies to consider for each.

Federal income and capital gain tax changes

- Income tax rate for top earners increases from 37% to 39.6%.

- Corporate tax rate increases from 21% to 28%.

- Carried interest – partner’s interest in profits earned by a hedge fund or private equity fund – taxed as ordinary income rather than capital gain.

- 1031 like-kind exchange on real estate are limited to gains of $500,000 or less.

- Capital gains are taxed as ordinary income at the proposed top tax rate of 39.6% for taxpayers with taxable income greater than $1 million and would include the 3.8% Affordable Care Act Medicare surtax, resulting in a total capital gains rate increase to 43.4% from the current top rate of 23.8%.

- The 3.8% Medicare surtax would apply to all net investment income – passive and active – for taxpayers with adjusted gross income (AGI) above $400,000 rather than only applying to passive net investment income for individuals with AGI above $200,000 and married couples filing jointly with AGI above $250,000.

- 20% pass-through income tax deduction for small business owners is eliminated.

What can you do to prepare for rising income and capital gain taxes?

- Accelerate taxable income to avoid future taxation at higher proposed rates. Examples can include Roth conversions, capital gain harvesting, accelerating shareholder dividends, exercising non-qualified or incentive stock options, or accelerating gain under 453(d) for installment sales.

- Spread out or defer taxable income to remain under proposed new thresholds for higher tax rates. Examples can include doing Roth conversions over multiple years, using 453 installment sales, charitable remainder trusts, 1031 like-kind exchanges, or investing in Opportunity Zones.

- Shift taxable income to other family members to remain under proposed new thresholds for higher tax rates. Examples can include using charitable remainder trusts and family limited partnerships.

- Avoid taxable income to minimize or avoid exposure to higher proposed tax rates. Examples can include investing in Opportunity Zones, 1202 Qualified Small Business Tax, using Incomplete Gift Non-Grantor Trusts to save state income taxes, or charitable lead trusts.

- Carefully time deductions to maximize the resulting tax benefit of the deduction if income tax rates increase or certain limitations are imposed or caps eliminated. Examples can include deferring business expenses, delaying unrealized capital loss harvesting, or accelerating vs. deferring itemized deductions such as SALT and charitable donations.

Federal estate tax changes

- Estate tax exemption reduces to $5.49 million from the current $11.7 million. Other proposals reduce this as low as $3.5 million.

- Estate tax rate increases to 45% from the current 40%.

- Elimination of the step-up in cost basis at death, replaced with exemptions of $1 million for individuals and $2 million for couples. Family-owned businesses and farms would still receive a full step up if they continue to be owned and operated by the family. Under current law, your beneficiaries receive a step-up in cost basis to value on the date of your death.

- Elimination of several estate tax strategies, including grantor retained annuity trusts (GRAT), legacy/dynasty trusts, some grantor trusts, and valuation discounts for family owned businesses. For a more thorough discussion, see How to Prepare for the Biden Estate Tax Increases.

What can you do to prepare for rising estate taxes?

- Accelerate use of strategies that may be eliminated, as they are likely to be grandfathered in if set up before new law is enacted. Grantor Retained Annuity Trusts (GRAT), Intentionally Defective Grantor Trusts (IDGT), Spousal Lifetime Access Trusts (SLAT), and Irrevocable Grantor Trusts (IGT) may not have the same effect if new law is passed.

- Make large gifts today before the historically high $11.7 million exemption is reduced. Consider funding Irrevocable Trusts, Dynasty Trusts, or Irrevocable Life Insurance Trusts to maximize the tax free growth of your assets for your future generations.

- Preserve flexibility for the future with trust strategies that move assets out of your estate but preserve some access like Spousal Limited Access Trusts (SLAT) or Special Power of Appointment Trusts. For more, read Out of Your Estate, Not Out of Reach.

- Preserve insurability by acquiring convertible term insurance today that can be converted to permanent strategies down the road if these laws pass. Life insurance often exponentially increases strategies to pay estate taxes because death benefits pass income tax-free.

Sources – Lion Street, CNR, CNR, CNR

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.