The Clients

Mary and George are 64 years old and live in Dallas, TX. They have a $2.5 million nest egg, with $275,000 in CDs as a rainy day fund.

The Challenge

Mary and George have built up a nice nest egg and have sufficient net worth to meet desired retirement lifestyle expenses. They have not done any Long-Term Care (LTC) planning because they assumed the risk was low and they could afford to self-insure.

They were surprised to find out that 52% of people turning age 65 will have a need for LTC during their lifetimes and over half of LTC claims that began in 2018 were for people of age 81-90.

Using John Hancock’s online cost of care calculator to estimate future LTC expenses, a four year stay in an assisted living facility in 20 years could cost $480,234 per person ($120,059 per year on average) adjusted for inflation. These expenses would be in addition to their normal lifestyle expenses throughout retirement. George and Mary realized that such LTC costs could threaten their retirement security and financial legacy to their children.

The Solution

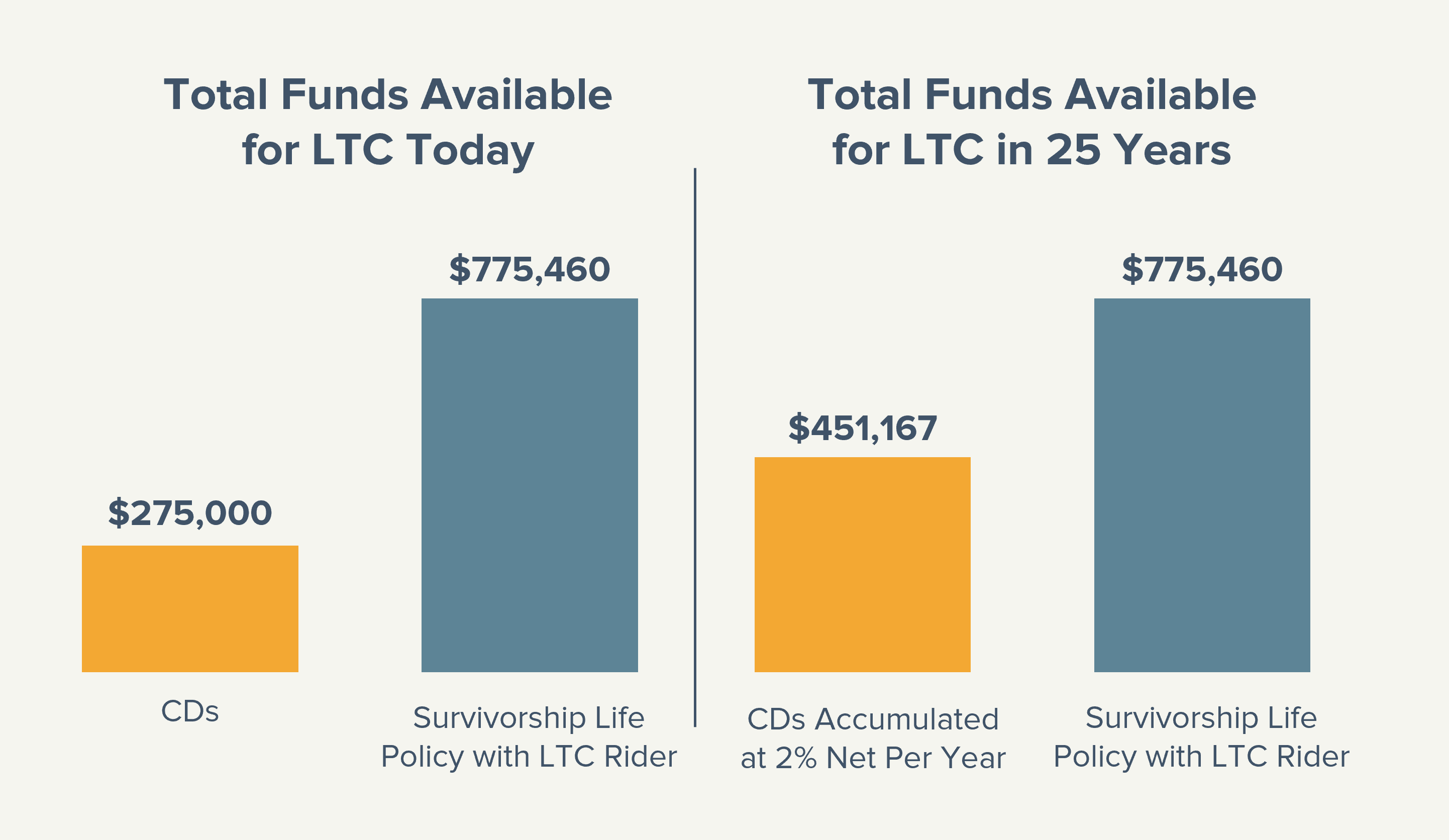

Mary and George have sufficient income from investments and other sources to meet their lifestyle needs. The CD funds are an additional source of liquidity but are not needed for income and are currently earning a very small return.

The CD funds were relocated as a single premium into a survivorship life insurance policy with an LTC rider, which can accelerate up to $387,730 of the face amount for each of them separately at 2% ($7,755 per month; $93,060 per year) to reimburse qualified LTC expenses in the event either one becomes chronically ill.

The Results

The $275,000 in low-yielding CDs was converted into $775,460 of death benefit or combined long-term care coverage. While that amount is not projected to cover 100% of potential LTC expenses, it may cover a significant portion of those expenses and protect retirement assets in case of an LTC event. If they do not need the LTC coverage or only use a portion, the remaining death benefit will be paid to their children, generally income tax-free.

Sources: Morningstar, Nationwide

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.