Patty and Steve want to leave a $1 million IRA to support their daughter with steady income but are worried about loss to taxes. Learn how they can use creative estate planning to reduce taxes and increase their impact.

The Clients

Patty and Steve Jones, age 75, have a net worth of $5 million, including $1 million in an IRA they don’t need for retirement income.

They want to leave this IRA to their daughter, Amanda, age 40, as a tax-efficient income stream rather than a large lump sum, if possible.

They are open to incorporating a favorite charity into the plan if it helps reduce taxes.

The Challenge

The Stretch IRA, which allowed a beneficiary to “stretch” distributions over her lifetime and spread out the income tax burden, was eliminated by the SECURE Act in 2019.

Patty and Steve’s daughter must now fully distribute her inherited IRA within 10 years after their death.

Amanda is likely to inherit the IRA in her highest earning years, which could mean she loses nearly 40% or more to taxes.

The Solution

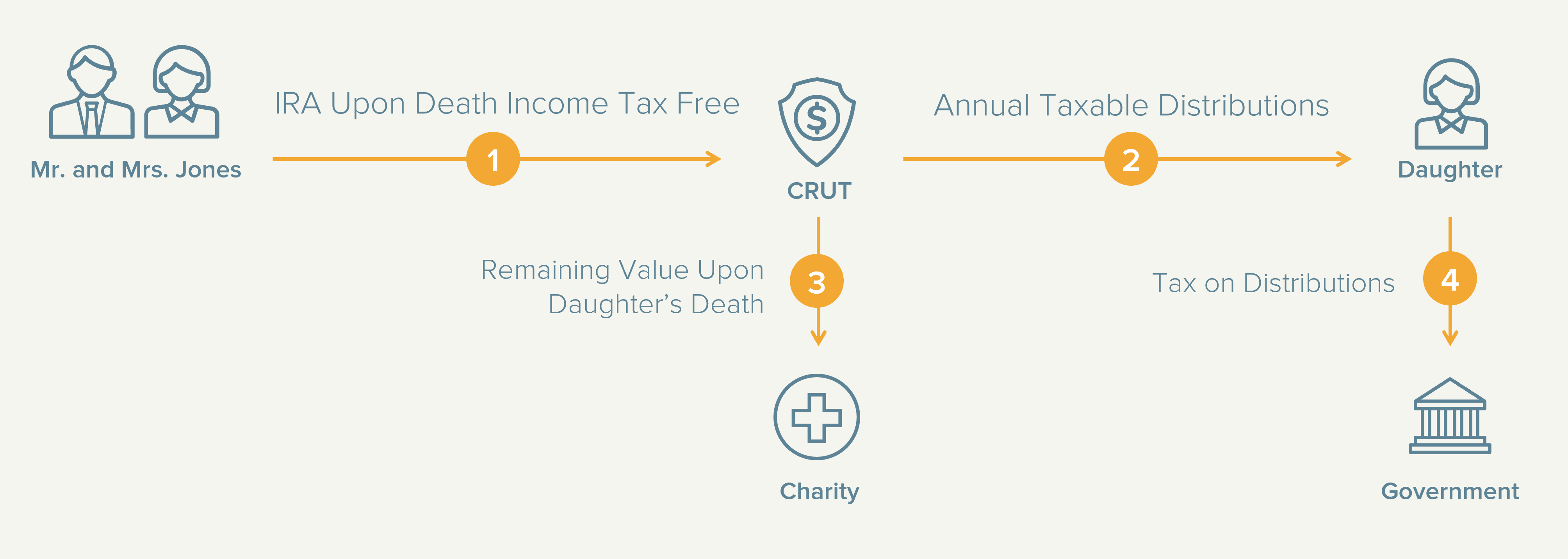

Rather than leaving the IRA directly to their daughter, Patty and Steve can designate a Charitable Remainder Unitrust, or CRUT, as the beneficiary of their IRA.

A CRUT is a tax-exempt trust that can pay an annual income to Amanda for her lifetime and pass the remainder to a favorite charity at her death.

The CRUT will be funded by the IRA when Patty and Steve pass away and must generally distribute at least 5% of its annual value to Amanda per year.

Because the CRUT can make distributions over Amanda’s entire life, it can simulate what was known as a “Stretch IRA” strategy prior to the SECURE Act.

Bonus tip! When Amanda dies, the remaining funds pass to the charity Patty and Steve selected. To replace the wealth for her family, Amanda could use a portion of the CRUT’s annual income to purchase life insurance, leaving an inheritance for her kids and extending the family legacy even further.

The Impact

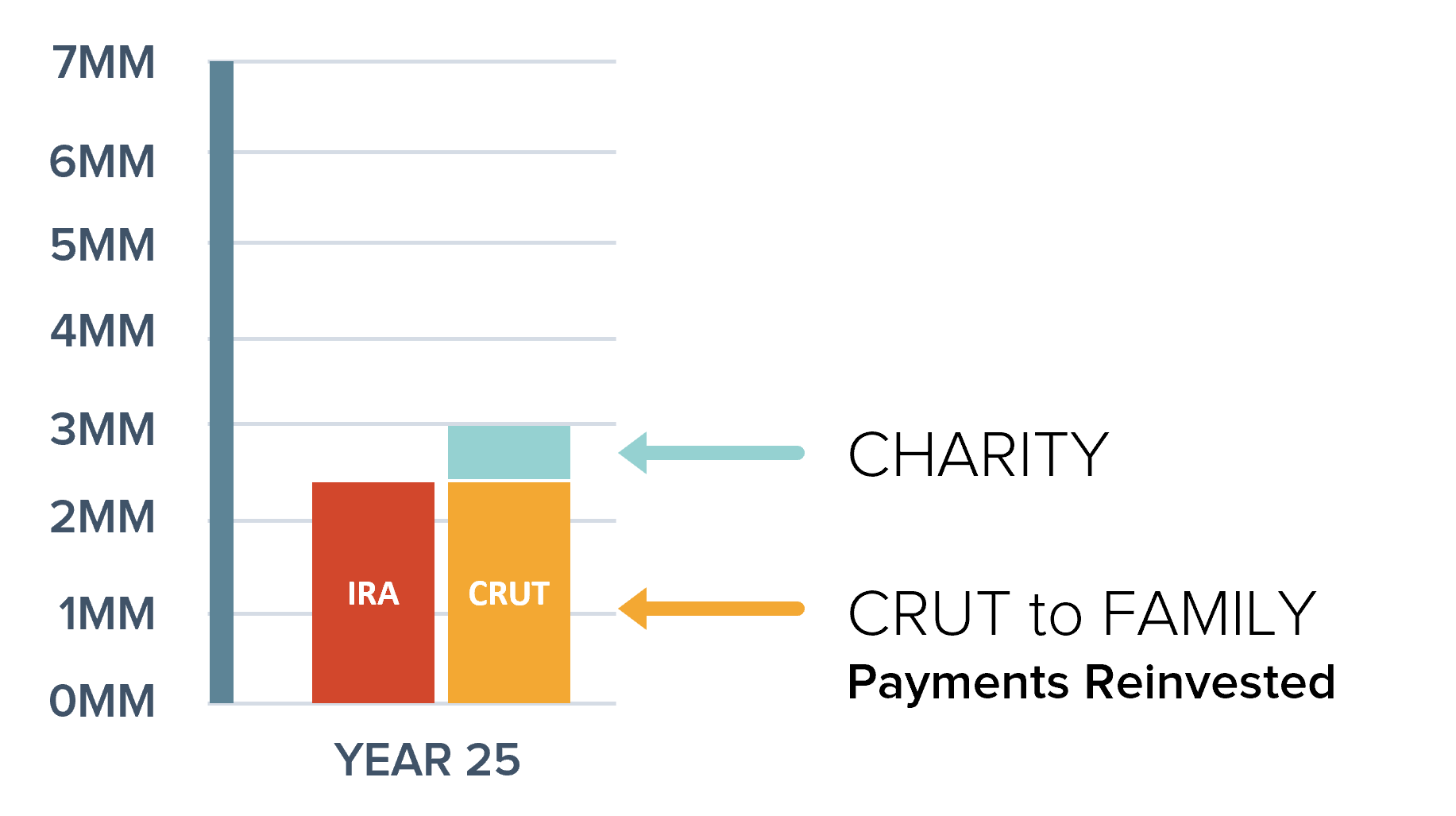

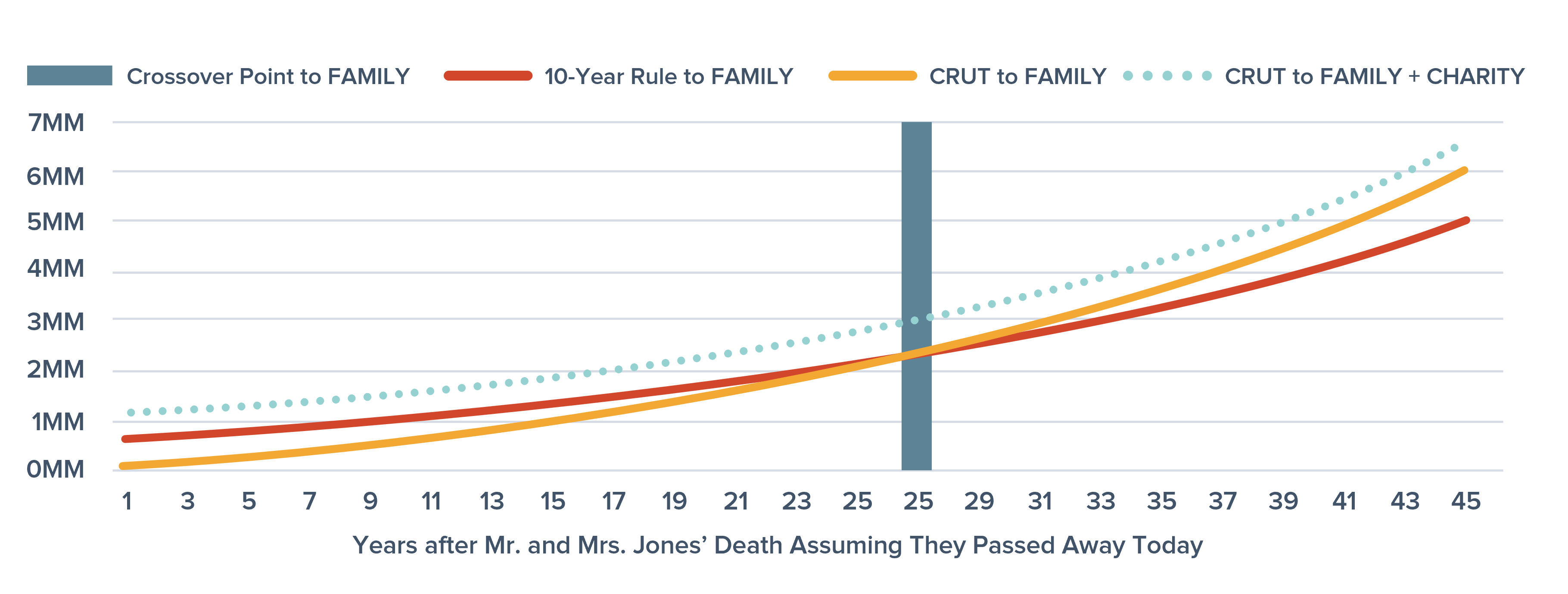

25 Years After Inheritance

Amanda receives and reinvests the CRUT income and has approximately the same amount of wealth after taxes as she would by inheriting the IRA directly and distributing at the end of the 10-year period.

As a bonus, a charity she cares about will receive a generous gift at her passing.

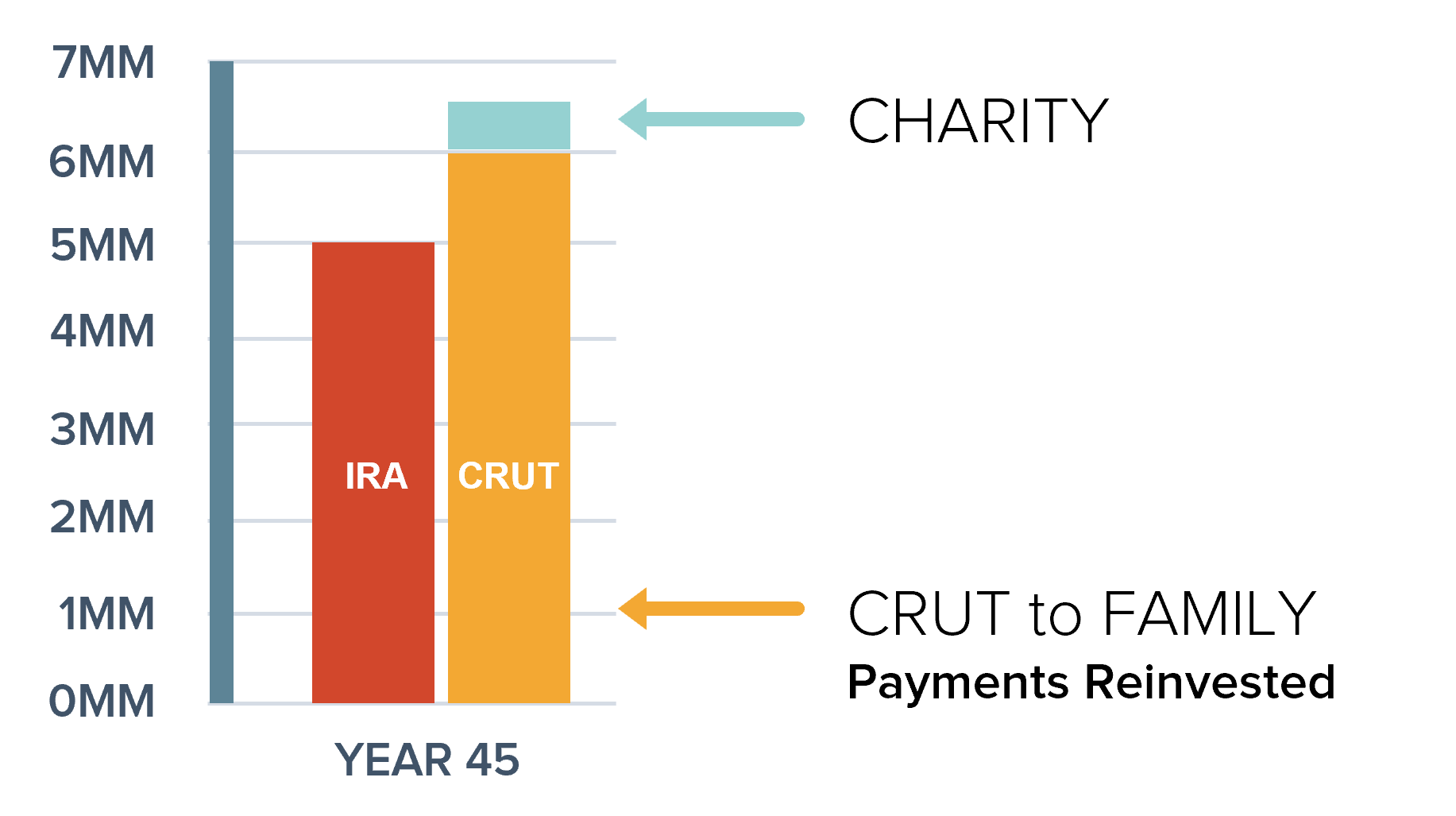

45 Years After Inheritance

Amanda has over $1 million more in her portfolio to pass on to her own kids and grandkids.

A charity she cares about will still receive a generous gift at her passing.

| Inherited IRA Balance | $1,000,000 |

| Pre-Tax Growth Rate for IRA and CRUT | 6.0% |

| After-Tax Growth Rate for Accumulation of After-Tax Distributions in both Scenarios | 4.5% |

| Distribution Method for IRA under 10-Year Rule | Lump Sum in Year 10 |

| Tax Rate on IRA Distributions for 10-Year Rule | 40% |

| Tax Rate on First $1,000,000 of Tier 1 CRUT Distributions (Ordinary Income from IRA Received at Death) | 35% |

| Tax Rate on CRUT Distributions after $1,000,000 has been Distributed (Assuming Capital Gain Income) | 25% |

| CRUT Payout Percentage to Minimize Present Value of Charity’s Remainder Interest to Minimum 10% | 7.0% |

| IRC § 7520 Rate for CRUT | 1.2% |

i. For account holders that died on or before 12/31/2019, the pre-SECURE Act rules apply and the life expectancy “streatch” option is available to Designated Beneficiaries. Eligible Designated Beneficiaries (EDBs) of those who died after 12/31/2019 are excluded from the 10-year rule and remain eligible for the life expectancy method. EDBs include a surving spouse, minor child (grandchildren are not eligible), disabled individual or a beneficiary not more than 10 years younger than the account holder. A surviing spouse can still elect to treate the inherited IRA as his or her own (i.e. spousal rollover). Note that upon death of an EDB, or reaching the age of majority, the 10-Year rule would apply.

ii. CRUTs are limtied to a term of up to 20 years or the lifetime of the income beneficiary and must pay out a minimum of 5% of the value of its assets each year (maximum of 50%). The present value of the charitable beneficiary’s remainder interest, as determined pursuant to the laws and regulations governing CRUTs, must be at least 10% of the value of the money and property contributed to it at the time of contribution. An estate tax charitable deduction can be available for the charitable remainder interest but not an income tax charitable deduction if formed at death. Based on the IRC § 7520 rate as of the writing of this piece, the non-charitable income beneficiary must be at least 27 years to recieve a lifetime income interest and pass the 10% remainder value test.

iii. As a tax-exempt entity, a CRUT generally does not pay tax on its income so there is no taxation of the IRA prceeds distrubuted to the CRUT upon death. The CRUT’s taxable income, including the ordinary income from the IRA at death and earnings realized thereon and thereafter, are passed out to, and recognized by, the income beneficary with the distrubtions as they are made. A four-tier ordering system applies for passing out taxable income to the income beneficary with each distribution: 1) ordinary income first; then 2) capital gain income; then 3) tax-exempt income; and then 4) tax-free basis.

iv. Once the Tier 1 ordinary income of the IRA transferred to the CRUT at death has been fully paid out from the CRUT, the taxable income recognized by the income beneficiary on CRUT distributions may be eligible for capital gain treatment in whole or part at a preferential tax rate depending on the type of income earned on the investment of the IRA proceeds transfered to the CRUT.

v. The exact payout percentage is 7.00354% assuming the valuation (contribution to the CRUT) proceeds the first payout by 12 months.

vi. Acquiring life insurance is dependent on meeting the carrier’s financial and medical underwriting requirements and paying the premiums needed to maintain the coverage to the insured’s desired age.

Hypothetical and for illustrative purposes only. Actual results will vary. Lion Street does not provide tax or legal advice. Taxpayers should seek such advice from a tax or legal professional.

Originally published by Lion Street, Copyright 2021

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.