Whether you’re retired and living on portfolio income or just starting your investment journey, big market swings are always unsettling. So why do you always hear that you should “stay the course” or “ride it out” when it comes to the stock market, volatility and long-term investing? To some, it probably sounds like a standard piece of advice that advisors give clients in tough times, but is it good advice? Well, the research seems to say so – and in a quite compelling fashion.

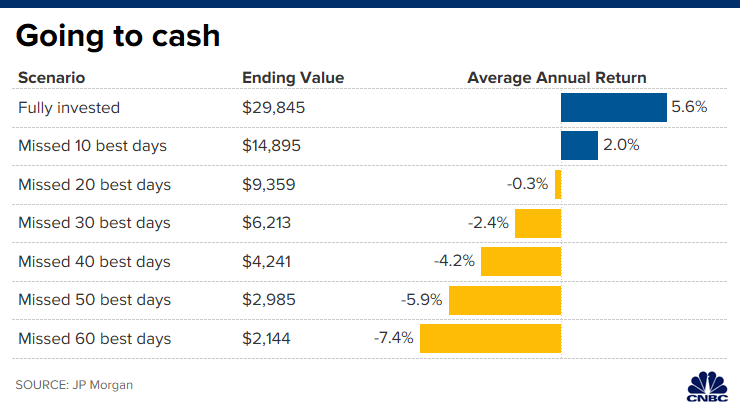

As we see below, $10,000 fully invested in the S&P 500 index from 1999 through 2018 would have grown to $29,895. But by missing the best 10 of those days – yes, just 10 days in 20 years – that growth was cut by more than half to $14,895.

Why? Because the market tends to drop quickly and rebound quickly. And there’s no reliable way to tell which particular day will bring that recovery. So, as we see in the data, what was thought to be a safe move would have cost thousands of dollars in growth and been difficult to make up. Investors jumping in and out of the market put themselves in the position of having to guess and be right.

This is certainly not to say that you should just ignore your portfolio allocation. You and your advising team should carefully build investment strategies based on the time frames of your goals and risk tolerance. But, once a well-designed portfolio strategy is in place, you should plan to stay the course.

Time in the market is better than timing the market – this old adage, while sometimes hard to stick to, sums it up perfectly.

Source – CNBC

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.