Stock market swings are always unsettling, whether you’re decades or months from retirement. But when it comes to recovering from market volatility, timing makes all the difference. As you accumulate, average return matters more than volatility. Assuming the same average return and no withdrawals, your portfolio results will be the same regardless of the order of your gains and losses. In retirement, however, withdrawals in down years can be harmful to your income strategy.

This is often called the Sequence of Returns. Drawing from Blackrock’s research on this topic, let’s look at an example to better understand the sequence of returns and how it affects a portfolio while you save and, more importantly, how it affects a portfolio while you’re taking withdrawals.

Before retirement, average return matters more than order of return

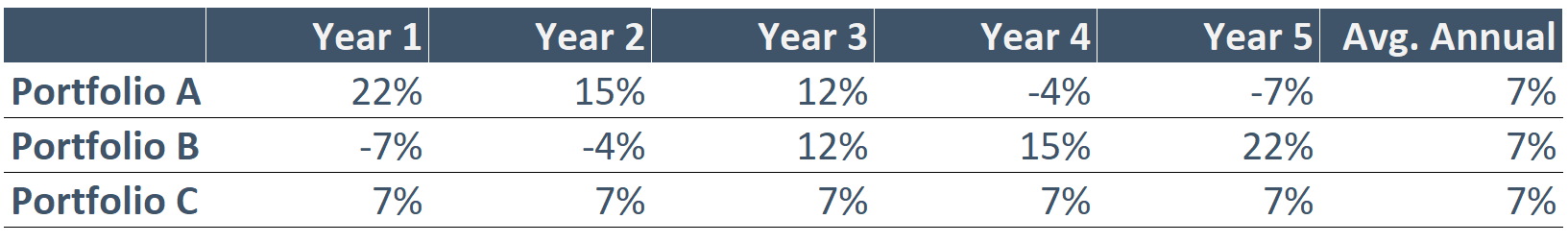

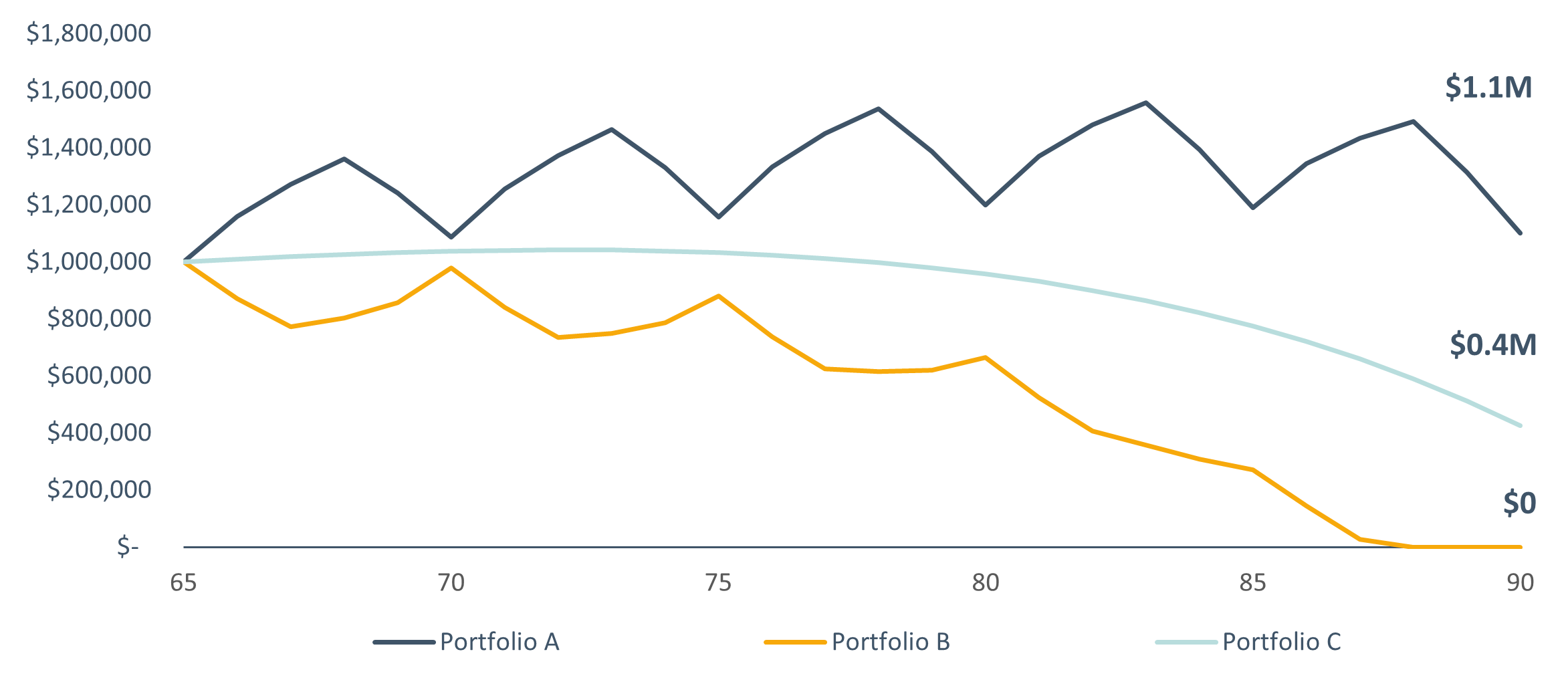

Here are three hypothetical portfolios, each averaging a 7% annual return over five years. Portfolio A earns strong returns in earlier years and poor returns in later years. Portfolio B earns poor returns in earlier years and strong returns in later years. Portfolio C earns a steady return each year.

We start with $1 million in each portfolio and repeat the five-year sequence for 25 years. We can see that each portfolio takes a different path but ends in the same place, growing to $5.4 million. So, while volatility is unsettling and no one wants to see losses to start their investment journey, the long-term average return gets you to the same place regardless of the order of your gains and losses.

In retirement, the order of returns matters more than average return

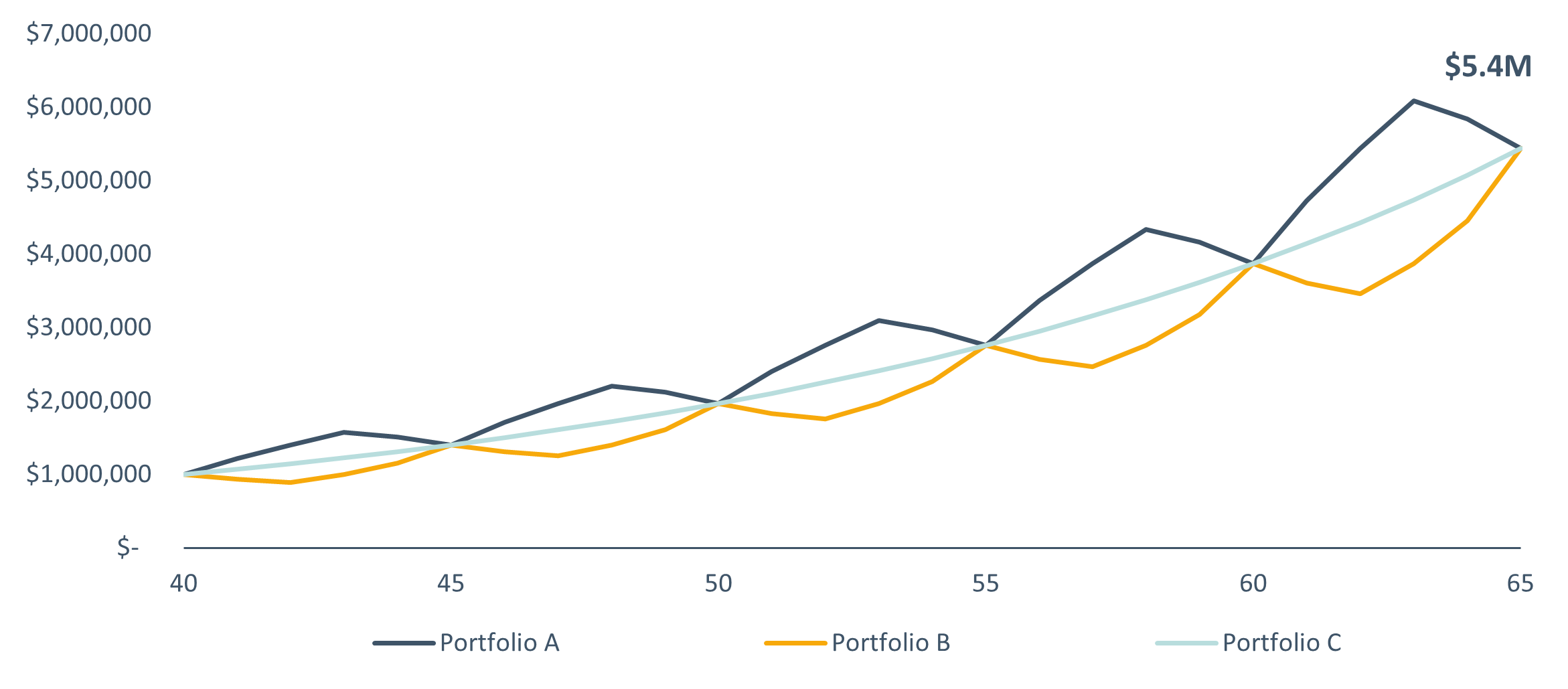

Conversely, when you’re taking withdrawals from your nest egg, the order of your portfolio returns makes a significant difference. Here are the same three hypothetical portfolios, each starting with $1 million and experiencing the same five-year return pattern. But this time, you withdraw $60,000 each year, adjusted annually for inflation.

Though each portfolio averaged 7% per year, the results are far from equal. Portfolio A grows to $1.1 million by age 90, benefiting from strong returns in the early years. Portfolio B runs out at age 88. Portfolio C declines to $400,000 by age 90.

Three ways to reduce Sequence of Return risk in retirement

No one controls the year-to-year market returns, so how can you address sequence of return risk in your retirement income strategy? Here are three ideas:

- Keep a reserve outside the stock market. For some, this looks like 6-12 months of expenses in high yield savings. For others, it could be cash value in a life insurance policy with guaranteed interest. Whatever you choose, having funds outside the stock market to draw on during down years reduces your volatility risk.

- Build sources of fixed income. Income sources like rent, annuities, pensions, and social security don’t change in down markets. This means less withdrawals during years of market decline and preserves more of your nest egg.

- Consider a securities-backed line of credit. Like a home equity line of credit (HELOC) which borrows against equity in your home, a securities-backed line of credit (SBLOC) borrows against an investment portfolio. The goal is not to go into long-term debt, but simply to prevent you from selling investments in the middle of a market downturn. Borrow, then repay when the market recovers.

Your sequence of returns poses more risk in retirement but is avoidable. Reducing this risk should be part of your overall plan to turn your nest egg into stable income you can rely on to enjoy life and help achieve your retirement goals!

Hypothetical example(s) are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment for actual clients.

Is your retirement as ready as you are?

You’ve saved for years—but turning that into steady income takes more than guesswork. A clear plan helps you avoid mistakes and enjoy retirement with confidence.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.