Do you have company stock in your 401(k)? You might if you spent your career at a large employer. If so, you might be able to save a significant amount in taxes when you retire using a tax strategy called Net Unrealized Appreciation (NUA).

NUA allows you to transfer company stock into a taxable brokerage account and pay the lower capital gain tax rate on the appreciation of the stock when it is sold, rather than the ordinary income tax rate you pay on all other distributions from your retirement plan.

Net Unrealized Appreciation (NUA) explained

Net Unrealized Appreciation is the difference between what you paid for company stock and its current value. The big question is: How much tax will you pay when you sell that stock in retirement? If you roll it to an IRA, you’ll pay ordinary income tax, but if you use NUA, you could pay far less. How much less?

Let’s look at a case study.

John retired after 30 years working for a large manufacturing company. During his tenure, he accumulated $2,000,000 in company stock in his 401(k) plan. The stock has a cost basis of $200,000, the total amount he paid for the stock. John expects to have a 24% income tax rate and a 15% capital gain tax rate.

If he rolls his 401(k), including company stock, to an IRA, he will pay ordinary income tax rates on everything he withdraws. But, if John uses NUA, he can transfer the company stock to a brokerage account, he will pay 24% income tax on the $200,000 cost basis and only 15% capital gain tax on the remaining $1,800,000.

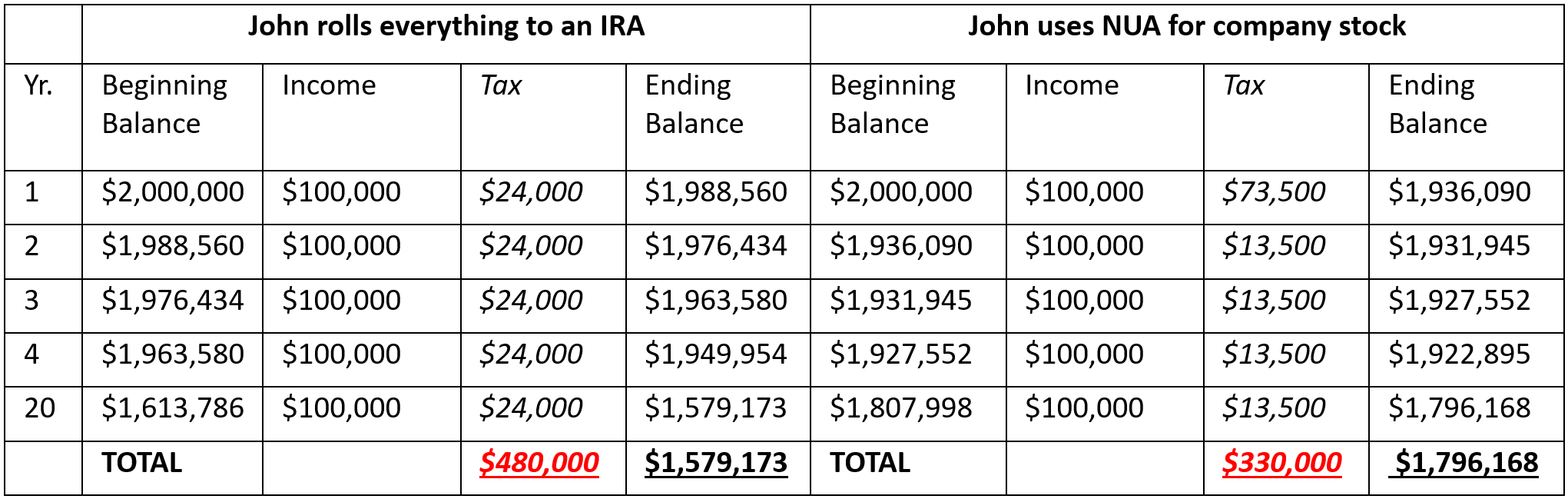

The table below shows John withdrawing $100,000 plus taxes per year from the $2,000,000 of company stock in an IRA compared with using NUA to transfer the stock to a brokerage account. Assume John earns 6% per year return, pays 24% income tax rate and 15% capital gain tax rate. Let’s look at the impact:

- In year 1, John pays more in tax in the NUA strategy because he must pay income tax on the $200,000 cost basis of the company stock.

- In all subsequent years, his tax on $100,000 retirement income is substantially less because he pays 15% capital gain tax rather than 24% income tax.

- After 20 years, John has taken the same $2,000,000 in income, paid $150,000 less in tax, and has $217,000 more in his portfolio using NUA.

How do you qualify for NUA?

To qualify for NUA, you must meet all four of the following criteria:

- You must roll over your entire retirement plan balance within one tax year.

- You must roll over all assets from all plans you hold with the employer.

- You must transfer company stock shares directly to a brokerage account, you cannot sell them and transfer as cash.

- You must have either separated from service, reached age 59.5, become disabled, or passed away.

Is NUA right for me?

If you hold company stock with significant unrealized appreciation and a low cost basis, you should at least consider using NUA. Like all financial strategies, there are considerations when deciding whether you should utilize the NUA rules. What other portfolio assets and retirement income sources do you have? What are your estate and legacy planning objectives? Your financial advising team can help determine if this is the right strategy for you. And, of course, if you’re looking for a team to help with integrating strategies like these into a plan for you, please reach out!

Case studies are intended to illustrate a strategy, not to represent the experience of any clients or imply future performance.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.