If you’re like many business owners, you’ve worked hard to build your income and face an ever-growing tax bill. You want to save more toward retirement and pay less in taxes.

The problem? You’re limited to $7,000 in an IRA and $23,500 in a 401(k), with a slight increase if you’re 50 or older. But if you own a business and are only using a 401(k) plan, you could be passing up big tax savings opportunities. One such opportunity is a Cash Balance Plan, a tax-deductible retirement plan that allows significantly larger contributions than a standard 401(k) plan.

In the video below, we interview Scott McHenry, founder of McHenry Advisers, an expert in designing, implementing, and maintaining these plans. And in the article that follows, we cover what you need to know about this kind of plan and how to find out if it’s a fit for you!

What is a cash balance plan?

A Cash Balance Plan is a type of Defined Benefit Pension Plan with much higher contribution limits than your standard 401k plan. Here are a few Cash Balance Plan highlights:

- Tax savings today. Your company contributions to the plan are tax deductible, which can knock down your tax bill.

- Invest and grow your funds. Like your 401(k), funds can be invested and grow and, while in the plan, taxes on your growth are deferred until you take them out in retirement.

- Tax benefits tomorrow. Though less common, cash balance plan can also be designed to own cash value life insurance, which can further increase contributions and provide tax-free death benefits and retirement income when designed properly.

- Safety from creditors. You want to protect your hard-earned retirement dollars as much as possible. Like your 401(k), a Cash Balance Plan can be protected from creditors, as well.

For the right company, a Cash Balance Plan can add up to big retirement contributions and tax savings.

How much savings are we talking about?

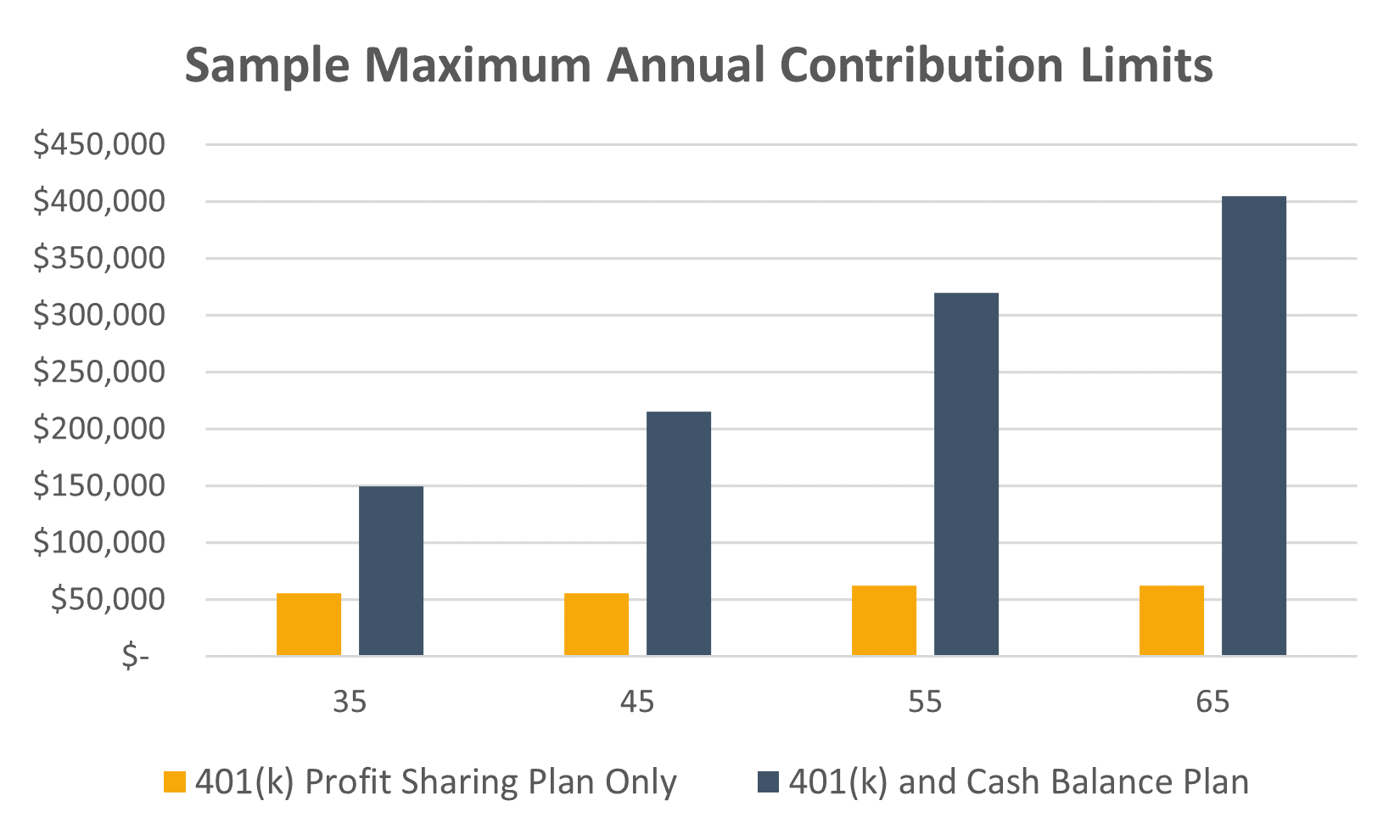

Your standard 401(k) plan contributions combined with a Profit Sharing Plan can exceed $50,000, all reducing your tax bill. However, as shown by McHenry Advisers, a third-party administrator specializing in advanced retirement plan design for business owners, a Cash Balance Plan’s maximum contribution can significantly exceed that of a traditional 401(k) plan.

Your maximum contribution will vary by age, income, and other factors. If you’re a 35-year-old business owner, you could be saving $150,000 per year. If you’re 65, contributions could exceed $400,000 per year – all tax-deductible. At the top 37% federal income tax rate, a $150,000 contribution saves you $55,500 in tax, while a $400,000 contribution saves you $148,000 in tax this year.

How much do I contribute for my employees? Two real life examples.

A Cash Balance Plan requires contributions for eligible employees, which provides a way to attract and retain top talent for your business. We have calculated sample tax savings, but you want to compare this with the amount of required contributions for your employees to determine if this strategy is right for you. This varies widely based on income, age, and number of employees, so you’ll need a customized plan designed for you. Here are two examples we’ve helped clients with recently:

- A 60-year-old consulting firm owner was able to contribute $200,000 to his cash balance plan. $186,000 went to him, $14,000 went to his two employees, and he saved $74,000 in tax.

- Two 40-year-old dentists were able to contribute $300,000 to their cash balance plan. $240,000 went to them, $60,000 went to their six employees, and they saved $111,000 in tax.

In each example, they saved far more in tax than they contributed to their employees and added a great benefit for their team!

What if I already have a 401(k) plan?

Good news! You won’t need to make any changes to your 401(k) plan, though a few small tweaks to a 401(k) match or Profit Sharing Plan can increase the amount of contributions going to you.

What kinds of businesses do Cash Balance Plans fit?

Cash Balance Plans can fit almost any kind of business, but we commonly see them for small physician groups, dental practices, self-employed individuals, professional practices, along with many other small business owners.

Once I start, can I make changes or am I committed to this full contribution?

Every business is at risk of hitting a slowdown and you should understand how this could impact your plan. Annual contributions can be flexible, with a minimum and maximum requirement. You can also amend your plan up to 2.5 months after year end to increase benefits and funding range.

You should plan to keep your Cash Balance Plan for at least 3-5 years, though you have additional flexibility to stop the plan in case of extenuating circumstances like a business sale or other major change.

How do I get started?

Tax savings and retirement planning are two important parts of a comprehensive financial plan. Our team at Alterra can help build a plan to evaluate what you’ll need to reach your goals, as well as the best ways to do it. Find out if we’re a fit!

Losing more to taxes than you should?

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.