Does the market care about presidential elections? Should you move to safety until the results are in?

We asked Russell Martin, Senior Portfolio Manager at City National Rochdale, to weigh in on this question. Here’s what he had to say!

Stock market volatility is normal. Short-term volatility tends to be driven by headlines and uncertainty while long-term results are driven more by fundamentals of the economy: whether companies are making products people want to buy, providing stable jobs, and making a profit. We rarely see short-term market swings driven by fundamentals like economic growth and corporate profits.

Even in positive market years, it’s not uncommon to see a 10-15% decline during that year. So, if we know that market volatility is normal and unpredictable, are elections different?

It doesn’t seem that way. Here are a few reasons why.

Presidential election years are typically good ones

Looking at a US stock market index like the S&P 500 can be a helpful indicator. While it isn’t a fully diversified investment strategy on its own, it can help us see what tends to happen in markets as it relates to presidential elections.

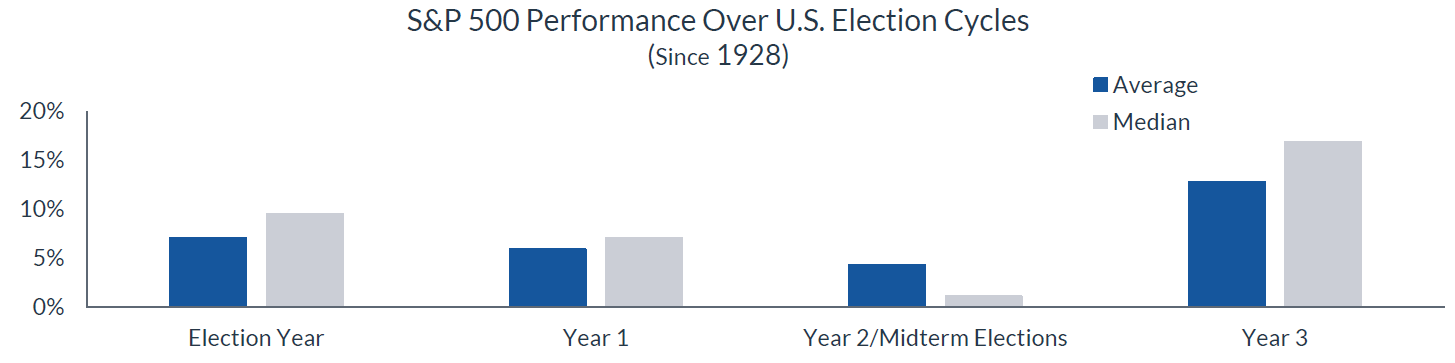

Since 1928, the S&P 500 has averaged positive returns in each of the four years of the presidential election cycle with and election year, as we see below.

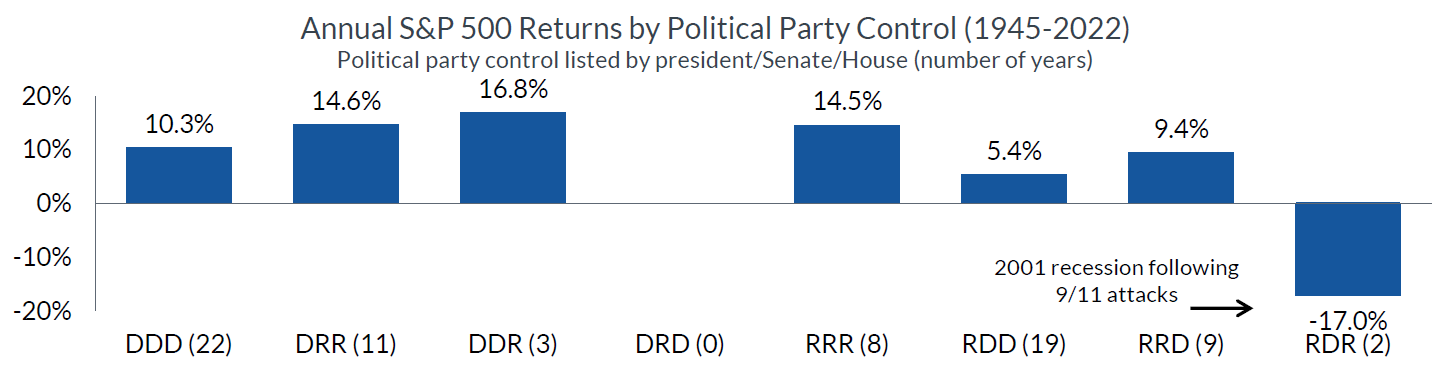

The stock market has also performed well regardless of the party controls President/Senate/House.

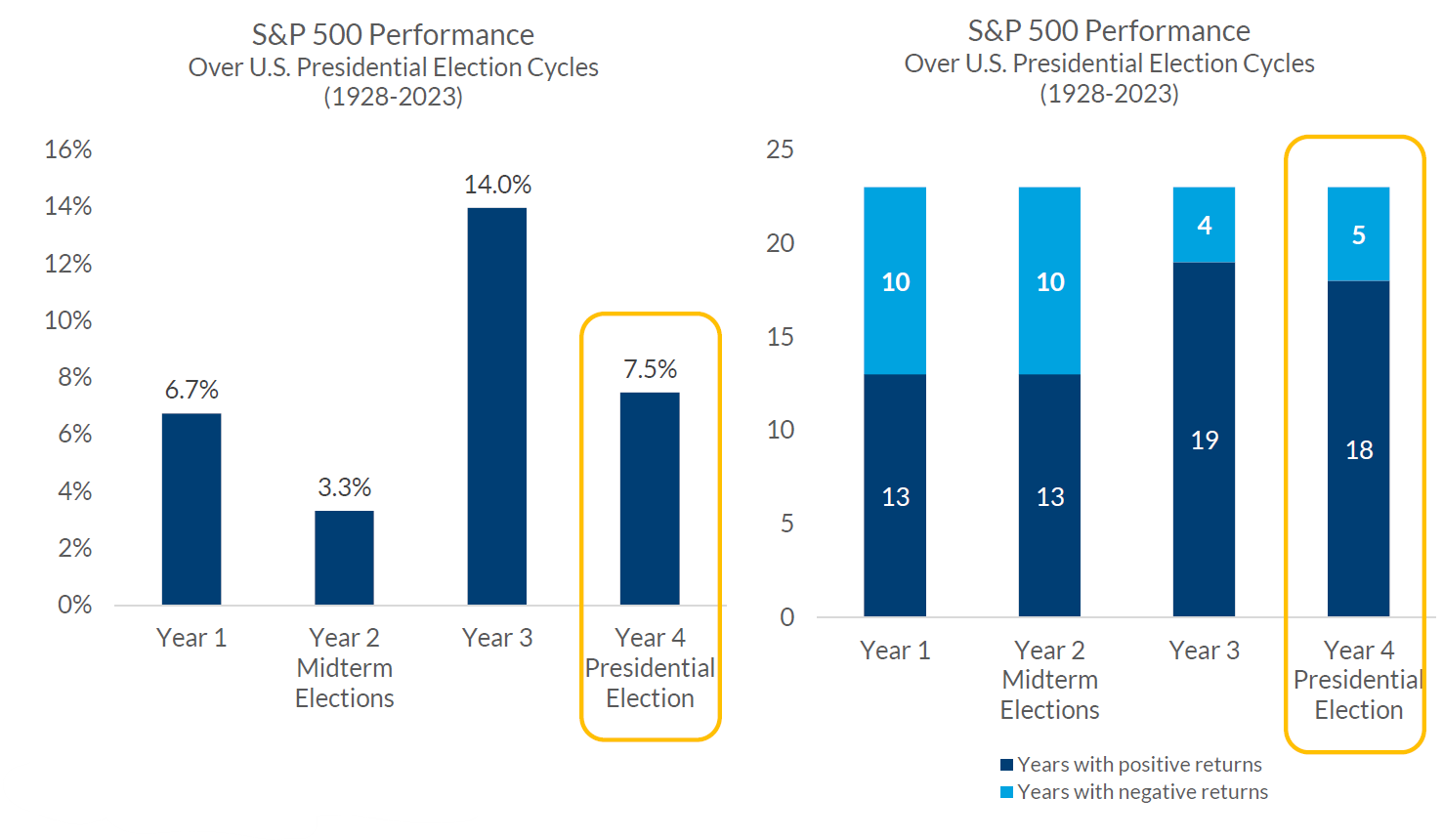

While it’s helpful to know that the market has averaged positive returns in election years, it’s even more encouraging to see how many of those years were actually positive. As we see below in the two circled bars, the S&P 500 averaged 7.5% in presidential election years and, of 23 total election years since 1928, 5 were negative and 18 were positive.

This doesn’t mean we won’t see a negative election year, just that history doesn’t indicate there’s a clearly predictable pattern of gain or loss that investors should use to alter their strategy.

What should investors do in election years?

Investing is largely about maintaining smart strategies in the long run and managing emotions in the short run. If you are feeling concerned and worried about a bad outcome, or if you are feeling enthusiastic and optimistic about a good outcome, my best advice is to speak with your financial advising team before taking action. The investors who see the best long-term outcomes and have the most secure financial futures are the ones who make their decisions centered around their financial plan rather than being reactive to headlines, political changes, or short-term market movements.

We can’t overstate the importance of open, regular communication with your advising team about what’s keeping you up at night financially. In addition to helping ensure your strategies keep you on track to your goals, clients tell us that conversations about short-term fears (like what might happen in an election year) are the most helpful discussions we have!

Learn more about How We Work at Alterra.

Source: CNR

Past performance does not guarantee future results. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. Clients cannot invest directly in an index.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.