Has someone ever told you they have the BEST way to build wealth? Whether a friend or “financial expert”, many seem to think it’s their way or the highway. Unfortunately, many financial experts seem to give conflicting advice, usually coming from one of four sources:

- Investment companies that recommend building wealth through stocks and bonds.

- Insurance companies that recommend insurance solutions to grow and protect your wealth.

- Real estate companies that say you should build wealth through real estate.

- Banks that suggest the safety and security of bank products.

And, of course, there’s the vocal friend or family member who suggests you should make your wealth however they made theirs because it worked for them.

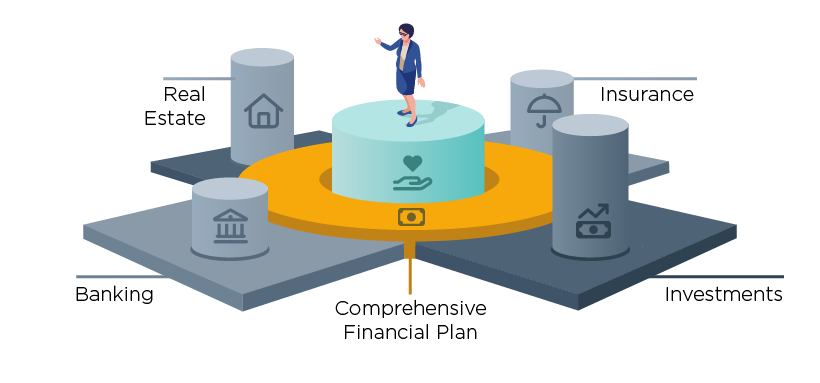

How do you know who’s right? What’s the best way to build wealth? The answer is…none of these is THE best way to build wealth. We think the right question is: What is the best way to build wealth for you? This question requires a process, a method to find your ideal mix of strategies. We think about it like this. Your plan should sit in the center, guiding which sources you should use to build wealth and how much you focus on each source.

So, to determine whose advice to follow, you can start by finding out if the financial advice you’re receiving is Product-Based Advice or Process-Based Advice.

Product-based advice

Each of the four source examples above has something in common: they start with a product. The “expert” in each case is only considering solutions they can offer. This doesn’t mean the solution is wrong, but it does mean the advice is limited.

If you go to XYZ bank to help reach your financial goals, it shouldn’t be surprising when they come back with solutions that XYZ bank offers. This doesn’t necessarily mean that they’re malicious or out of line. Sometimes it just means that those are the products they understand best and have a bias towards. Other times, it’s because these are the only products they offer, whether or not they’re the right fit for you. This leads to an inherent conflict, explaining why many people have a deep mistrust for financial advice.

Apply this to another field. If someone in construction told you “Hammers are good, shovels are bad, you should only buy hammers”, you might laugh at them. If they haven’t even asked what you’re trying to build yet, how can they possibly recommend a hammer? But if you learned that they work for Hammers, Inc, it would make a little more sense and you’d understand why they might view the hammer as a solution to pretty much any problem.

Product-Based Advice isn’t likely to help you find your best way to build wealth, but a process-based approach just might.

Process-based advice

Process-Based Advice helps address your financial challenges by starting with the question. “What are you trying to accomplish?” “How do you feel about risk?” “Are there strategies you know you like and others we should rule out?”

Based on your answers, a process-based approach then outlines potential strategies, suggesting tools to help reach your specific goal. Process-based advice must come from an independent advisor who starts with your goals. They must also understand each of the financial pillars without being committed to any of them as “the best one”. At Alterra, this is why we always start with our comprehensive financial planning process to learn which goals are most important to you, what preferences and concerns you have, and then build your customized action plan.

Building wealth starts with a process, not a product

So, what’s the best way to build wealth? It’s a process, not a product. And with this process in place, you don’t have to be confused by seemingly conflicting advice. You can simply and clearly evaluate any product or strategy to see if it fits into your wealth building plan!

Zach Hamilton

CFP®

Partner, Financial Advisor

About the Author

Zach graduated from Gonzaga University with degrees in Marketing and Finance. While growing up, Zach heard stories from his grandfather about his work as an insurance agent, and other stories from his dad who was an investment manager. They both spoke financial “languages” but had completely different dialects. Recognizing the breadth of the financial vocabulary ultimately led to Zach’s passion for financial planning. He credits his family for this enthusiasm. Zach sees his time with clients as an opportunity to translate all of the different – and often confusing – information they’ve heard and provide clear guidance for each unique situation.

Zach enjoys working with people – his clients – who also appreciate that their financial decisions have an impact not just on themselves, but also on their families, charities and their own life legacy. Many of Zach’s clients have a strong desire to “make a difference”, and they rely on his financial expertise to magnify their philanthropic goals.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.