What’s the value of partnering with a Financial Planning and Wealth Management team like Alterra Advisors?

This is a frequent question we hear in conversations when someone is considering hiring an advisor. And it’s an important one! We believe that, for the right family, our team can add value by working as an expert guide, navigating important wealth decisions with our clients to ensure they stay on track and arrive confidently at their goals. Working with a Wealth Management Team is not for everyone, but if you think a wealth management partnership is right for you, here’s what the value of an advisor looks like practically.

Vanguard’s “Value of an Advisor” research

Vanguard has conducted exhaustive research to quantify the value that a good wealth management team can add, from comprehensive planning to helping avoid major missteps. Then, they put it in terms of potential annual return this value could add to your portfolio. Here’s how they break it down:

| Vanguard’s Advisor Value Component | Value-add range |

|---|---|

| Wealth strategy design & asset allocation | > 0.00%* |

| Guidance to avoid critical mistakes (behavioral coaching) | 0 to > 2.00% |

| Rebalancing | 0.14% |

| Aligning the right investment with the right account | 0 to 0.60% |

| Spending strategy & withdrawal order | 0 to 1.20% |

| Cost effective investments | 0.30% |

| Total return vs. income investing | > 0.00%* |

| Total potential annual value-add | Up to or above 3% |

*significant potential value, but too unique to each client to quantify

We apply this research through seven principles that we believe can add to your bottom line and help you sleep better at night knowing you’re on track to reach your goals.

1. A customized plan. Just for you.

What’s your North Star? Where do you want to go? It’s crucial to start with clear goals that motivate you. From there, we build a road map and help you choose strategies tailored to you. Your comprehensive financial plan should help make sure you’re on track for retirement, design investment strategy, help reduce income and estate taxes, and address risks that could derail your plan.

Your customized plan aligns your efforts and serves as an ongoing reminder of the most important impacts you want to make.

2. Wealth strategy design.

What should you actually invest in? Which mix of strategies should you rely on to make your wealth dreams a reality? This is more than a portfolio. It’s a comprehensive action plan to apply your wealth to your goals.

We talk through how you feel about the ups and downs of the market and your timeline for using your wealth, often called your risk tolerance and time horizon. Your life stage makes a big difference here. Investing for maximum return is much different than allocating for steady retirement income.

From there, we put the right mix of investment strategies in place, help you decide which accounts to draw from and in what order, and monitor the portfolio over time to ensure it stays in line with your goals. We also consider strategies that avoid risk of the stock market for those who want a smoother approach to grow wealth.

3. Your plan put in motion.

A plan is only as valuable as how well it’s implemented. This is why we don’t stop at plan design. We do the heavy lifting of set up, consolidation, and making sure your wealth is working for you in the strategies you’ve selected. We’ve heard countless stories of well-intended plans sitting on the shelf for years.

We proactively help move your plan forward, bringing you closer to your goals every day.

4. A guide to help avoid critical mistakes.

What should you do when the market tumbles, the economy slides into recession, and all seems lost? We’re here to listen and talk through these kinds of concerns, an important part of avoiding common pitfalls, like selling during market downturns or chasing after hot investments. This can provide a steadying hand in volatile times, helping you stick to the long-term investment strategies that serve your goals.

What can this mean in real dollars?

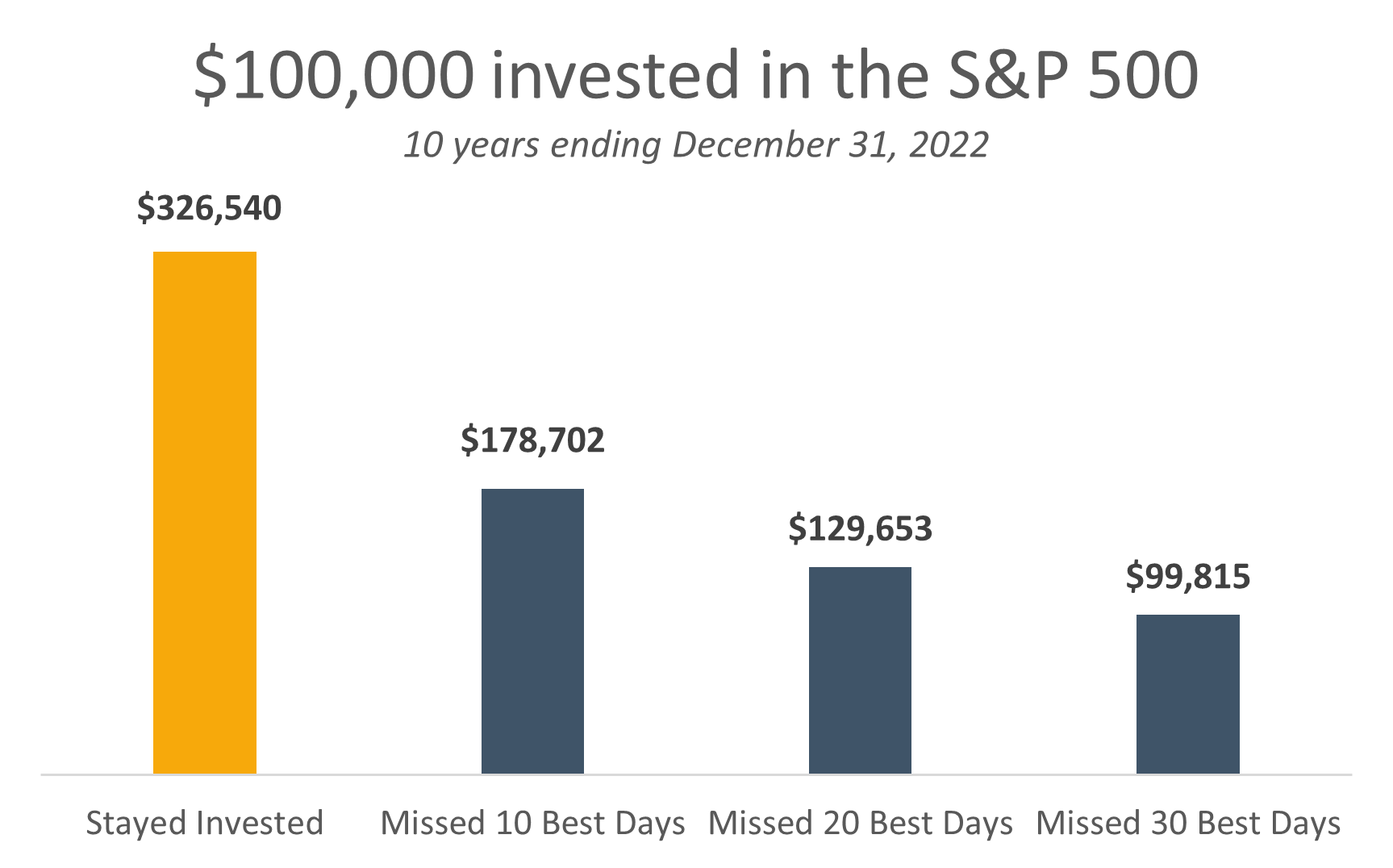

The best market days often follow the worst days very closely. Here’s what would have happened to $100,000 invested in the S&P 500 for 10 years ending 12/31/22, showing how painful it can be to miss 10, 20, and 30 of these best days.

Vanguard’s research suggests that these common mistakes can cost you as much as 2% per year – mistakes a good Advising Team can help you avoid.

5. Reducing taxes and keeping more in your pocket.

Being a tax-smart investor can help reduce your tax bill and help you keep more of what you earn. Russell’s research shows that investors lost as much as 2.14% per year in their US equity investments over the five years ending December 31, 2021. That’s $21,400 in potential loss to taxes on a $1 million portfolio…per year!

We help reduce tax drag in your investments by maximizing use of tax-advantaged strategies, making sure you hold the right investments in the right accounts, and harvesting losses to offset gains. We also help build strategies to reduce taxes when passing wealth to the next generation or causes you care about.

6. Rebalancing your portfolio along the way.

If you select a portfolio invested 60% in stocks and 40% in bonds and stocks shoot up in a single year, your portfolio isn’t split 60/40 anymore. Your stocks have increased (great!) but now your nest egg is exposed to more risk with a higher percentage in stocks.

Russell’s research showed that a hypothetical 60% stock / 40% bond portfolio slid to 83% stock / 17% bond between 2009-2022 if not rebalanced. If this was your portfolio, you would be in for an unpleasant surprise in the next market downturn if you thought only 60% of your portfolio was invested in stocks.

We regularly rebalance your portfolio to ensure it stays in line with your risk expectations. This is not just good investment housekeeping, it’s a systematic buy low, sell high strategy at work, which maintains your portfolio’s target asset allocation.

7. Guiding through life’s ongoing what ifs.

What if I move, have more grandkids, or unexpected medical expenses strike? We are your lifelong financial partners, talking through the impacts of changes in your life and goals. When wondering “Do I need to make a change?”, we stand ready to help you answer that with an open ear and a strategic game plan.

Vanguard shows that these seven principles can add as much as 3% per year to your results. But the right Wealth Management Team can add value beyond simply managing a portfolio. We’re a true financial partner, like being friends with a financial pro who can talk through challenging circumstances and difficult decisions, leading to a clear path forward.

For more about our process here at Alterra, we invite you to learn more about How We Work!

Diversification and asset allocation do not guarantee a profit or protect against a loss. Past performance does not guarantee future results. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. Clients cannot invest directly in an index. The Vanguard Group and Russell Marketing Research Inc, are not affiliated with Alterra Advisors.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.