The Russian invasion of Ukraine is concerning in many ways and our deepest sympathies are with those affected on the ground. We hope for a peaceful resolution quickly. The conflict and its possible implications lead nearly every headline, so it’s understandable if you find yourself worried about potential economic and financial impacts.

As with every event like this, the Russia-Ukraine conflict brings uncertainty. However, we’ve seen similar situations and conflicts in the past, so history has some valuable insights that may provide some reassurance. Here are a few possible impacts we see from the Russia-Ukraine conflict, how markets have reacted in the past, and what we can take away from this.

How might the situation in Ukraine affect the economy in the near future?

In the short-term, there are a number of possible impacts that could come from the conflict in Ukraine.

- Energy is likely to be affected as we are seeing with the recent surge in oil prices. Russia is a primary source for European natural gas and is also a large global oil supplier. As the conflict drags on, Europe will bear the most significant impacts on energy prices, but we will likely see prices rise here, as well.

- Sanctions are a historically effective response to military actions like this, but they could compound short-term challenges. Among the most severe sanctions, Russian banks are already being restricted from access to SWIFT (Society for Worldwide Interbank Financial Transactions), the primary financial network that enables global financial transactions. Russia could restrict its own oil and gas supply in retaliation. In addition to being a global oil supplier, Russia is a major exporter of wheat, ammonium nitrate, platinum and aluminum. Interrupting this supply could drive inflation in these areas.

- Inflation is already a concern here in the US but could tick up further or sustain longer that originally expected in areas like food, energy, and industrial commodities. If an increase in inflation is sharper than expected, we could see moves like interest rate increases come sooner than planned. For more on this, see Inflation and the Federal Reserve.

- Russian stocks are clearly at risk, especially with severe sanctions being considered. However, Russian equities typically make up a very small percentage of emerging market investments.

How have markets responded to these conflicts in the past?

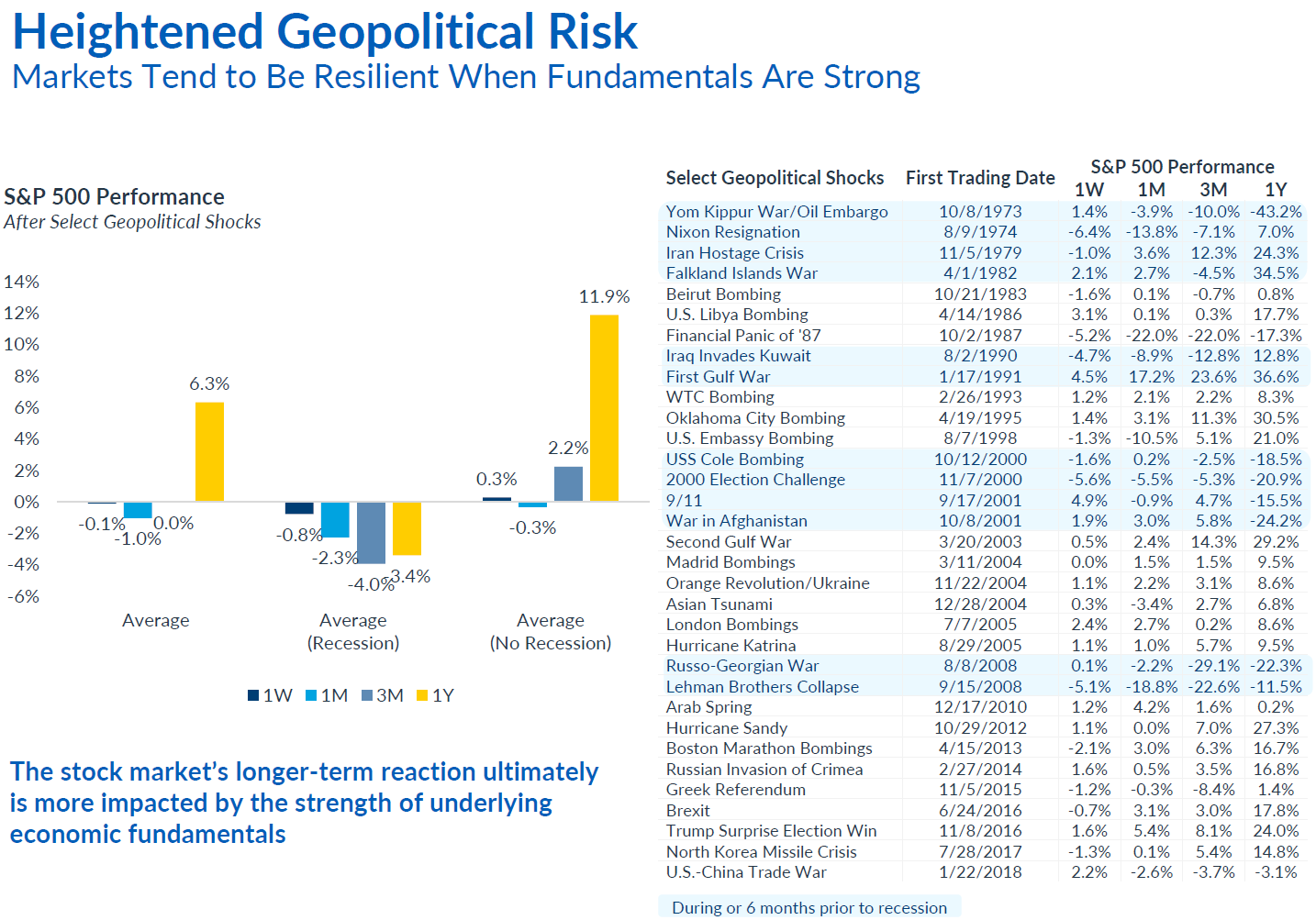

We’ll draw some lessons from City National Rochdale in the chart below, which details 33 past geopolitical shocks and how the S&P 500 performed in the following year.

- As quoted in the chart, the stock market’s longer-term reaction is more impacted by the strength of the economy than a particular global shock. Right now, the US economy is healthy on many fronts. US households and businesses have strong balance sheets. Companies are expected to continue to grow this year, though perhaps more moderately than in the last few years. These underlying fundamentals are encouraging.

- In the year following a geopolitical shock, the S&P 500 averaged a 6.3% gain, but this isn’t the whole story. If the US economy was in recession, the S&P 500 lost 3.4% in that year, but if not in recession, the S&P 500 gained 11.9% in that year. We’re not currently in a recession and have a strong underlying economy, which is also good news.

- Global conflict is troubling on many levels. We’re concerned for those affected. We want peace to return but can’t personally bring that to fruition. The general sentiment is heavy and can turn negative. In times like these, it’s important to recognize that markets aren’t always correlated to these general sentiments. In past conflicts like this, the stock market tends to bounce back quickly.

These risks are certainly worth your attention, and we are closely monitoring the developments in Ukraine as they occur. As with past conflicts like this, we expect the short term ups and downs of the market to increase. But though this conflict is challenging in a variety of ways, history shows us that we shouldn’t make dramatic short-term changes to long-term assets.

We at Alterra remain focused on how you can maintain financial security and stay on track with your goals. We find time and again that markets, economies, and people are resilient. In this sense, your long-term investment approach can carry on in the face of short-term uncertainty.

Sources – CNR, Morningstar

Investing involves risk and possible loss. Past performance is no guarantee of future results. Forecasts, estimates and certain information contained herein should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.