“I’m thinking of paying my mortgage off early. Being debt free would feel great, but is this a good strategy? Should I be investing those extra dollars instead?”

Paying off your mortgage is an exciting accomplishment and feels like a huge burden being lifted – you’re finally free from that monthly payment! Keep in mind that debt is both financial and emotional, and these principles must be adapted to current interest rates, but as we dig into the numbers, we find out that paying the mortgage faster might not be the shortest path to financial independence.

By paying your mortgage faster, what are you saving?

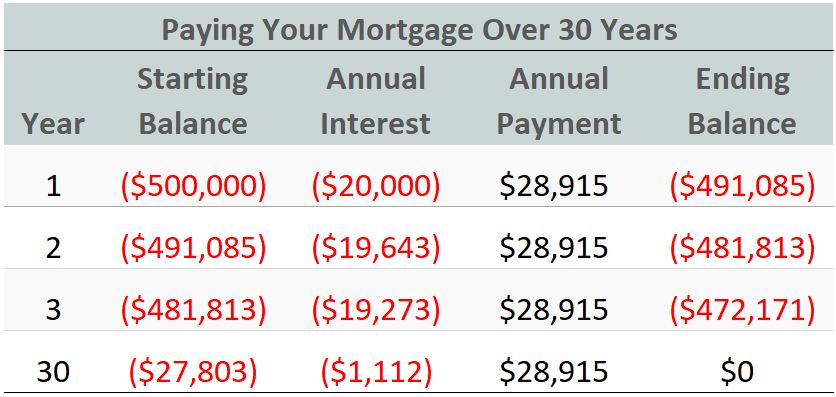

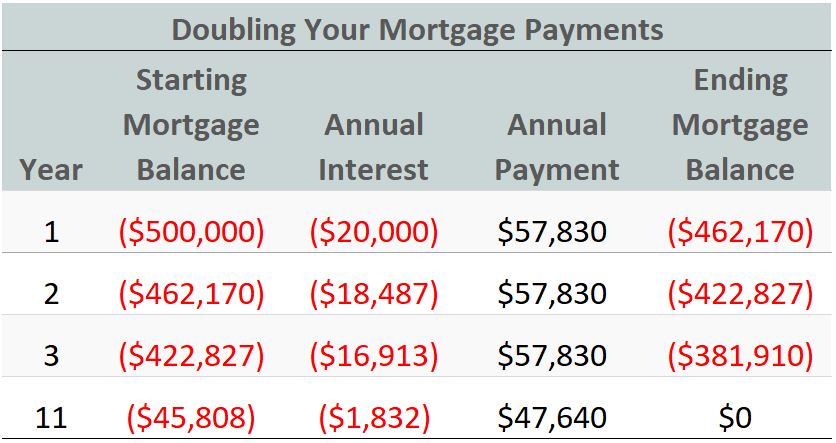

When you pay off your mortgage, what are you saving? The answer is interest expense – fewer dollars paid to the bank, which sounds great! With a 30-year, $500,000 mortgage at 4% interest, for example, you will pay about $20,000 in interest to the bank in year one. As the principal decreases each year, your interest expense decreases as well.

If you pay the mortgage over the full 30-year term, you will have paid nearly $370,000 in interest – no small amount! What if you double your payments? How much will you save?

By doubling your payments, you pay off the mortgage in 11 years and pay just $126,000 in interest – 19 more mortgage-free years and $244,000 less interest – seems like a no-brainier right? If the alternative is spending the extra money, it’s a great deal. But what if you invested those extra payments instead?

What if you invest those extra mortgage payments instead?

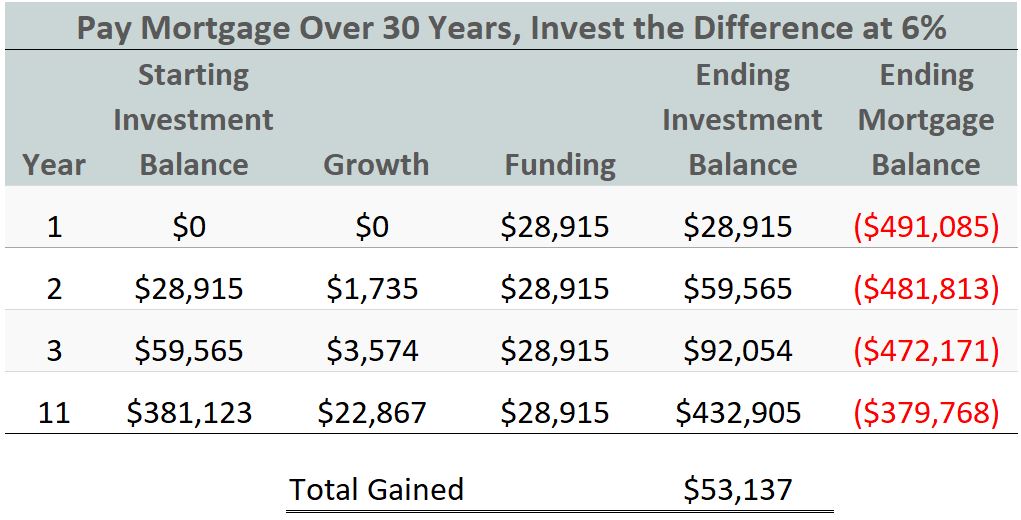

We’ve seen what you could save by paying the mortgage faster. Now, let’s compare with what you could earn if you invested those additional dollars instead. We’ll use the same mortgage example but assume you make the minimum mortgage payment and invest the extra $28,915 per year in an account earning a 6% after tax return.

Comparing the two scenarios we can see a dramatic difference.

- By making double mortgage payments, you pay off the mortgage in 11 years and $0 invested.

- By investing the extra mortgage payment at 6%, you accumulate over $430,000 and have $380,000 remaining on the mortgage. Even if you pay off the remaining balance, you have over $50,000 left.

But my mortgage rate is guaranteed…my investment return isn’t.

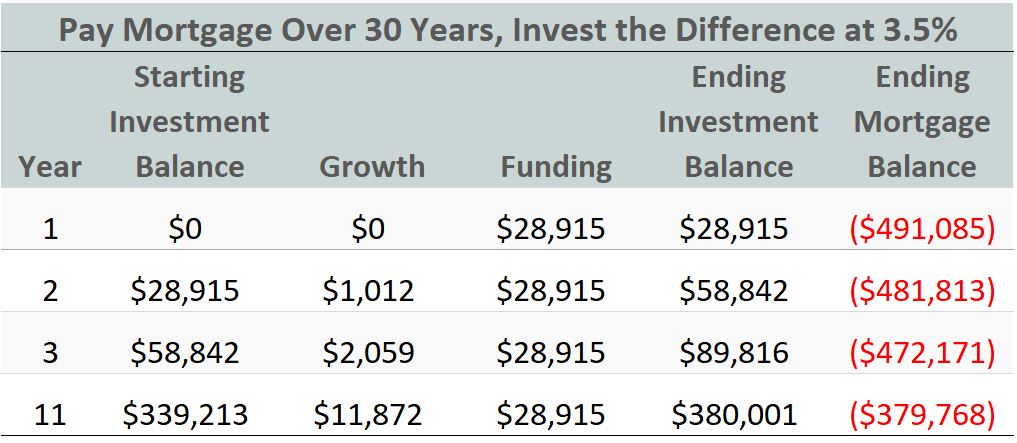

You might be thinking “my mortgage rate is guaranteed and, while 6% return sounds nice, it’s not guaranteed.” You’re right. When you pay your extra mortgage payment, you’re guaranteed to save that interest rate while you’re not guaranteed to match that in your investments. So, what if your investments underperformed while you continue to pay 4% on the mortgage? As we see in the example below, you only need to earn 3.5% in your investments to break even.

At the end of 11 years, earning 3.5% per year, you have $380,001 in your investment account and $380,000 left on the mortgage. How is this possible?

Albert Einstein is credited with saying “compound interest is the eighth wonder of the world.” This is an example of that principal at work. Though you’re investing at 3.5% while paying 4% on the mortgage, your mortgage balance decreases while your investment balance grows each year, so as you build growth, you earn growth on your growth – or compound interest – like a snowball getting bigger and bigger as it rolls down a hill.

Bringing this into real life.

We’ve walked through a simple example to illustrate the power of compounding interest. In the real world, however, there are a few added considerations.

- This principle must be adapted to current mortgage rates, so you’ll want to consider your specific situation with your advising team.

- Your investment risk tolerance will also affect this. If you’re a very risk averse investor, paying your mortgage could be the right move. But if you can tolerate market risk and have a long time horizon, the gap between interest savings and investment return could be even more dramatic.

- Your mortgage interest is likely tax deductible, so the IRS will pick up some of that interest expense by reducing your tax bill.

- If you used the extra savings to fund a tax deductible 401(k) or tax free Roth, you increase the impact even further.

Debt is both financial and emotional.

If we consider the math alone, the case is clear – you gain the ability to accumulate more by investing rather than making extra mortgage payments. But debt isn’t just financial – it’s also emotional. You might lose sleep at night knowing that you could be getting out of debt faster and not receive the same satisfaction by investing those dollars instead. This personal preference should not be overlooked. If you’ve worked with your financial advising team and you can reach your retirement goals either way, you might prefer to pay the mortgage faster and forego the chance to earn more in the long run.

Your financial plan should help you evaluate the pros and cons of these decisions and show you where you’re likely to end up in each scenario. As we see here, it could help you uncover opportunities to grow your wealth faster and make a bigger impact on your goals!

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.