When it comes to leaving your hard-earned wealth to the next generation, often called estate planning, everyone has a plan by default – the government’s plan. They’ve already decided what taxes you’ll pay, who will make important decisions, and how your assets will be divided.

But would you choose this plan?

If not, the good news is that you’re not stuck with the default plan. You can choose a plan that works to reduce taxes and maximize your impact on loved ones and causes you care about.

Planning by default vs. design – a tale of two families

The contrast between these two hits close to home because there have been legacies left to my family and me on both sides. One was a plan by default and the other by design.

My grandpa on my mom’s side of the family was a confident business owner and Washington State senator. He would have told you he had a plan, but his estate was poorly organized. When he passed, his estate took over 14 years to settle, lost too much to taxes, and was incredibly divisive for his family. It is not what he would have wanted for his loved ones.

The story on my dad’s side of the family is much different. I had the privilege of helping my dad’s father create a plan to see that his legacy was carried out the way he wanted it to be. He wasn’t one to discuss money often, but he did cast a vision for how his wealth should be used. This led to strategies to reduce taxes, put things in order, and increase his overall impact. When he passed, everyone understood the plan and what should be done. His estate was settled quickly and, more importantly, in a way that honored him. It’s what he would have wanted.

These stories share one thing in common – they both had a plan. But one was by default and the other by design.

Plan by default – the government has a plan for you

In your default plan, the government has already made several key decisions for you.

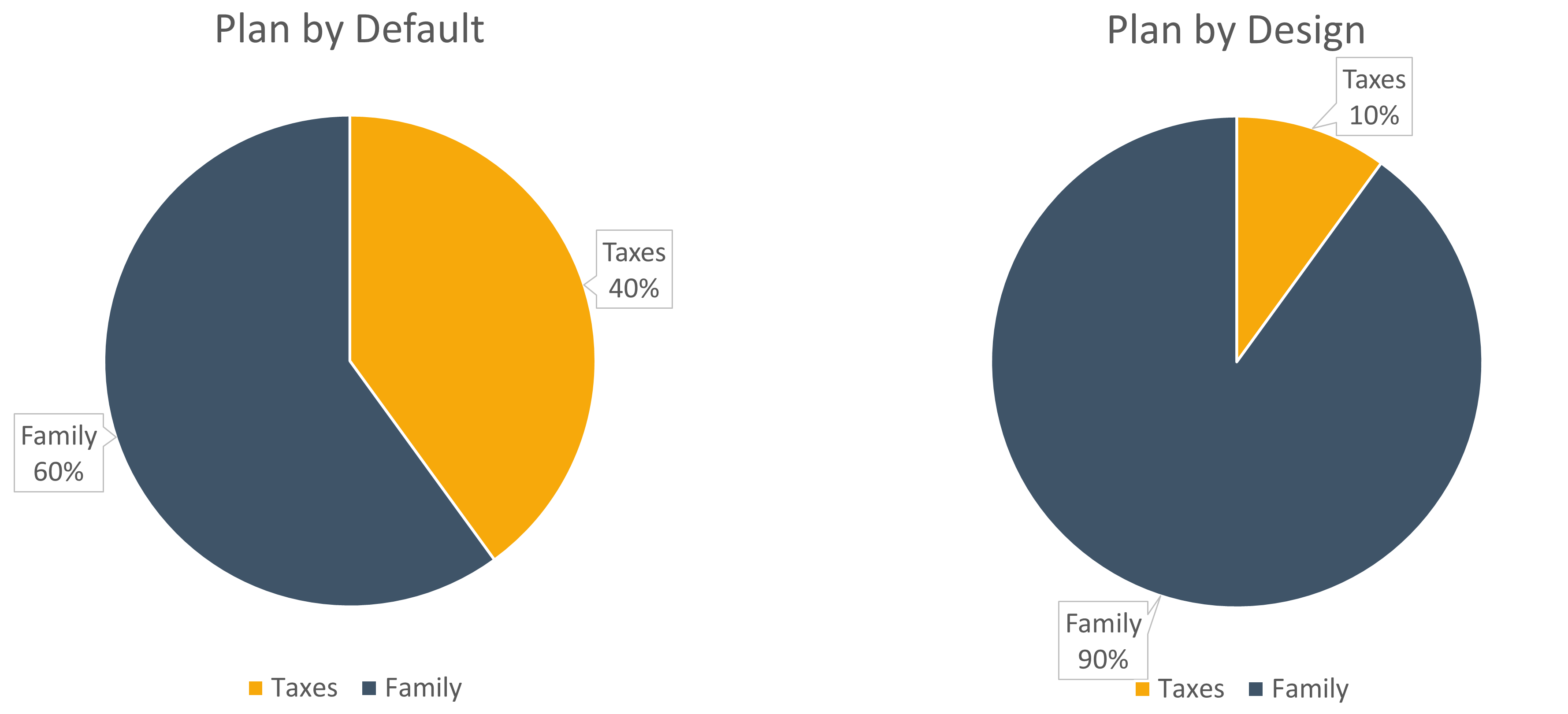

- How your assets will be divided. There are only three destinations for your assets when you die: taxes, friends and family, and charity. The government passes everything tax-free to your spouse first. When your spouse dies, the government takes their taxes and passes the rest to your family, with no consideration for charity. If you’re in WA state and have a $10 million estate, your plan by default might look something like this:

- Taxes 40% – $4 million lost to taxes

- Family 60% – remaining $6 million to loved ones

- Charity 0% – nothing to causes you care about

- Family and financial decisions. Unless you choose differently, the court will choose a guardian for your children and the assets you leave them. They’ll also choose how the most important family and financial decisions are communicated to your loved ones.

- What you’ll pay in taxes. When you leave assets at death, the federal government and many states, including WA, can take 50% or more in taxes. Curious to know if you’re at risk of paying estate taxes? Use our calculator to find out!

If you’re happy with the default plan, make sure you understand it. But what if you’re not? It’s time to design one of your own – one that fulfills your goals, helps avoid family conflict, and can save a hefty tax bill.

Plan by design – the plan you choose

If you’re not satisfied with the government’s plan, it’s time to design your own plan. One tool we love is a family mission statement. What’s important to you and your family? Is it giving back to the community? The family business? Traveling the world? Education?

When you can identify what you are passionate about, it’s easier to focus on a legacy and estate plan that is designed to meet your needs and those of your loved ones.

- Decide what impacts you want to make. By default, the government takes their taxes and passes the rest to your family, with nothing left to charity. To start your plan by design, fill in this simple outline of how you’d like to leave your assets:

- Taxes ____%

- Family ____%

- Charity ____%

- Choose the guardians of your legacy. By default, the government chooses who would care for your kids and assets. You likely have specific people in your life that you trust with this level of care, and you’ll want to be sure to include them in your plan by design.

- Reduce taxes and pass more to loved ones and causes you care about. Last, but certainly not least, you can look at ways to shift from your default taxes toward your designed plan. While your default plan might lose $4 million of your $10 million to taxes, your designed plan could reduce that to 10% or less depending on your goals.

If you include charity in your plan, you can eliminate estate tax entirely, moving every tax dollar to family and causes you care about instead.

Your Estate Plan Should Match Your Financial Plan

In all this discussion about legacy, tax, and estate planning, should you be speaking with an estate planning attorney, CPA, or a financial advisor? The answer for most is: all of the above.

If you have a large estate and wide-ranging family and charitable goals, you could benefit from having a coordinated professional team. Some goals, like direct gifts to charity, can simply be added to your will. But a coordinated team might help you incorporate gifts during your life, for example, to further reduce taxes and increase your impact. The big takeaway here is that you want the tax, legal and financial parts of your plan coordinated and working together toward your legacy vision.

Everyone leaves a legacy…choose yours

The question isn’t if you’ll leave a legacy, but what kind of legacy you will leave. These are almost always a blend of values and finances. Will yours be a plan by default, determined by the government? Or will it be by design, oriented around your values and vision?

Not sure where to start? I like asking these questions:

- If your memorial service was tomorrow, what would you like to be remembered for?

- What would you like to be remembered for but haven’t accomplished yet and what do you need to do to make it happen?

These might seem like monumental tasks, but with the right guidance, legacy planning can be a very enriching experience. If you’re not sure where to start, a conversation with an advising team like ours at Alterra is a great first step. We help you look at the big picture and design an action plan to bring your legacy vision to life, passing more to the people and causes you care about for generations to come.

Zach Hamilton

CFP®

Partner, Financial Advisor

About the Author

Zach graduated from Gonzaga University with degrees in Marketing and Finance. While growing up, Zach heard stories from his grandfather about his work as an insurance agent, and other stories from his dad who was an investment manager. They both spoke financial “languages” but had completely different dialects. Recognizing the breadth of the financial vocabulary ultimately led to Zach’s passion for financial planning. He credits his family for this enthusiasm. Zach sees his time with clients as an opportunity to translate all of the different – and often confusing – information they’ve heard and provide clear guidance for each unique situation.

Zach enjoys working with people – his clients – who also appreciate that their financial decisions have an impact not just on themselves, but also on their families, charities and their own life legacy. Many of Zach’s clients have a strong desire to “make a difference”, and they rely on his financial expertise to magnify their philanthropic goals.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.