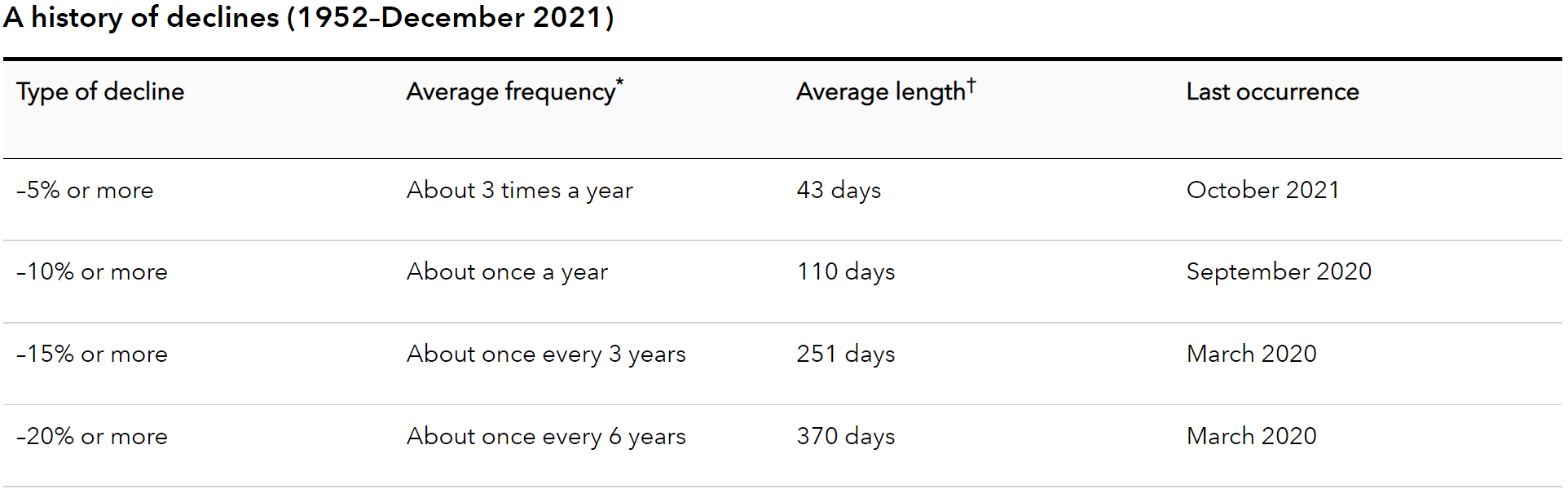

No one enjoys seeing portfolios drop due to a downturn in the stock market. It brings anxiety and concern that you may not recover. And to make matters worse, it’s never clear when a market correction will happen and how long it will last. But we know market declines are more common than we like to think. According to Capital Group, on average the market declines 5% about three times per year, 10% once per year, and 20% or more once every 6 years.

So, while it’s impossible to know when the next downturn will strike, there are investment and tax strategies to keep in your back pocket to make the next market correction work for you.

- Put excess cash to work. If you have more cash on hand than you need, put that surplus to work in your portfolio. Like shopping during a big sale, a down stock market is an opportune time to buy in at a discount. If you’re hesitant to invest your entire surplus at once, consider breaking it up into monthly contributions over a three-to-six-month timeframe, sometimes called Dollar Cost Averaging.

- “Harvest” losses to reduce taxes. As we discuss in Can Losses Increase My Investment Return?, you can sell investments that are down, replace them with similar investments, and use the loss to offset other investment gains and up to $3,000 of earned income. When deciding what holdings to sell, start with stocks that no longer fit your investment goals or positions you were already looking to replace.

- Diversify concentrated positions. If you have a too much in a single company, but your shares have appreciated over the years, you could be facing a sizeable tax bill if you sell. A market downturn can be a chance to sell shares, pay less in taxes, and spread those funds across your diversified portfolio. This is especially common if you receive stock as part of your compensation package. See Taxes & Highly Appreciated Stock for more.

- Conversions from an IRA to a Roth IRA. Converting pre-tax IRA funds to a tax-free Roth IRA is a common way to eliminate taxes on future withdrawals for you or your loved ones. You pay income tax on dollars you convert today, but these funds now grow tax-free and can be withdrawn tax-free in the future. When your pre-tax IRA value drops due to a market decline, you can convert more pre-tax IRA funds to a Roth IRA, pay less in taxes, and capture tax-free growth when the market recovers.

- Take your Required Minimum Distribution. If you’re 72 or older, you’re required to distribute a portion of your IRA each year, called a Required Minimum Distribution (RMD). The IRS requires you to remove a larger percentage of the IRA each year. But what if you don’t need these RMDs to support your lifestyle? A market correction is a great time to take the distribution and reinvest the proceeds in after-tax portfolios. Why? When the market is down, you can distribute a larger percentage of your IRA and allocate the account to a more tax-efficient investment account, capturing the market recovery and reducing future taxes on withdrawals.

- Make the most of gifts to loved ones. In 2022, you can give $16,000 to anyone without concern about gift taxes. See Can You Gift Too Much? for more. This is a common strategy you might use to pass wealth while you’re alive to reduce future estate taxes. If making gifts from an investment portfolio, you can give more shares away while the market is down, making better use of this $16,000 gift. Your family, friend, or loved one will now benefit from the growth when the market recovers.

These are among the best ways to make a down market work for you. Your financial strategy should plan for the best but prepare for the worst and, if you plan in advance for the next big decline, you’ll be prepared to make that downturn work for you!

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.