On Monday, October 19, 1987, the Dow Jones Industrial Average plunged by nearly 22%. Black Monday, as the day is now known, marks the biggest single-day decline in stock market history. Since then, we’ve seen the Tech Bubble of 2000, Great Recession of 2008-2009, and the Covid-19 Recession of 2020, all reminding us that investment involves market risk.

When thinking of investment risk, is this the kind of risk that comes to mind? It’s certainly an important one to address. With too many eggs in one basket, you add significant risk of loss. However, market risk is just one type of risk to address in your financial plan. What else should you consider? Here are three risks you should account for in your financial planning.

Market risk

Having too much exposure to one stock, bond, or any investment can lead to much higher risk of loss in your financial plan. If you’ve risen through the ranks at Amazon, you receive a significant portion of your compensation in stock. This means if the company falls on hard times, your paycheck and portfolio are both at risk.

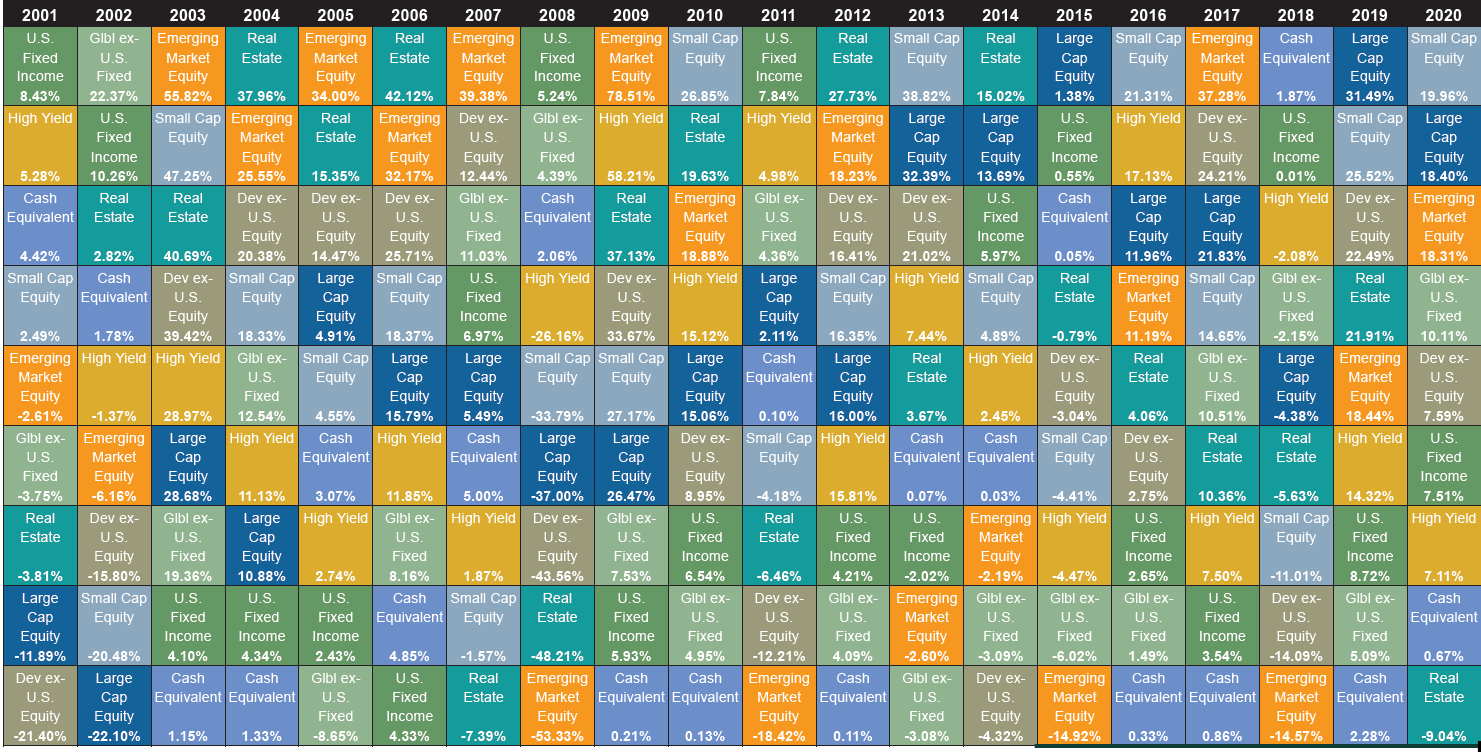

What’s the solution? Diversification. Invest in a variety of assets that have a history of growth and compliment the risk of the others. If one investment fails, the others keep you on track. Callan’s “quilt chart” shows annual returns for different kinds of investments and makes a case for spreading your funds out rather than trying to guess which will be the winner in any given year.

Click here for a list of indexes used as proxies for each asset class.

Tax risk

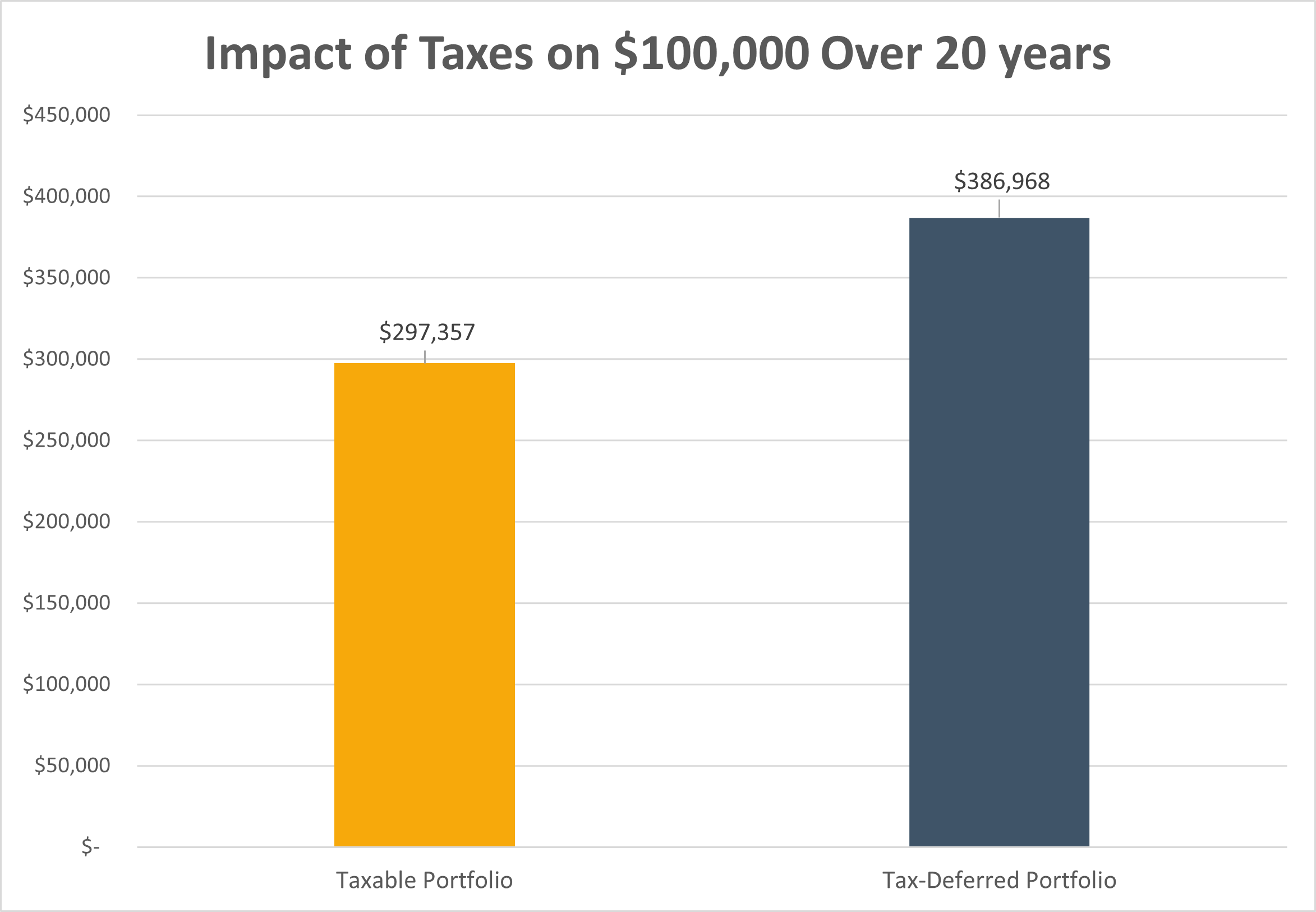

If you’re a top income earner, taxes are taking an ever-increasing bite out of your return. If your stock portfolio grows at 7% each year and you’re in the top income tax bracket, taxes could eat up 1.4% or more of that annual return. What does that mean in real dollars? If you invested $100,000 for 20 years, taxes cost you almost $90,000.

What’s the solution? Maximize use of tax-deferred tools like a 401k or tax-free tools like a Roth IRA. If you’re a business owner looking to supercharge your results, many need to look no further than adding a well-crafted tax plan to your investment strategy.

This is a hypothetical example used for illustrative purposes only.

Creditor risk

Building wealth in an increasingly litigious world can be scary. If someone sues you, can they take all your hard-earned assets? Though you hope never to find yourself here, asset protection cannot be overlooked. As noted by the legal experts at Helsell Fetterman, there are protective measures that can help here, but by the time you’re staring down a lawsuit or creditor, it might be too late. Consider the following tips:

- 401(k)s and other ERISA-governed plans are protected from creditors by federal law. Make your maximum annual contributions.

- IRAs are protected in Washington State. This protection is governed by state law, so consult the rules where you live.

- Life insurance, including unlimited cash value, is also protected in Washington State. Once again, this is governed by state law, so check your local rules. Life insurance cash values are also tax-deferred, so can help reduce that risk in the right situation.

- Consider owning real estate in an LLC to limit risk from claims of a tenant to the assets within the LLC, protecting your other personal investments.

- Maintain appropriate auto, home, and umbrella coverage and review each policy to understand what is and isn’t covered to make sure nothing falls unexpectedly through the cracks.

This is by no means a comprehensive list, but hopefully starts you on the path to better protected assets.

At the end of the day, your planning is all about reaching your goals as quickly as possible and in as many scenarios as possible. In one scenario, you make all the income you expect for a full, satisfying career and ride off into the sunset. Taxes aren’t a challenge, no one comes for your assets, and your portfolio increases every single year. But change just one risk factor and your entire plan could be in danger. Risk planning involves more than just avoiding the ups and downs of the stock market. It should account for changing tax laws, risk of lawsuit, and plan to fulfill your goals in case you’re not able to work due to death, injury or illness. While no plan is bulletproof, comprehensive risk planning gets you as close as possible.

It is not possible to invest directly in an index, which is unmanaged. Diversification does not protect against loss in declining markets. Alterra Advisors does not provide legal or tax advice. For complete details, consult with your tax advisor and attorney.

The “Alterra” name was coined by joining the Latin roots “alter”, the origin of the word “altruism” with “terra” meaning earth or land. This name reflects the company philosophy of “clients before profits” and providing firmly grounded advice.