Case Study

Crafting a plan to ensure John and Susie can “live and give” in perpetuity.

Meet John & Susie

A legacy-focused retirement plan

The McRae’s have a long history of working hard, enjoying life and giving generously. But as they seriously consider retirement for the first time, they’re struggling to know how to “live and give” when faced with the challenge of living off their hard-earned savings. They’ve always used a big portion of their income to support charities and save for the future.

Now in their early 50’s, John and Susie did a very good job accumulating wealth. Because they came from modest means they still wrestle with the nagging worry they will outlive their savings and cannot continue their charitable giving. But, they’re determined to find a way to balance enjoying life, supporting their causes, and creating a legacy for their kids, though they intend to follow Warren Buffett’s wisdom: “Give them enough to do anything, but not enough to do nothing.”

Step 1: Getting to Know You

We met John and Susie through their attorney who was looking for ways to help them manage a $500,000 tax bill resulting from a stock award he would be receiving upon retirement. Through conservative spending and wise investment, they built close to $19 million in net worth between their retirement savings, real estate and company stock.

The McRaes clearly saw their family and community as the true purpose of their wealth. With such a clear vision for their wealth, they were growing frustrated with the complexity of their situation and were looking to us to help them think comprehensively and creatively about their situation to help secure their retirement while continuing to make the family and community impact that has always been at their core.

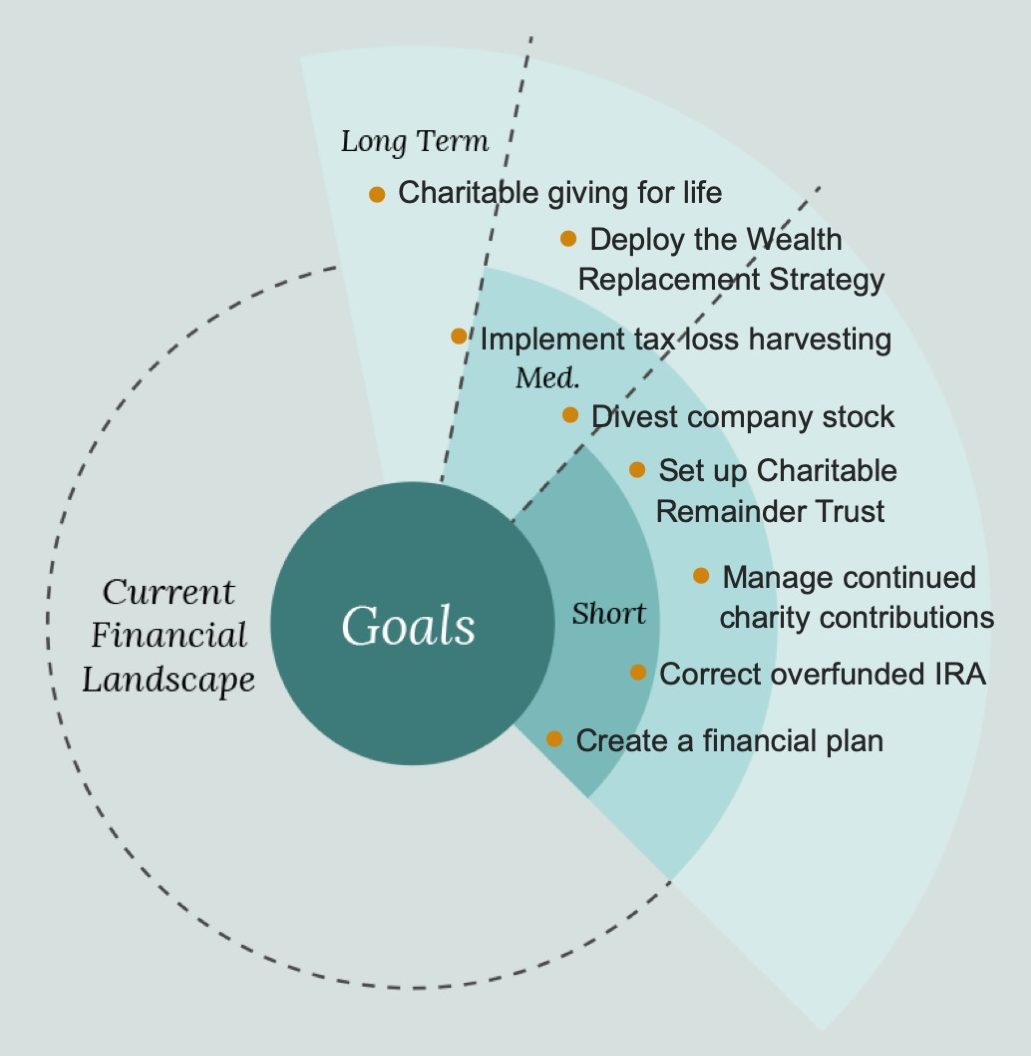

Step 2: Establishing Your Goals

After careful analysis of their situation, we identified four primary goal categories and got to work strategizing for each of them.

Secure Retirement

Create a plan that assures the required income needed for the remainder of John and Susie’s lives.

Family Legacy

Explore ways to manage estate taxes and move assets outside of the estate while still maintaining control while the kids and grandkids are young.

Minimize Taxes

Minimize taxes on the sale of company stock, reduce capital gains and optimize plan for taxes on retirement income.

Charitable Giving

Maximize gifts to causes they care about through strategic use of charitable giving tools, reducing taxes and maximizing impact.

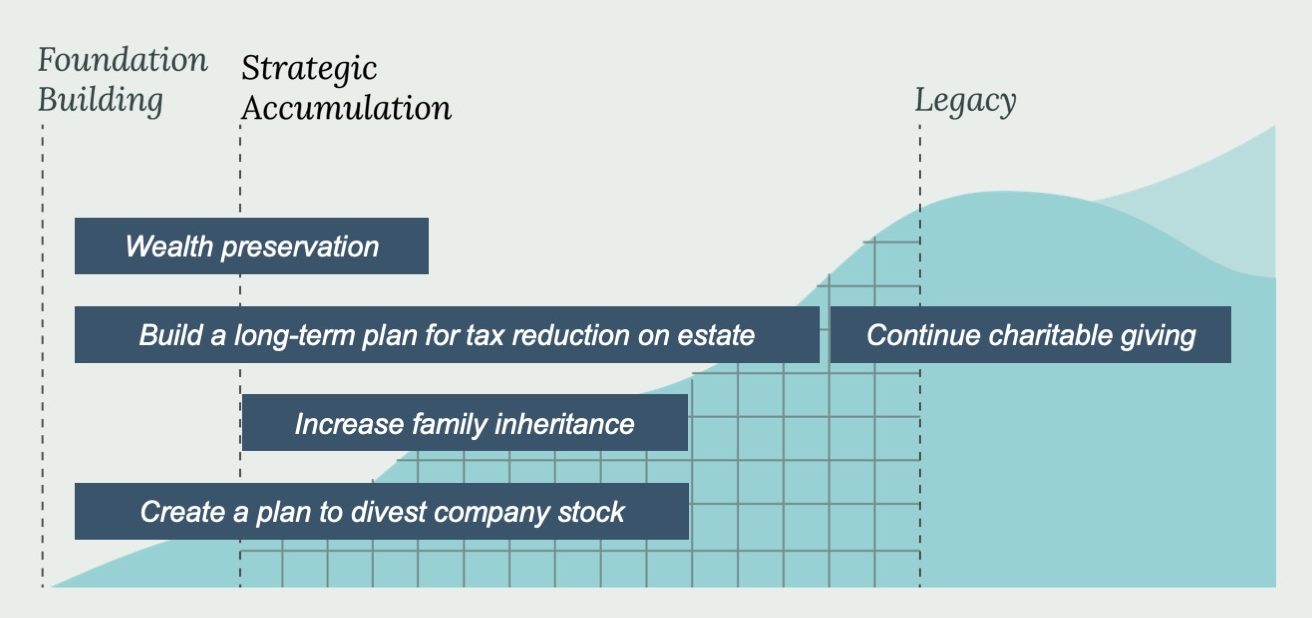

Step 3: Creating Your Roadmap

With goals established, we walked the McRaes through their roadmap. A carefully crafted income strategy with ample investment reserve would provide their retirement security. In collaboration with their attorney and CPA, two charitable giving tools would allow John to sell his stock without paying any taxes and provide a tax deduction of nearly $500k, which would help minimize future taxes. They would also use a portion of the subsequent income to fund a trust outside their estate, increasing the legacy left to their family.

The Results In Depth

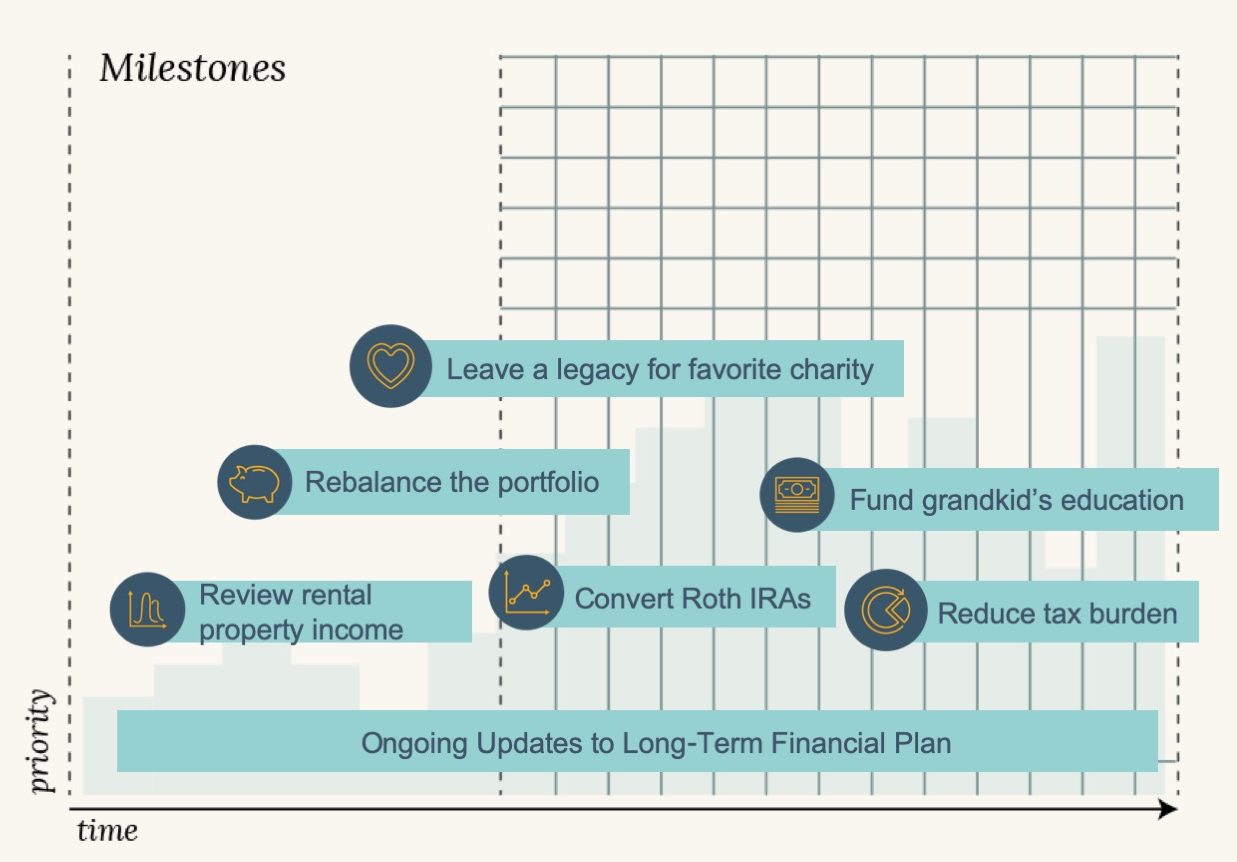

Step 4: Guiding the Way

When all was said and done, the McRaes had accomplished quite a lot. They implemented a strategy to generate consistent retirement income. They had increased their projected charitable gifts by over $11 million, reduced their anticipated estate taxes by almost $11 million and increased the legacy to their family by $4 million. And through regularly scheduled reviews with the Alterra team, they’ll be able to see their plan progress as the years go by.

More important than the numbers, their plan frees them to return their focus to what they truly care about: their family and community. They’re meeting charity directors who will steward their gifts, meeting with family to lay out the vision for their legacy and they’re seeing the plan in motion, ensuring the impact they intend is the impact they make.

Keeping You Informed

In addition to our regular plan reviews together, you’ll also have immediate access to view your accounts through our client portal and mobile app. That way, you can monitor all your finances with a single login. And, we encourage you to reach out anytime you have a question. We’re always here for you and you’re never on the clock.