Case Study

A strategy for generating a secure income for the life they want during retirement

Meet Mike & Kari

A secure income-generating retirement strategy

Mike & Kari Walton recently retired after long, successful careers at Alaska Airlines and are now finally shifting focus to their most important priorities: spending time family, supporting their grandkids and volunteering at Seattle Children’s Hospital. Family has always been most important to them and you’d often hear them discussing ideas for the legacy they want to leave behind.

The Waltons have long been financially responsible and invested well. They’ve also worked with several investment advisors over the years, but never found the right fit to support their retirement and the vision for their legacy. They had quite a few different strategies but, because they never created coordinated plan, felt disjointed, like they were somehow missing the big picture.

Step 1: Getting to Know You

We were introduced to Mike & Kari by their CPA, who described the work we had done for another of her recently retired clients. Though they’re not worried about running out of money, they are unsure of how to create a consistent income when their portfolio seems to be so volatile. As an Alaska Airlines pilot, Mike also had important decisions to make about his pension and they’re overwhelmed by all the options they’ll face with social security.

The worry about their own income has taken attention from the goals they’d much rather focus on. They hope to help several grandkids through college, leave a legacy to their family and earmark a significant portion of their remaining assets as a charitable donation to the Seattle Children’s Hospital. They feel this should all be possible, but the complexity in their life has them overwhelmed.

Step 2: Establishing Your Goals

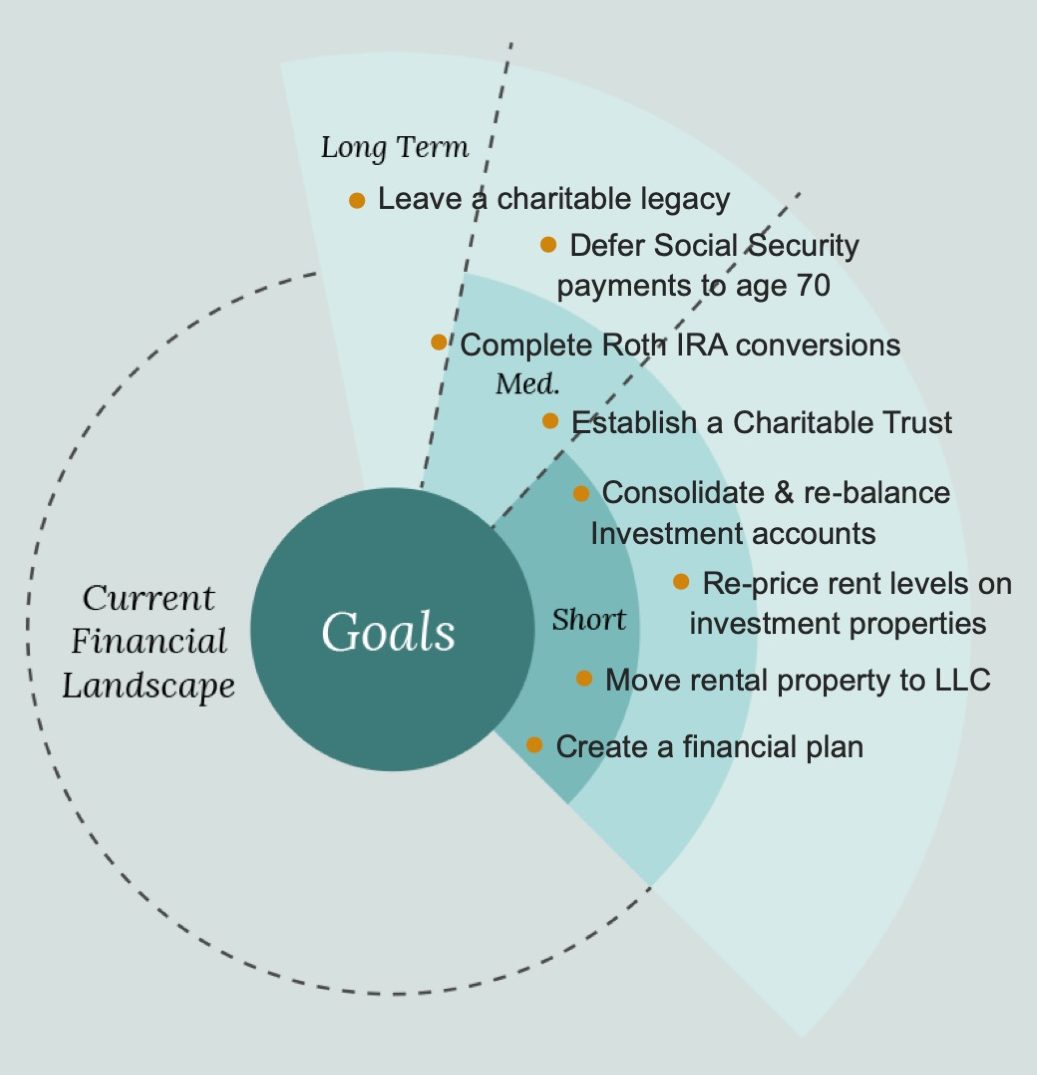

A thorough analysis of their situation suggested we focus their planning in four areas.

Financial Security

Create a sustainable income of $12k a month with a consolidated investment and wealth preservation strategy.

Inheritance Strategy

Enhance family legacy for the future education funding through tax minimization and estate planning.

Tax Planning

Work in coordination with CPA to identify strategies that both reduce taxes and preserve asset flexibility.

Charitable Giving

Explore options to maximize the assets earmarked today for gifting to Seattle Children’s Hospital.

Step 3: Creating Your Roadmap

The Walton Family roadmap consolidated their portfolios, reducing risk by 50% and filling their monthly income need. We also recommended ways to optimize their pensions and social security. 529 savings increased from 30% to 75% of the grandkids’ college costs with the rest in a new Walton Family Education Trust. With their CPA and attorney, Mike and Kari set up a Charitable Remainder Trust to give about $1 million to Seattle Children’s Hospital while reducing taxes and funding a Wealth Replacement Trust for future generations’ education.

The Results In Depth

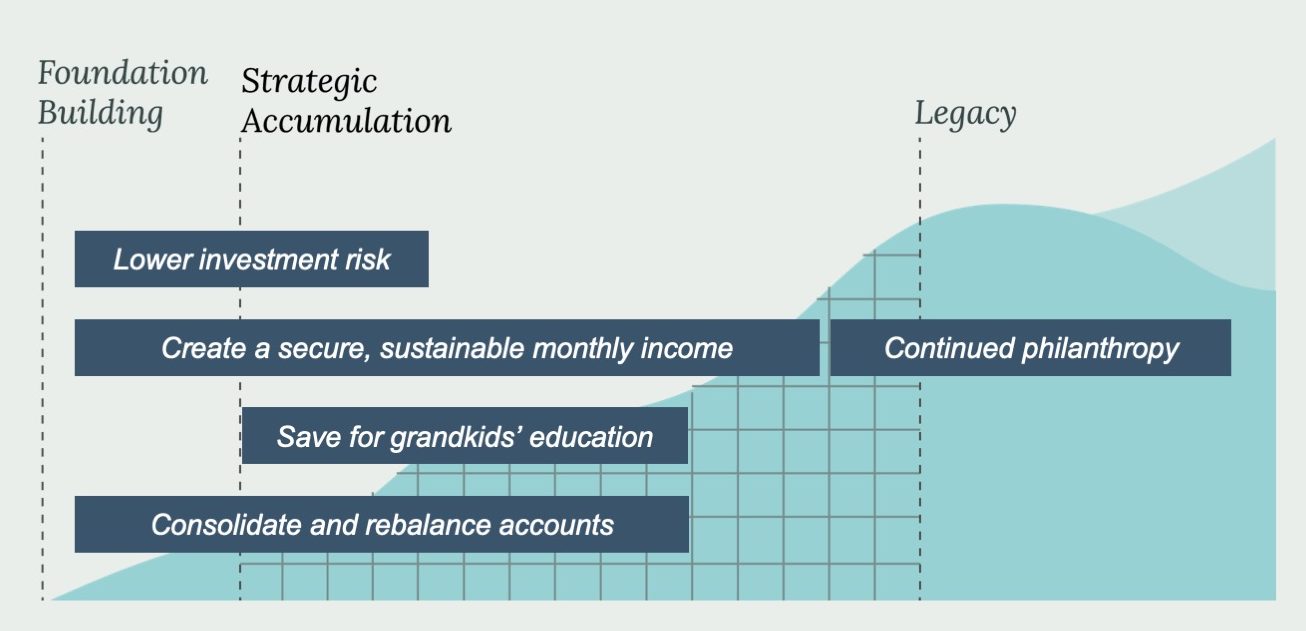

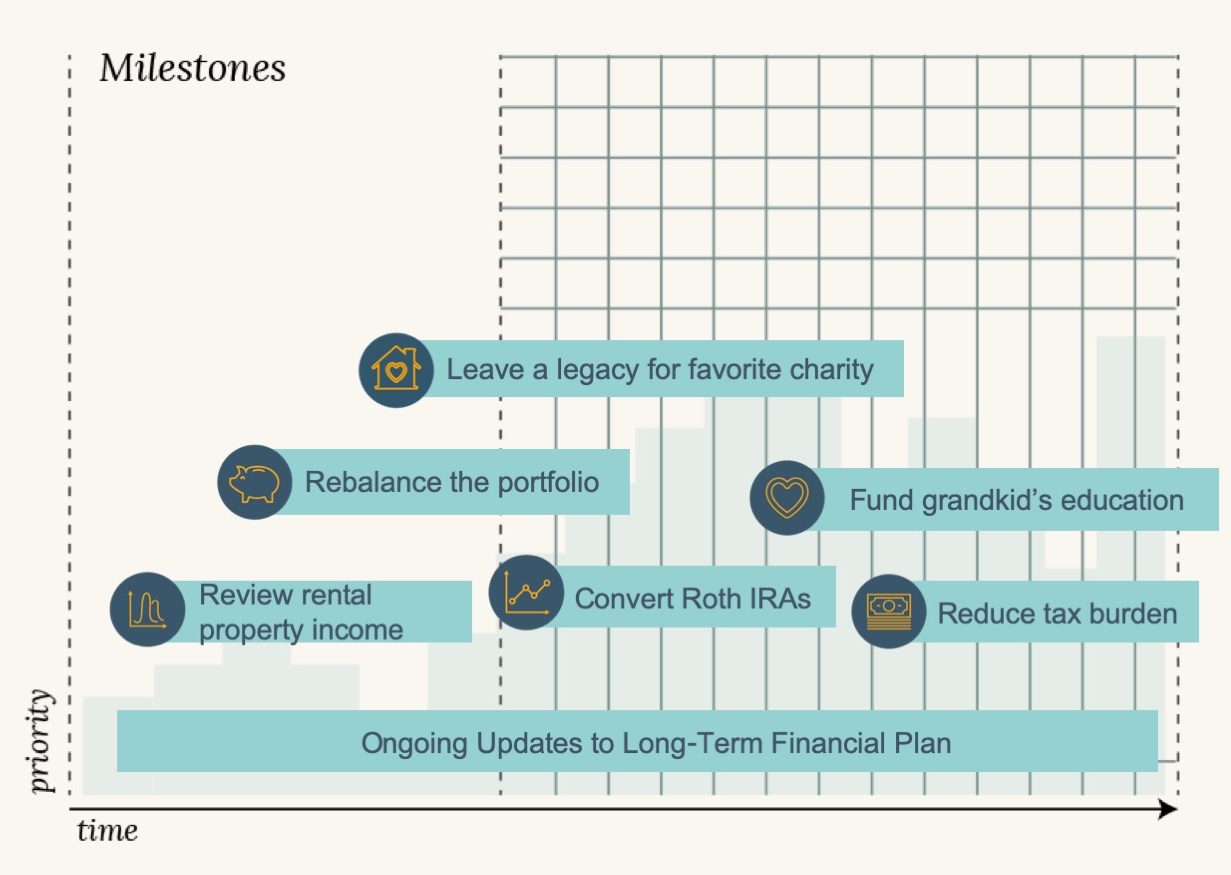

Step 4: Guiding the Way

Because family is the core motivation for everything else in the Waltons’ plan, the first critical element was to ensure that Mike and Kari had the secure, sustainable income they required. Once their income strategy was in place, we could focus on guiding them through strategies to reduce their tax burden, plan their legacy to their family, and enhance their charitable goals beyond what they thought was possible.

At the end of the day, Mike and Kari’s plan built the income they would rely on for their life, reduced income and estate taxes, created a $1 million gift to their favorite charity and more than doubled their projected family legacy to over $22 million, all with a vision of providing care and support to those most important to them.

Keeping You Informed

In addition to our regular plan reviews together, you’ll also have immediate access to view your accounts through our client portal and mobile app. That way, you can monitor all your finances with a single login. And, we encourage you to reach out anytime you have a question. We’re always here for you and you’re never on the clock.